This week saw rates tease but leave affordability hopes dashed. Mortgage approvals fumbled their way through April but sales activity found their feet in May but asking prices remained insecure. Renters continued to be squeezed and development inactive. Welcome to another UK Property Recap – 06.06.2025.

May price pick me up or not

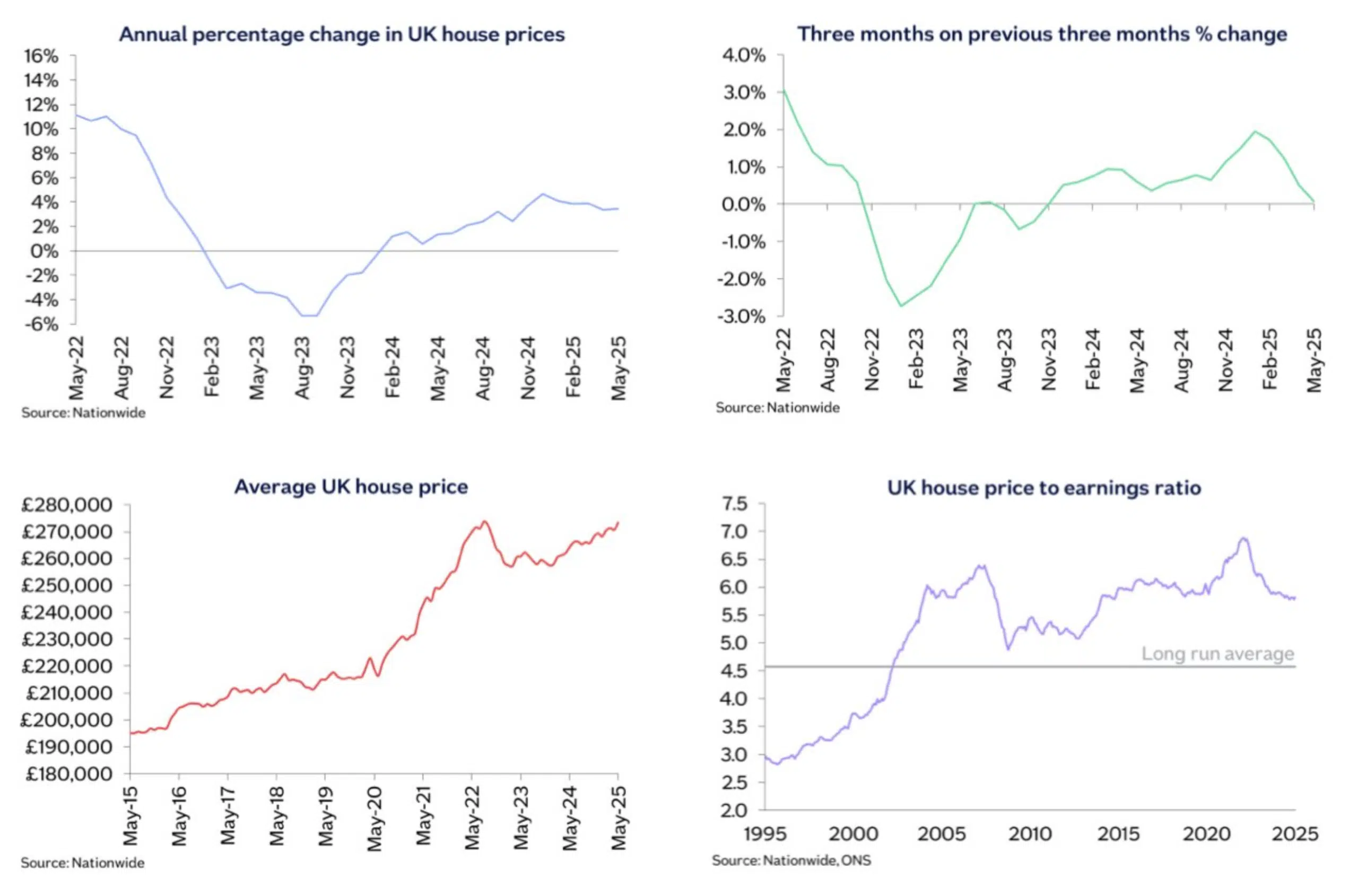

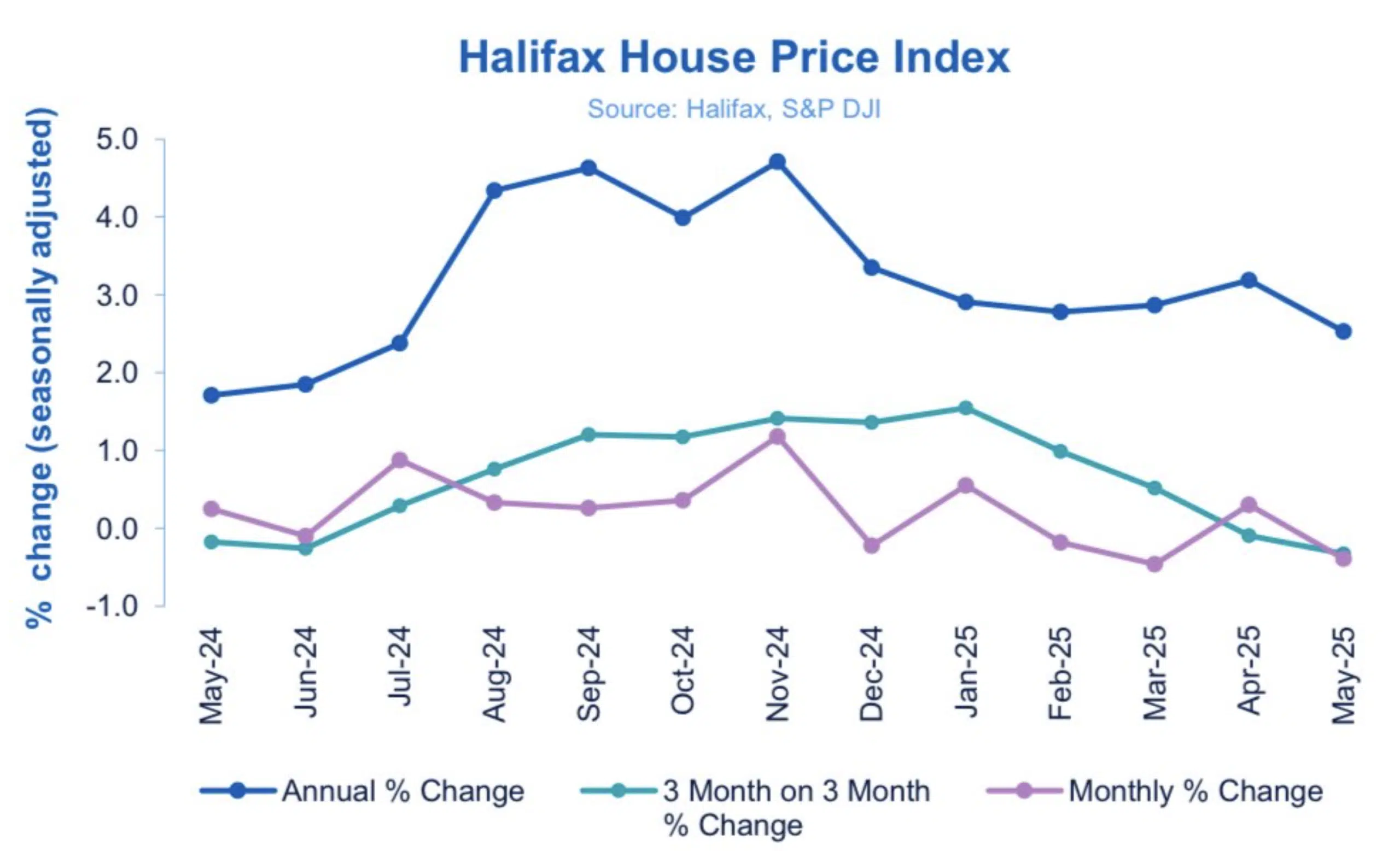

According to the lender Nationwide, house prices edged up by 0.5% in May, after a fall in April 2025, to £273,427. Activity picked up after the initial lull after stamp duty changes, buoyed by downward rate adjustments in response to Trump’s tariffs but as this threat diminished so did expectations of a further rate cut this month and lower interest rates. Instead, in some cases, they have edged back up – maintaining a sense of conflict within the property market.

In contrast, Halifax HPI for May 2025 found house prices took two steps back after taking two steps forward in April. Falling 0.4% to £296,648. This game of cat and mouse looks set to continue throughout the year, with rates determining the outcome.

Shared ownership code launched to aid transparency

A VOLUNTARY new shared ownership code launched that shows you how much you will be fleeced and could further be once in. Greater transparency and longer snagging periods but still a terrible purchase choice.

