This week, post-summer analysis showed the midfield was overrun with stock and despite premium listings there was a clear lack of urgency and hunger from buyers. This saw transactions, mortgage approvals and construction statistics fall. Given this poor performance many are looking to post Reeves’s budget for clarity on how best to play the market when moving forward. Welcome to another UK Property News Recap – 03.10.2025

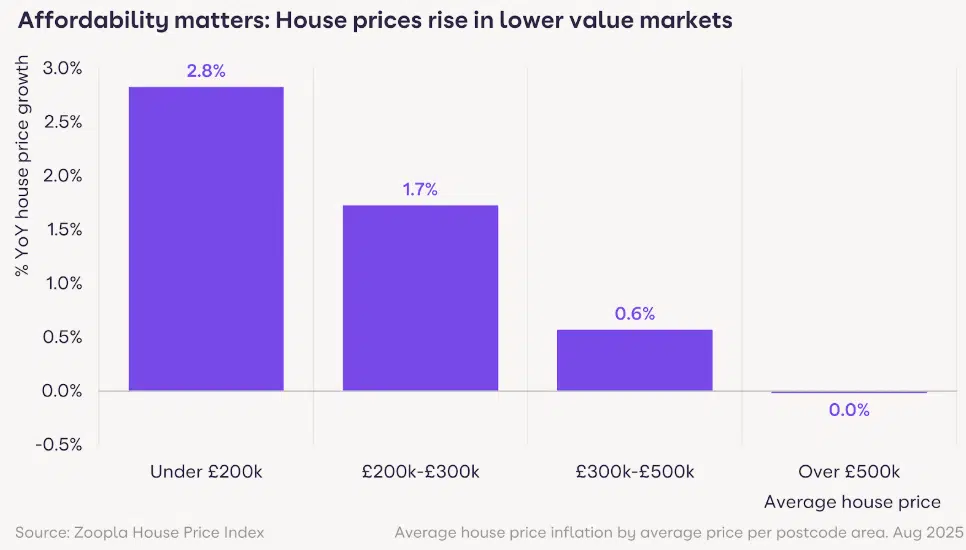

House Price growth slows

Budget uncertainty restricts overall UK house price growth, to 1.4% in Zoopla’s latest house price index. Properties priced under £500,000 continued to outperform, buoyed by first time buyers’ reduced stamp duty, however sellers above were hit the hardest causing demand to retract by 4% along with listings, down 7% compared with last year. Those with homes above the £1m mark, especially in London and the South, are struggling to garner interest leaving many sellers praying for a better market in the New Year, Rachel Reeves and interest rates permitting. This gamble could however prove costly should the chancellor go for the Capital Gains jugular.

Thinktank suggests drawing down on foreign homeowners

Foreign second homeowners are considered fair game for increased property tax. According to a think tank called Demos, charging landlords NIC and applying a 200pc council tax premium – and then taxing them again if they opt out – would generate £21bn.

International Investors look north

Indian buy-to-let investors have superseded the Chinese in the UK with Nigerians hot on their tail. Unperturbed by new legislation, investors are bypassing the capital, instead focusing on Northern regions offering 10% returns. Hamptons found that in the first six months of the year; of the 33,600 buy-to-let companies set up, 20 per cent were owned fully or partly by foreign nationals.

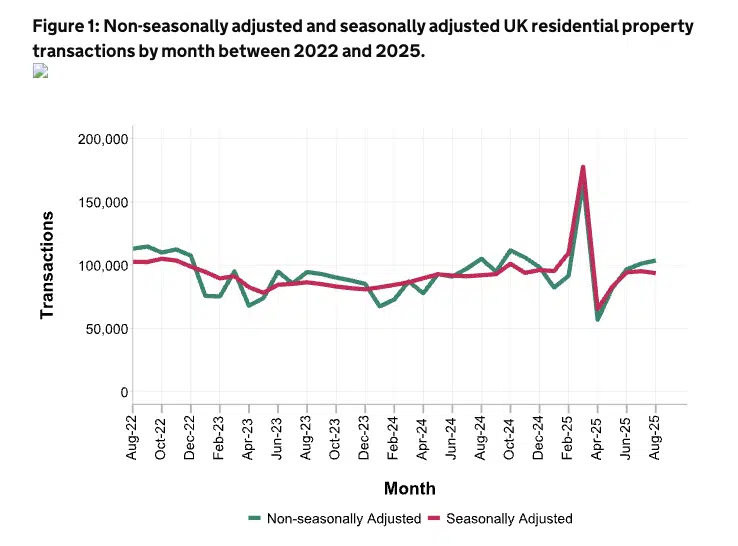

UK Property transaction numbers ease

UK monthly property transaction figures show that after a three month run of increases, transactions eased by 2% from 95,240 in July 2025 to 93,630 in August 2025, when seasonally adjusted.

