House price growth has slowed under the weight of budget concern and affordability issues, along with construction levels. However, activity remained mobile at the lower end of the market with buyers keen to get moving before others, buoyed by reducing rates, decide to join their ranks come the New Year. Welcome to another UK Property Recap – 05.12.2025.

Council homes worth over £2m to be spared mansion tax

110 council homes, largely situated in the south of England, are to be spared the Mansion Tax when it is introduced in 2028. I’m not sure the taxpayer fancies contributing to someone else’s accommodation more than they already do, nor that this would go down well with the public.

Transaction levels remain steady

Budget speculation slowed but didn’t stem property transactions while those looking to remortgage tried to hold out for another rate cut before facing a new higher borrowing reality. Despite the ‘effective’ interest rate – on newly drawn mortgages – reducing to 4.17% in October, net mortgage approvals decreased by 600 to 65,000 in October. Approvals for remortgaging with a different lender fell by 3,600 to 33,100 in October when seasonally adjusted. That said, when not seasonally adjusted house purchases tiptoed up by 1,320 and remortgaging only reduced by 487.

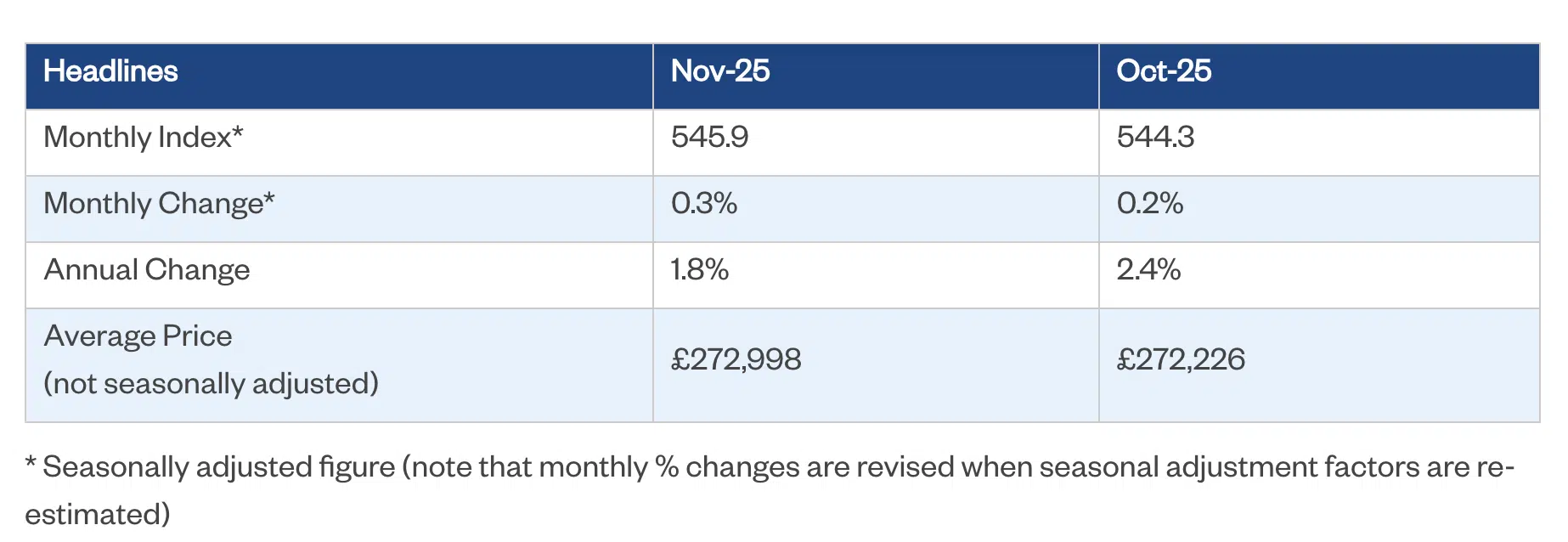

House price growth slows in November

According to lender Nationwide house price growth slowed in November as buyers and sellers clenched pre-budget. The majority of activity was in the £125-250,000 bracket in England and the £500,000-750,000 bracket in London. Meanwhile the £2m plus market struggled to feature as fears over how buyers would be taxed in the future weighed heavy on minds. Moving forward, expect more stock come the New Year in this section of the market and from accidental landlords looking to get rid.

