This week, the focus lay heavy on the capital and its new homes drought. In an attempt to resuscitate developments and “start” them back into life, the London mayor Sadiq Khan met with housing minister Steve Reed and together they agreed an emergency package to get things moving again. Welcome to another UK Property News Recap – 24.10.2025.

Asking prices remain reserved

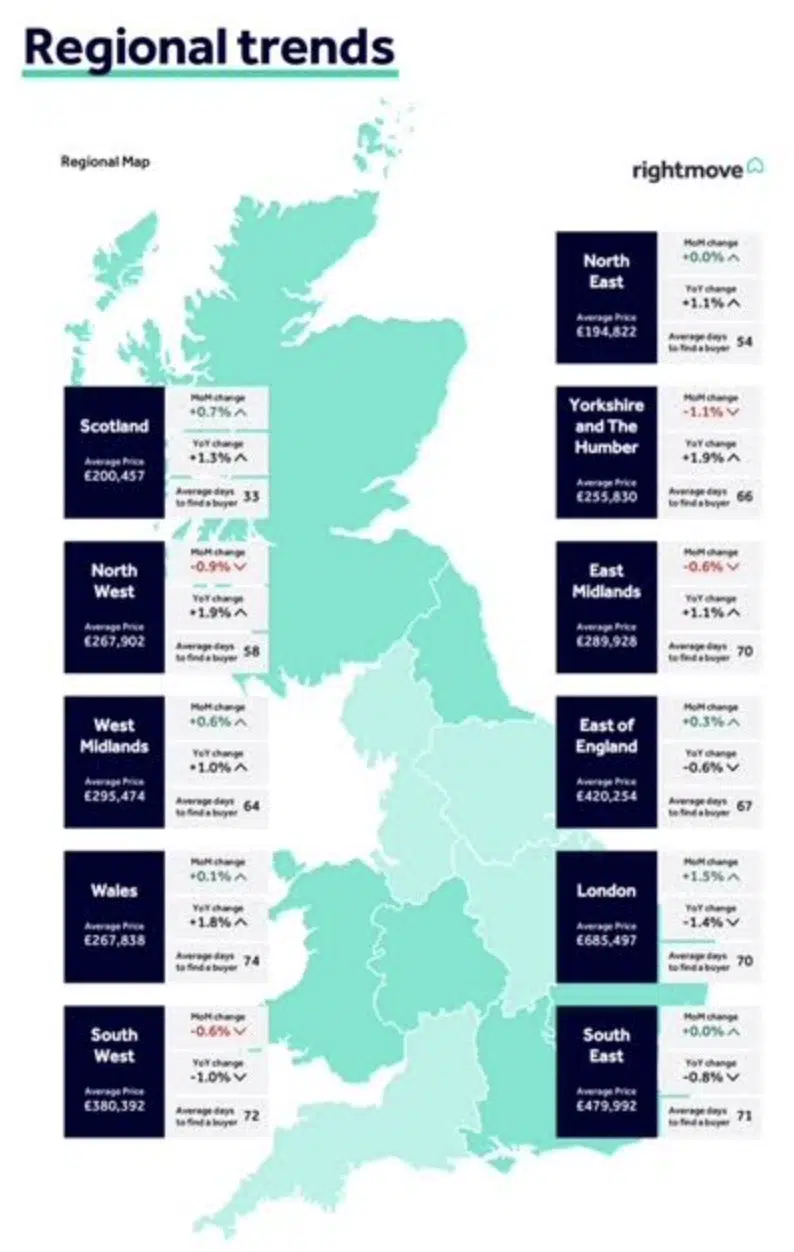

Sellers tentatively hope for more, cautiously raising overall asking prices by 0.3% in October in Rightmove’s ASKING Price index. Despite this increase, expectations remained muted when compared against the 10-year average, which typically sees asking prices bounce back come autumn. This subdued rise was largely attributed to Rachel Reeves’s kite flying, which grounded sellers and buyers who retreated by 5% in September till they knew which one would take flight. Others however, were unperturbed by the market instability; this led agreed sales to tick 5% higher than this time last year. Some took advantage of deals in the south while others fought for more affordable but connected housing in northern regions, causing prices here to rise 1%.