Mortgage approval slump in April

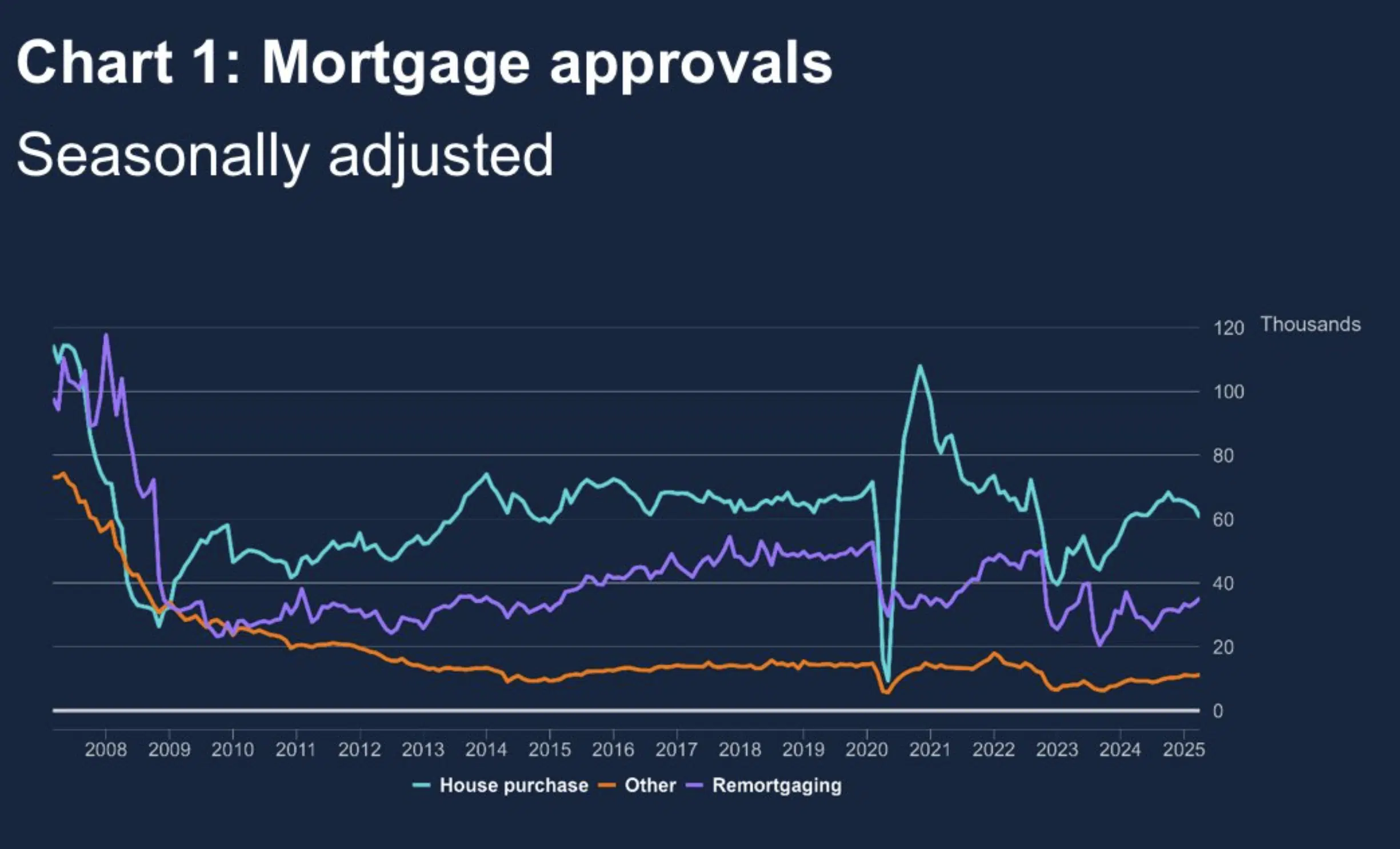

Rate falls galvanised those looking to remortgage, with renewals up 1,600 to 35,300 in April when seasonally adjusted but down when not, but still they remain higher than in April 2024. At the same time stamp duty holiday blues hit mortgage approval numbers, which fell both when seasonally and unseasonably adjusted the former by 3,100 to 60,500 in April, according to Bank of England data.

Section 106 timelines drag on

New analysis from the Home Buyers Federation found local authorities reported a 20% rise in Section 106 negotiation timelines.

The recruitment drive to deliver those promised planning officers appears to be lacklustre. This means the current status quo of an average of 515 days to finalise S106 agreements will continue to stall development.

Acquisition time

Another independent agency gets consumed. This week, Martyn Gerrard expanded its web by acquiring the Islington agent, Carlton.

Gleeson sees gross margin nosedive along with its share price

Development group Gleeson shaved 21% off its share price with its latest trading update, which showed the group’s gross margin for the year fell circa 1%. This further decrease is attributed to increased build costs, a reduction in flat prices, the continued use of incentives and several bulk sale transactions. Also as a result of an aborted land sale in Yorkshire, the group anticipates an operating profit circa 15% – 20% below current expectations. Moving forward they hope to offload further sites boosting profit levels but expect continued planning delays to limit growth abilities.