That said, when non-seasonally adjusted residential transactions increased by 2% in August 2025 relative to July 2025. Meanwhile non-residential transactions fell both when seasonally and non-seasonally adjusted. Down 3% and and 13% respectively on July’s efforts.

Mortgage approvals felt the heat

According to the Bank of England, the summer saw a mild slowdown in mortgage approvals and remortgaging numbers: down 500 to 64,700 and 900 to 37,900 respectively in August 2025 when SEASONALLY adjusted. These numbers however only fell further when not seasonally adjusted as buyers took time to reflect on the market whilst away.

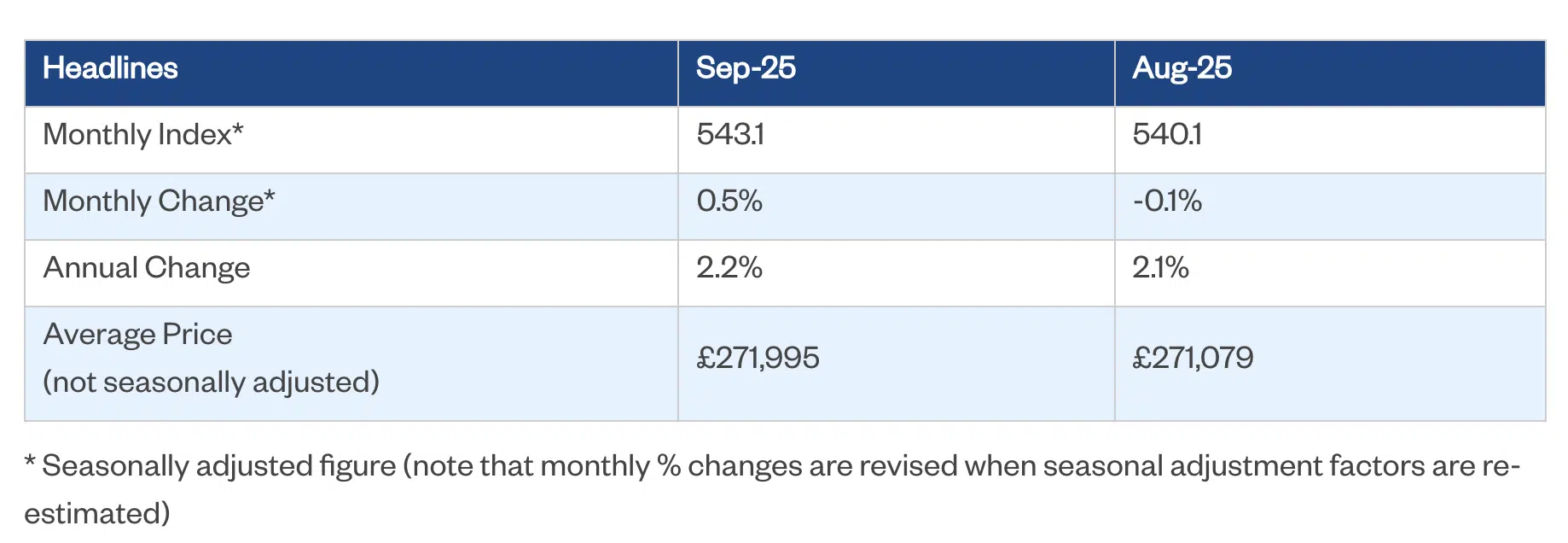

Nationwide claims house prices rose

In Nationwide’s latest house price index for September average house price growth nudged up by 0.5%. This made the average home now worth £271,995 according to their index. Once again Northern Ireland and the North continued to outperform the rest of the country boosting overall growth numbers. However across all regions growth slowed in Q3 as budget uncertainty tethers prices and growth.

