This week, PM Keir Starmer’s London home came under attack. London and the south of England continued their run of limited price and construction growth while the North “yielded” more positive results. Meanwhile, new build registrations are on the rise but delivery lags, while construction output largely remains stagnant. Falling interest rates offered relief to some borrowers, while tax hikes on second homes and nom-doms put prices on ice in select parts of the UK market. Welcome to another UK Property News Recap – 16.05.2025.

Northern property gets consumed by buy-to-let investors

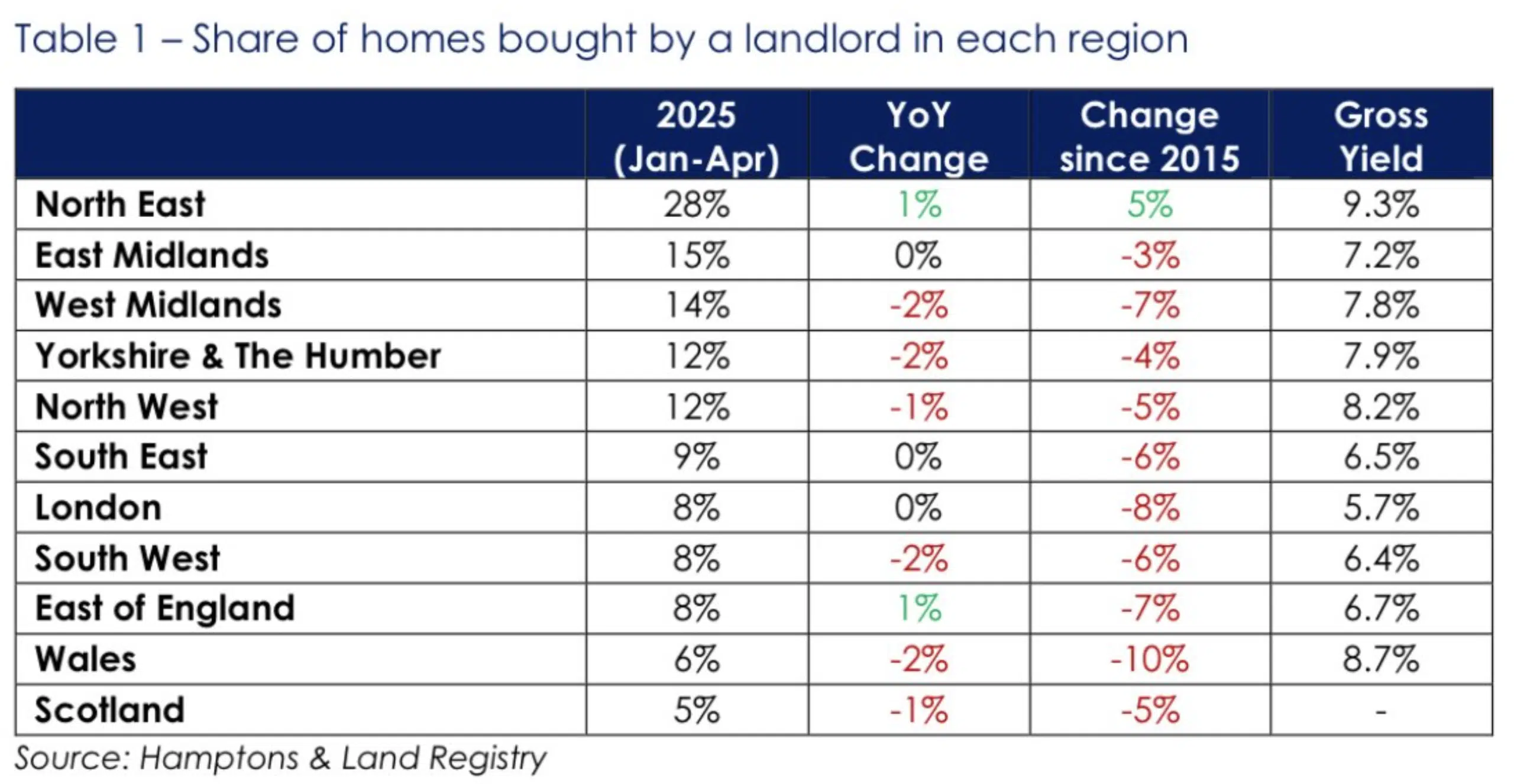

Despite rising rents, landlords tacked north for better yields, abandoning the capital and southern shores where investment is more costly and returns minimal.

