This week, Rachel Reeves dominated the headlines for being selective with the truth about her house while flying a mansion tax kite that has the middle, to the top, of the market hoping the wind blows it off course. The Renters’ Rights bill ascended after Royal assent was given, however house prices remained grounded while developers looked to bury their affordable housing targets of 35%. Welcome to another UK Property News Recap – 31.10.2025.

The divide between North and South house increases

Sellers are forced to wait for buyers post Christmas who are waiting to first hear what Reeves has to say and if another rate cut is forthcoming before making any New Year resolution to move. As a result, Zoopla’‘s latest HPI showed the first annual fall in agreed sales in two years. That said, first time buyers or those looking to spend under £500k are continuing to press ahead while those with bigger budgets are being more restrained.

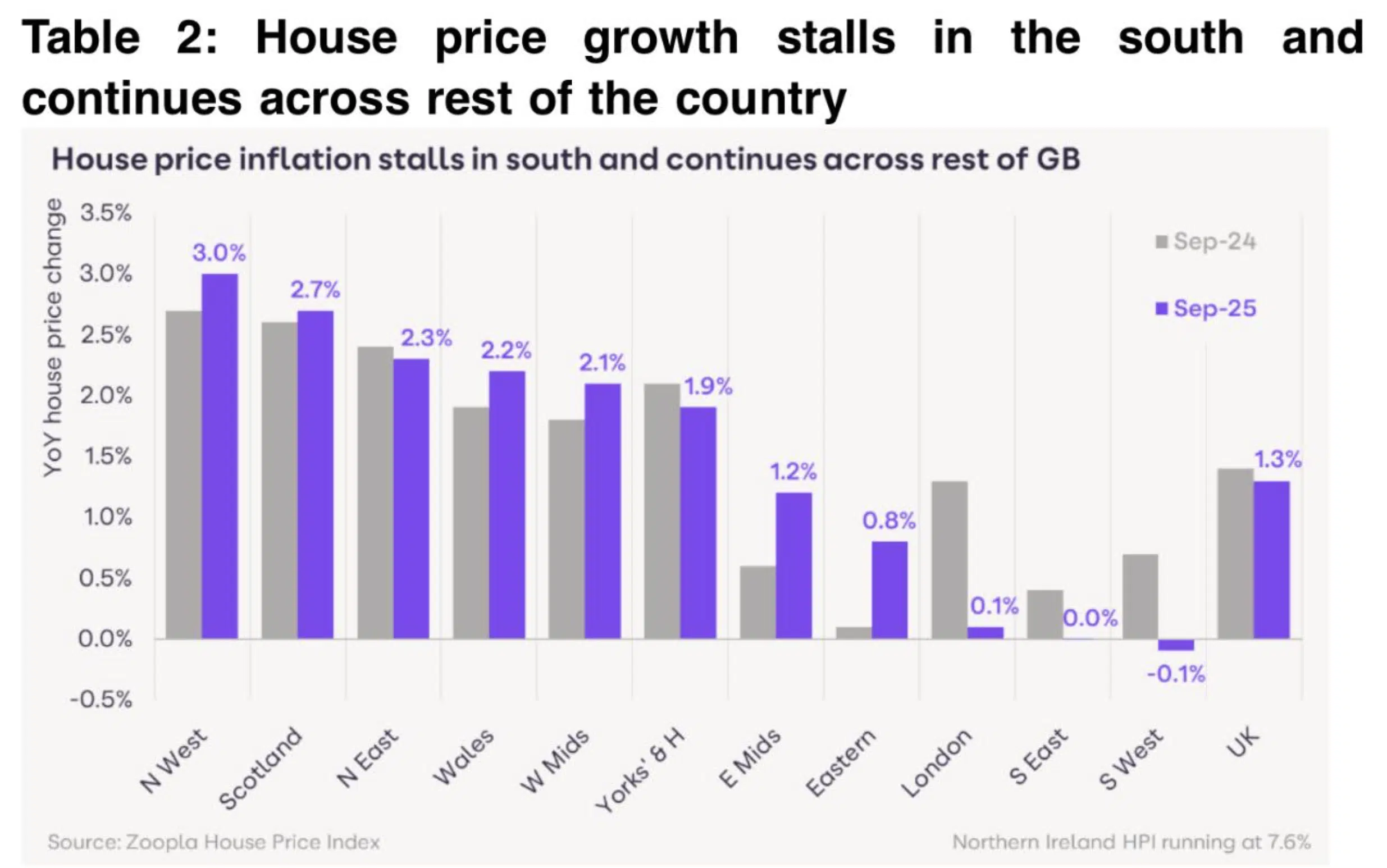

Increased stock levels have kept annual growth, according to Zoopla’s index, consistent at 1.3% across the UK but the south has stalled while Scotland, Wales and the northern regions of England have seen growth of over 2%. The market remains divided between what is deemed affordable and what isn’t. The latter continues to play for time while the former embarks.

Landlords continue to ask for more

Another quarter, another rental hike. The average advertised rent for newly listed properties across the UK, excluding the capital, rose 1.5% in Q3 to £1,385 per calendar month, according to Rightmove, and up 3.1% annually.

London tenants are feeling the financial strain more acutely so rental growth was more restrained here, rising only 0.9% to £2,736, up 1.6% annually.

Despite wages rising 5%, the tension between rental affordability is beginning to be felt across the county, as rents now consume, on average, 44% of take home pay. Areas that were once affordable are now under attack as prices rise. Preston in Lancashire saw prices rise 32% annually while Keighley in West Yorkshire, rose 27%.

