We can’t have a week go by without Reeves trying out a new kite, this week it was an exit tax should you wish to flee the UK. One thing staying put was the base rate, but interest rates fell while the amount you can borrow stretched. Developers, though, weren’t taking any chances and reduced their output further in October until they know which way the wind was taking them. Welcome to another UK Property News Recap 07.11.2025.

Reeves considers capital gains exit tax

Chancellor Rachel Reeves added to her pic and mix of wealth tax options with a potential 20% capital gains exit tax for those looking to move further afield, which will leave those departing with a bitter aftertaste.

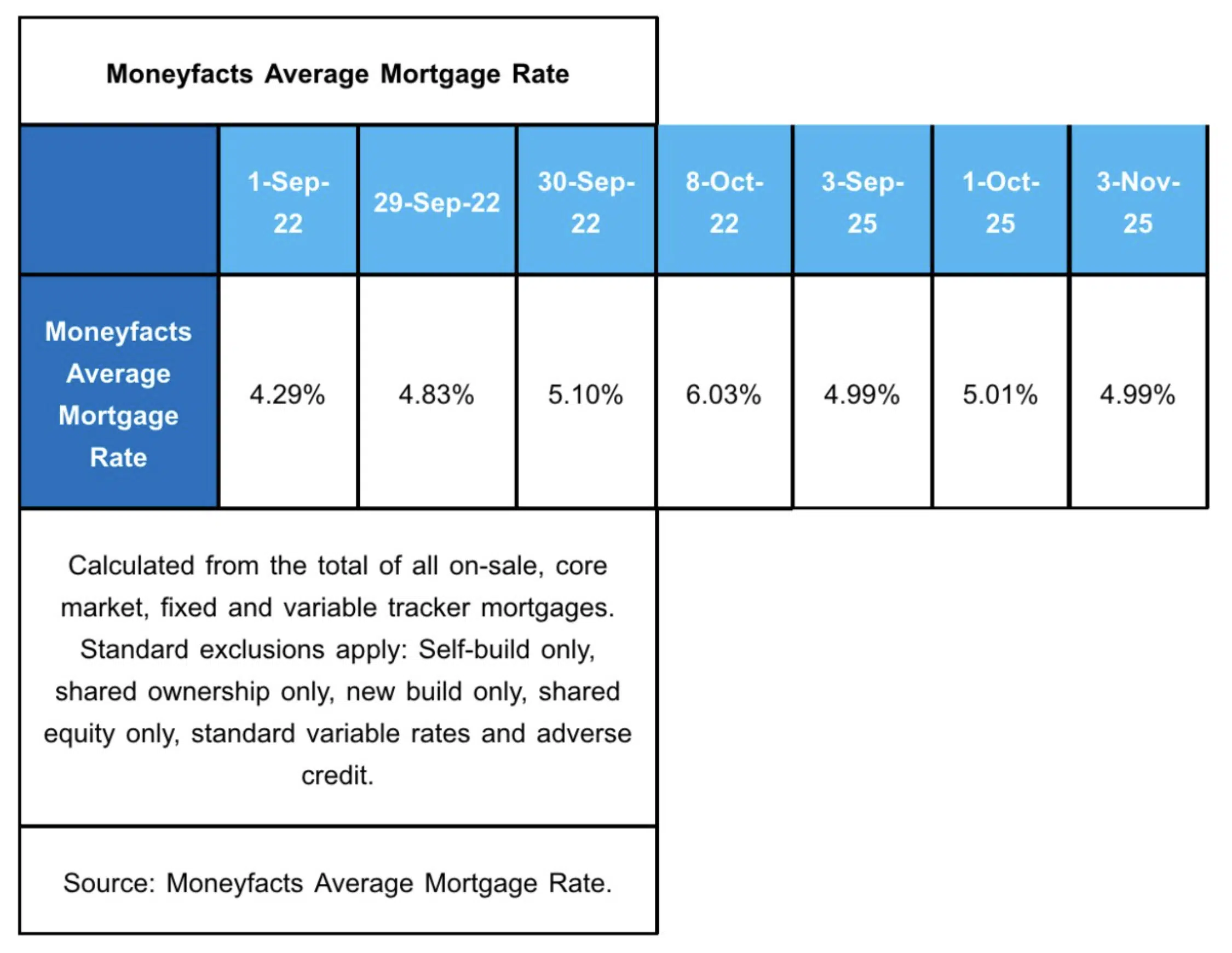

Average mortgage rates fall below 5%

Moneyfacts’ Average Mortgage Rate index showed average rates dipped below 5%…again. This was a result of swap rates falling giving lenders a little more wiggle room to enable them to try and pick up some new business before Christmas.