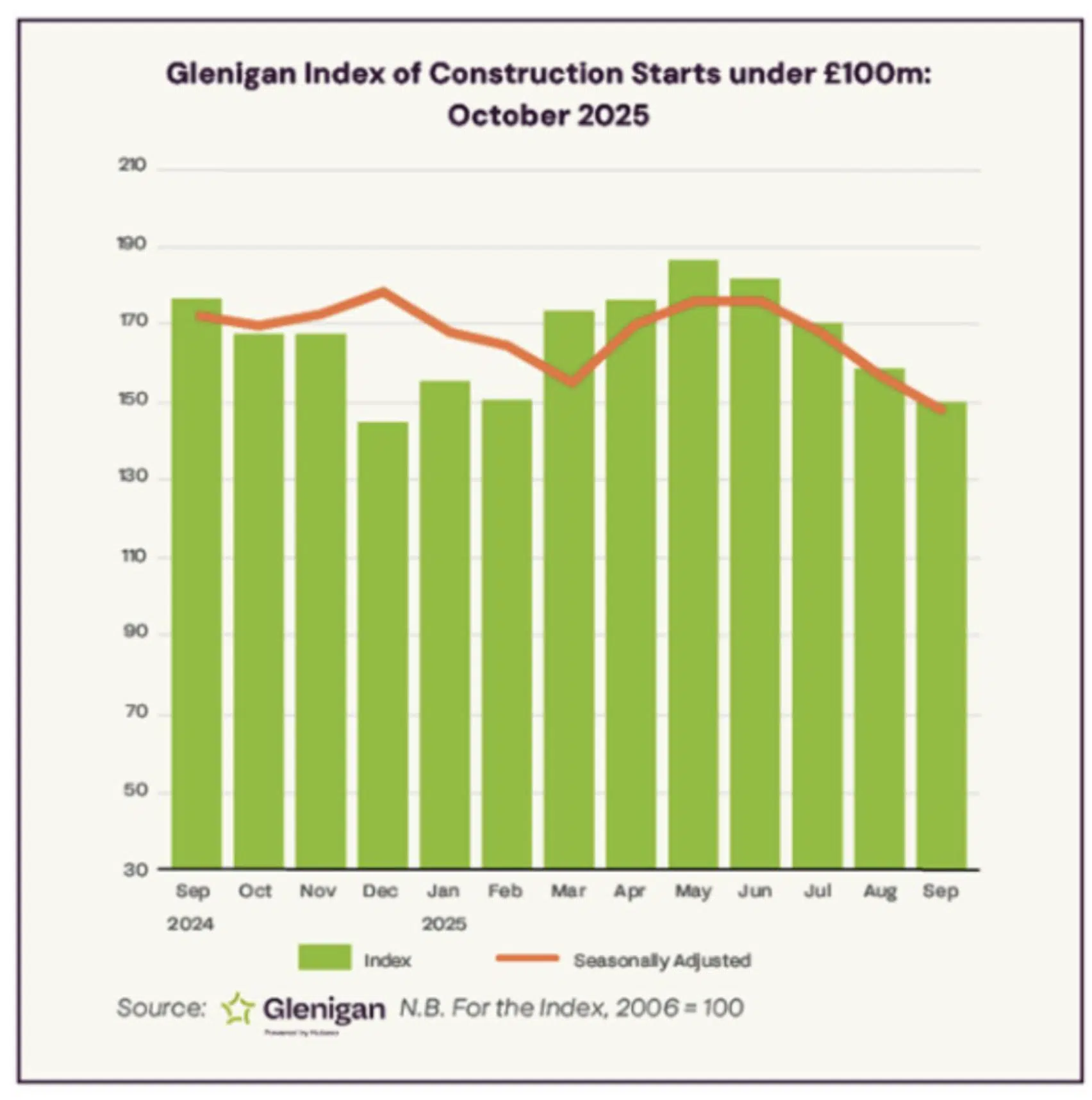

Construction hits a number of false starts

In the Glenigan October Index construction was hammered by market uncertainty and budget anxiety. This caused residential construction starts to fall 26% on the preceding three months to September and 24% against last year.

Non-residential project starts were less severe but still declined 9% against the previous quarter, 5% down on a year ago. The only sector showing growth was office space as employers look to entice workers back to their desks. Starts on-site rose 32% when compared to the preceding three months.

Council tax revaluations ruled out by Reed

Housing secretary Steve Reed pulled down one of Reeves’s previous flown kites, claiming at the Labour party conference that any revaluation of council tax thresholds wasn’t going to happen as “We’ve got enough on our hands.”

And that concludes this week’s UK Property News Recap – 03.10.2025 Any comments or suggestions, please don’t hesitate to get in touch.