London remains unaffordable

Housing minister Steve Reed and London Mayor Sadiq Khan’s attempted to entice developers back to the capital with a number of measures to make building appealing again. These included not only reducing developers’ affordable housing target from 35% to 20% but also relieving them of the infrastructure levy which is the backbone of any new development scheme. Alongside this a £322m funding pot was provided to be used towards clearing development land.

In response Labour MPs pleaded for them not to give way on their affordable homes quota but it appears a target is more important come reelection time, as opposed to homeowners’ usability and quality of life.

Interest rates play peekaboo

Average residential rates this week yo-yoed between 4.98 and 4.99% for a two-year fixed residential mortgage while five-year rates remained above 5% at 5.03%. Many are hoping for more significant movement come the end of the year after traders increased their bets for another rate cut, after the yield on the two-year gilt, dropped 0.08 percentage points to 3.77% and 0.07 percentage points to 4.41% on the 10-year gilt in response to UK inflation holding steady at 3.8%. Much rests on Rachel Reeves’s budget moves and how the markets respond, meaning any base rate cut is unlikely to be forthcoming until December.

That said, in response to inflation holding steady, Barclays, Santander and HSBC jumped and cut their rate offerings ahead of the budget in an attempt to garner stalled businesss ahead of December. For those intent on moving, be it even in the New Year, securing a preferential rate early, which could be revised further down, is wise. For just as rates can go down, they can just as easily rise again if circumstances change.

