This week aspirations to “Build, baby, build” were restrained by the government’s own hand as talk of additional property taxes and high inflation bred inertia. Sellers yearning for house price increases in the autumn were met with indifference as buyers were spoiled for choice but for those keen to move, transaction times continued to prove a drag. Welcome to another UK Property News Recap 19.09.2025.

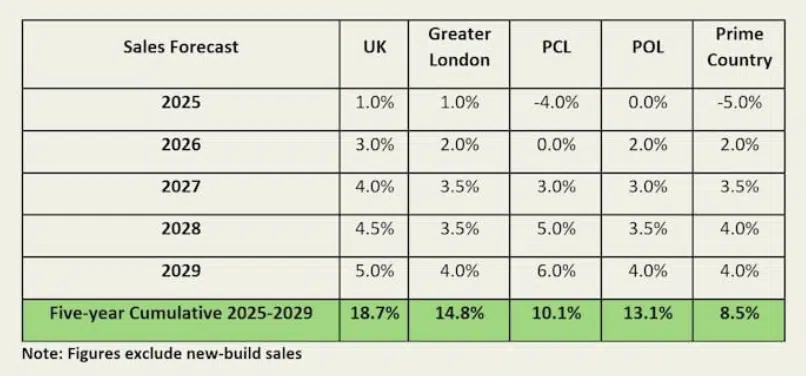

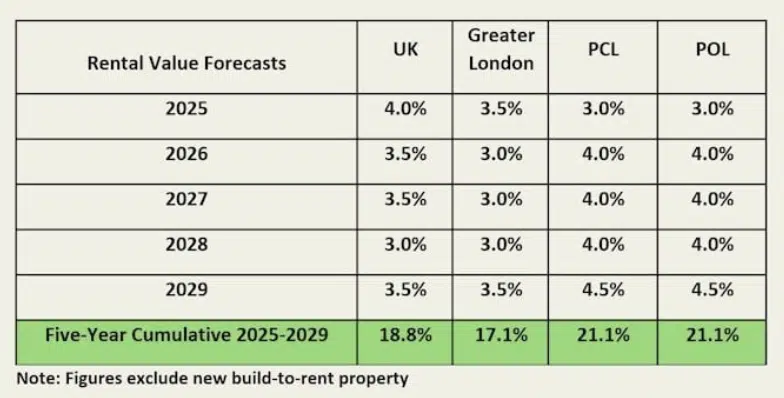

Knight Frank revise house price predictions down

Estate agency Knight Frank came late to the table in revising its house price “predictions” down. They now claim average UK mainstream prices will rise by only 1% in 2025, down from their previous prediction in May of 3.5%. Prime central London prices were also amended, as increased taxes and the potential for more hikes have buyers turning to the rental market or off shore. As a result, Knight Frank amended its forecast down to -4% from 0% in May for 2025 and from 2.5% to 0% in 2026. Hindsight is a wonderful thing especially when in Q3.

As for their rental forecast, this remained largely unchanged, with only a further revision for 2026 in prime central and outer London – up from 3.5% to 4% as supply weakens and demand increases.

