This week, while Rachel Reeves’s kites soared, UK house prices stumbled as the market kept an eye on which way the wind blew. Anxiety further seeped into the UK property market causing buyers to question the cost of their next move and sellers to either jump ship fast or batten down the hatches. Meanwhile developers’ profit margins were further squeezed, leaving them banking on affordable homes funding. Welcome to another UK Property News Recap 12.09.2025.

Borrowers who took out appreciation mortgages take lenders to court

Between 1996 -1998, Barclays and the Bank of Scotland “banked” off mortgage lenders’ naivety by cooking up appreciation mortgages called Sams. They were aimed at “asset-rich, cash-poor” borrowers who were required to only pay back the original amount plus an INCREASE in the VALUE of their home when the mortgage was repaid, or when they died and the house was sold. Today the law firm Teacher Stern is bringing group actions against both banks as borrowers are now faced with hundreds of thousands of pounds to repay. Unsurprisingly, the lenders are throwing up their hands, claiming that they advised borrowers to take out independent financial advice at the time. That said, why was it even an option in the first place for borrowers for the long term and why, if it was SO innocent, was it so swiftly removed from their lender shelves.

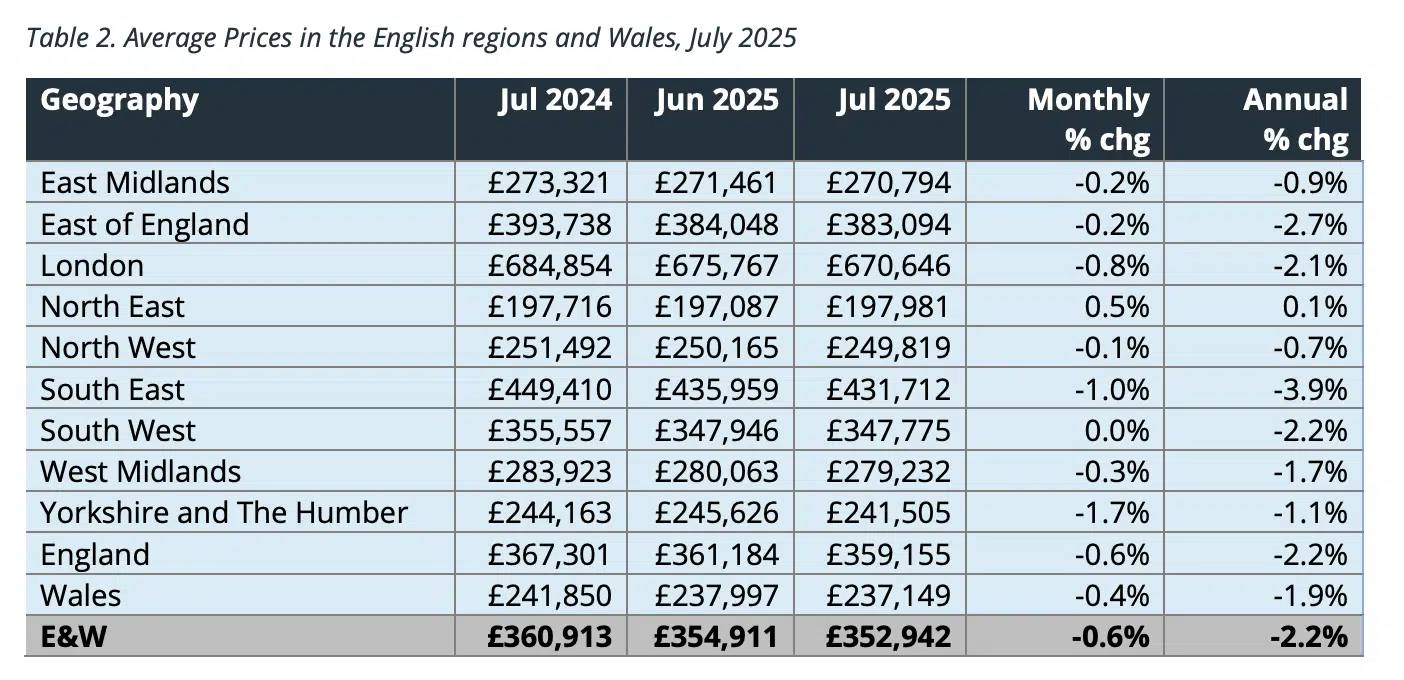

UK house prices stagnate

In Acadata’s latest HPI for August: House prices in England and Wales were unchanged on July’s efforts but down 2.8% annually to £352,930. Northern markets continue to outperform the South, in particular the South East, but growth overall slowed. Only in the North East were prices marginally up on last year while in London, despite prices remaining subdued, prices shifted up a gear.