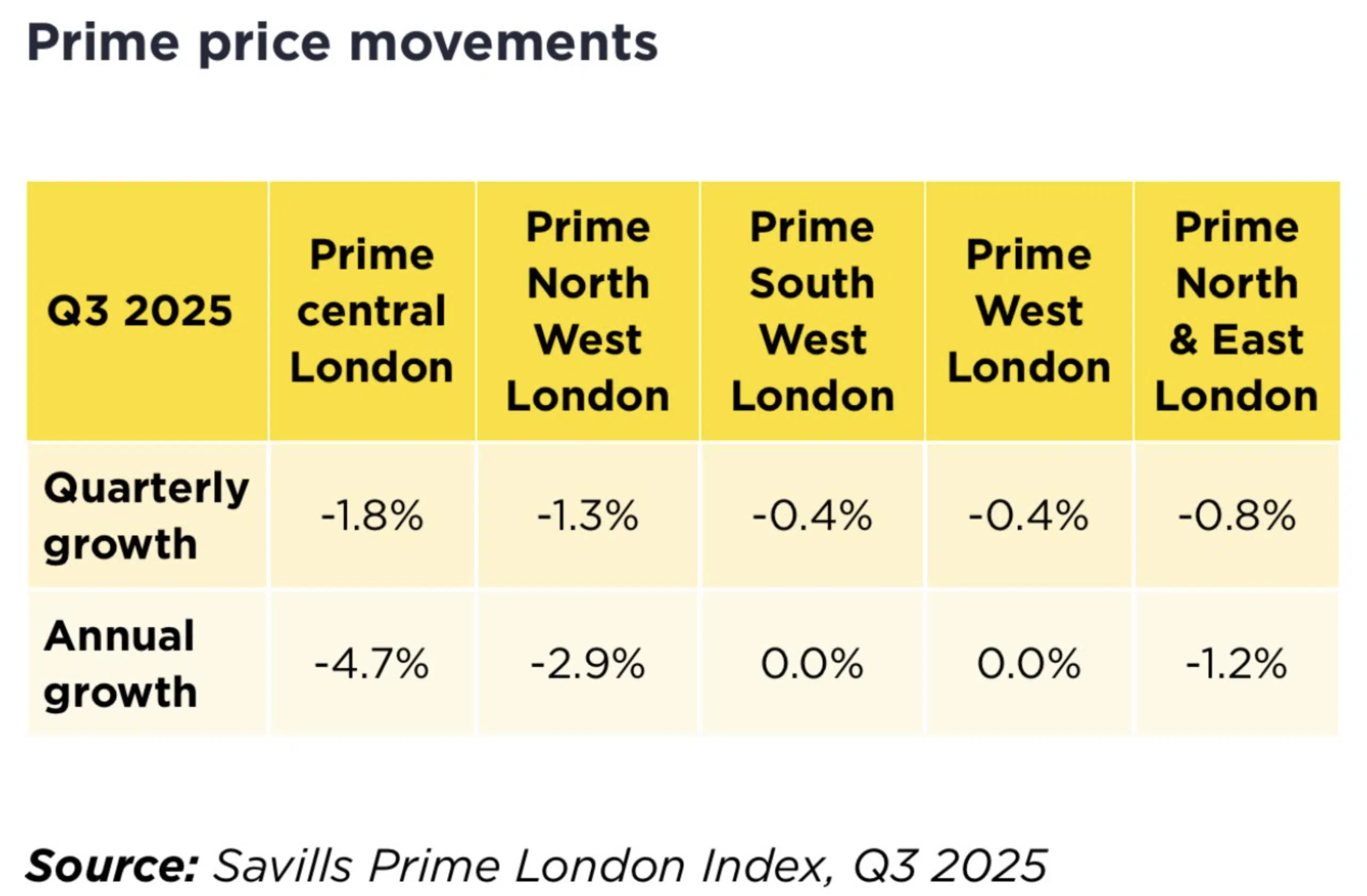

Prime Central London Prices are hit by budget concerns

Under the glare of Reeves’s budget plans: Prime central London saw prices melt 1.8% over the summer. Overall this has meant central London prices are now 24% below their previous 2014 peak, according to Savills research. This means any concerns over capital gains on primary residences for those who bought at this time, ought to be removed. However most continue to hope for 2022 gains so continue to list; instructions are up 4% despite agreed sales being down 10% for properties worth a million and above.