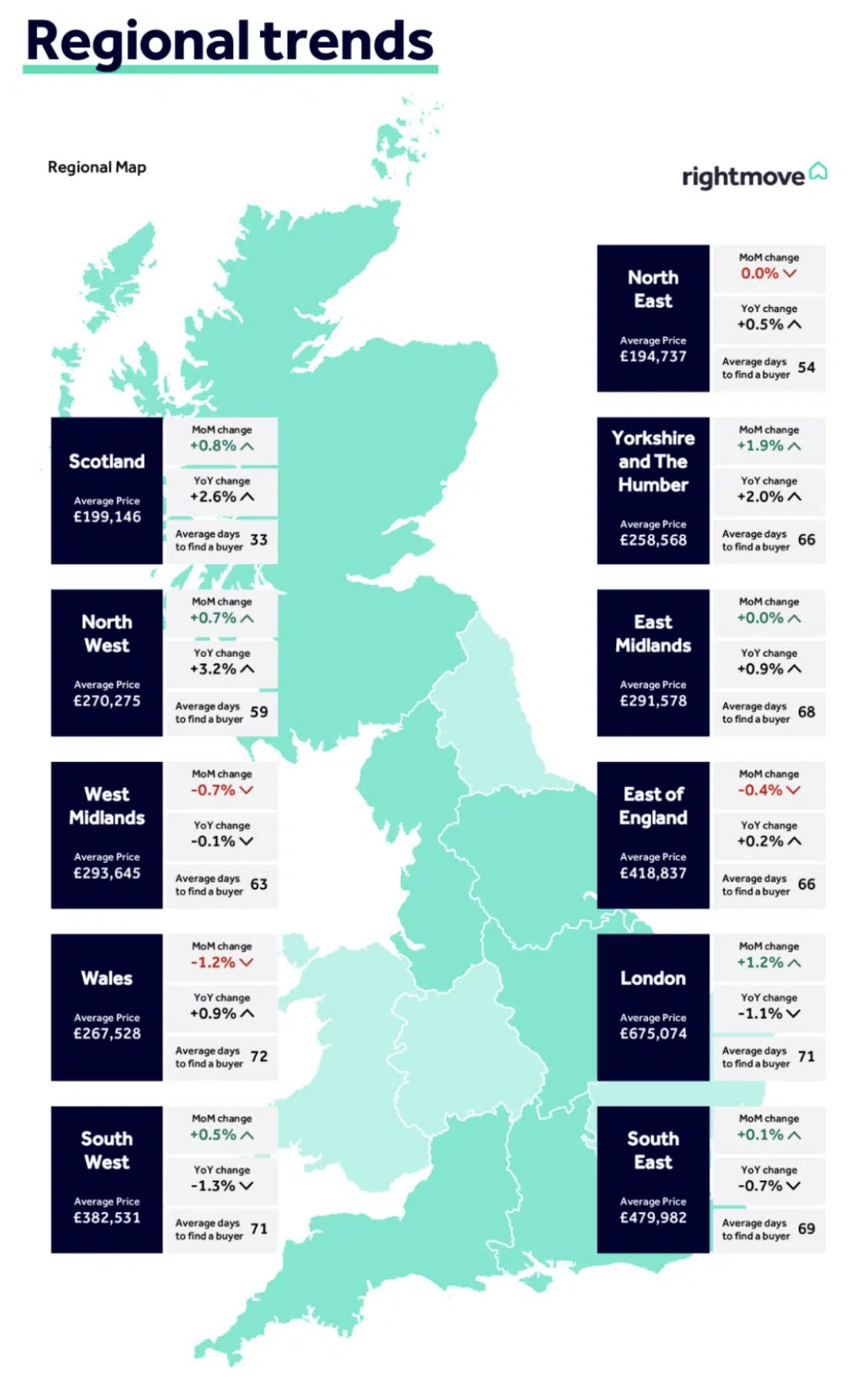

UK asking prices rise in September

According to Rightmove, sellers aspiring for a more buoyant market in September cautiously raised ASKING prices on AVERAGE by 0.4% on last month’s efforts to £370,257. Yet when compared against last year’s asking prices they were down 0.1%, making this the first annual price drop since January 2024. This new-found tepid realism, thrust upon the south and London, has however driven sales activity which was up 4% on last year’s numbers. This was helped, predominantly, by rates edging downward across the year. As further movement is expected to be muted till inflation is tamed and Rachel Reeves delivers her budget, realism remains key to moving on.