New build homes could lead to negative equity

Those with only a 5% deposit investing in a new build are at a great disadvantage of falling into negative equity should the economic environment worsen. A new start can be a costly one if buyers have no financial buffer to weather any economic storm. Lenders WANT new build business, the government NEEDS new build business to motivate builders and reach their housing target. They are less concerned about individual welfare long term but holding their position short term.

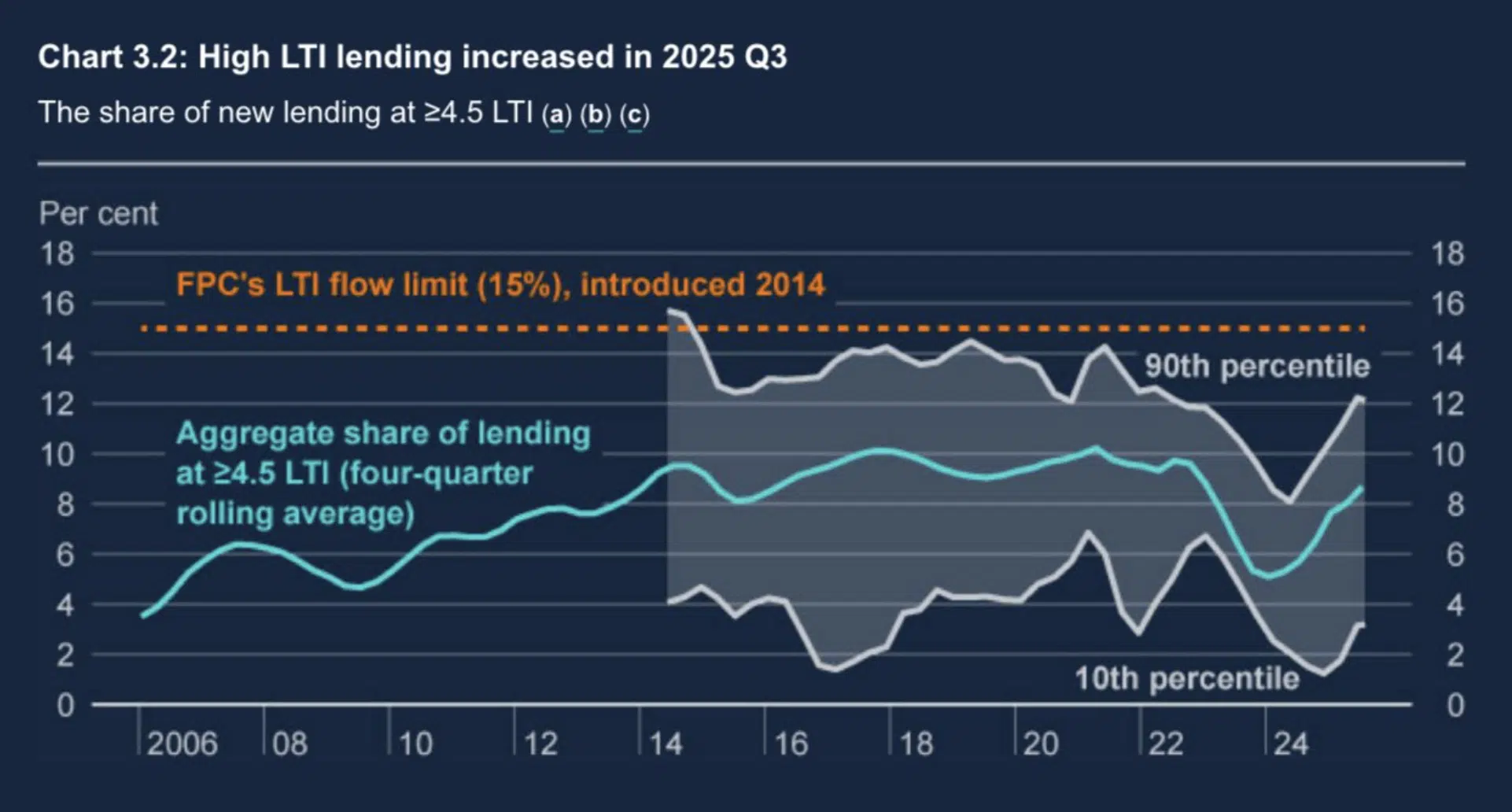

The amount of loans with high loan to income ratios increases but lending remains stable

The Bank of England’s Financial Stability Report showed that lenders have responded to a suggestion from the FCA to ease their lending criteria for borrowers with high LTI ratios while preserving a 15% aggregate flow limit on new UK mortgages.