Hamptons research found, increased stamp duty on second homes has dented buy-to-let investment across the UK with Wales and London experiencing the greatest falls, down -10% and -8% respectively. In contrast, the Midlands and North of England has achieved 39% of buy-to-lets purchased so far this year.

Australian group to build 3,000 homes on UK golf courses

The Bangarra group go “out of bounds” to give new housing a shot around their eight existing golf courses in London and the South of England, aiming for a financial hole in one

Rate fall

Throughout the week rates continued their gradual descent down, in an attempt to entice borrowers out of their post stamp duty holiday slumber, and comfort those standing on the base line.

April showers let debt flower

April Mortgages reintroduce 100% mortgages for those with a household income of £24,000. The catch? Fix for 10 to 15 years at 5.99%. How to squeeze borrowers for longer.

New build intentions

29,356 new homes were registered to be built in Q1 2025, up 36% on Q1 2024 (21,635) but the number of new homes completed in the same period were down 1% to 26,120. The National House Building Council reported positive build intentions but sluggish delivery. The uplift was driven predominately by freehold developments in the North of England while apartments registrations across the UK were down 3% in Q1 2025 compared to Q1 2024.

Rightmove and Nationwide team up to make a lasting first impression

Now buyers can not only check if they can afford a property on Rightmove but if a lender will lend on it. Nationwide will be “banking” on retaining buyers once hooked.

The Mansion House Accord cash cow

The government looks to secure additional UK funding for British businesses, property and major infrastructure projects, via the “Mansion House Accord.” To date, 17 of the UK biggest pension funds have signed up but others remain cautious of being steered into investing 5% of their workplace pensions into UK assets to save the government’s bacon, if it could provide smaller returns.