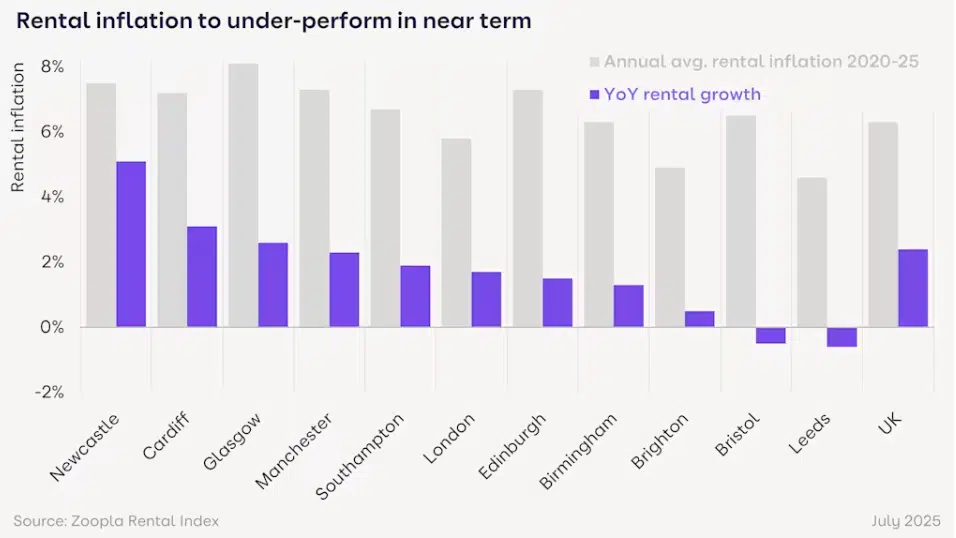

UK rental growth slows in July

Rental growth continued to slow in July, with rents up 2.4% in the last year. This is the slowest rate of growth seen in four years, according to Zoopla, making the average UK rent £1,301. The cause: buyer affordability has improved for some causing a rise in first time buyers, while others are seeking visas elsewhere leaving less competition.

For all the landlords looking to exit the market others are taking advantage of lower prices to cash in on higher yields in more affordable areas. However, London continues to struggle with prices still high and yields low. Those unable to sell are returning to the rental market, achieving better rents but hopeful for a sale in the new year.

First-time buyers step up onto the freehold ladder later

The time it takes to raise a deposit means first-time buyers are coming later to the property ladder. As a result they are bypassing starter flats in favour of freehold properties, opting for greater control, room to grow and reduced stamp duty from stepping up again over high service charges and leasehold properties.

Barclays data showed “semi-detached properties made up 33.5 per cent of first-time buyer purchases in August — up 1.7 per cent year-on-year – while flats declined in popularity by 2.7 percentage points, accounting for only 19.6 per cent.”

