This week prices continued to be weighed down by the sheer choice on the portal shelves, yet some sellers remain hopeful for the New Year, refusing to compromise. Instead they are opting to short let in the interim to enable flexibility should Reeves’s budget choices turn on them. Welcome to another UK Property News Recap – 26.09.2025.

Zoopla’s struggles with Yourkeys

Zoopla’s acquisition of Yourkeys in 2021 caused the portal to see red; the group’s annual revenue fell by 7% to £84.17 million, down from £90.45 million in 2023. This was attributed to a £19.5m write down on the developer platform, which helps to manage reservations and sales but struggled to build on numbers in the current climate. Moving forward Zoopla remains the portal underdog with a lot of ground to cover to compete against Rightmove, which generated more than double Zoopla’s annual revenue in the first six months of 2025 alone.

Asking prices compete for business

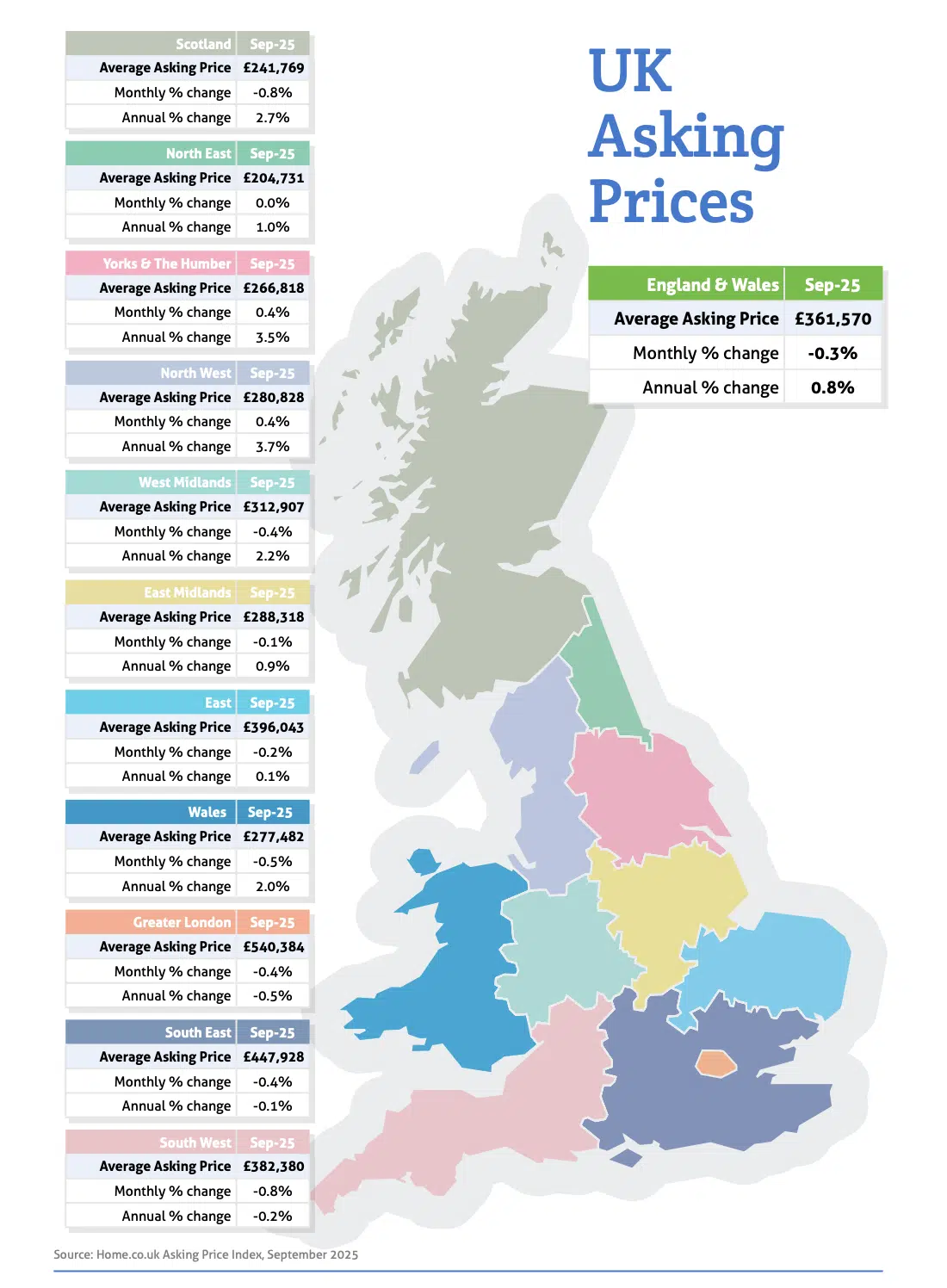

According to Home.co.uk HPI for September 2025, the continued weight gain from mounting choice is dragging real asking prices down and leaving excess properties to languish on the portal shelves. As a result annual house price growth remains below the level of inflation at just 0.8% overall.