HSBC stretches lending criteria for premier customers

HSBC hoped to drum up business by offering loans of 6.5 x borrower’s salary for those with a 10% or more deposit and who have a premier account. The government is desperate to get buyers moving again, encouraging lenders to be more flexible – let’s hope no one stretches too far and does themselves an injury.

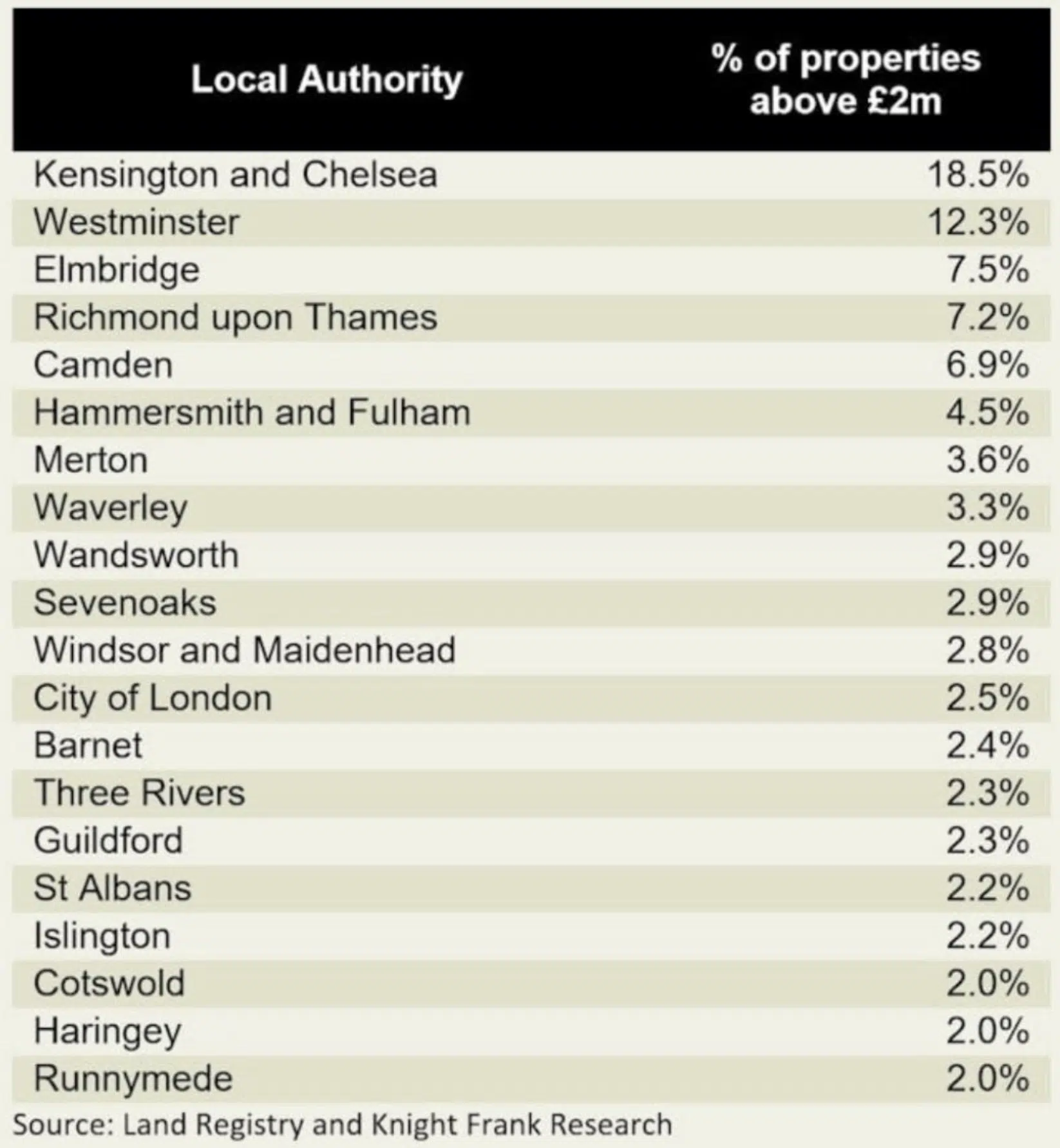

London Boroughs most at risk from a property levy

Knight Frank, highlighted the London boroughs that could be adopting the brace position SHOULD Reeves slap additional levy’s on homes above £2m.

Don’t be surprised if those homes bought just under the threshold whose occupants have no plans on moving but now find their homes are worth more, claiming their purchase price as its value. Self imposed down valuing to keep afloat.

The ladder takes priority over forever

According to Zoopla younger buyers are prioritising getting on the ladder, be it further afield, as opposed to finding their forever home. The reality is that, in most cases, such a dream property wouldn’t be achievable from the start so if they can first get on the ladder they will, then, ideally, move on up if they bought wisely. At the same time, buyers are looking for ways to make money on what they buy, so if there is room for improvement be it through refurbishment, expanding up or out, from which they can profit, by increasing the square footage and usability, they will. It also removes the pressure for more space in the short term enabling buyers to ride property cycles out for longer should things take a turn for the worse.

George Lucas feels the force of a London property

The creator of the franchise Star Wars propped up property prices in London buying a reported £40m mansion in St John’s Wood.