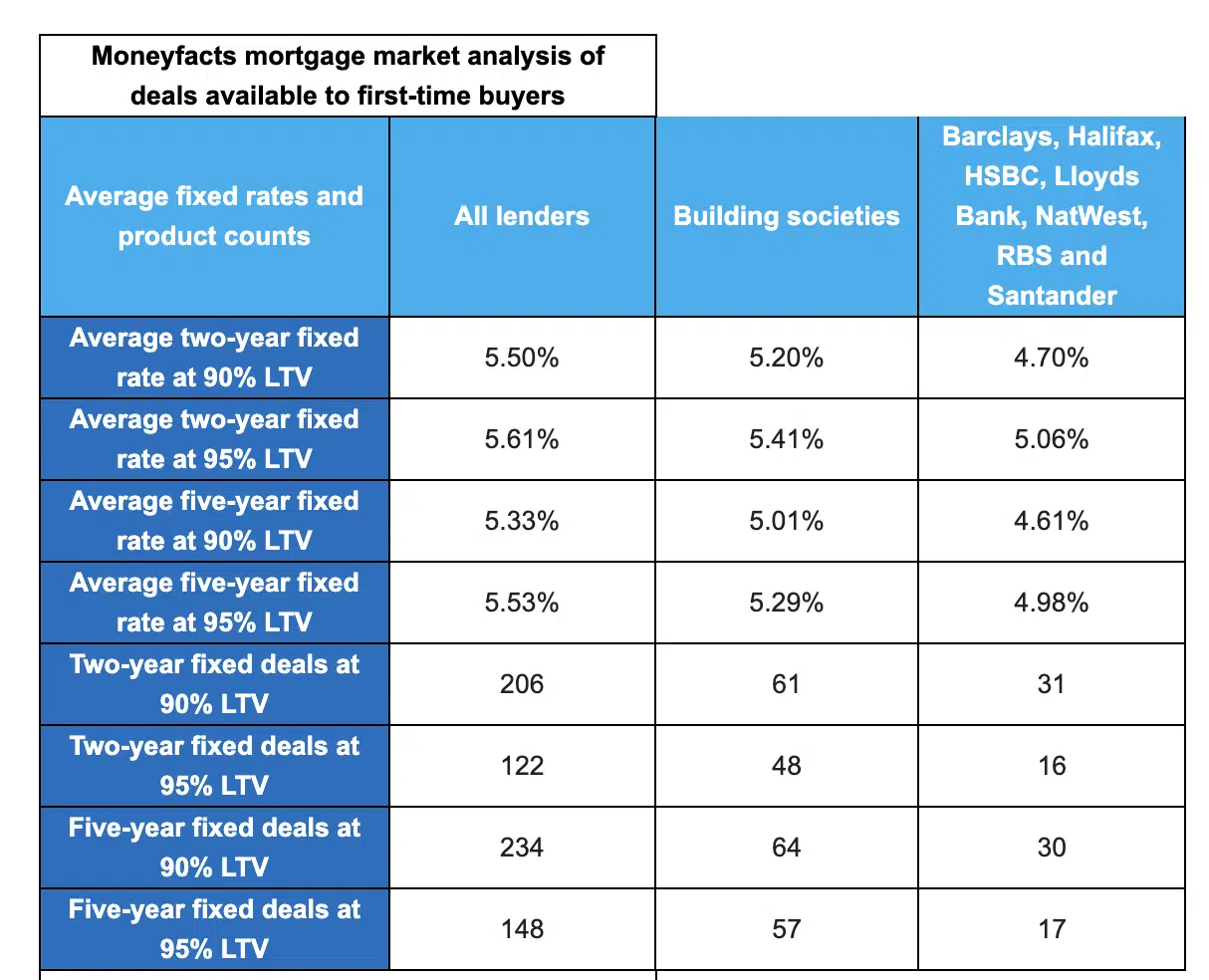

Building societies v banks for first time buyers

Affordability issues remain the biggest hurdle to clear when aiming for your own set of keys. Moneyfacts found the average rates for 90% and 95% loan-to-value deals, for two- and five-year fixed mortgages, were on average better with building societies. However, when they looked at the seven biggest high street banks, the average rates combined were lower but these might not be the best on a true cost basis.

Savills report shed doubt on housing targets

Questions have been raised further after the National Housing Federation commissioned Savills to see how realistic the government’s new housing targets are. Long story short, without more ‘affordable’ funding and a 1% social rent increase chances remain slim to none.

The wealthy continue to relocate

Data analysis by Henley and Partners claim at least 10% of the UK’s wealthy non-dom population have upped sticks in response to increased taxes. If this snowballs further all those billions due in taxes will fall considerably short. This has led to calls for the government to rethink the additional 40% inheritance tax to be levied on overseas assets.

