This week was dominated by Angela Rayner’s stamp duty misdemeanour. House prices fell – on one measure and rose on another – the pound tanked and gilt yields soared, before recovering, but Rayner continued to dominate the headlines with speculation over whether she did, or did not, know what she was doing. Either way, it clearly pays to pay for good advice. Welcome to this week’s UK property news recap – 05.08.2025.

House prices melted in August

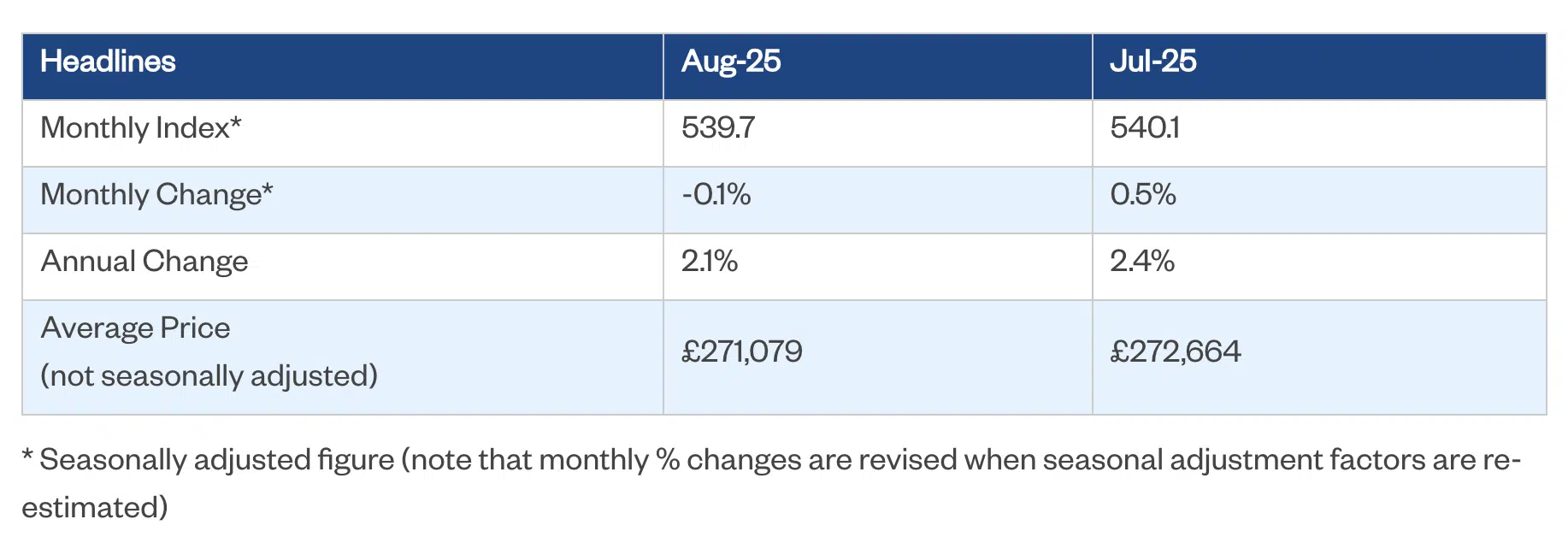

Nationwide’s House Price Index for August showed UK house prices sweated under the glare of Rachel Reeves’s property tax musings and the holiday sun. House prices fell 0.1% month-on-month to £271,079. Moving forward the lender continues to “bank” on improved affordability from lower rates as we progress through 2025 to 2026.

Mortgage approvals crept up in July

The Bank of England found net mortgage approvals, when seasonally adjusted, tiptoed up 800 to 65,400 in July while remortgaging with a different lender decreased by 2700, to 38,900 as the ‘effective’ interest rate fell for the fifth consecutive month, to 4.28% in July. However, when not seasonally adjusted both remortgaging and mortgage approvals increased in July. Both rose significantly when compared to the same time the year before.

UK Finance analysis supports lower stress tests

Despite a slump in mortgage lending after the stamp duty holiday, lending made a comeback in June, facilitated by lower rates and a determination to avoid another year in rental accommodation.

Moving forward, UK Finance analysis suggested “that a “modest” increase in lending, enabled by lower stress rates, could improve access to mortgages—especially for first-time buyers—without significantly raising arrears.” At the same time, this “blessing” could turn into a curse as it has the potential to nudge prices up further.