Mansion Tax Fears

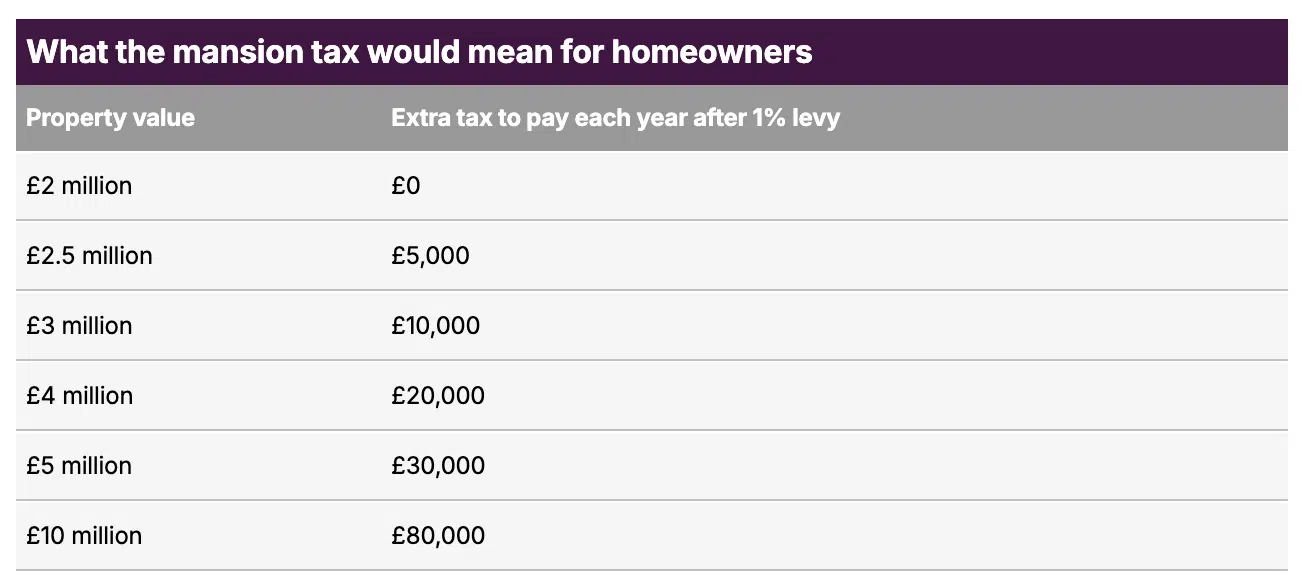

Reeves’s kite flying yet again caused chaos. In a desperate attempt to fill the deficit, the chancellor is “considering” a 1% annual tax on properties worth over £2m. It is estimated there are around 150,000 to 160,000 £2m properties in the UK but how she is going to assess and value them in a timely manner remains unclear. This would devastate the top end of the market further and cause a lot of deception around the threshold . If she wants to deter investment and discourage achievement, she is doing a cracking job. Short term thinking will have long term consequences that will be costly rather than financially rewarding.

Renters’ Right Bill gets Royal Assent

On the 27th of October the Renters’ Rights Bill received Royal Assent. Over the coming weeks ministers will outline how the reforms will be rolled out. The most significant change is the end of Section 21 ‘no fault’ evictions, which will provide more security for tenants. Landlords, though, fear that the courts are unable to be reactionary should a tenant warrant eviction. Faced with a 9+ month wait to reclaim their property, some will abandon ship, causing another loss to the market. Therefore, in the short to medium term, expect initial chaos before the new norm kicks in.