Construction workers get a free pass

In a bid to replenish the Brexit exodus of construction workers the government is introducing the Temporary Shortage List. This list boots off other occupations that were once included in favour of other sectors which will include construction workers. Employees will be able to hire up to 1,300 from overseas, without a degree, where there is currently deemed to be shortage…like fulfilling a housing target.

Rents set to increase further with the Renters’ Rights Bill

The Renters’ Rights Bill comes at a cost to renters as landlords choose between moving on or increasing rents. Housing lender Landbay, found 44% of Britain’s buy-to-let landlords plan to increase rents by an average of 6% in response to the Renters’ Rights Bill due to be implemented by the end of the year

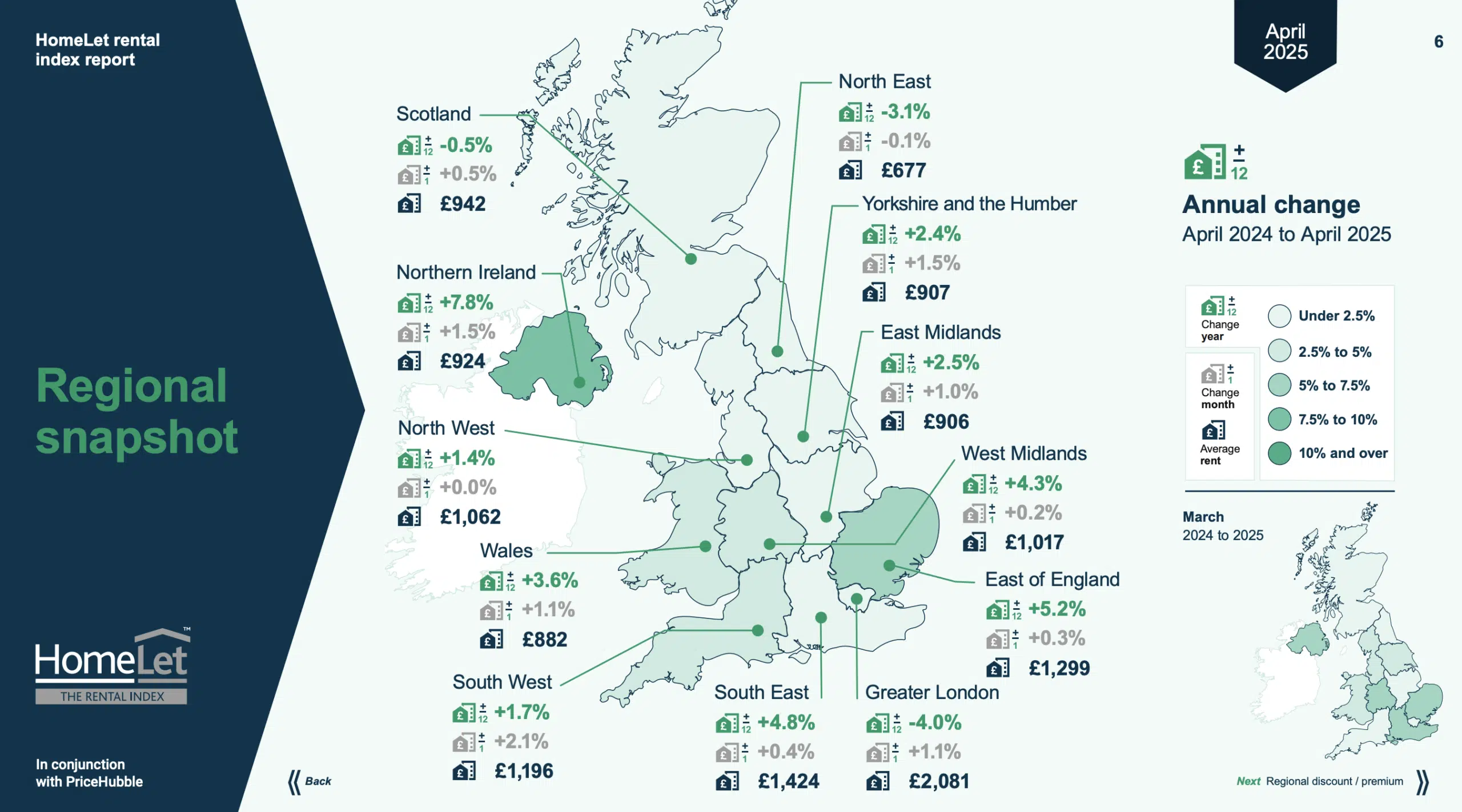

Rents edge up again in May

Another month, another squeeze renters didn’t want. According to HomeLet rental index for May 2025 – average rents across the UK rose by +0.7% to £1,307 and 0.8% outside of London to £1,124 per month, 2.8% higher than a year ago. In London, Barnet was the strongest performer up 8.1% and Lambeth the worst, down 7.5%. Regionally, only Scotland, the North East and Greater London saw a slight decrease in annual rent but given previous increases any benefit is yet to be felt by residents.

