This week the chancellor continued to “consider” various options to extract more tax from homeowners to fill the debt abyss. If anxiety levels weren’t already elevated enough this certainly helped them rise higher. As a result of all this public musing, some are waiting to hear Rachel Reeves’s final judgement come budget day while others, mainly sellers, who potentially were sitting on the fence holding out for the asking price may suddenly swallow reality as others take their first page ranking on the portals, once schools are back. Welcome to another UK Property News Recap -29.08.2025.

UK Mortgage rates on the rise

Just when you thought you were out, they pull you back in. News that the 5-year fixed rate was below 5% became stale in days. According to Moneyfacts lenders reversed recent cuts increasing the average 2-year fixed and 5-year fixed rates to 4.98% and 5.01% versus 4.96% and 4.99% the day before. The likes of NatWest, the Royal Bank of Scotland and NatWest Intermediaries Solutions increased rates by up to 0.20%, Santander up 0.11%, Gen H up 0.15%, Vernon Building Society up 0.15% and Hodge up by 0.20%. These rises come as the need to compete for business reduces and inflation along with swap rates rise. Expect further change before the budget.

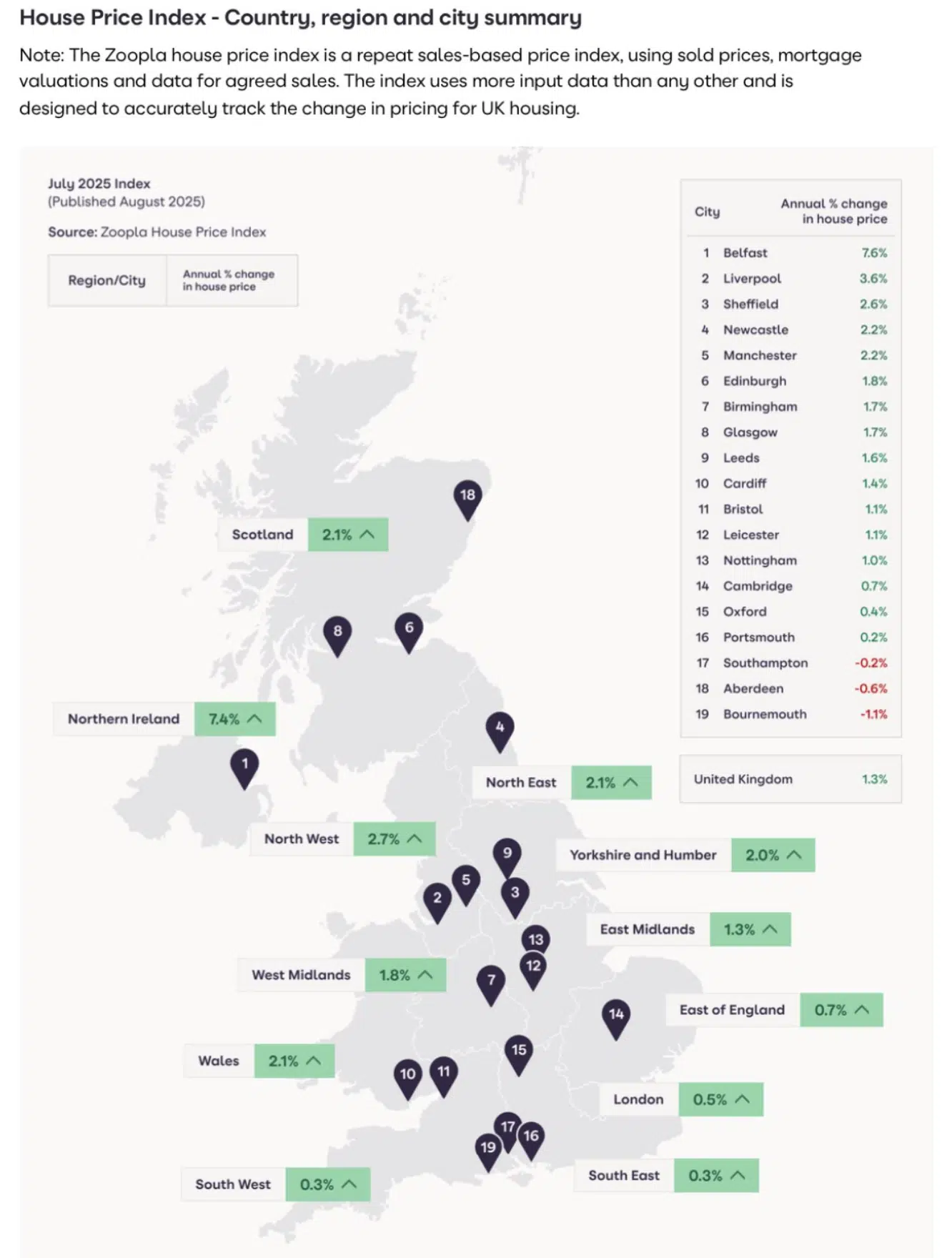

UK House price growth slows over the summer

In Zoopla’s latest HPI, increased stock levels mixed with buyer budget caution caused a rise in the number of price adjustments; 1 in 10 homes found their price needed taking in, drawing out agreed sales times. As a result, UK house price growth overall slowed, leaving house prices in July up only 1.3% on last year’s efforts. Homes in more affordable Northern regions were found to be shifting, on average, within 27 days compared with southern regions where buyers are browsing the well stocked portal shelves for a bargain. Homes here, are taking on average, 39 days to shift. Despite this, agreed sales were up 5% on last year, showing buyers will “come on down…if the price is right.”