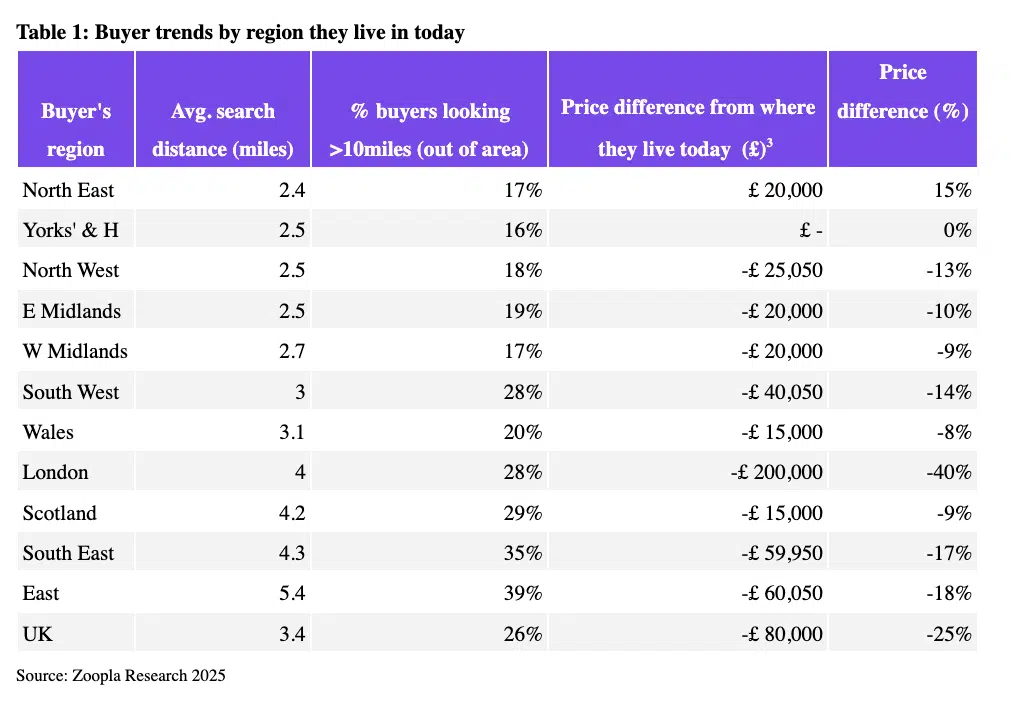

Buyers hone in on more affordable areas and pan out in those more expensive

The research team at the property portal Zoopla found that buyers in more expensive areas like London and the South East are having to extend their search area further to find a more affordable home. At the same time, those looking to buy in more affordable areas, like the North East are able to keep their search criteria tight when hunting. Overall though buyers are holding out for their preferred area: the average search radius narrowing to 3.4 miles in 2025, down from 4.3 miles in 2021.

Passing the “buck”

Councils are trying to offload problem tenants onto landlords by greasing their palm with taxpayers’ money to the sum of £10,000+. Meanwhile overall UK councils’ debt spirals to £122bn.

Bailey tries to play down long-term UK debt levels and borrowing costs

Andrew Bailey was wheeled out to try and calm the markets and the media from “exaggerating” the impact of long term borrowing costs. He claimed the government has borrowed at the same interest rate for the majority of the year despite a rise in the rate on 30-year gilts. Either way, the chances of another rate cut in the near future is unlikely to be realised.

Angela Rayner’s stamp duty saga ends in tears

This week Angela Rayner reported herself to the ethics adviser after taking “specialist advice” over her recent property purchase in Hove. This council found that she was ill-advised in the first instance, if she indeed was advised, and she should have paid more stamp duty on her Hove apartment. Since then her apartment has been vandalised, Keir Starmer and Rachel Reeves have had to publicly defend her while some of the media and the public are calling: hypocrisy. On Friday, it all came to an abrupt head, with Rayner stepping down. Be it unintentional or deliberate it was clearly not worth the risk. If you have a complex trust in place and you are deputy prime minister you can’t afford to ever wing it.