Rightmove’s UK Hotspots

In response to the rates bum shuffle downwards, agreed sales increased on last year’s efforts by 6%. Affordability though is dictating where in the UK activity is more prevalent. Typically, it appears to be in areas where property prices remained below the national average. Top of Rightmove’s May Hotspot List came Greater Manchester, closely followed by Pudsey in West Yorkshire.

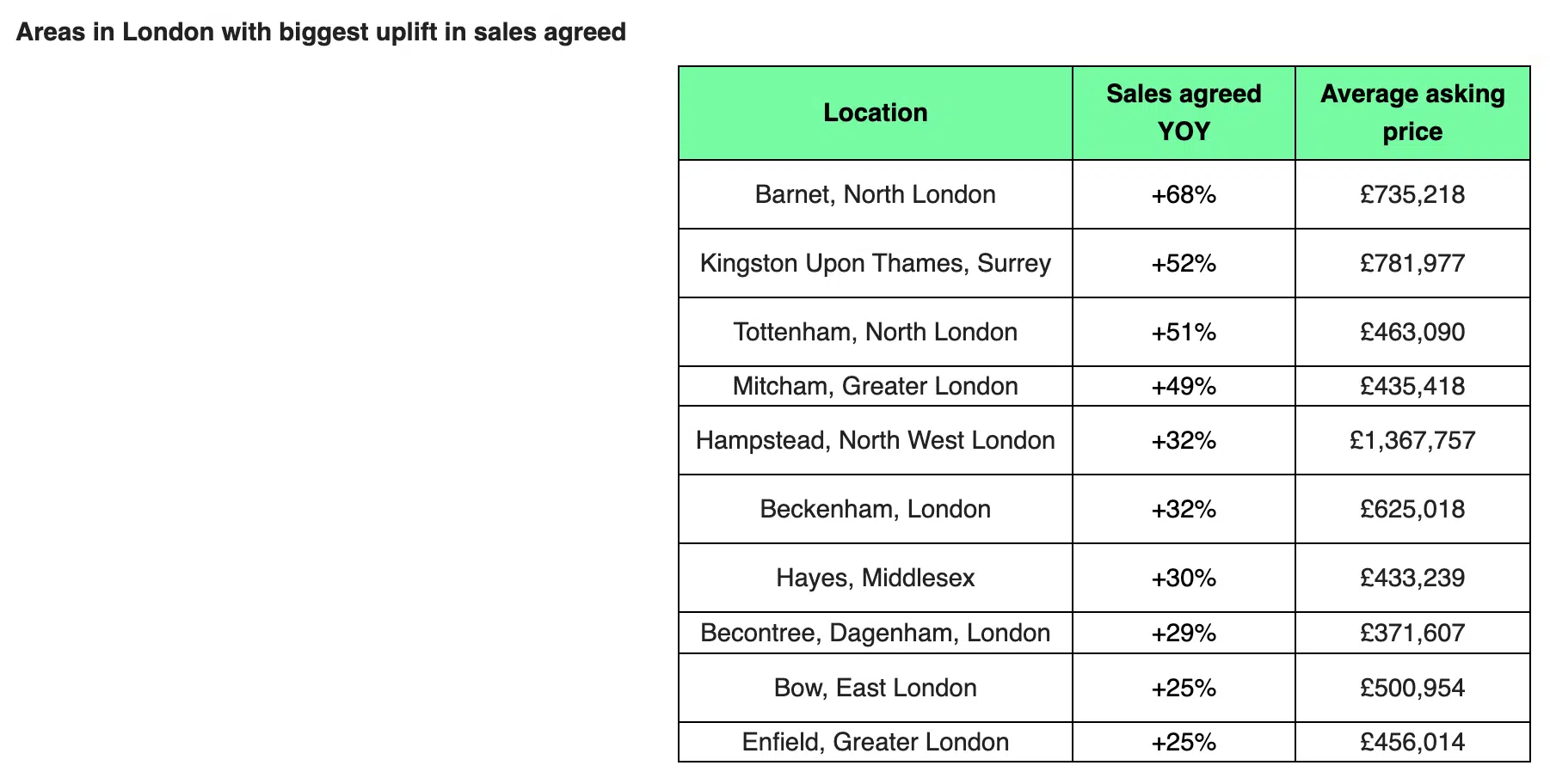

In the capital, sales only increased 1% on last year with Barnet, Kingston-upon-Thames and Tottenham seeing the biggest uplift in sales.