Scotland and the South West indicated the largest price falls, while the North West was the top regional performer with a 3.7% year-on-year gain, followed by Yorkshire at 3.5%.

Lack of suitable stock restricting downsizers

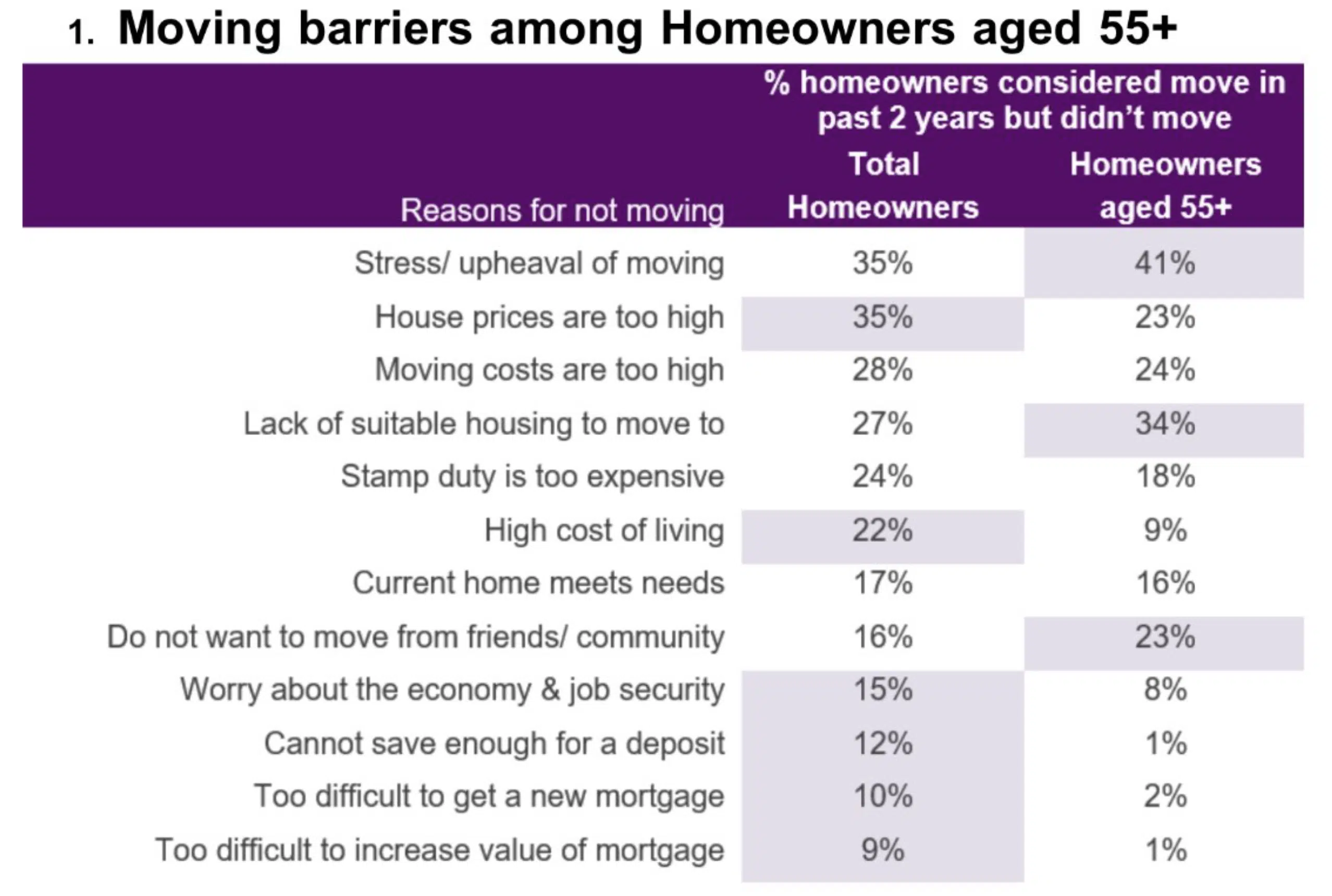

The HomeOwners Alliance found that 1.2m UK householders aged over 55 have put plans to move on hold. The main reasons cited are the stress of moving and shortage of available homes. During the course of our lives many work their way up the ladder, as and when they can afford and need more space. Working your way back down is then physiologically hard not just because of the stress of moving and finding the right property but because you are working backwards, and losing part of your identity and status that some have spent years cultivating.