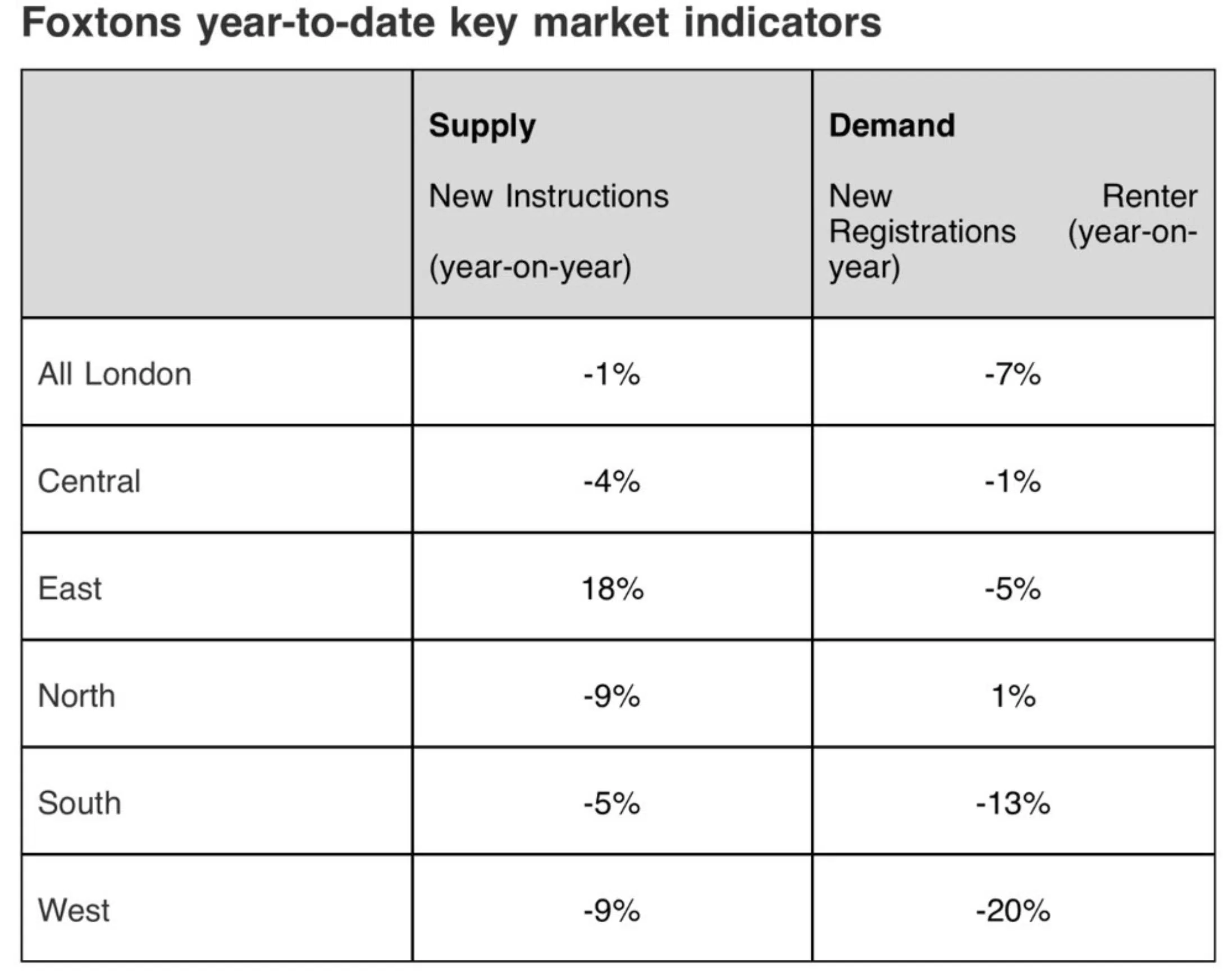

More stock help alleviate rental growth

Landlords who are unable to sell are returning stock to the rental market shelves, which boosted supply numbers by 40,000 compared to the same time last year in August. At the same time demand fell by 11% as some stepped up onto the property ladder,as sluggish house price growth and falls in certain regions, alongside improved affordability made home ownership possible again. This caused average rents to ease back slightly in August to £576 per week, down 5% from July’s seasonal peak according to Foxtons. This meant, tenants spent an average of 97% of their stated budget in August, down from 99% in July.

