You always know when it’s December not because of the tinsel, the lights or the carols or even the onslaught of aftershave and perfume ads that take over our screens with impossibly goodlooking people trying to convince us that if we use this product we too could be part of their club. No, it is the start of the property market prophecies. This week, the forecasts started with many putting their money on interest rate reductions stirring up 2026 activity and prices with the exception being the top of the market where taxes will dampen sellers’ expectations. This will split house price growth and activity between the North and South, leaving more affordable regions to flourish over more established and pricier ones. Welcome to another UK Property News Recap – 12.12.2025.

Hamptons predicts a market divided

The estate agency Hamptons expects house prices in 2026 to rise 2.5% across Britain but freeze in the capital with those properties affected by the incoming Mansion Tax to see 5% shaved off their house price. 2026 looks set to see a lot of movement but some won’t feel the benefit.

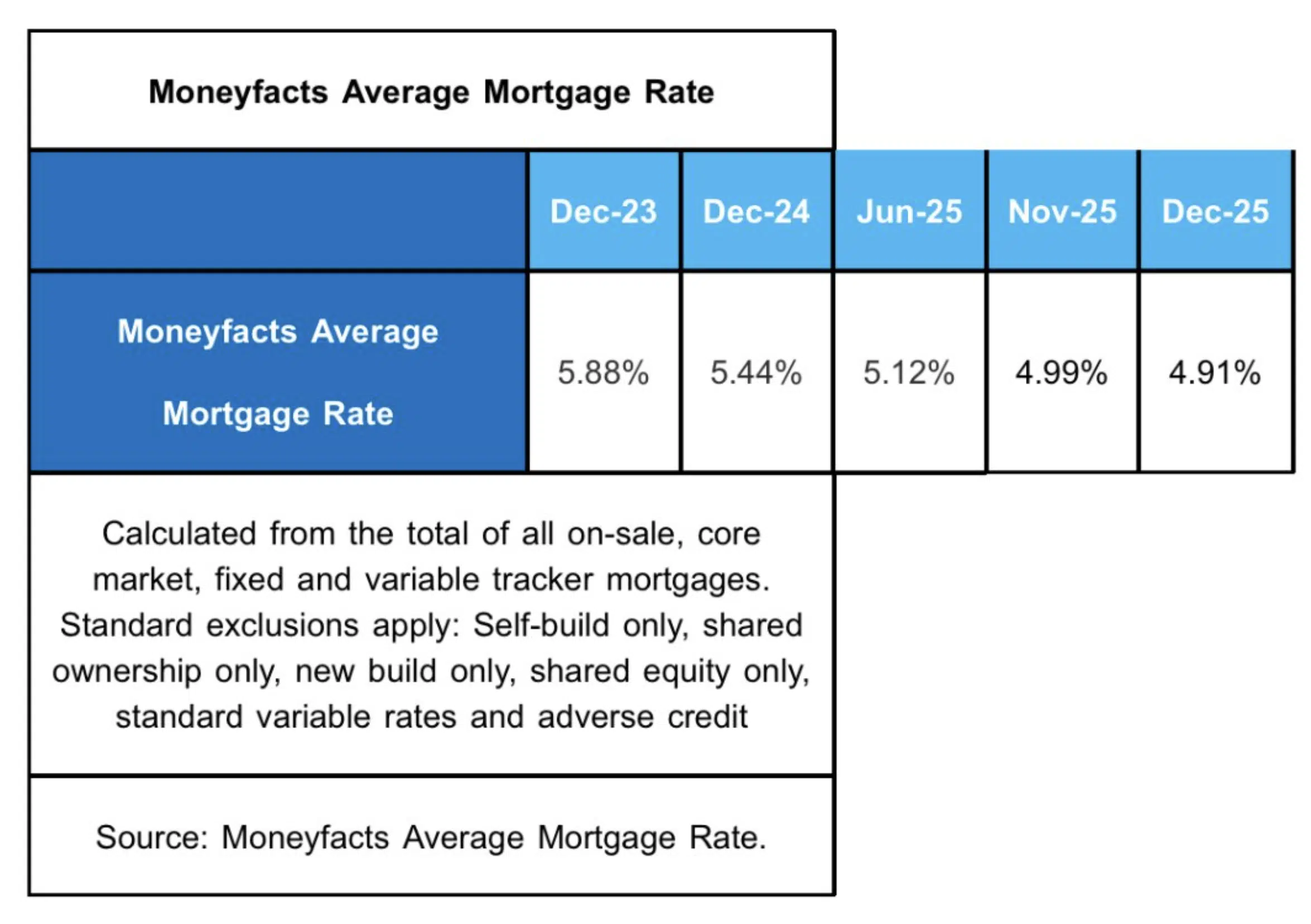

Lenders kick off rate sale

The New Year rate sale has begun in earnest, kicking off weeks before Santa could make an entrance or a firework be lit. Lenders, keen to garner business, have been discounting their product offerings while at the same time creating more choice. The average two- and five-year fixed mortgage rates fell month-on-month to their lowest levels since the start of September 2022, dropping 0.08% and 0.10%, to 4.86% and 4.91% respectively, according to Moneyfacts.

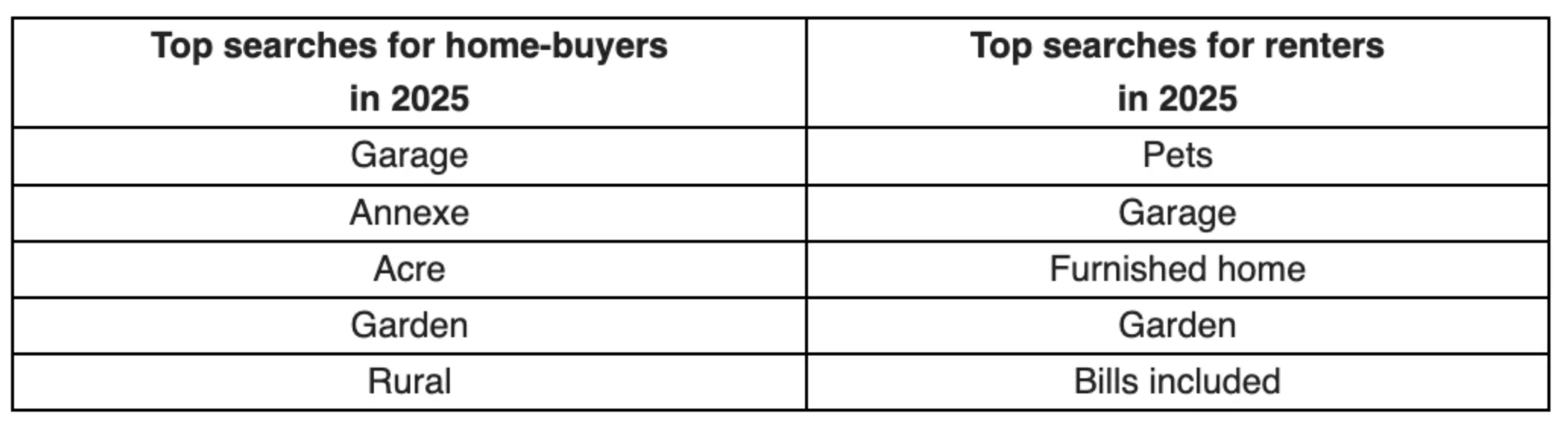

Property must have and have nots

It’s that time again…Rightmove released the most searched terms on their platform in 2025, revealing the UK’s buying and renting preferences.

The top three locations to buy were all well connected: London, Manchester and Glasgow.

In the capital, buyers concentrated on areas south of the river: Wimbledon, Fulham, and Chiswick while renters opted for Canary Wharf, Clapham, and Fulham.

Overall, buyers prioritised a garage (unlikely in London) while renters focused on pet-friendly homes.