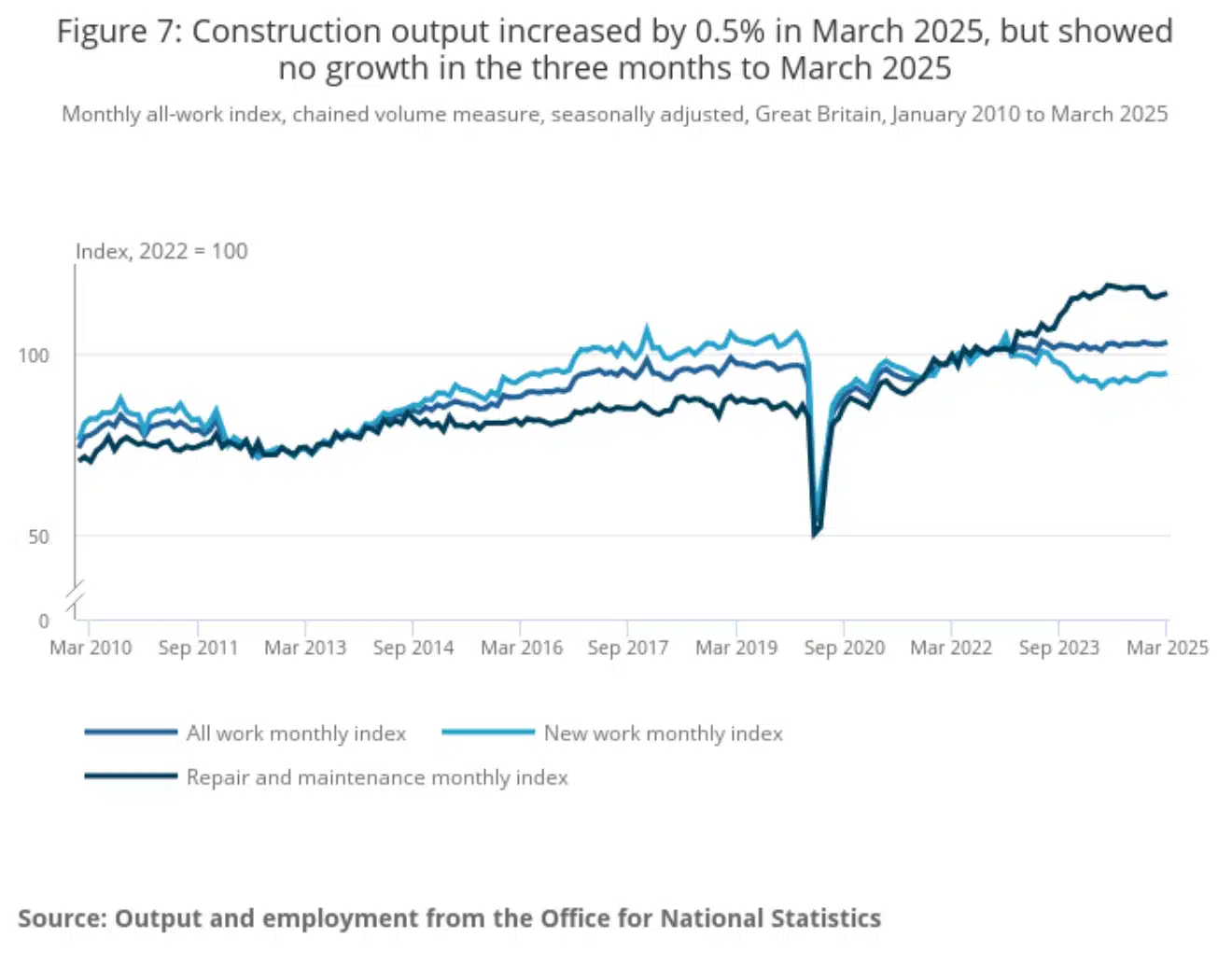

Construction struggles to get off the ground

No change for construction as output flatlined in Q1 2025 when compared to the same period in 2024. That said, March had a sunnier outlook with 0.5% growth reported. This was driven predominantly by both new work, and repair and maintenance, which grew by 0.6% and 0.4%, respectively. Private housing and infrastructure projects boasted numbers but new housing is proving hard to get off the ground.

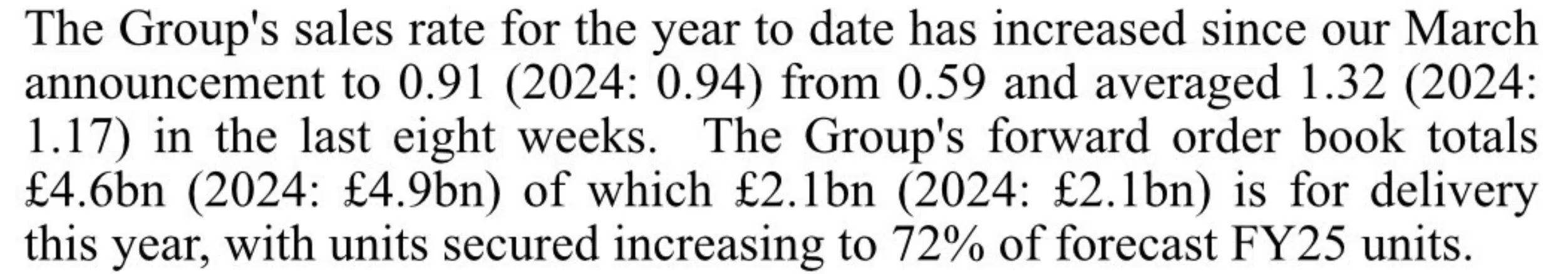

Vestry sales rates gains momentum after a sluggish start

Developer Vistry looks to a more “affordable” future but expects 2025 to largely mirror 2024 with more notable progression come 2026 in latest trading update.

Sadiq Khan wants to take more from second homeowners in London

Sadiq Khan this week claimed that second homeowners should pay more than double tax for vacant properties in the capital. At the same time, it recently emerged that Labour-run Westminster council had urged the Government to relax rules that allow local authorities to confiscate empty properties from two years to six months.

If building isn’t affordable, then buying isn’t either

According to a development report by the G15, 4,708 new home builds started in 2024–25 in London, down from 13,744 two years earlier. Between January and March this year there was a 7% drop in new build starts, compared with the same period in 2023. As a result the group is calling for a 10-year rent settlement “to provide long-term certainty for planning and investment.” In addition, they are calling on a rent convergence mechanism and full access to the Building Safety Fund for housing associations.