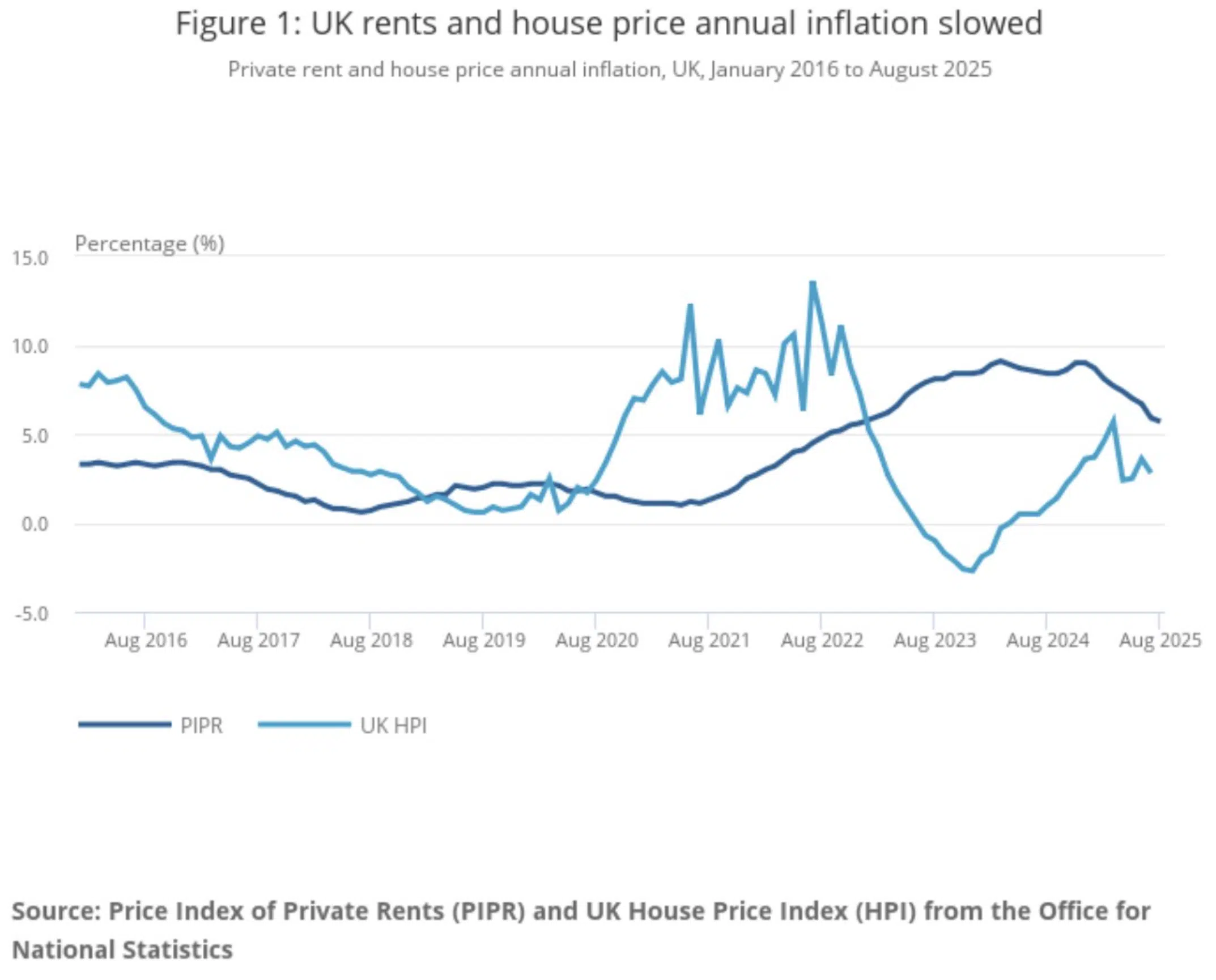

Rents and house price growth slows over the summer

Growth rates for both rents and house prices were estimated by the ONS to have fallen back in August and July, down from 5.9% to 5.7% and 3.6% to 2.8% respectively. London continues to battle against affordability constraints and increased tax doubts which is why annual house price inflation was the lowest here at 0.7%, while in more affordable regions like the north east it rose by 7.9%.

Annual rental growth was highest in Wales, up 7.8% and lowest, for new lets, in Scotland at 3.8% closely followed by England at 5.8%. This slowdown in rental growth will be welcomed by tenants but provide little relief.