Homes England and Vistry team up to create Hestia

Homes England teamed up with Vistry to acquire large scale development sites with £150 million worth of investment. The new partnership, called Hestia, aims to turn a profit by parcelling up land to smaller developers. Lets hope they are still in business.

Buyers cut commute time over greener pastures

The call of the office leaves buyers’ dream of greener pastures on hold. Leaving them to only watch prices rise outside the capital and prices inside to stagnate. According to Hamptons the proportion of homes bought by Londoners outside the capital was 5.3%; the lowest it’s been since 2013.

UK house price reductions rise

The South of England is driving the volume of price reductions nationwide, as buyers continue to resist asking prices that are no longer financially achievable or sustainable. The latest research from TwentyEA showed there were 809,000 price‑reductions so far this year. This was the highest on record and 17.8% above last year. Despite this there are still pockets of resistance in prime markets, where buyers are still refusing to accept a hit, resting on the catch phase: “ I don’t need to sell.” That’s code for “.. but we’d like to… but at our price”, wasting everyone’s time in the process. Transactions and Listings also made record increases alongside agreed sales which have reached 897,000, currently 5.9% higher than in 2024. However, timelines have stretched for both finding a buyer, up to 77 days and reaching an exchange, which now can drag on for, on average, four months.

Howard de Walden Estate profits off the back of rental demand

What a difference a year makes. After attempting to shift stock previously the Howard de Walden estate generated record rental income and the family will enjoy a £50 million dividend

The Howard de Walden estate benefited substantially from the increase in rental demand as buyers postponed a more permanent move until Rachel Reeves showed her hand. The estate generated an 8% rise in rental income to £164.1 million in the 12 months to the end of March while the portfolio increased in value by 1.1%, making it now worth £4.27bn.

The substantial service charges here, which typically start from £10,000, no doubt, also increased. Never has a lightbulb been more overpriced in blocks devoid of a lift, concierge or a separate entrance.