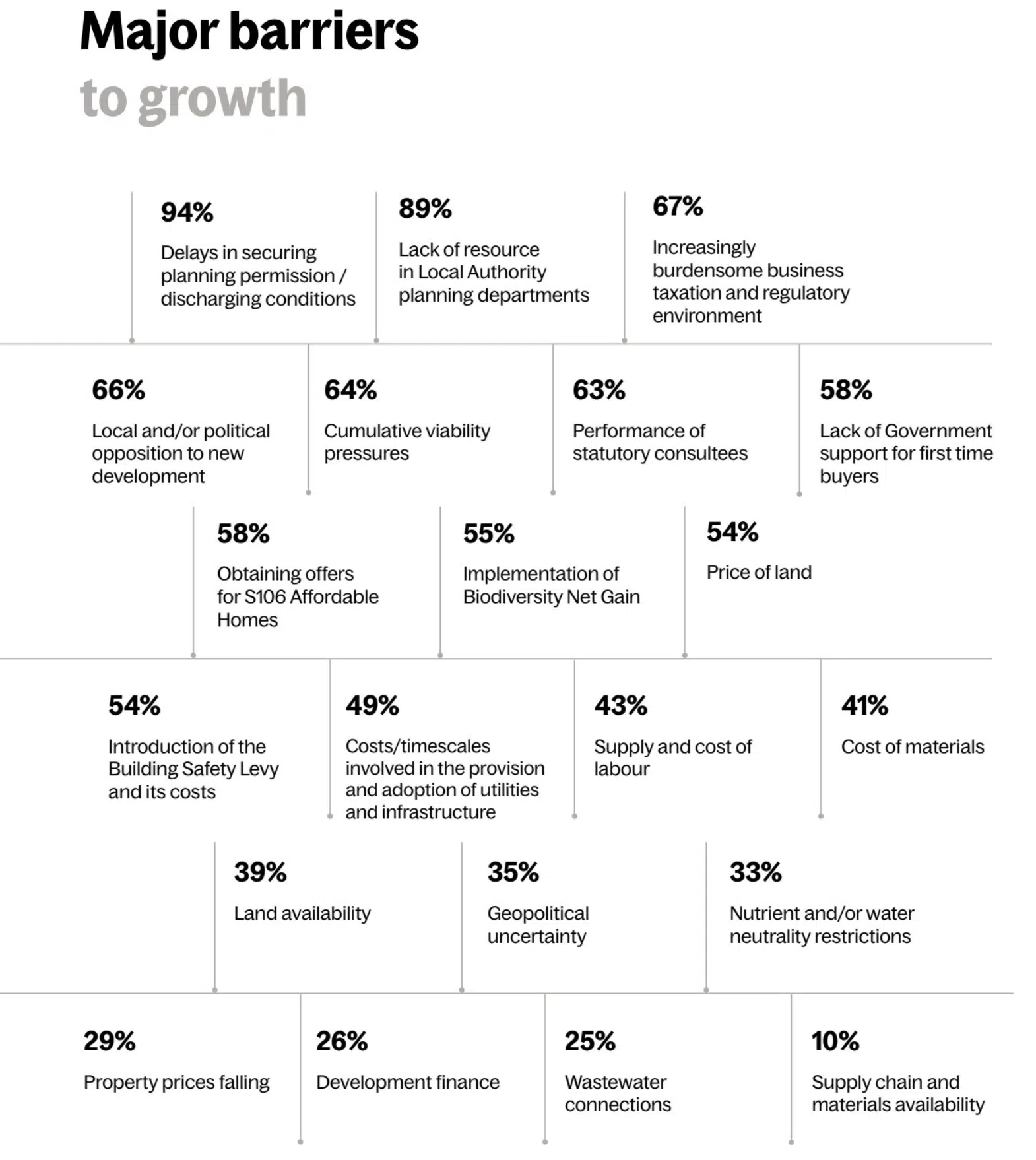

The state of construction

The State of Play report 2025/2026 highlights the barriers SME builders are facing in today’s economic climate. Financial pressures – including excessive red tape that prolongs build time along with high land values, affordable homes targets which are difficult to shift given the dearth of investors and a lack of local authority staff to process applications – are proving a drag on development. If these were ironed out, SME builders believe their productivity would improve by 56% on average.