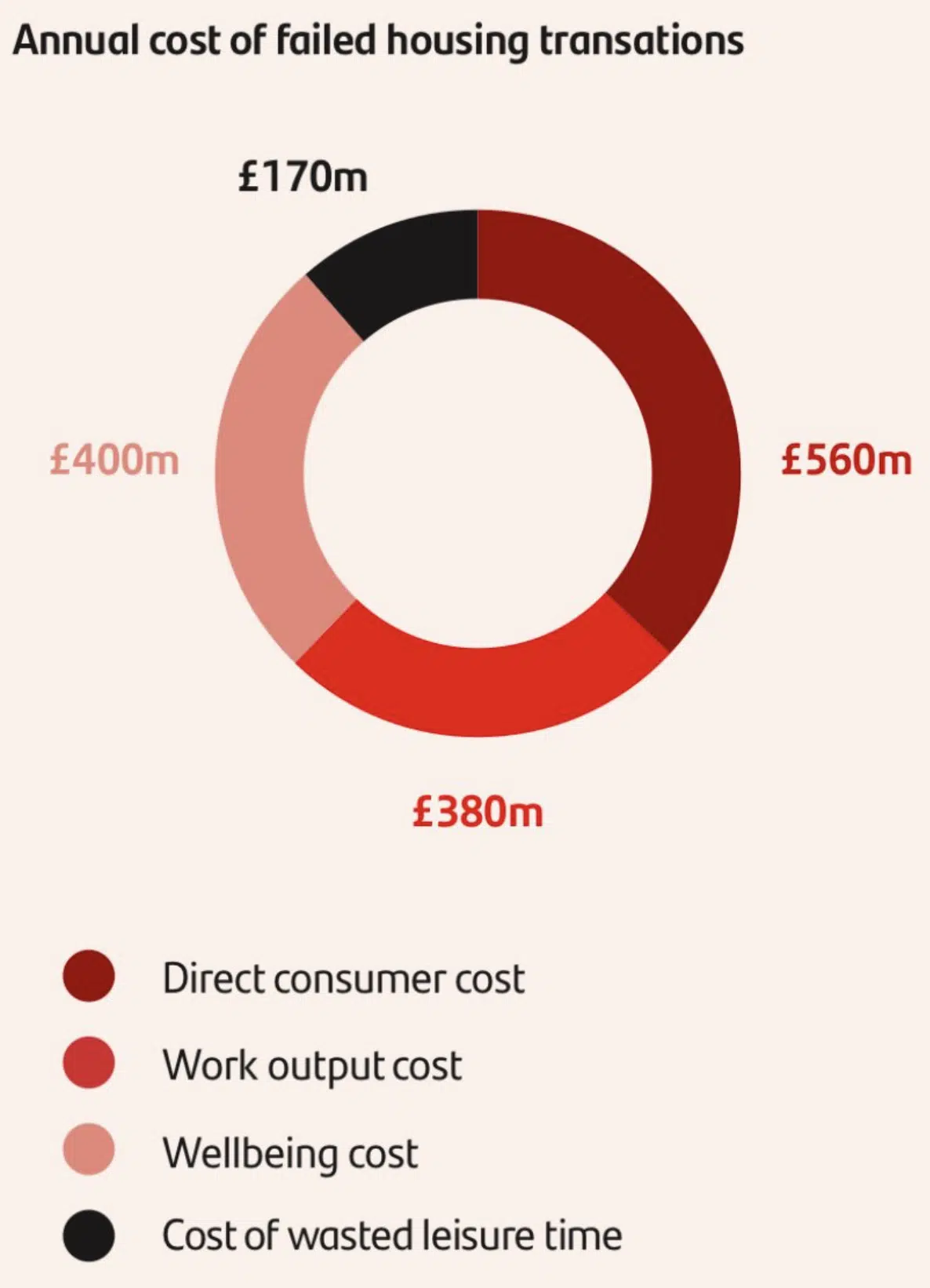

Santander find transactions times costly

Prolonged transaction times enable doubt to seep in, create additional stress and financial loss, and allow the market to shift and alternatives to be considered. The current inability to share conveyancing data or report issues, early doors, resulted in 530,00 failed property transactions each year, causing a £550m cost directly to consumers. “Pledges” are being made to speed up conveyancing times but until there is a consensus and change is accepted over the status quo; buyers and sellers remain reliant on an archaic system.

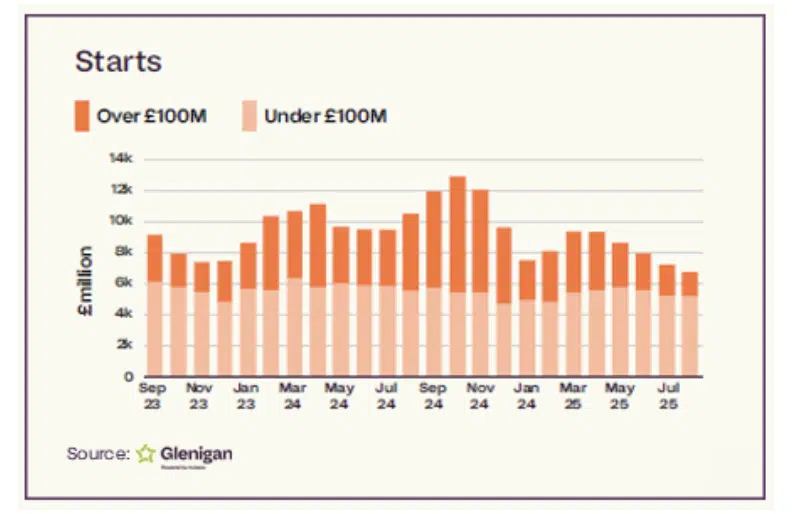

UK Construction stalls in the three months to August

UK construction dragged its feet after further uncertainty was stoked by Rachel Reeves’s kite flying, and inflation’s refusal to abate. Glenigan’s latest construction review, of the three months to the end of August 2025, reported a decline in project starts of 22%, 36% down compared to 2024 levels. At the same time, planning approvals dropped 48% against the previous three months, falling 17% on the previous year. As a result; main contract award values were down by 33% year-on-year. Only non-residential property showed any signs of growth; driven by community and amenity led projects and new office space. The new housing secretary Steve Reed’s comment to “Build, baby, build” looks to have fallen on deaf ears.