The share of high LTI lending increased; averaging 8.7% over the past quarter, leaving plenty of room for further lending now buyers have certainty post-budget. This alongside falling rates will continue to galvanise the lower end of the market.

For renters, though, a report by the NMG showed the gap in median savings to income between outright owners and renters had widened over 2025. Over 35% of households are renters and recent increases in outgoings leave them vulnerable to any economic shocks, which will concern any accidental and stretched landlords further.

The Bank of England also found 3m households would see mortgage payments reduce over the next 3 years while 3.9m are expected to refinance at higher rates than they historically were. Overall the report expects households to remain resilient in aggregate and lenders to remain protected from those struggling with higher interest rates and those who aren’t given the current lending criteria and safeguards in place.

UN calls out social Landlord L&G

The UN wrote to the government claiming that the social landlords L&G were “systematically failing to ensure or restore the habitability of their rentals …” Given the government’s stance on rogue landlords and Awaab’s Law you’d have thought they wouldn’t have needed the UN to highlight the issue but clearly they continue to look the other way until they are made to take note.

A new east end home for Billingsgate and Smithfield

Casting off with the Elizabeth line for a bite, cutting up city commuters armed with meat and fish, East London potentially gets another culinary treat.

Billingsgate and Smithfield could swim downstream to the London’s Royal Docks…planning and government permitting