Rental and house price growth slow

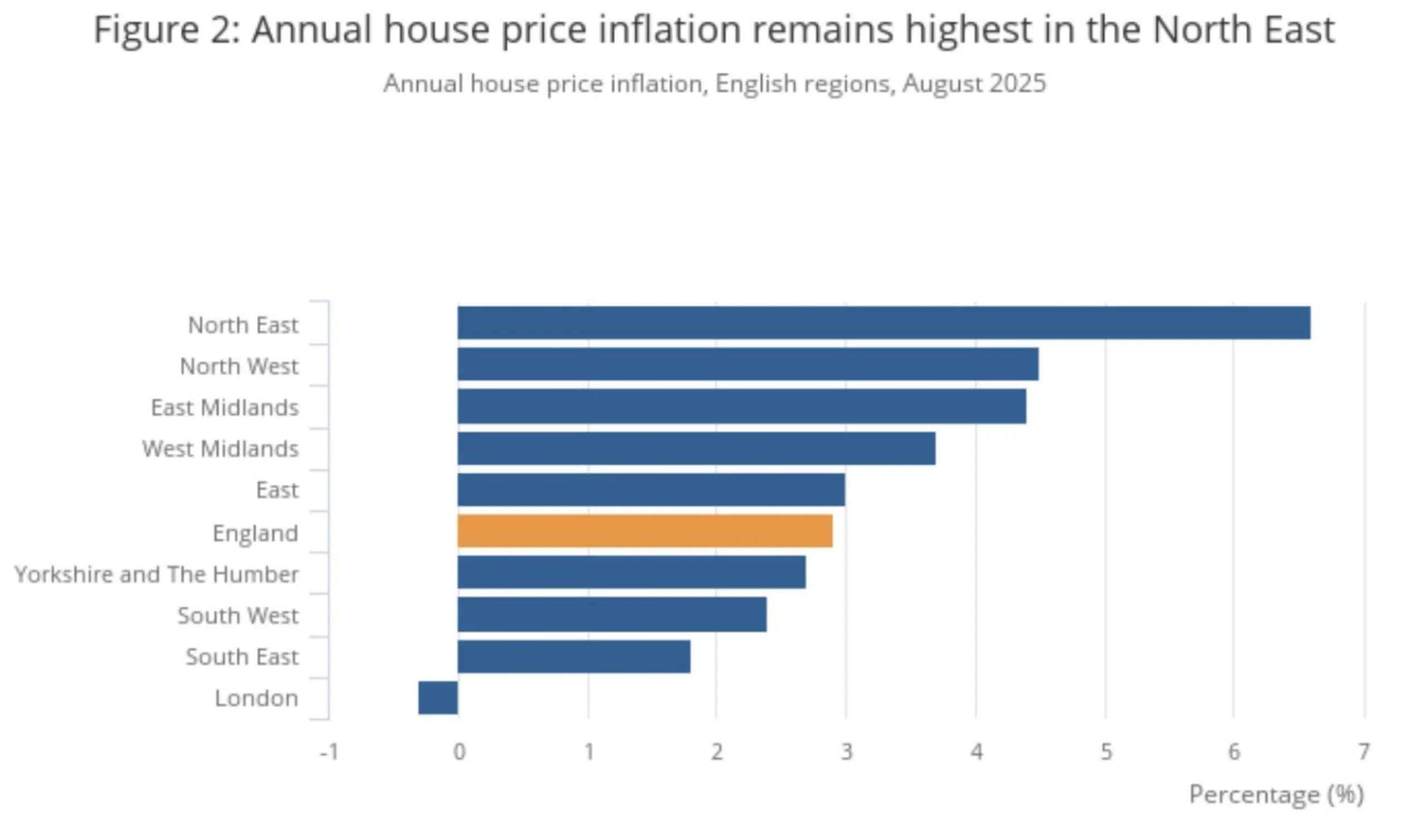

The ONS estimated that average UK house price growth slowed in August to 3%, making the average home now worth £273,000.

Average house prices increased the most in Northern Ireland in Q2 up 5.5% closely followed by Scotland, where prices rose 4% to £194,000 in the 12 months to August.

The North East however was the region with the highest house price inflation, at 6.6% while London continued to have the lowest annual house price inflation at minus 0.3% but this was slightly improved on the -1.3% in July 2025.