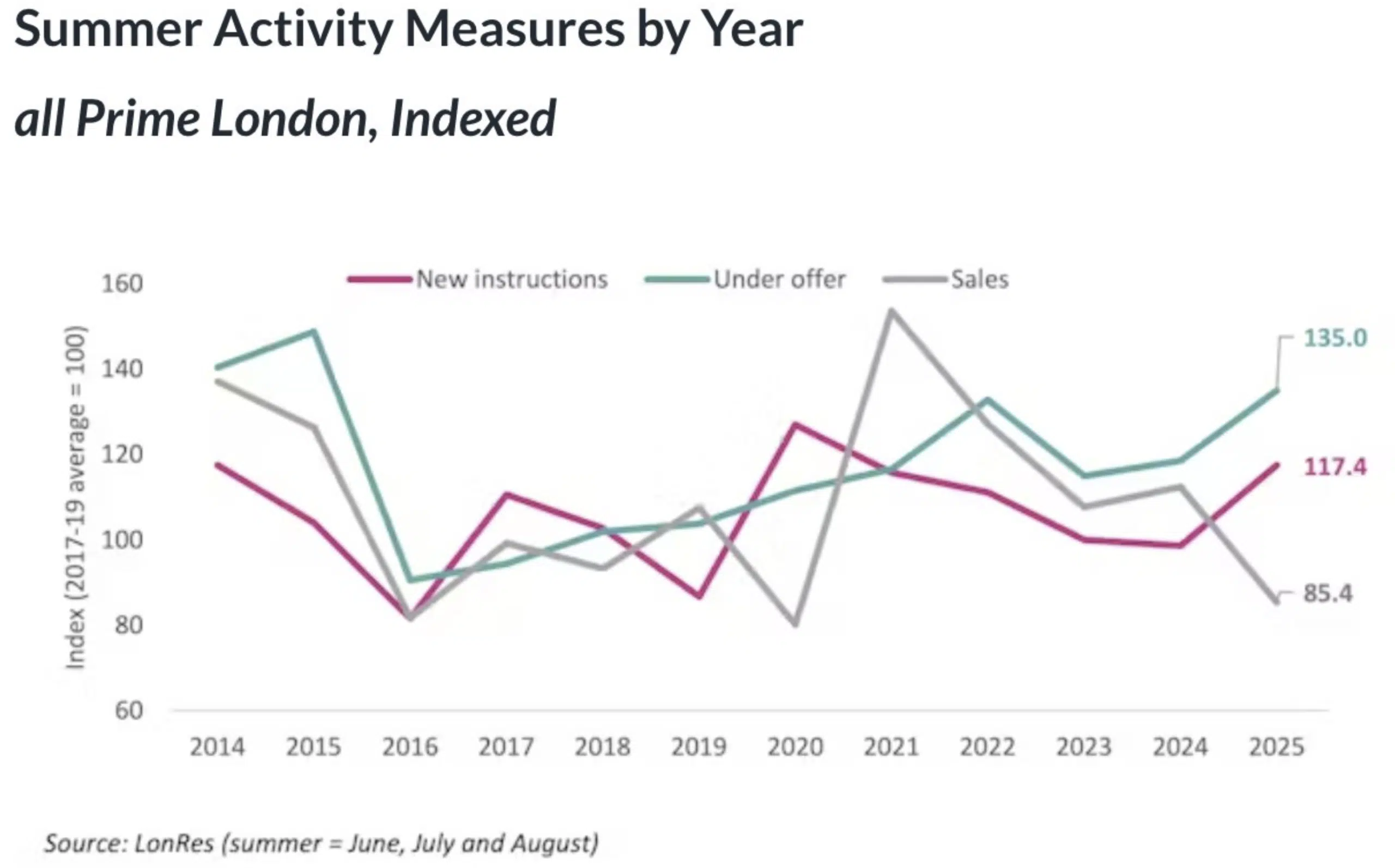

Agreed sales in Prime Central London tick up at a discount

Dented pride is better than dented long term finances. Prime central London provides pockets of realism from those willing to accept the change in property values to get out quick before more taxes could further eat away at their wealth. As a result, according to Lonres, agreed sales ticked up over the summer along with stock levels but transactions nosedived from previous resistance.

Affordability for the average home across all four UK countries improved in FYE 2024, according to the ONS, as ratios decreased compared with the previous year. In England the average income ratio was 7.9, 5.4 in Wales, 5.3 in Scotland and 4.6 in Northern Ireland. That said, affordability remains strained in England unlike Northern Ireland, which was the only UK country where homes sold for less than five times the average household income in FYE 2024

The UK Base rate holds at 4%

The UK Base rate holds at 4%

There was a stronger consensus in the Monetary Policy Committee’s vote on Thursday, with a 7-2 vote in favour of holding the base rate at 4%. Inflation is expected to further rise in September before easing again before Christmas. Given this “expectation” and Rachel Reeves’s forthcoming budget, this New Year could provide a new found resolve for those making New Year’s resolutions over whether to move or not.