The HomeOwners Alliance claim 38% of homeowners aged 55+ would prefer a bungalow for their next move, however they only make up 11% of new homes. The issue is bungalows take up land; it is therefore more profitable for developers to build up. Also, these homes are rarely in the same area that downsizers are accustomed to, so they are also having to accept a change from their existing social circle, doctor and amenities. This move is never an easy one but once made, on the whole, many question why they didn’t do it sooner.

Premium prices for access

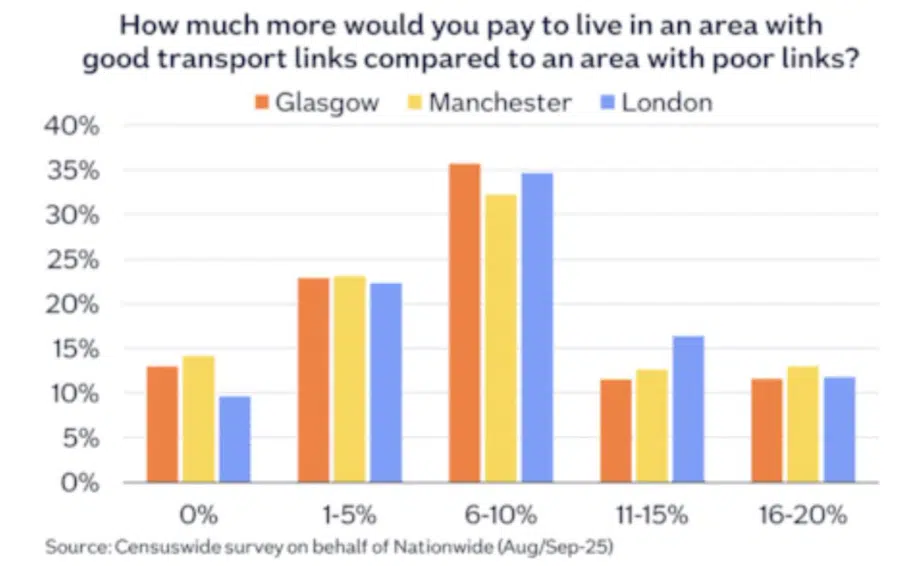

Time is money. Out of 3,000 people surveyed across Manchester, Glasgow and London, Nationwide found the premium buyers would pay to be closer to transport nudged down this year but remained prevalent. In London, buyers would pay an additional £42,700 for a property 500m from the nearest station; in Greater Manchester £10,900 and £8,800 in Glasgow.