Household numbers are projected to tick up by 10% in the next 10 years

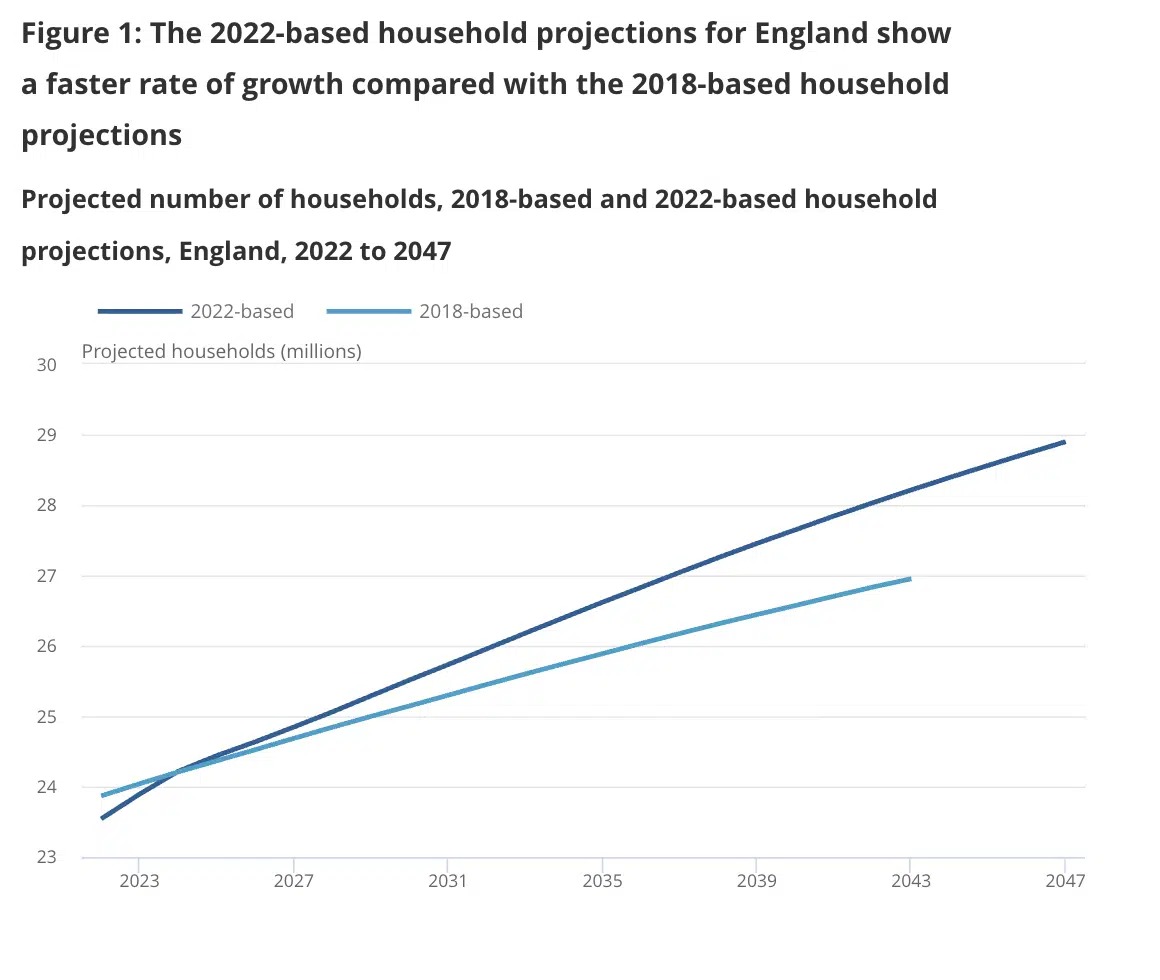

The ONS projected that over the next 10 years, the number of households in England will increase by 2.4 million (10.3%), from 23.5 million in 2022 to 25.9 million in 2032. The biggest rise will come from those well into retirement; aged 85 years and over; they are projected to increase by 452,000 (42.3%) from 1.1 million in 2022 to 1.5 million in 2032, of these, 280,000 (61.9%) are projected to be living alone. This is a ticking time bomb for housing. The motivation to build for the older generation is slim as bungalows or lateral flats take up too much space that could otherwise be used to house more homes, generating more profit. The compromise some will face in later life is worrying. Offsetting this, the number of households with children is set to decrease by 8.4%. Affordability and social change are holding back households.

The OBR warn Labour will miss their 1.5m housing target

The OBR decided to state the obvious that Labour was on track to miss their 1.5m housing target. This is being attributed to the cost of building, planning delays and a decrease in demand. To help boost housing numbers, the OBR suggested re-introducing Help- to-buy – which helped drive prices up and future buyers out.

Berkeley argues for a reduction in affordable housing on Peckham scheme