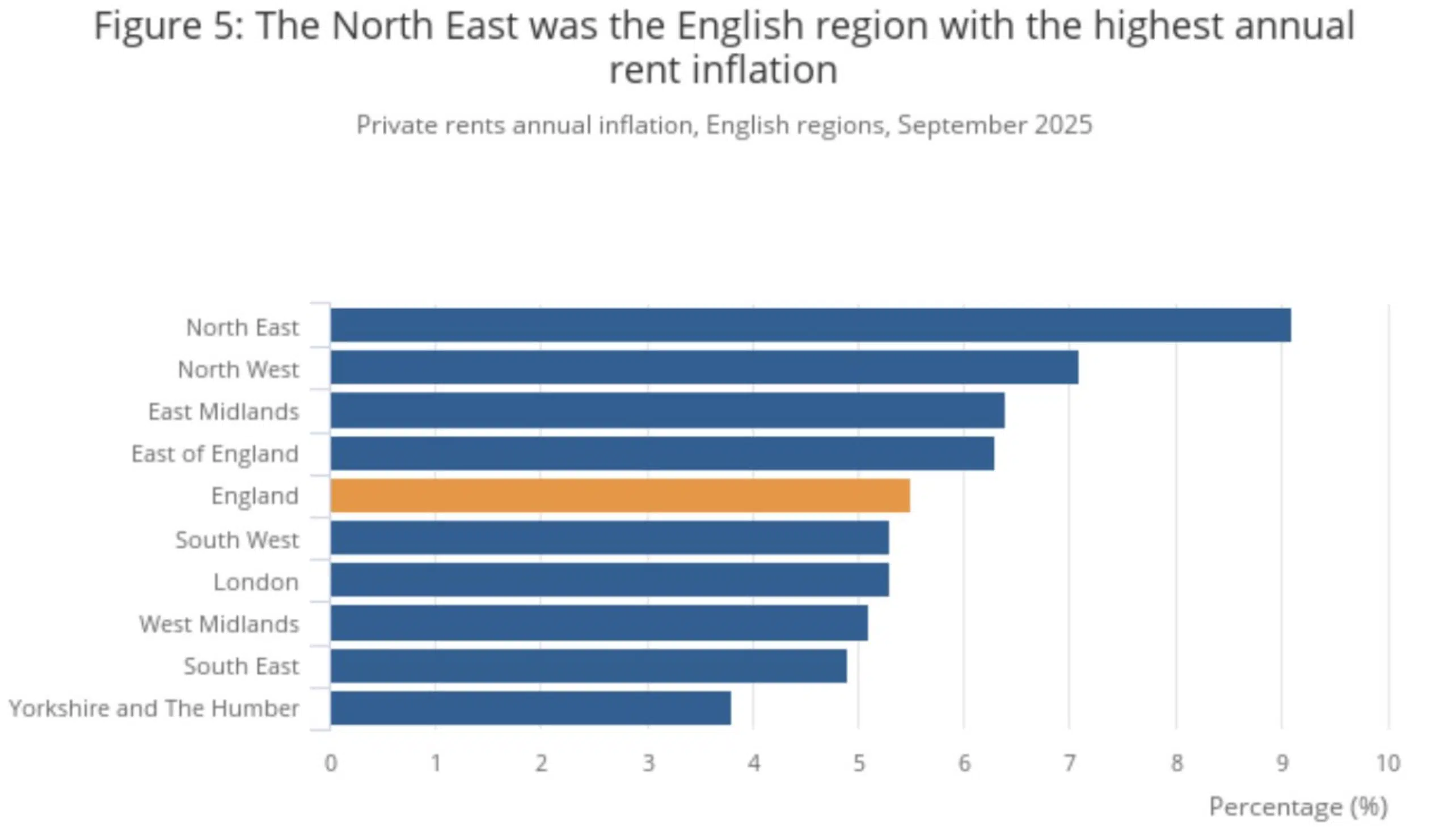

In the rental arena: tenants felt little benefit from the slowdown in rental growth in September 2025 from 5.5% to 5.7% to £1,354.

Annual rental growth was highest in Wales and Northern Ireland at 7.1% but the English region outperforming the rest of the country was the North East, growth here up 9.1%.

London remained the most expensive area to rent at £2,260 but annual inflation slowed the most here since its peak, decreasing by 6.2 percentage points since November 2024.

Nationwide lend a helping hand

The number of first time buyers who took Nationwide’s Helping Hand rose 53% annually to 23k. The lender’s offering enables buyers to borrow up to six times their income, borrowing up to 95% LTV on new-build houses…. and greasing both lender’s and developers’ palms.

