This week, the Prime London market took centre stage. Under the spotlight properties lost their appeal as buyers and sellers alike looked to Dubai, the US and Italy for tax security. This saw stock levels rise and asking prices fall. The government who had banked on drawing down from the wealthy may find funds lacking, leading to calls to leave inheritance alone. Welcome to another UK Property News Recap – 26.06.2025.

Agreed sales of London homes above £5m faulter

Knight Frank, the estate agency, found that the current non-dom UK exodus has not only hit asking prices but sales. The number of £5 million-plus sales in London in the year to May was 14% lower than the previous 12-month period. This, they calculated, equalled a £401 million loss in stamp duty revenue. The promised tax haul from the wealthy looks set to be meagre, if those watching and waiting, opt to swim downstream to the Persian Gulf. In a separate report by investment migration consultancy Henley & Partners they claimed the UK will haemorrhage 16,500 millionaires over the course of 2025. How true this is remains to be seen but if the current increase in recent listings are to be believed they may not be wrong.

On the plus side, the current unease around investment in the prime London market has meant luxury apartment blocks 60 Curzon and The Bryanston now guarantee the few residents residing within their gilded cage privacy, if nothing else.

Lonres finds PCL London price flatlined since 2015

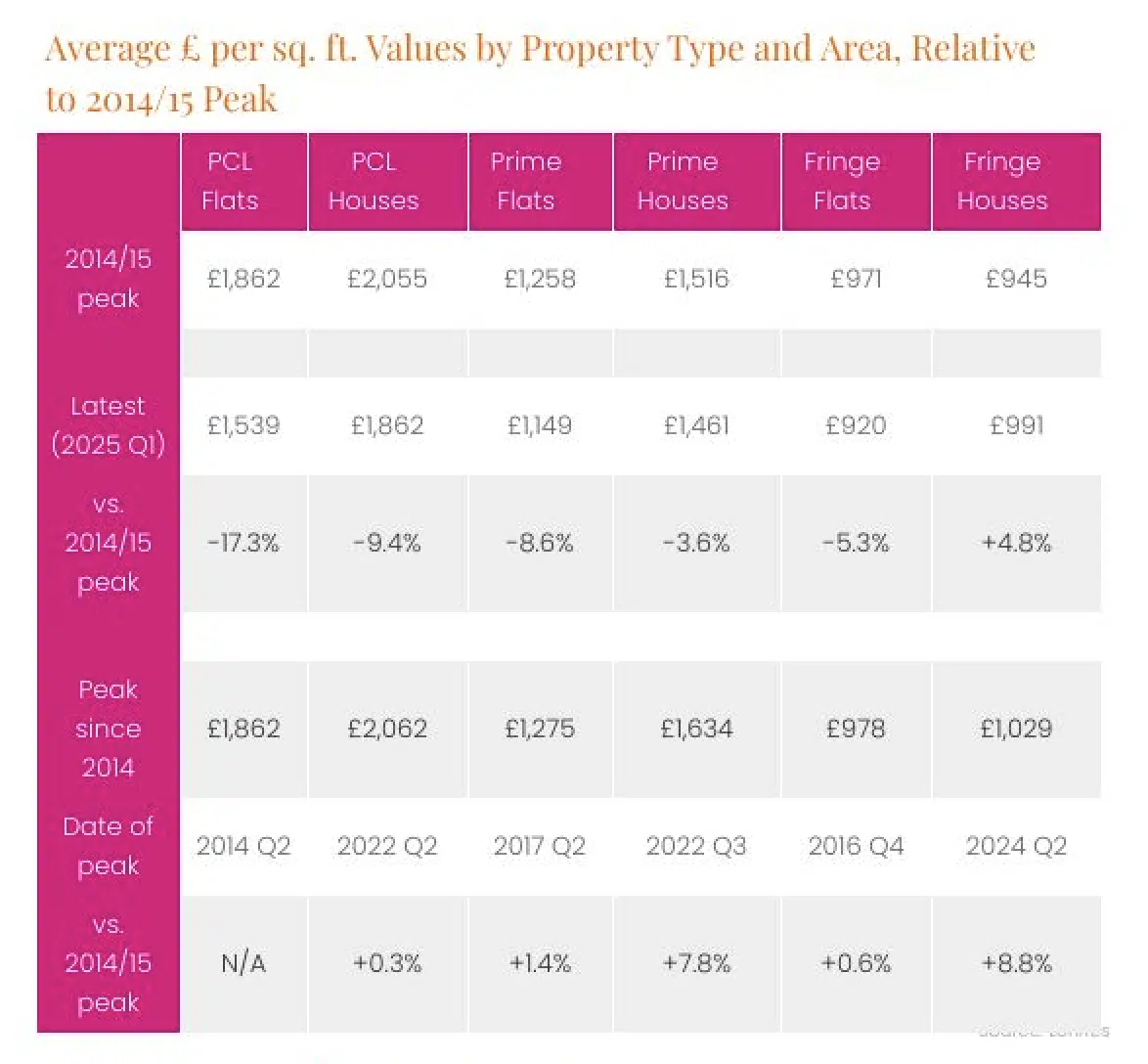

Lonres found that Prime London average values are roughly aligned with 2014-15 prices. To get there, though, a 9.1% discount is on average having to be applied. Only, houses in the prime fringes of London had an average value higher than at this time, up 4.8% after a 2022 peak of +8.8%. Average values for PCL flat owners, however, have flatlined since 2014 and more recently, dipped to 2012 or 2013 levels. The start of the Brexit debate applied the brakes to rising prices. Only the stamp duty holiday revived property fortunes before reality set in.

Council draws down on part time beach hut residents

Bournemouth, Christchurch and Poole council are beachcombing for extra pennies from part-time residents who bought overpriced Wendy houses on the beach via increased licence fees. As a result, sales listings for beach huts have increased but post Covid buyers aren’t rushing to lay their towel.

The annual hut licence fee has increased by 30 per cent in the past two years to £3,240, with another 5 per cent rise planned for next year. This is in addition to the £23,100 transfer fee.

The fastest and slowest selling UK regions

Semi-detached and terraced homes fly off the portal shelves in Glasgow but property in Brighton and Hove, risk prolonged exposure causing their profile to fade. The fastest selling homes remain affordable, between £200,000-300,000, and/or a three bed. The slowest; five beds which take an average 20 weeks to sell.

The building safety application lag

Building safety applications prove costly and laborious to get across the line. According to cost consultant and project manager Cast, just 20 applications out of 187 submitted had been given gateway approval. A 16 to 18 week lag for gateway 2 approval is being blamed for delays along with the quality of the applications submitted. So it would appear the Building regulator needs to “man up” to speed up their process and builders to work on both their development and admin skills if new homes are to be delivered in a timely fashion.