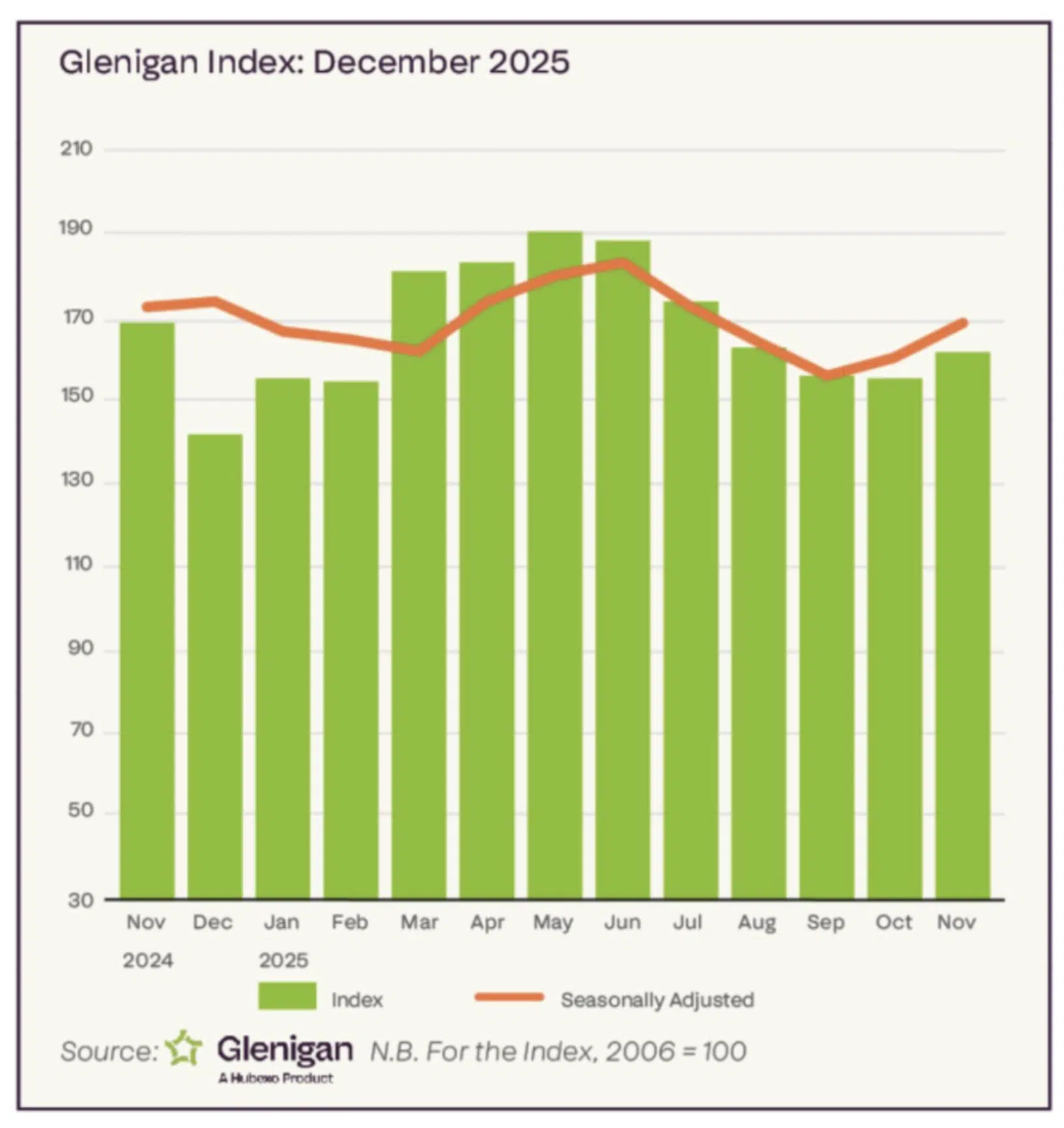

Construction remains in flux

According to Glenigan UK’s construction index the industry started to build on its previous numbers, up 4% overall since 2024. This rise was driven by development in the non-residential sector, up 15% followed by civil work up 4% compared to last year. However despite the rise in social housing, up 11% – private housing was down 18% on last year.

The government and developers share a New Year wish that with the budget behind us and rate cuts on the horizon this will provide enough ground work to lay some foundations for the future.

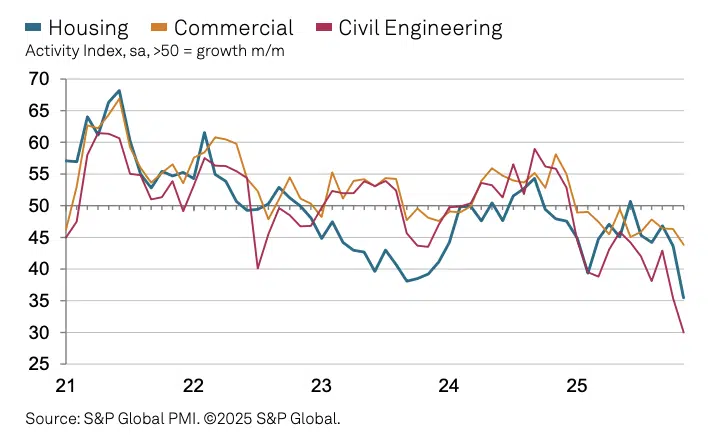

However S&P Global’s construction Index found UK construction output fell at the steepest rate for five-and-a-half years. None of the construction sectors were immune to budget fears and economic uncertainty; leaving many a new order on the shelf. As a consequence from the lack of demand, supplier staffing levels improved for those still working through the doubt but many labourers found they weren’t needed, employment levels falling yet further.

RATE CHANGE

Lenders are getting impatient for business so are starting their New Year rate sales early, vying for borrowers attention. NATIONWIDE kicked off by announcing a drop of all its rates by up to 0.21 percentage points for new and existing customers tomorrow, hoping to pick up some new borrowers before we reach the end of the 2025 line.