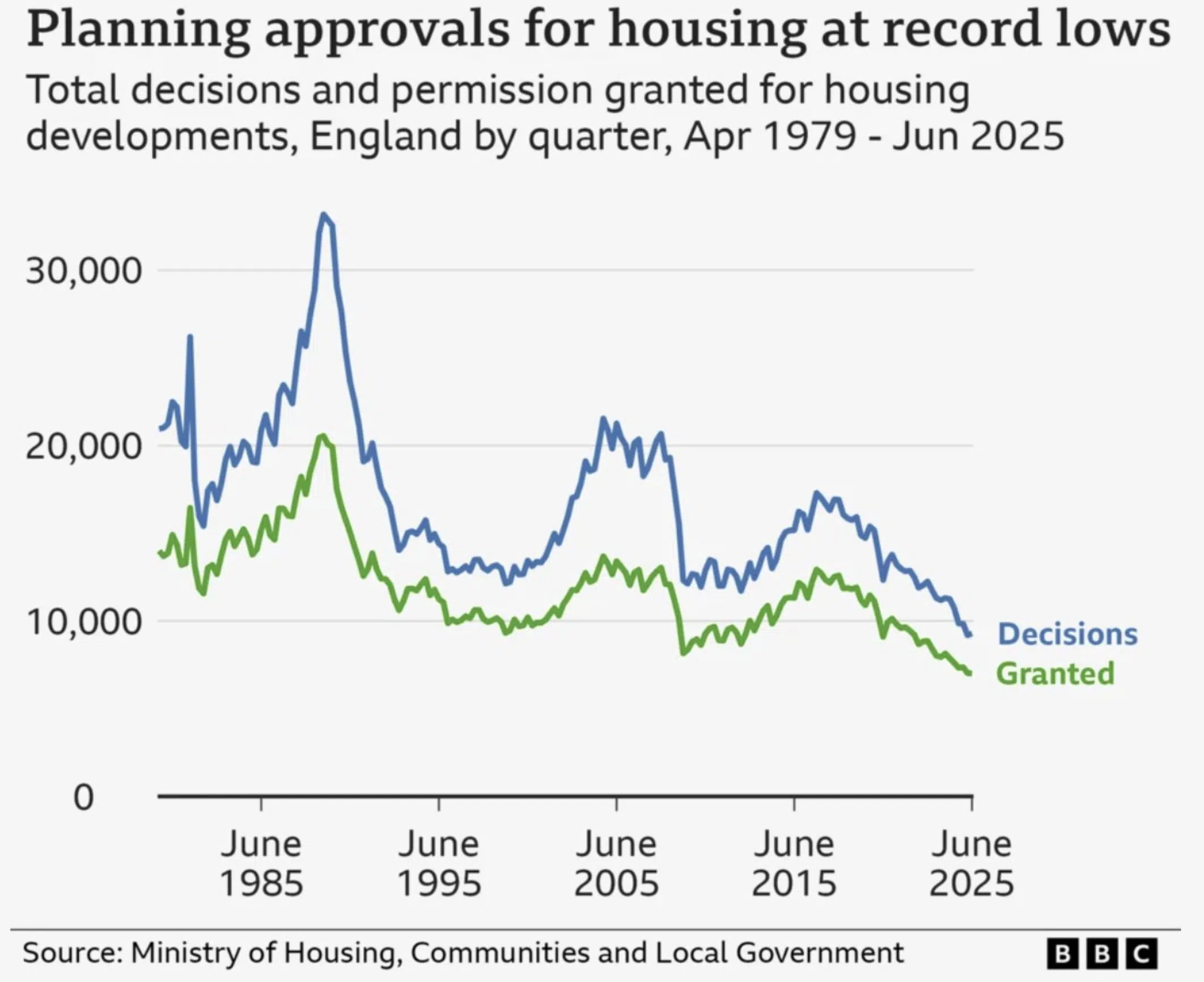

Construction permissions fail to pass go

With each month that passes, Labour’s ambitious housing target of 1.5m homes dwindles. Doubts over the economy, future tax rises and inflation have stalled construction but for those projects hoping to get up off the ground, getting permission continues to be an additional hurdle.

“About 7,000 applications for housing were granted permission between April and June 2025 – the lowest three-month figure since records began in 1979 and an 8% fall on the same three months of 2024”

That concludes this week’s UK Property News Recap- 19.09.2025. Any questions or comments please get in touch.

The UK Base rate holds at 4%

The UK Base rate holds at 4%