Berkeley defended their decision to cut affordable housing to 8% on their Peckham scheme saying “no reasonable developer” could deliver the 35% London Plan minimum for affordable housing on the Aylesham Centre site, and described the number as “simply unattainable.” “Build, baby, build” appears to only be achievable after a developer’s ransom. Expect other schemes to follow Berkeley’s lead.

Affordable housing deemed unaffordable to be sold off

In response, come Friday it was revealed that developers could sell affordable homes that are deemed unaffordable, at a higher price to private buyers…Labour’s need to be able to say they hit their housing target takes precedence over everything else, when they are reliant on this for re-election.

Reeves is “selective” with both her home and the truth

The chancellor Rachel Reeves was forced to admit she broke housing rules by renting out her home without getting a “selective licence.” So many have fallen foul to this as councils designate at will with little fanfare. It transpired however that Reeves’s husband did know, but the fault lay with the rental agent for not applying for the licence as promised. They could go to tribunal but given both knew a licence was needed and did nothing, they’d be better off settling.

To make matters worse, Reeves dug herself a deeper hole by claiming to the prime minister that she knew nothing about it, when in fact she did, she just…forgot.

Landlords run scared of ground rent caps

Large scale investors are lobbying against the government’s plans to cap ground rents, threatening to lawyer up if their income is diminished in any way.