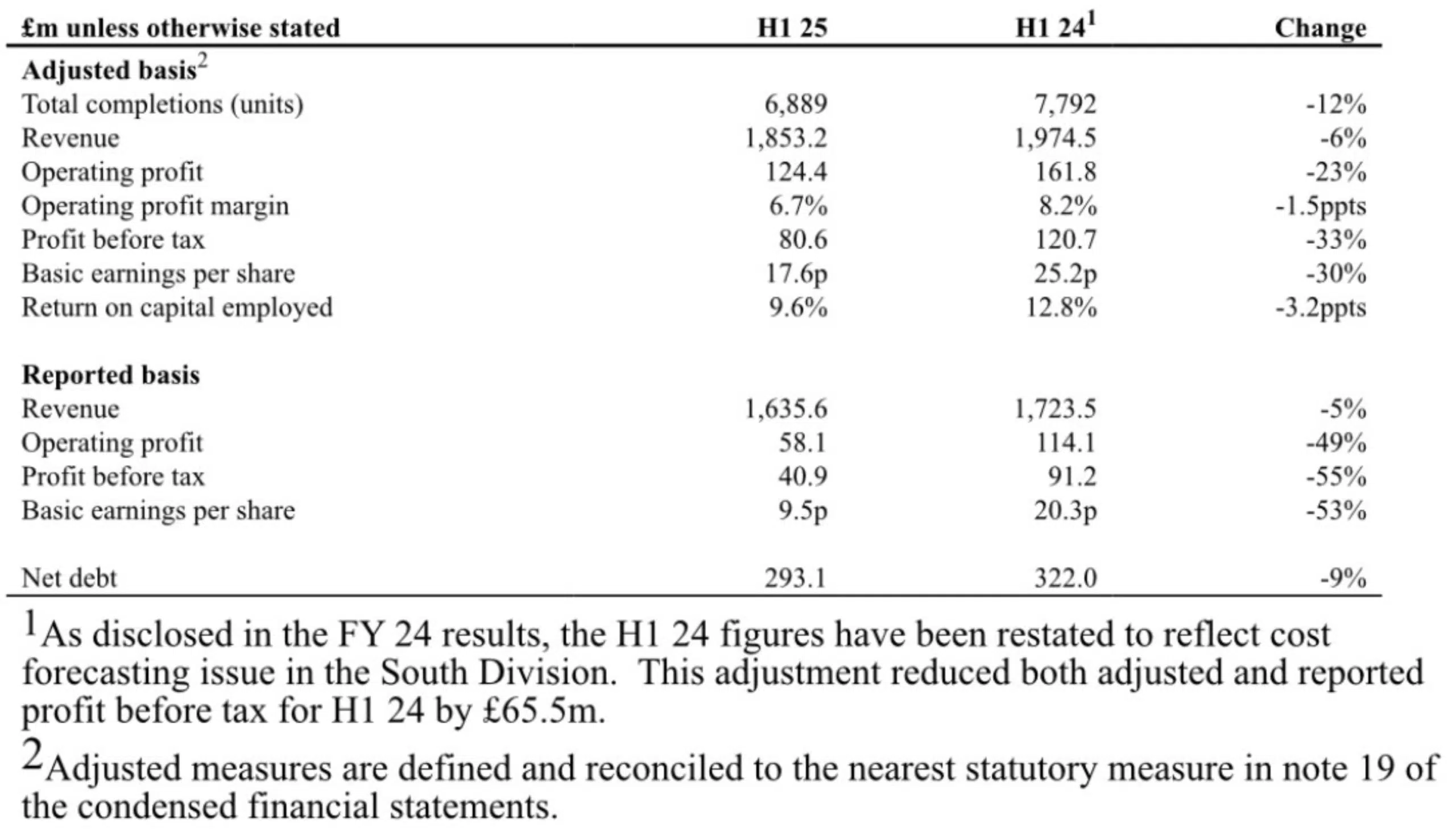

Vistry profits are consumed by buyer doubt

The Vistry group’s half year results show how the developer’s hopes, which were pinned on further rate cuts to increase affordability and so in-turn boost profit margins, were dashed. As a result, completions were reined in for the short term till things improved. Despite this optimism remains that activity will reboot off the back of the affordable homes program and further rate cuts next year.

First time buyers get a lending leg up

Newcastle Building Society levels the lender playing field by backing higher earners who are making their own way without the aid of mum and dad. The lender is offering loans to first-time buyers up to £350,000 with deposits as low as £5,000, with the stipulation that buyers must fully fund their own deposit.