Brownfield sites get overlooked in favour of Greenfield sites

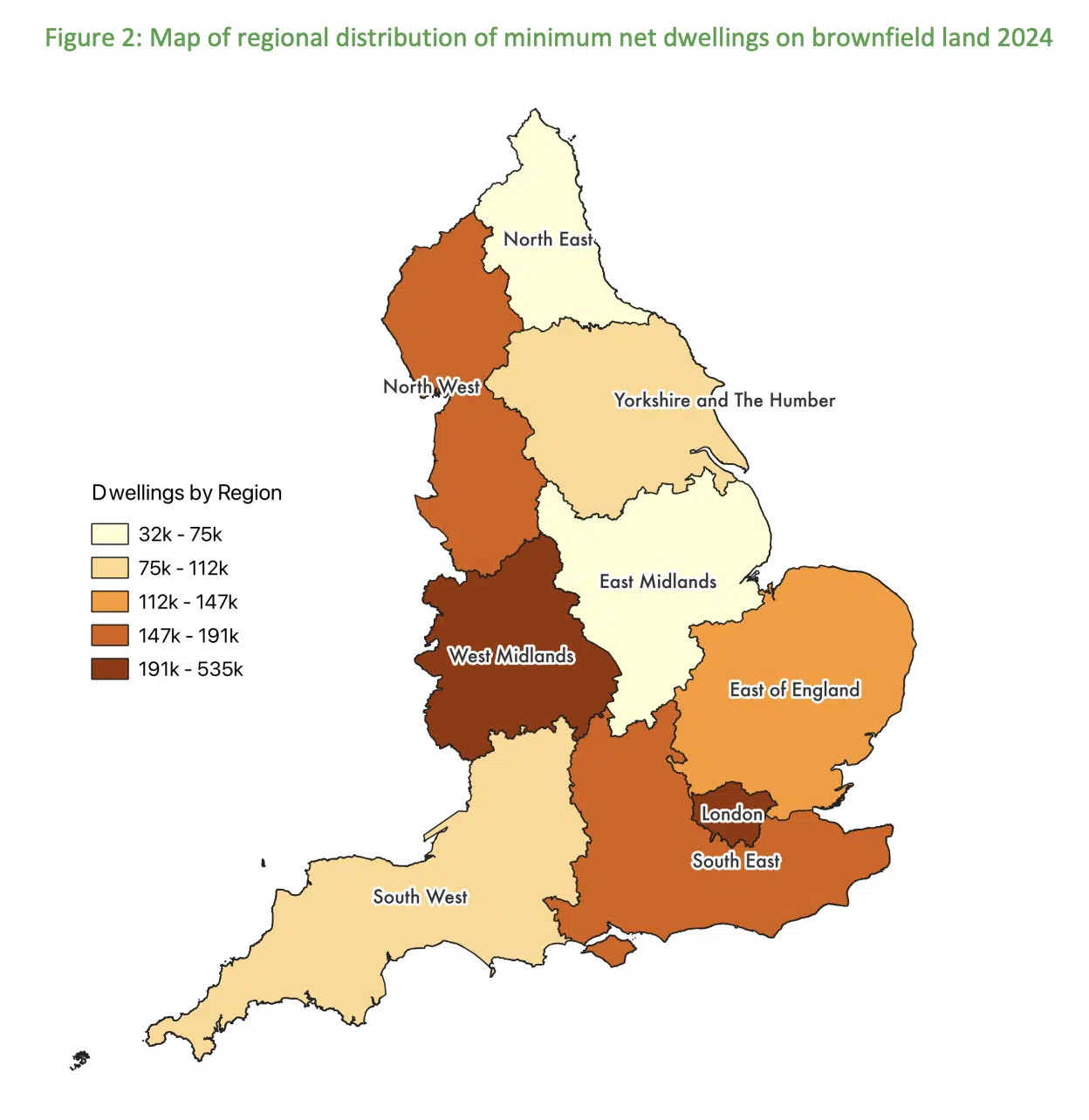

A recent study from CPRE found that there are currently 30,257 brownfield sites available, covering 32,884 hectares (81,223 acres) that local councils have identified as suitable for 1.49m dwellings. Given this you’d assume this was the obvious development route, especially in London, where there are the greatest number of sites yet developers opt for cheaper greenfield sites over brownfield due to convenience and reduced clearance costs. This is despite brownfield sites tending to be more centrally located and with existing infrastructure around to support it.

Short lets rise in popularity when sales aren’t forthcoming

Without question, those refusing to accept reality in prime central London are turning to short lets to fill the gap, as it enables mobility should Reeves’s budget prove costly and excludes them from incoming legislation that will restrict them. Prime Estate Agencies are quickly adding short let services to their menu so as to be best placed to sell should the right buyer come along or the vendor decides to proceed with the lower offer they previously refused.