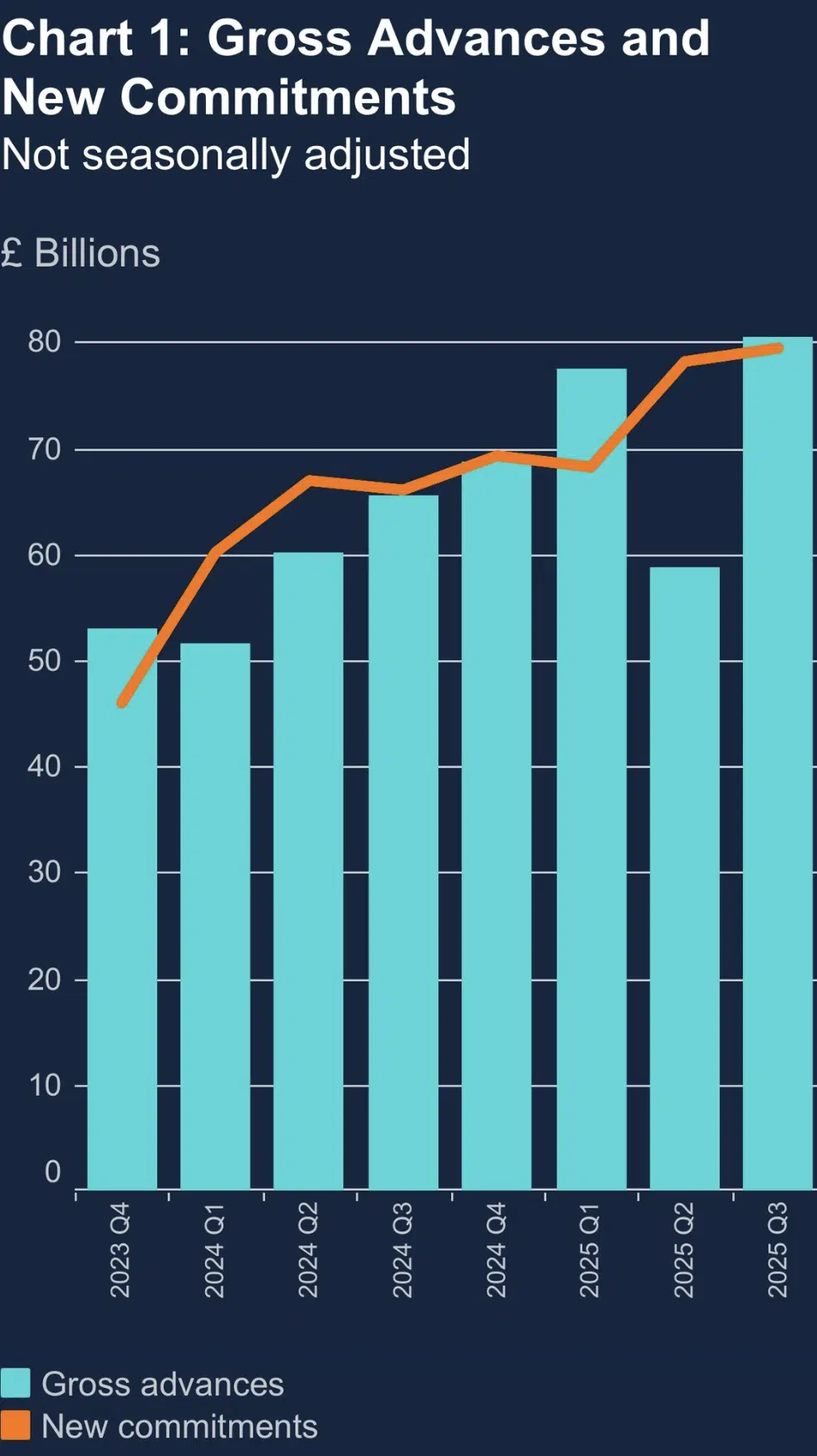

Lenders increase lending to first time buyers

In the Bank of England’s latest Mortgage Lenders and Administrators Statistics for 2025 it was apparent that despite economic uncertainty borrowers were keen to tentatively move forward. In Q3 the value of gross mortgage advances increased by 36.9% from the previous quarter to £80.4 billion alongside the value of new mortgage commitments, which rose 1.6% to £79.4 billion. The proportion of borrowers with small deposits or with high loan to income ratios stepped up by 0.3pp and 3.3pp respectively as lenders began to create more opportunities for first time buyers.