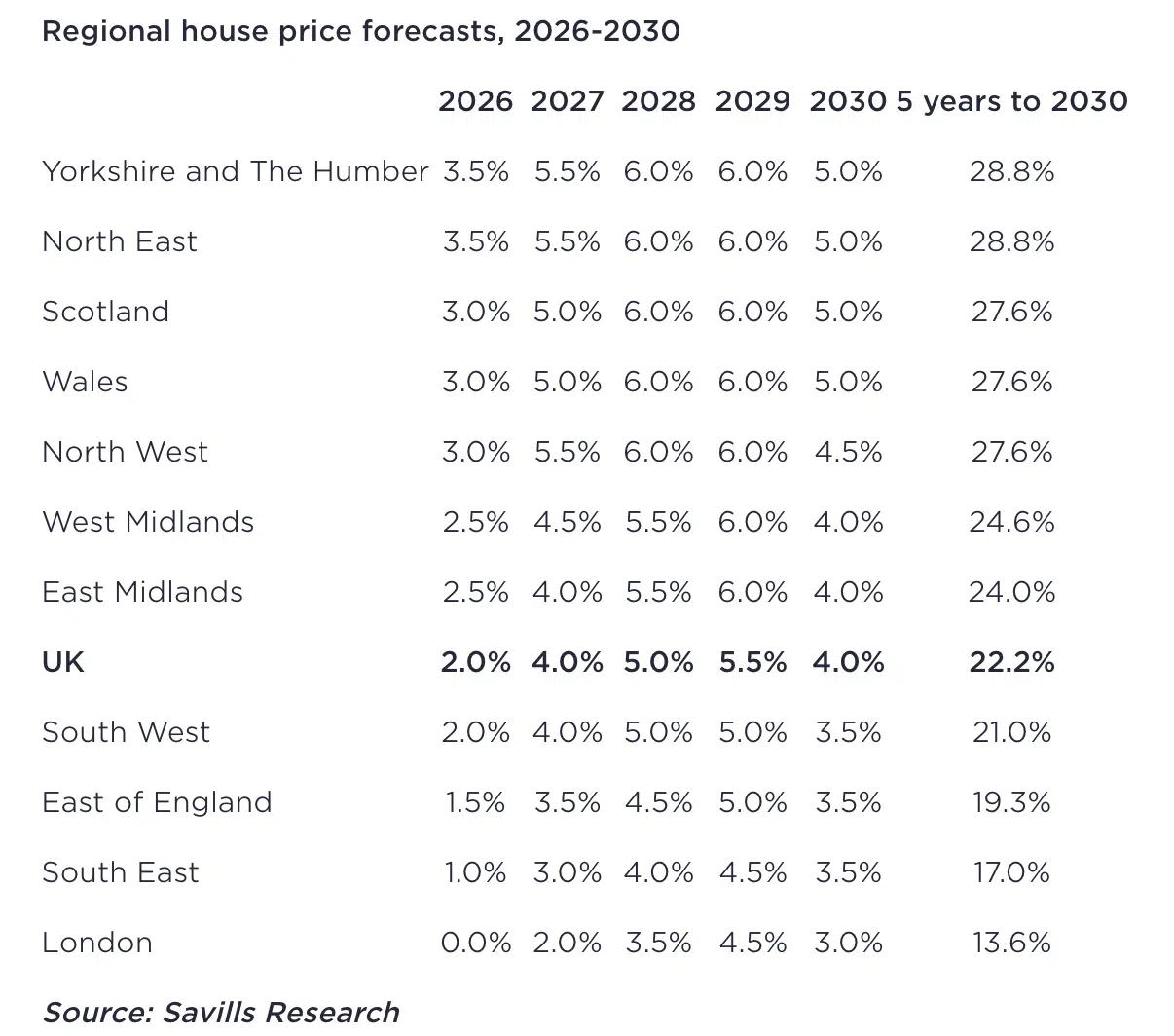

Savills predicts house price growth

Savills gave their New Year house price predictions early. The estate agency foresees growth of 22% over the next five years across the UK, off the back of interest rates reducing. Growth will be more prominent in more affordable, generally northern regions, but the south will not be totally immune. After a sluggish 2026 they expect things to slowly pick up.

Given how often these “predictions” are revised I would recommend a generous dash of salt be applied.

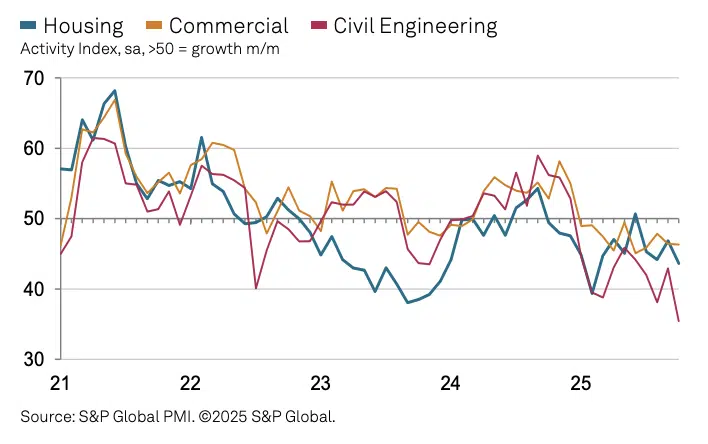

Construction activity declines at fastest pace for over five years

The S&P Global UK Construction Purchasing Managers’ Index showed activity further slipped in October due to sluggish demand and increased costs. Civil engineering and Residential development fell hard. Only commercial building activity showed any resilience. As a result, developers are shedding staff, and demand for construction products and materials fell, easing supply chains.

No change – Base Rate remains at 4%

The decision by the MPC to hold the base on Thursday at 4% came as little surprise. The vote was split 5-4 which gives hope for movement come Christmas, post-budget, when we may be in greater need of one to compensate for Reeves’s choices. That said, the MPC claimed that despite inflation reducing their decision was based on wanting to be more surefooted in this arena before taking another step down Table Mountain.

As it stands, swap rates have already reduced in the past week causing traders to increase their bets of a rate cut in December, post budget.

Lenders are currently on the charm offensive in an attempt to garner business so for those looking to buy there are deals to be had but many will be looking to the New Year for further rate cuts before making their move.