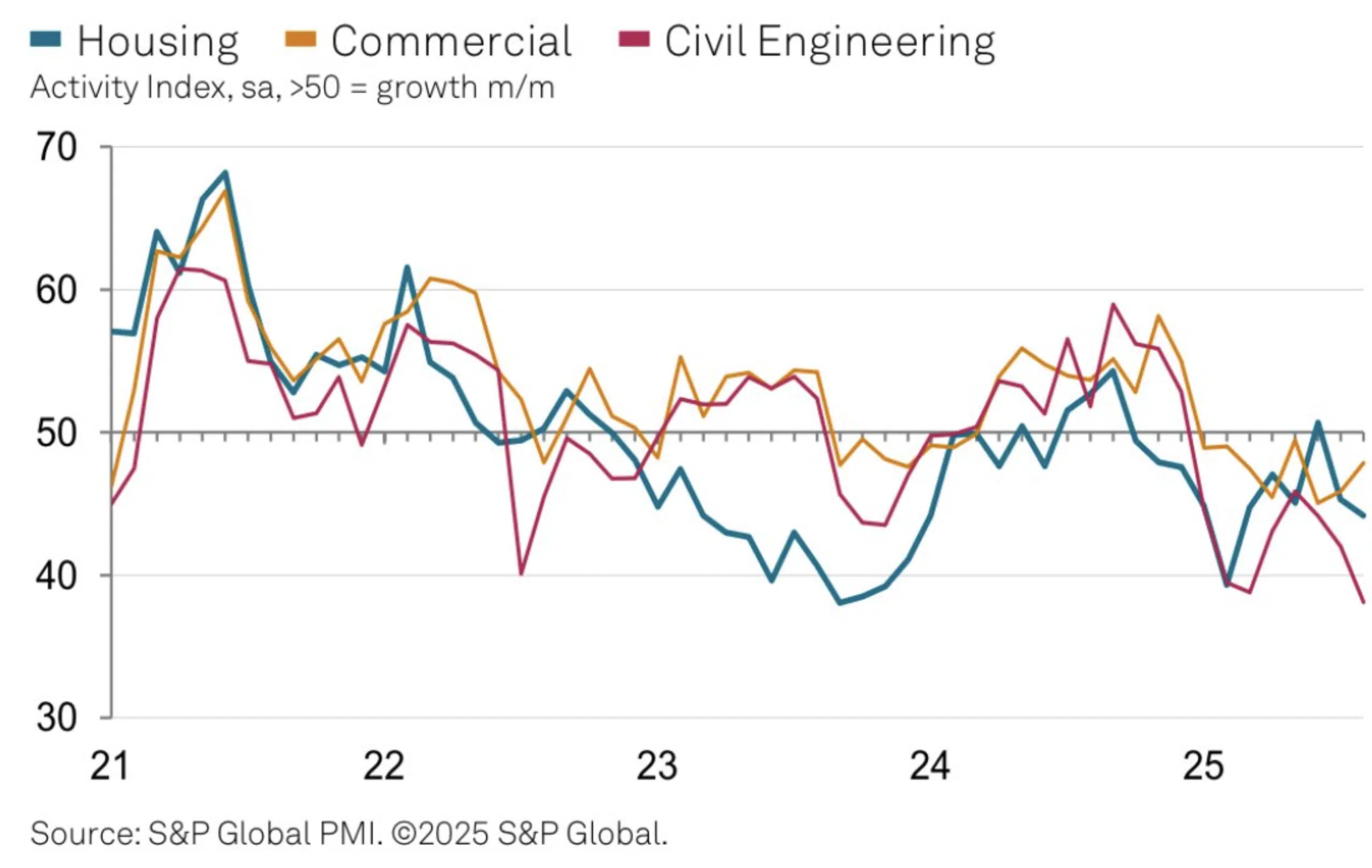

Construction stalls

In S&P Global’s UK construction PMI, the overall construction mood music was sombre in August. Spiralling staffing costs resulted in staff getting laid off as new work loads diminished. This alongside the general unease over the economy and Reeves’s potential budget choices has the industry ticking over till there is clarity. House building and civil engineering saw the sharpest falls while the commercial sector slowed. Once again, the government’s 1.5m housing target looks further and further from reality but this time it is as a result of their own choices.

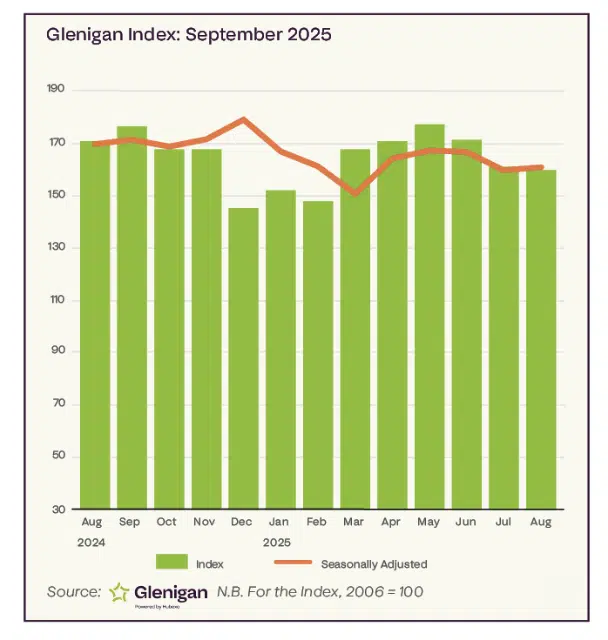

In other construction news: Glenigan found that hopes for construction activity to build on its earlier efforts through into Q2 were set back due to, yes you guessed it..the economic backdrop. The value of work starting on-site dipped by 4% in the three months to the end of August, standing 6% lower than 2024 figures during the same period. Residential starts-on-site fell 18% on the preceding three months, however the non-residential sector registered a 13% increase on the preceding three months to stand 11% up on the previous year.