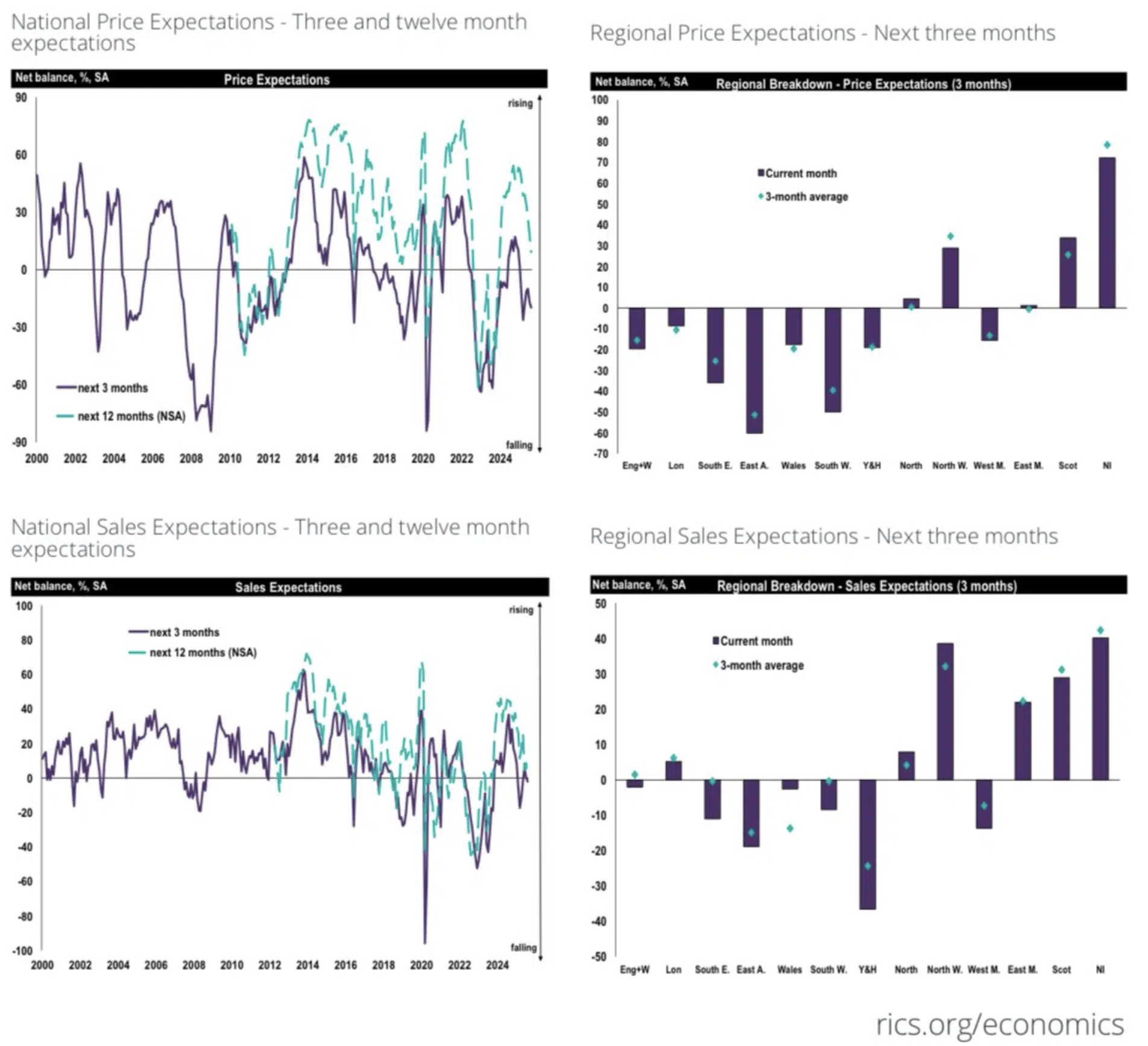

UK housing market is rocket by budget concerns

Rachel Reeves’s kite flying is leaving the property market incapacitated as it watches and waits to see where it falls. Demand and agreed sales in August retracted causing house prices to soften. Moving forward, RICS surveyors paint a rather gloomy picture for the next three months with house prices now only tiptoeing up at the 12 month mark. For those sellers hopeful for a better year in 2026 they may find they are better to cut their losses now than face the consequences of Reeves’s autumn budget.