Nationwide lends a helping hand

Nationwide looks to help itself by first offering a “helping hand” to first time borrowers. On the 26th of June the building society will raise its lending criteria to up to six times a borrower’s income for those looking to purchase a new build house with a 95% loan-to-value and 85% loan-to-value on new build flats. At the same time, they are increasing their offer period for new build properties from six months to nine months.

UK Buy-to-let mortgage choice increase

Buy-to-let product availability increases as rates decrease for a fourth month. Unfortunately this still isn’t enough for some landlords to turn a sufficient profit in southern parts of the country but it will enable others in more affordable northern regions.

The Financial Conduct Authority looks to allow more people to borrow, for longer

The Financial Conduct Authority is seeking a public conversation around mortgage lending. Considerations are: to update lending rules to open up the market to more people, and in so doing, reset what is considered risky lending. In addition they want to explore the potential increase in later life lending and so set out a legal framework to support this.

This would indeed enable more onto the ladder but at what cost, remains to be seen.

Feedback closes on the 19th of September.

TIming is everything

Property portal Zoopla claimed that featuring a property’s USPs at the right time of year to correlate with the current seasonal “need” could boost its value.

- South-facing garden – Adds £5,832 in summer

- Swimming pool – Adds £5,832 in summer

- Balcony – Adds £4,018 in summer

- Wood-burning fireplace – Adds £4,568 in winter

- Aga-style range cooker – Adds £3,337 in winter

Climate change could result in financial change

This week there was speculation that the next financial crisis could be a result of climate change. As our weather becomes more extreme and the damage more extensive, insurance companies could hike premiums and in certain cases make some homes, that were once converted, uninsurable. The knock-on effect is that lenders could refuse to lend leading to a house price crash.

This isn’t about if but when. Banks can swallow a certain amount of losses but as more areas and properties get reassessed, expect financial change.

Westminster Council to bring back lifetime tenancies

Westminster Council is to bring back lifetime tenancies after a 12-month introductory period. Ensuring a home for life and generations to come regardless of whether your circumstances improve and others are in greater need.

Social Landlords given Awaab’s Law notice

From the 27.10.2025 phase one of Awaab’s Law will be initiated. This means landlords will be expected to address emergency damp and mould issues within 24 hours. For initial concerns they will need to investigate issues within 10 days, report in 3 days, and make safe within 5 days.

2026 – other hazards, including excess cold and excess heat; falls; structural collapse; fire; electrical and explosions; and hygiene hazards.

2027 – all remaining hazards in the Housing Health and Safety Rating System, excluding overcrowding to be included.