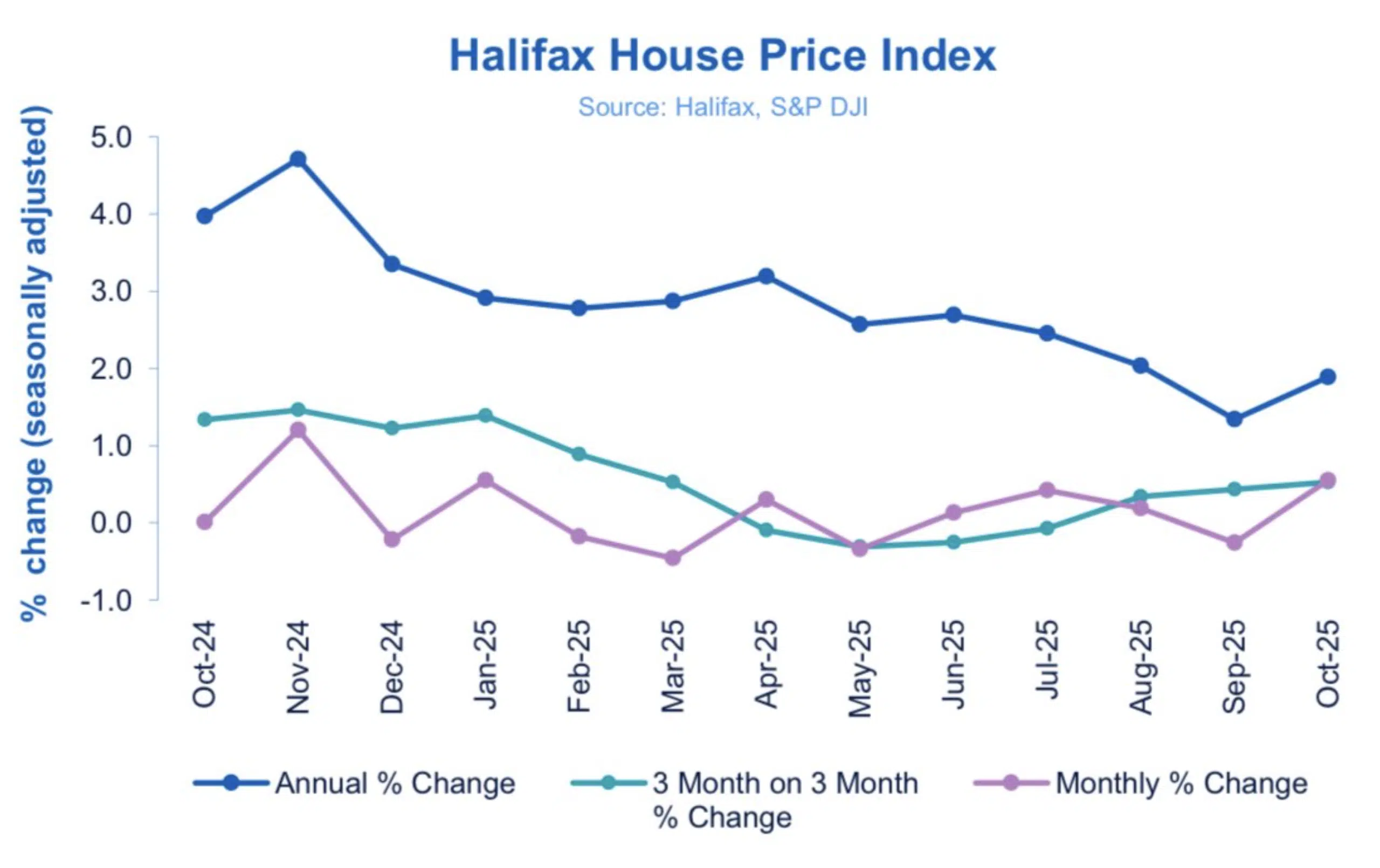

House prices rise

According to the Halifax HPI, prices rose 0.6% in October after a fall of 0.3% in September. As a result the average UK property price, on this index, is now £299,862. Rising prices have arisen from significant growth in more affordable regions. Northern Ireland is up 8%, Scotland 4.4%, Wales 2% and England 4.1% annually. However, London and the South East continue to struggle. Prices here falling 0.3% and 0.1%.

There is nothing specific about an average.

,

And that concludes this week’s UK Property News Recap 07.11.2025. Any comments or suggestions please don’t hesitate to get in touch