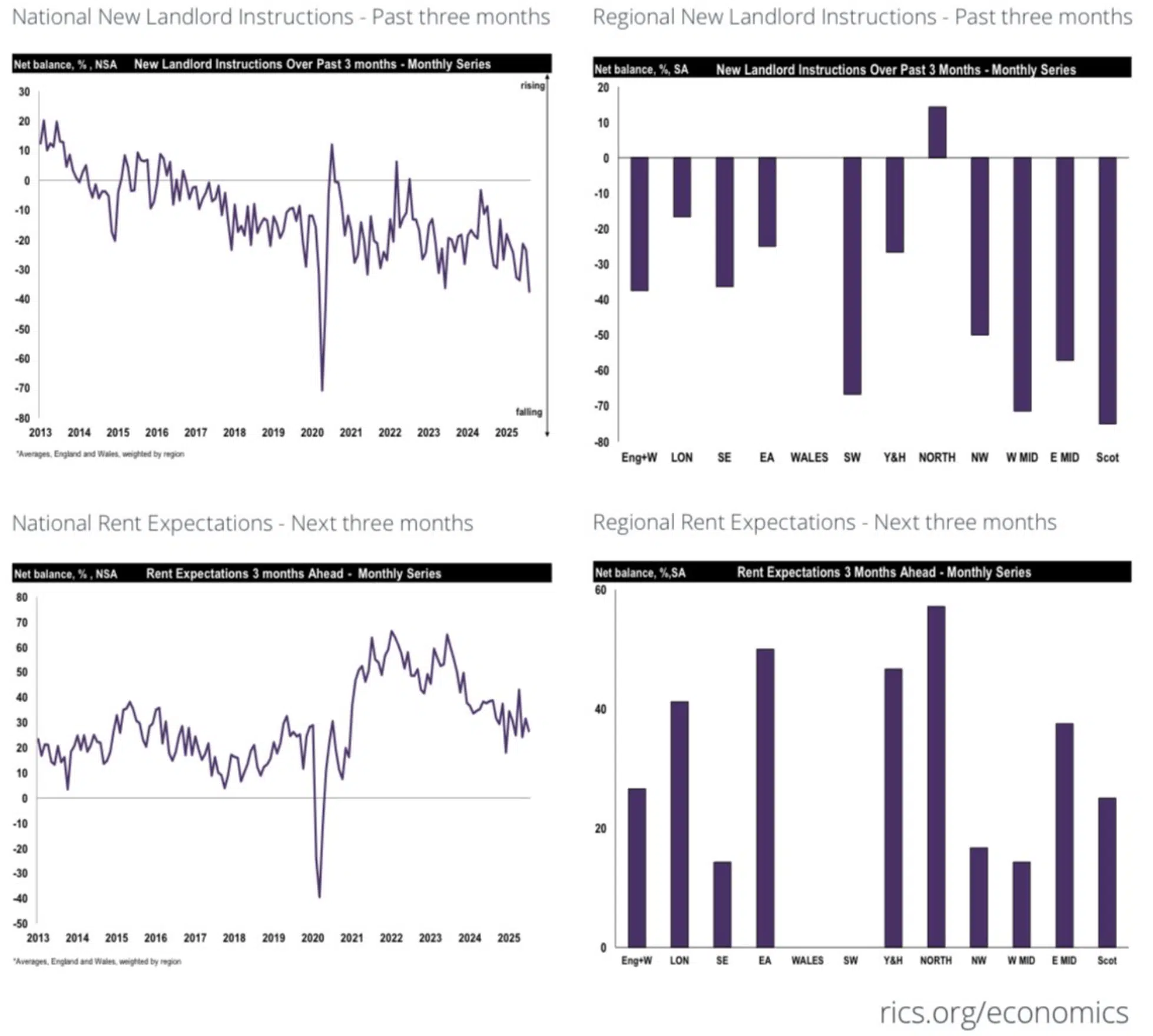

In the rental market; landlord instructions further reduced while demand remained constant. Given this, those surveyed anticipate rental prices to rise nationally by 3% over the next three months.

Nigel Farage comes under stamp duty fire

Nigel Farage is accused of being the pot calling the kettle black after questions arose over how his partner could afford to buy her house in Clacton on her own. Legally, as the couple aren’t married, she can buy a property in her name and not be subject to an increase in stamp duty as she doesn’t have other property in her name. What is being called into question is Nigel Farage’s insistence that he didn’t financially help her out. Given they are in a long term relationship this would be an easy way for him to buy another home without paying additional stamp or council tax. This is all legal, but given how vocal he was over Angela Rayner’s recent stamp duty misdemeanour many are calling hypocrisy.

Pledging change to speed up conveyancing

Simon Brown, the chief executive of Landmark, brought together a merry band of lenders, conveyancers, mortgage brokers and estate agencies to sign an eight-point charter, this week, pledging to reduce the process of buying or selling a property to 28 days. The hope is others will join and in time this aspiration will become a reality. In today’s market, conveyancing can take up to around 190 days to get to exchange, if more companies are prepared to share data, the process will become more streamlined but a lot still rests on local authorities to modernise their end.

Construction ticks up in July

According to the ONS, private housing repair and maintenance, and new housing, boosted monthly growth across the sector by 0.2% in July. Up 2.4% and 1.2%, respectively. However growth remains tentative; infrastructure work and repair and maintenance patching up rather than building on activity levels.

That concludes this week’s UK Property News Recap – 12.09.2025. Any questions or comments, please get in touch.