The Crown and Lendlease plan joint venture deal

Lendlease is close to striking a deal with the Crown Estate which will see the group halve its future funding developments as it refocuses down under. The Crown will enter into a 50/50 joint venture for six development projects within Lendlease’s UK development portfolio to release longer-dated capital at or slightly above book value.

The rental payout

Britain’s largest landlord, Grainger Plc, released a statement saying its net rental income grew 15% to £61.3 million in the six months through March, enabling the company to increase its interim dividend to shareholders by 12%.

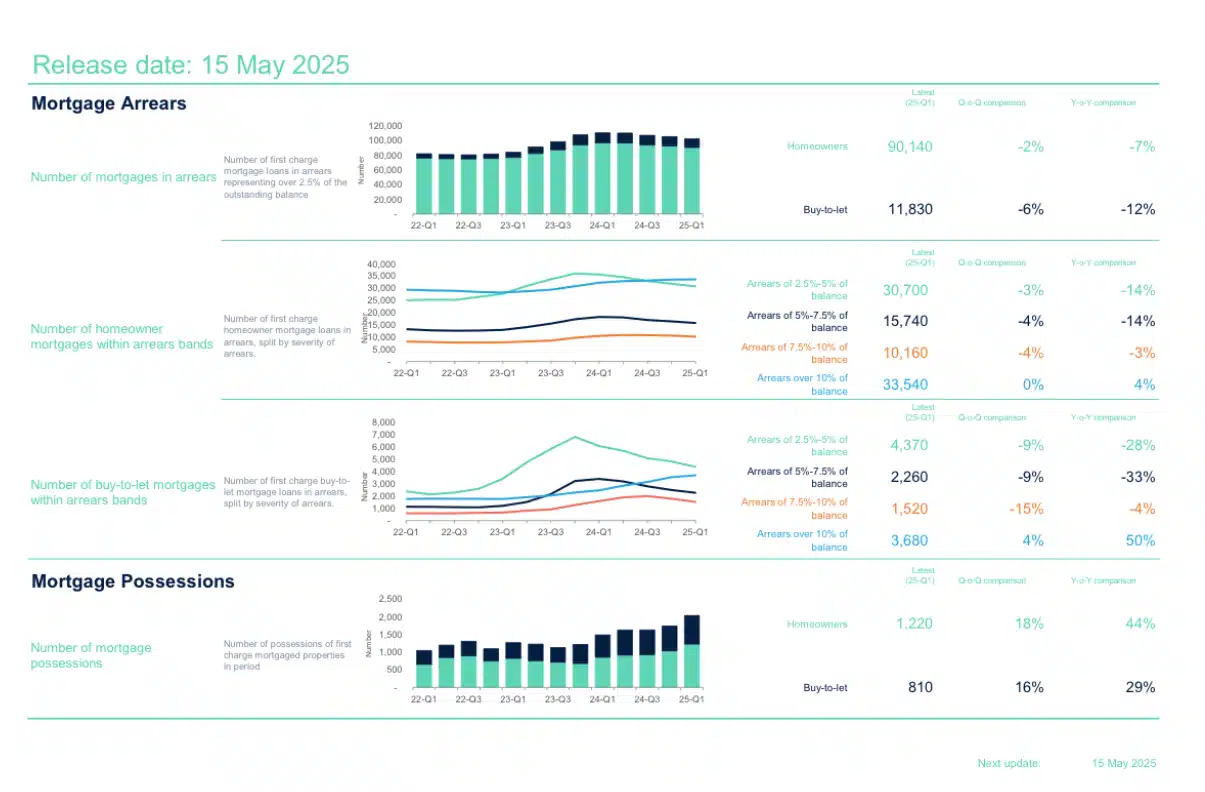

“Rate” relief rescues some homeowners from repossession but for others it comes too late

UK Finance found mortgage arrears, which accounted for 1.03 per cent of all homeowner mortgages outstanding, and 0.61 per cent of all buy-to-let mortgages in Q1 2025, fell by 7 % but repossessions crept up but remained lower than the long-term average.