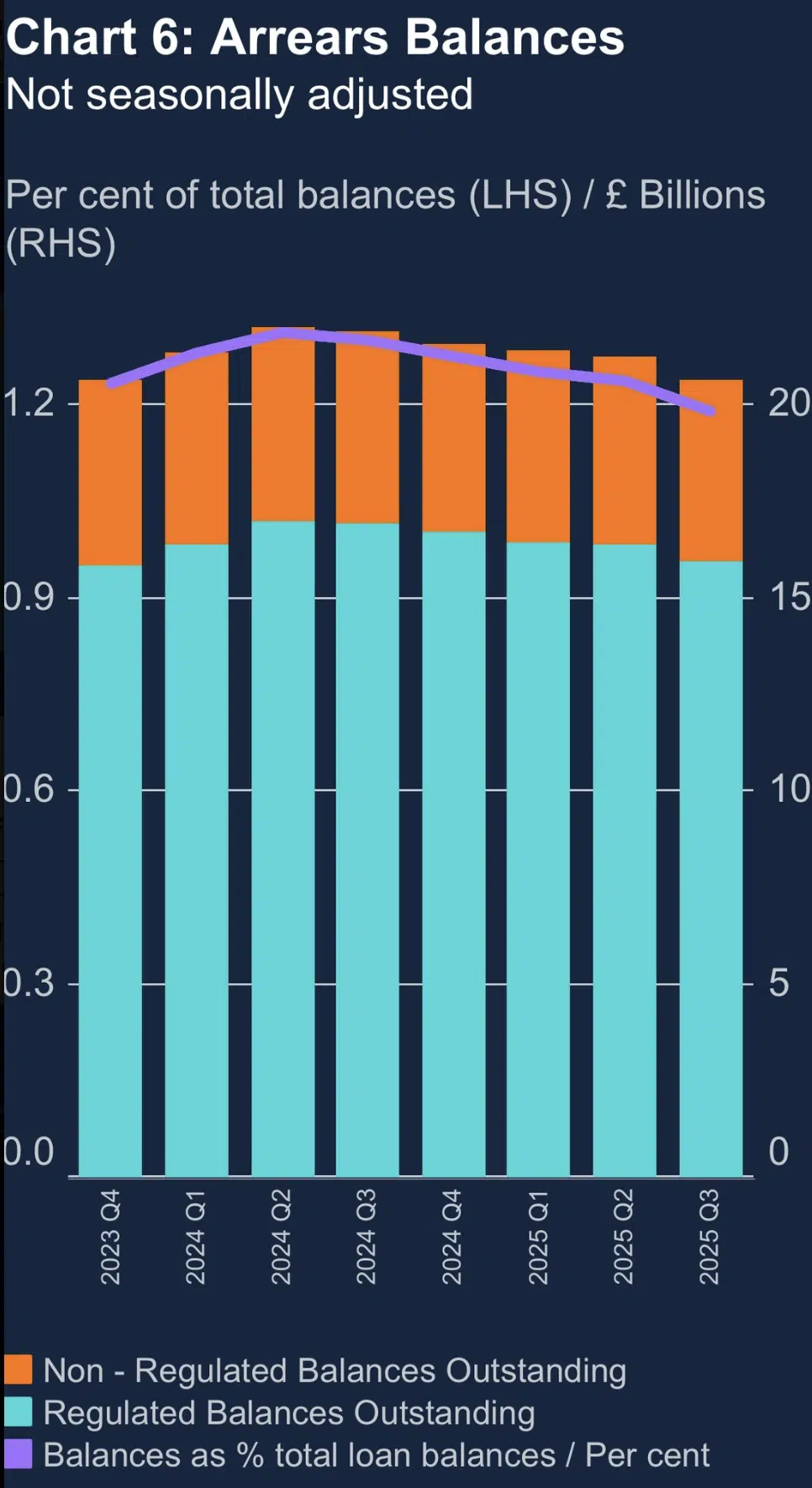

Meanwhile, the number of borrowers struggling with repayments remained stable at 1.2% but the outstanding value decreased by 2.9% in Q3 to £20.6 billion. The good news is the number of households recently in arrears decreased by 0.1 pp on the previous quarter.

Developer Berkeley’s forward sales are hit by uncertainty

Budget uncertainty hits Berkeley’s pockets which are yet to feel the benefit from the government’s recent actions to cut through all the red tape. As a result; “cash due on its forward sales was £266 million lower on Oct. 31 than it was in April 2025. Berkeley said the value of its sales reservations in the six months through October was 4% lower year-on-year and down 30% over the past two years.” However they end the year with the same optimism they started saying, “these headwinds will recede and the feelgood factor will return.”

No yearly housing target for a reason

The 1.5m housing target relies heavily on interest rates reducing, economic stability & additional affordable funding. Development will increase over the coming years which will help the government make or at least come close to their target in time for the election but it will come only after more concessions are made to benefit developers’ bottom line and if and when they decide to release them to the market.