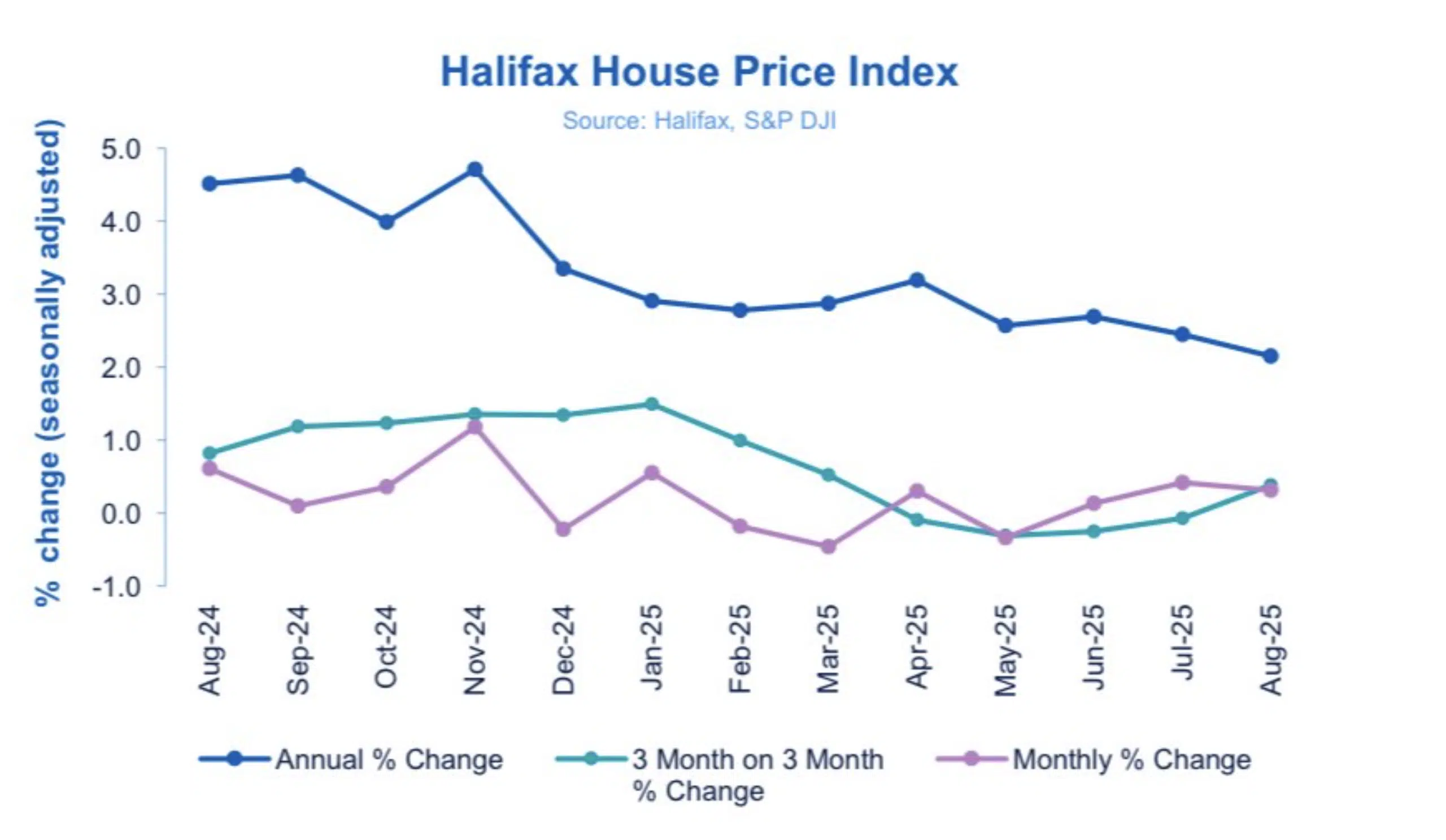

Halifax reports House Price rises in August

In contrast to Nationwide at the start of the week, Halifax ended it by reporting house prices rose for the third consecutive month, up 0.3% in August. This put the AVERAGE property price, according to this lender, at £299,331. This rise is once again driven by activity in more affordable regions where prices have room to grow: Northern Ireland, Scotland and the North West unlike the south west, where prices fell 0.8% over the past year.

Asking Rents rise before legislation hits

In anticipation of the Renters’ Rights Bill landlords have hiked rents when they can. At the same time increased stock levels from those exiting the rental circus for the property ladder has done little to alleviate rents. Property portal Rightmove reported that average asking prices for UK rents rose in August to £1,577 per month: 3% higher than last year. London remains the most expensive area to rent despite growth slowing as affordability levels are breached, with north-east the cheapest.

And that concludes this week’s UK Property Recap – 05.09.2025. Any questions or comments please get in touch.