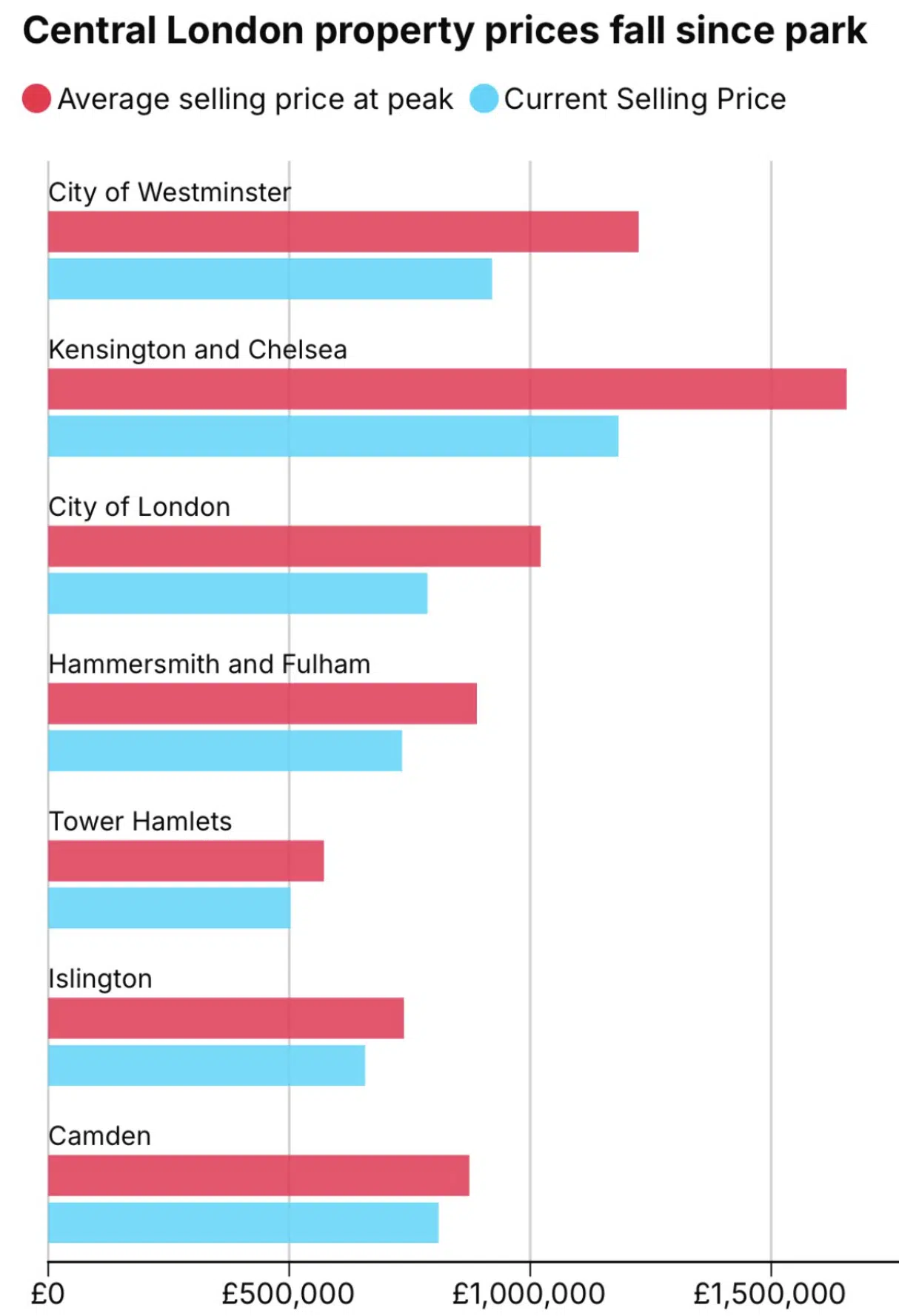

Prime central London Real Estate is forced to get “real”

House prices have nosedived in response to increased taxes and economic uncertainty. As a result, sellers can’t sell and buyers won’t pay.