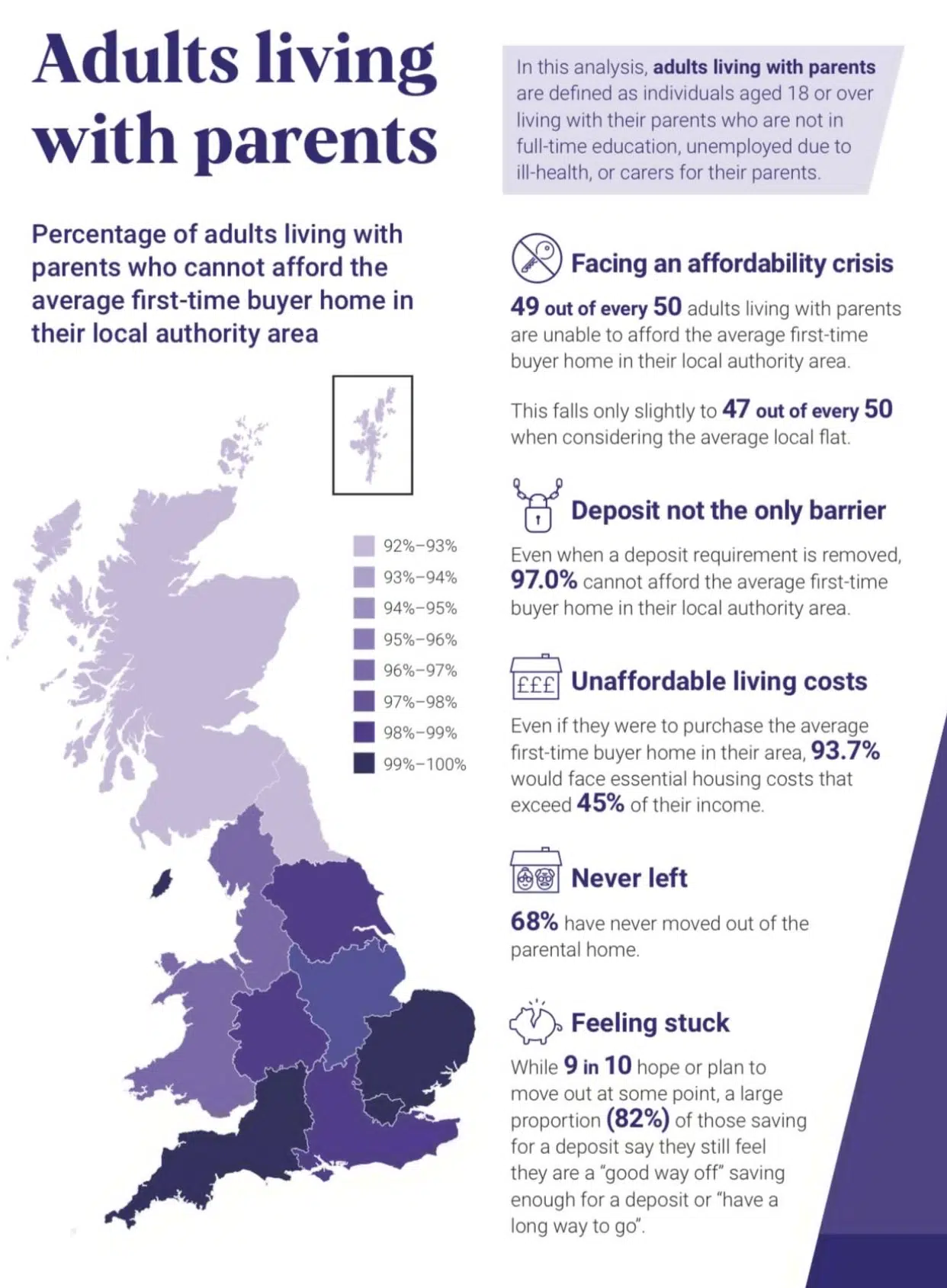

Affordability issues tether offspring to the family home for longer

Affordability remains a significant hurdle for first time buyers. Even those withdrawing from the Bank of Mum and Dad would struggle to make monthly payments, leaving them despondent over their future. The Skipton Group Home Affordability Index found that only 11.5% of first-time buyers, hoping to remain close to home, could afford to buy within the same local authority in Q2 2025. This means that many will have to move out first before being able to come back home when buying. The most affordable area was Scotland but surprisingly Cardiff tops the least affordable area and Hackney the least affordable local authority, closely followed by others in London.

Housebuilders turn to self-help

Barratt Redrow and Vistry are looking to follow Persimmon’s lead by offering equity loan incentives to buyers in the absence of any initiative from the government to boost their sales and bottom line.

Purple bricks goes in the red

The purple writing was on the wall even before Strike bought Purplebricks in 2023 when the group had just made an adjusted loss of £18.4m. Roll forward to 2025 and the group has losses before tax of £37.3 million on a turnover of £31 million, up from £13.2 million. They are blaming interest rates and not that it’s just a terrible platform.

That concludes this week’s UK Property News Recap 26.09.2025. Any comments or suggestions please get in touch.