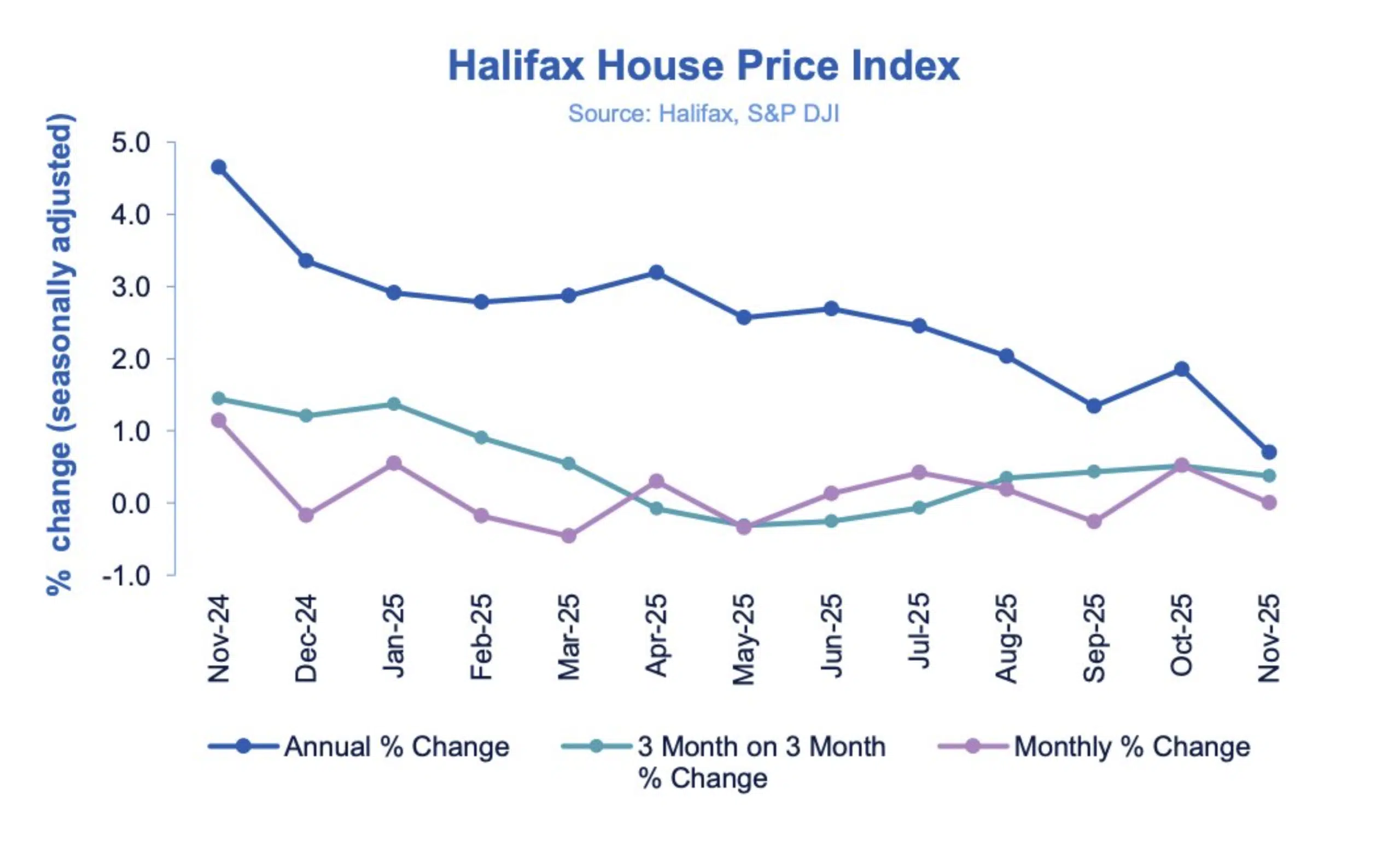

House price growth flatlines in November

According to the lender Halifax house prices remained flat in November after rising in October, making the AVERAGE house price, on this index, now £299,892. Growth and activity was once again driven by activity in Northern and more affordable regions. Annually house prices rising the highest in Northern Ireland, up +8.9%, followed by Scotland, up +3.7% and Wales, up +1.9%. In England, the North West and North East pressed ahead up 3.2% and 2.9% respectively. HOWEVER southern regions felt the chill; annually house prices in London FELL by 1.0%, 0.3% in the South East, and 0.1% in Eastern England. Affordability issues acting like ozempic to growth.

Rightmove under threat

Over the past few weeks, London-based Independent Franchise Partners has built up a 5.8pc stake in Rightmove, leading some to believe they will steer the portal towards accepting a take over bid. The portal’s share price recently dropped after the company substantially invested in AI technology which won’t see a return on investment for 3 years. Rightmove, which is known for turning a healthy profit, may be under pressure now but long term it will remain the primary site for property listings which is why investors want a piece.

That concludes this week’s UK Property Recap – 05.12.2025. Please get in touch if you have any comments or suggestions.