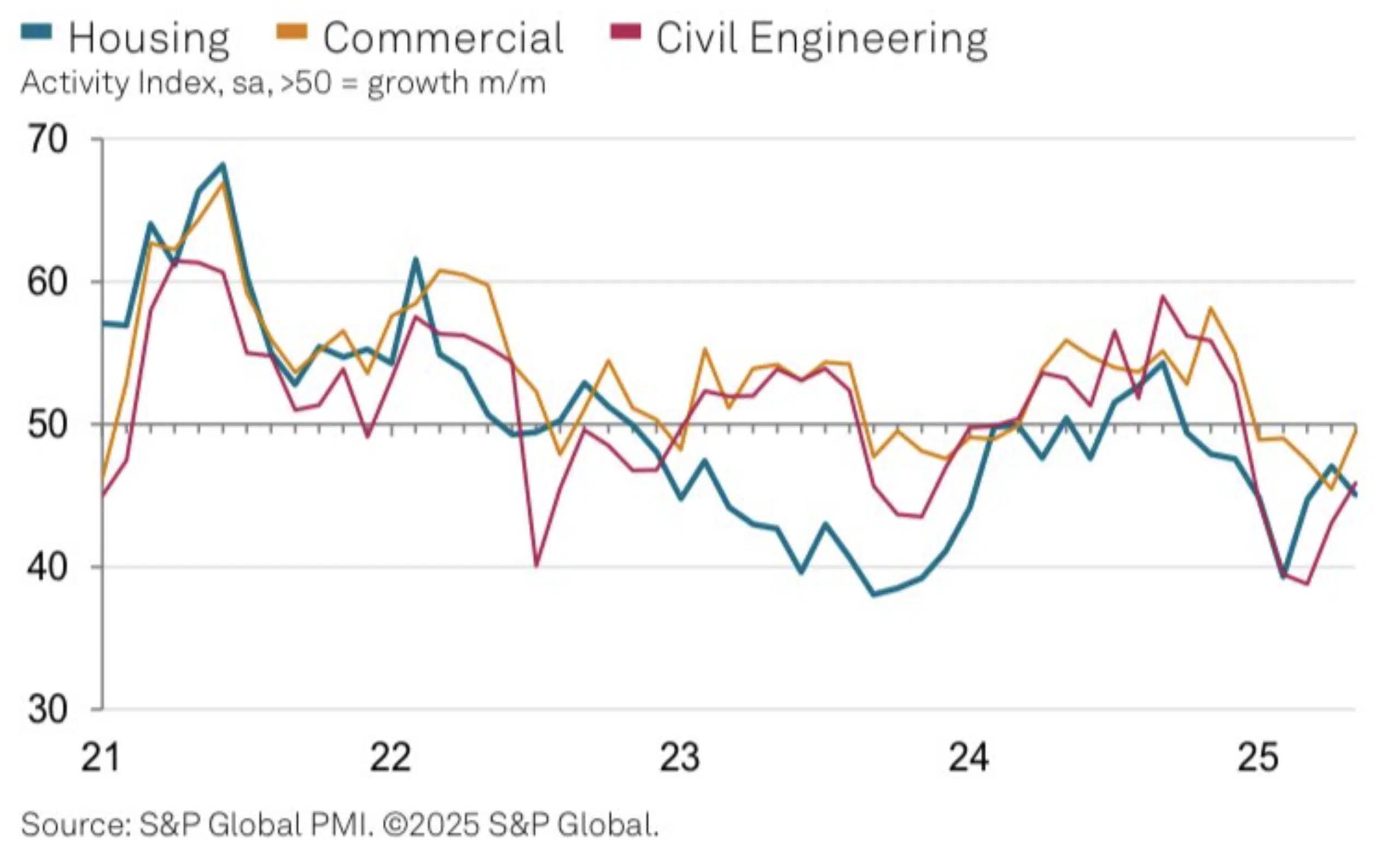

S&P Global Construction UK Index

Construction output continued to trudge along, last month at a slightly less dismal pace than previous months, largely due to commercial work increased workload. Meanwhile, new housing sped up its output descent in response to weak demand. As a result the construction sector is shedding staff; reluctant to fill vacancies while new work is proving hard to get off the ground and employment costs are on the rise.