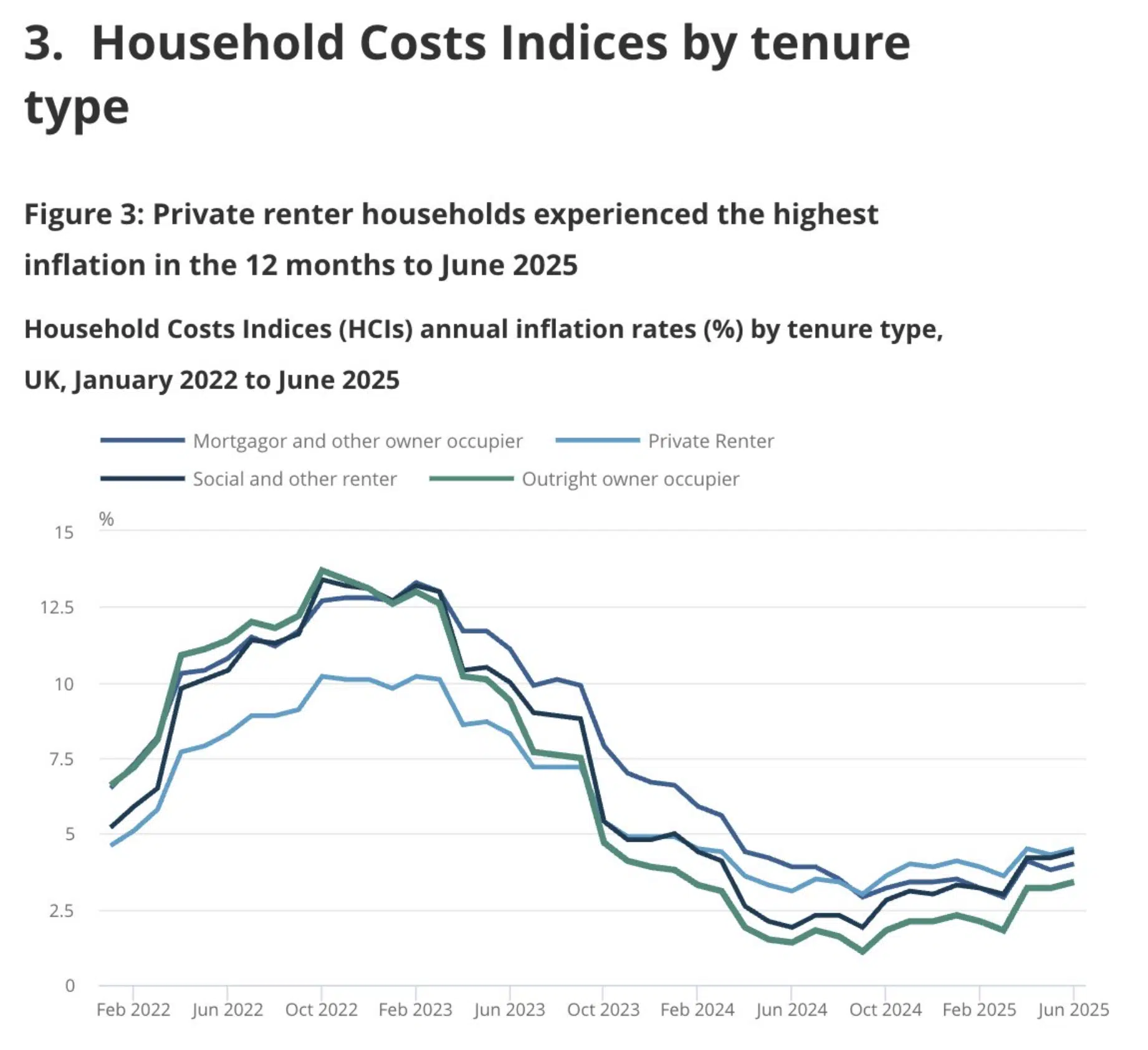

Low-income households hit hardest by inflation

Inflation tightened its grip around low-income households; squeezing them harder than high-income households. Costs rose by 4.1% versus 3.8% in the year to June 2025. At the same time private renters had the highest annual inflation rate of 4.5% in June 2025, while outright owner occupiers experienced the lowest annual inflation rate of all tenure types, at 3.4%.

Angela Rayner gets creative with tax owned on new home

Once upon a right-to-buy discount, a politically driven red head, seized on an affordable option and scaled up while scolding others for aspiring to do the same. Angela Rayner came under scrutiny this week after she bought a 3 bed apartment in Hove, claiming it was her primary residency. This saved her a considerable amount in stamp duty which would be fine if she wasn’t still claiming that her other home in Manchester was her primary residence for council tax purposes. It would appear she is playing the system to minimise tax owed, leaving the tax payer to pick up her council tax bill while Labour “considers” taxing the public more on their own.

Reeves considers applying National Insurance to rental income

Reeves considers giving smaller landlords another shove out of their rental door by slapping NI on rental income. This will cause many to not bother turning around and others to find shelter in a limited company. First time buyers will only feel the benefit if properties become affordable otherwise their existing rental costs will only increase annually.

UAE homebuyers look for UK discounts

UAE residents make a tidy profit, cashing in as demand soars to buy at a discount in the UK where demand has waned. How long this residency lasts, remains to be seen, but for now some are making hay.

And that concludes this week’s UK Property News Recap – 29. O8.2025. Any comments or suggestions, please get in touch.