Foxtons profits rest on the rental market as sales activity slows

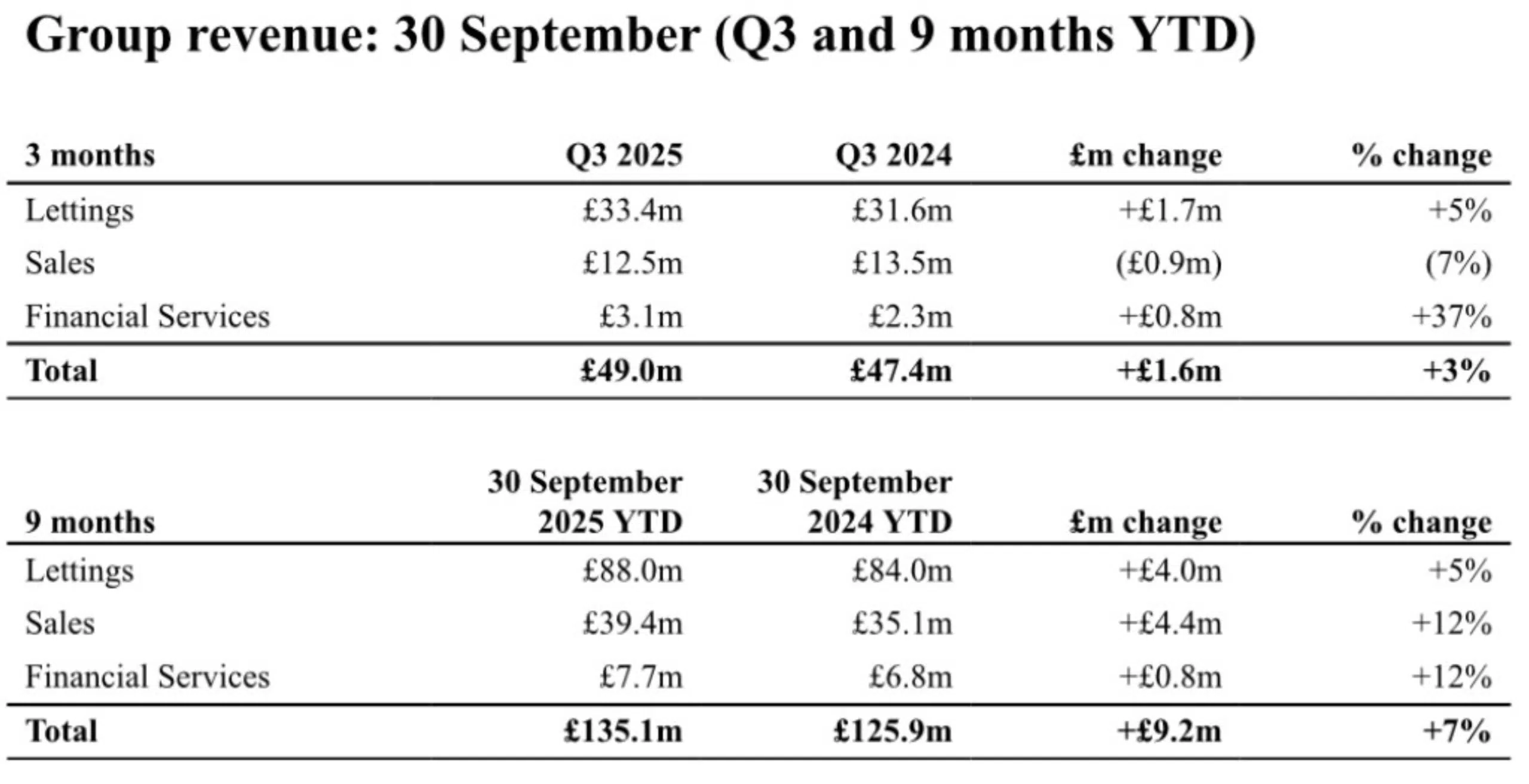

Foxtons’ latest trading update showed slower sales activity caused by budget uncertainty resulted in revenue for the group falling 7% to £12.5m over Q3. The group, however, remained unperturbed as their lettings book and financial service offerings rose 5% and 37% respectively! Also, despite the fall in sales the group’s year-to-date revenue was up 12% to £39.4m, meaning their quarterly progress report is “at the expected level.”

That concludes another UK Property Recap – 24.10.2025. Any questions or comments please get in touch.