House price growth slows in October

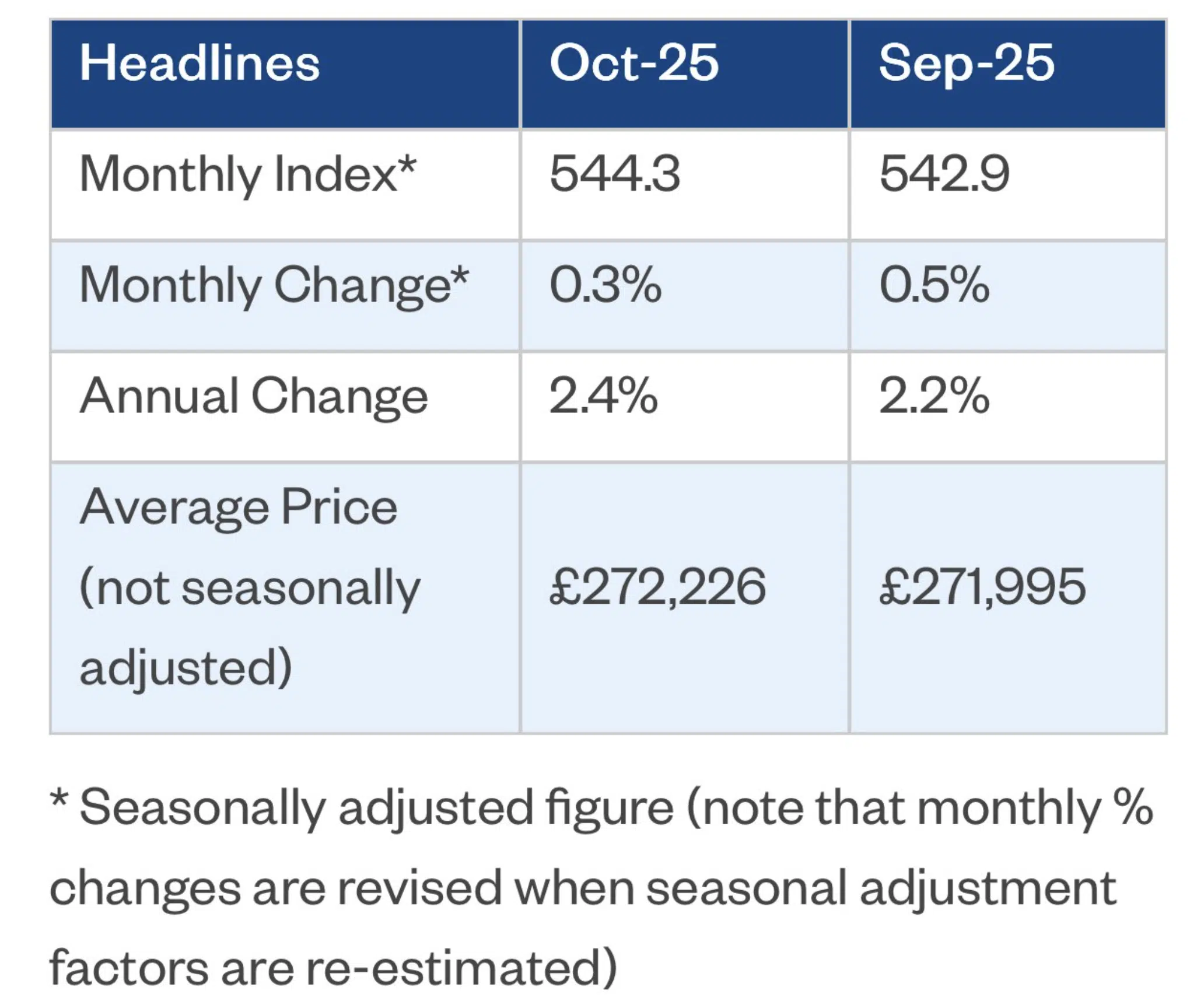

According to Nationwide HPI index: house price growth slowed from 0.5% to 0.3% in October but annual growth rose to 2.4% making the average, seasonally adjusted, home worth £272,226.

Moving forward, prices are expected to remain stable with minimal variation in either direction till the budget is delivered and rates reduce down further.

That concludes this week’s UK Property News Recap – 31.10.2025. Any suggestions or comments please get in touch.