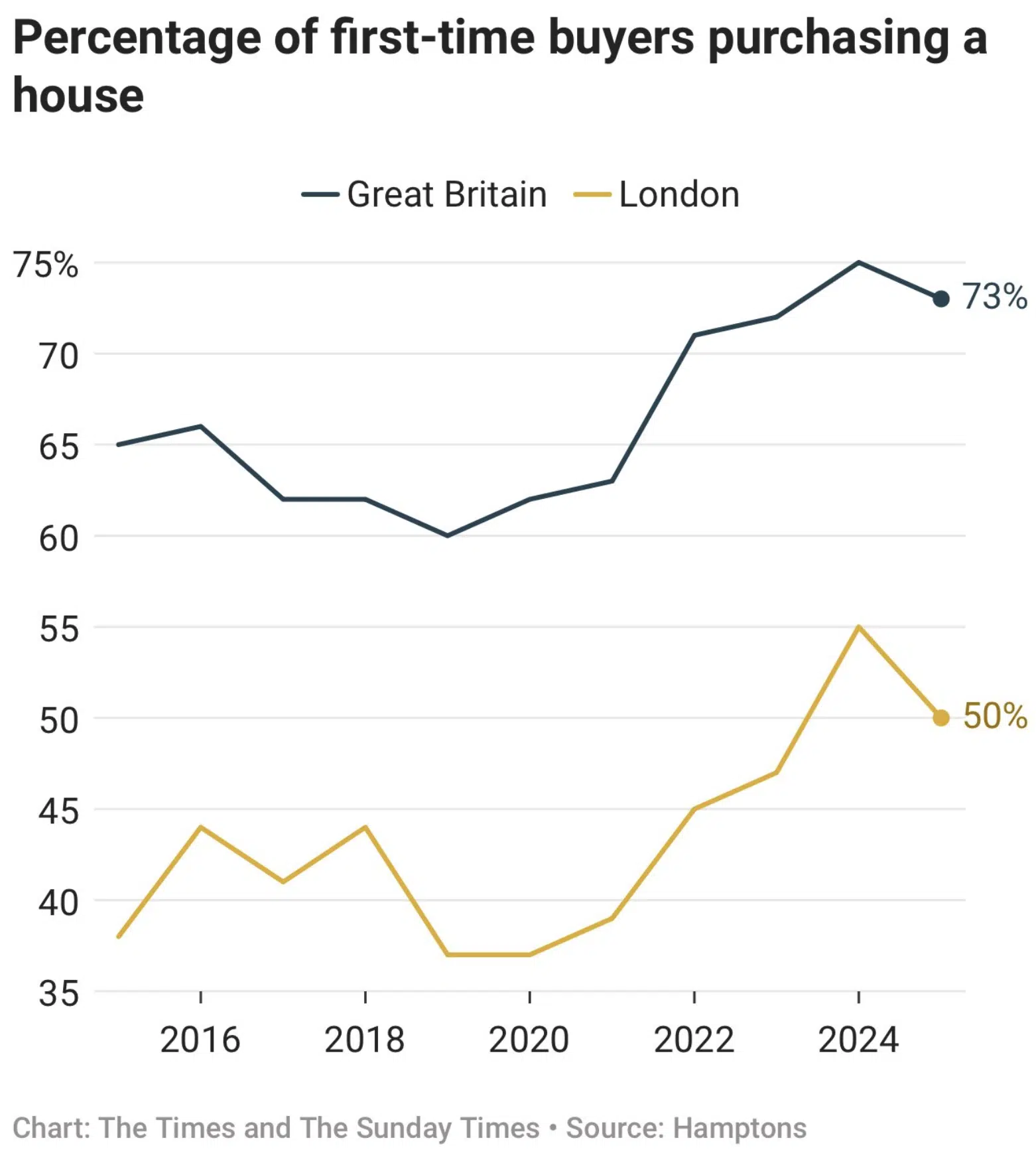

First time buyers move to houses

Affordability permitting; skipping a rung or two has become a more appealing option than opting for a flat in the first instance. First-time buyers are thinking forward about future stamp duty payments and if they can avoid neighbours above, below or both and the additional costs involved with leasehold flats. About 73% of first-time buyers in Britain have bought a house in 2025, up from 62% in 2020, according to Hamptons. In London, 50% have bought a house, compared with 37% in 2020.

Foxtons’ financial comeback

The big Foxtons comeback is in motion. Stage one complete, stage two includes a new medium-term target to deliver £50mn in adjusted operating profit – more than double the figure of £21.6mn achieved in 2024. The CEO Guy Gittins said this would be driven by further expansion of their lettings business through mergers and acquisitions. Increased reliance on AI and data to drive performance, improved CROSS-SELLING across FINANCIAL services, (groan) and training and CULTURE. (good luck)

The state of the rental market

The Londoner found that there is just one fully qualified environmental health officer for every 7,566 rented properties (one for every 4,266 privately rented homes, and one for 3,300 socially rented homes). Funding cuts mean government reform will never be enforceable when the scale of the problem is this big.

And that concludes another UK Property News Recap – 06.06.2025. Any comments or suggestions, please get in touch.