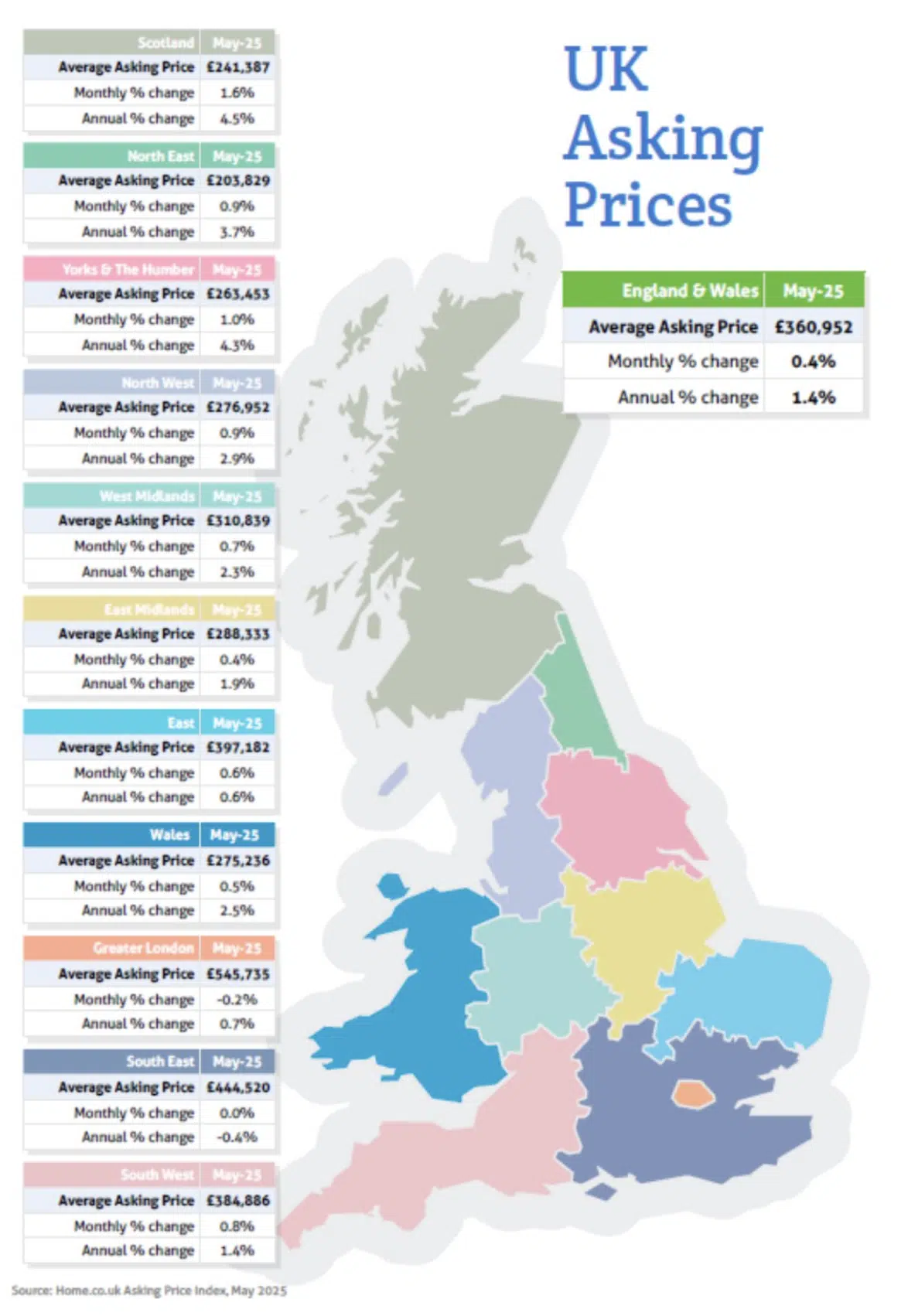

Asking prices increase along with stock levels according to Home.co.uk

Unsold sales stock weighed heavily on the market in May 2025. 30,621 properties were added to agents’ burgeoning portfolios during the last month, leaving 533,797 in need of a buyer. Unperturbed, sellers continued to ask for more, hoping buyers would “spring” back into action, which they have, with Greater London and the South East being the exception, as rates fell but in a more contained fashion.

Americans eye UK real estate

The property portal Rightmove reported a 19% uptick in US enquiries for UK property but location preferences have pivoted from Westminster, which comes with a higher price tag to Edinburgh, which is currently more affordable and with better growth potential.

Many are seemingly looking to purchase a second home or buy-to-let property in the UK as 47% trawl the portal pages for smaller 0–2-bedroom homes and the other 32%, 3-4 family homes.

And that concludes another UK Property Recap. If you have any comments or suggestions please get in touch.