Completions rise but new affordable starts stumble

Affordable housing completion rose 15% but new starts only increased 0.6% on the previous year. Falling short, affordable Housing schemes, including Shared Ownership and Rent to Buy fell 27% along with affordable Rent accommodation, which fell 18% for the financial year 2024.

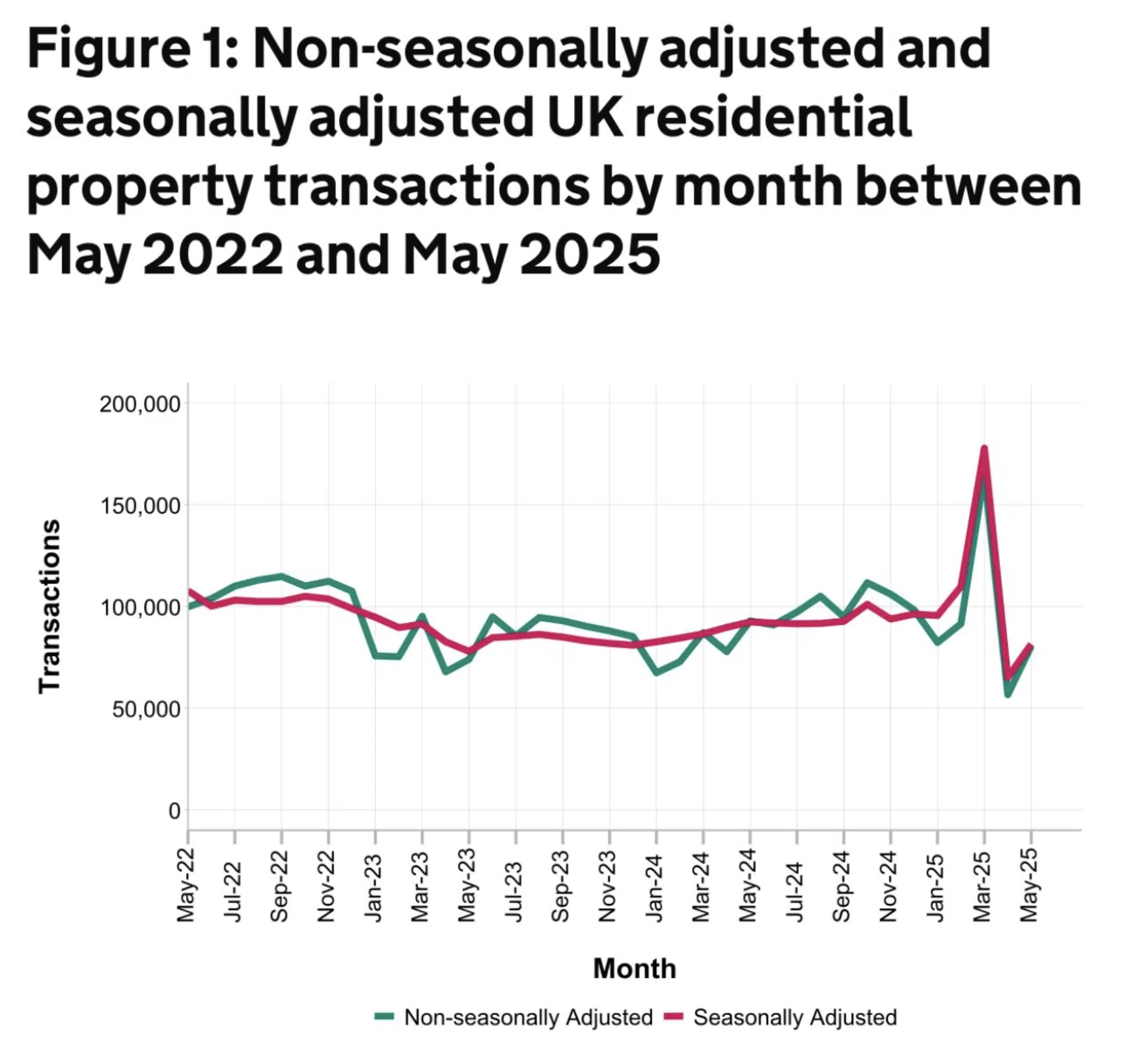

Buyer activity picks up after an initial lull post stamp duty

UK Residential transaction provisional figures for May 2025 increased by 25% for seasonally adjusted transactions & 42% when non-seasonally adjusted from April 2025. However residential transactions in May 2025 were 12% lower than May 2024 and 13% down when non-seasonally adjusted at 81,470.

This concludes the week’s UK Property News Recap – 26.06.2025. Any suggestions or comments please get in touch.