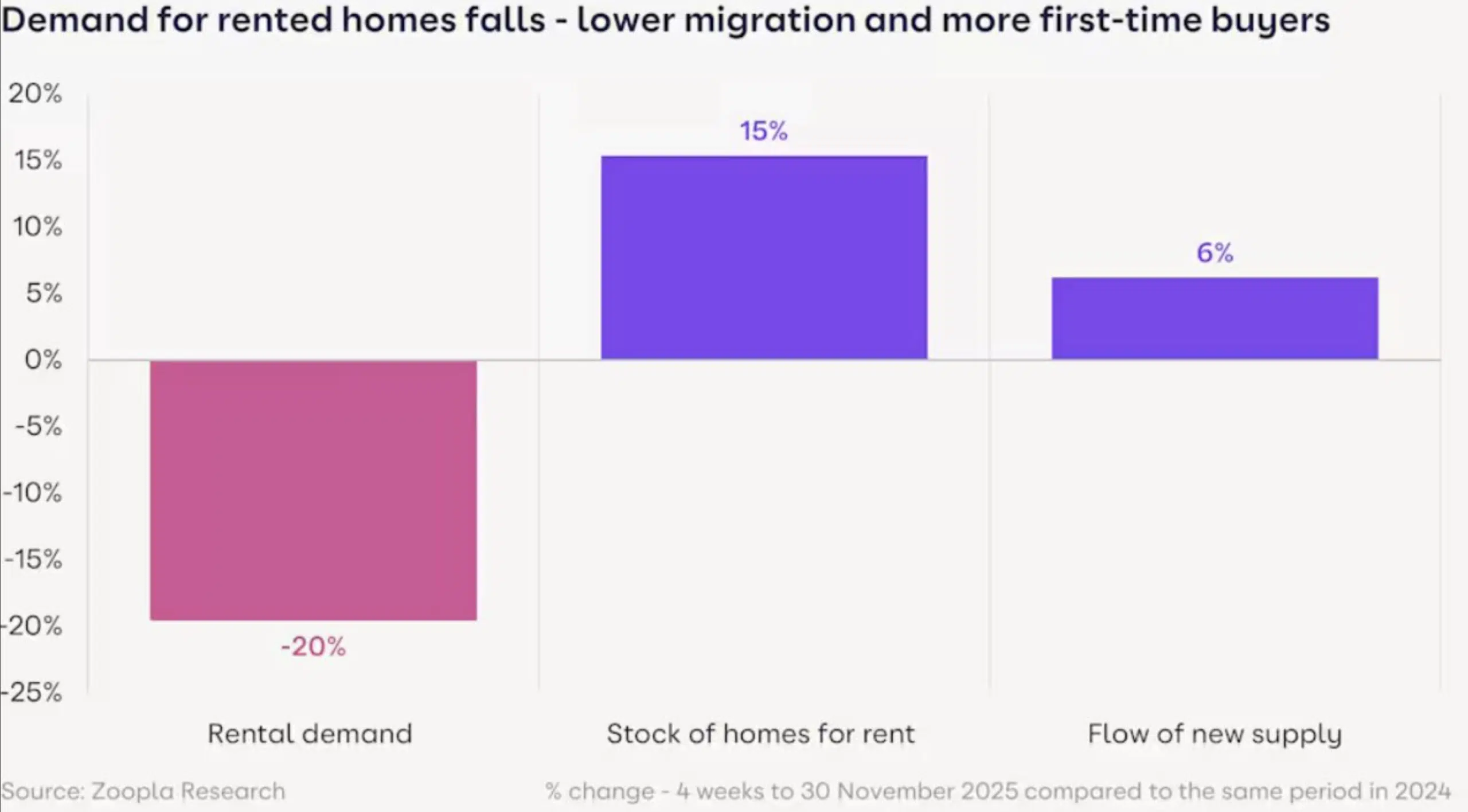

Rental growth continues to slow

Rental growth slowed to 2.2% this year as immigration fell by an estimated 78% and renters become first time buyers as affordability improves. This has meant supply levels were up 15% on last year according to Zoopla’s rental index and the time taken to secure a tenant stretched to 17 days. More affordable regions are experiencing more choice from renters jumping on the ladder, freeing up stock, as opposed to the capital where demand is high but supply is limited as landlords look to offload but first time buyers still can’t afford to reach.

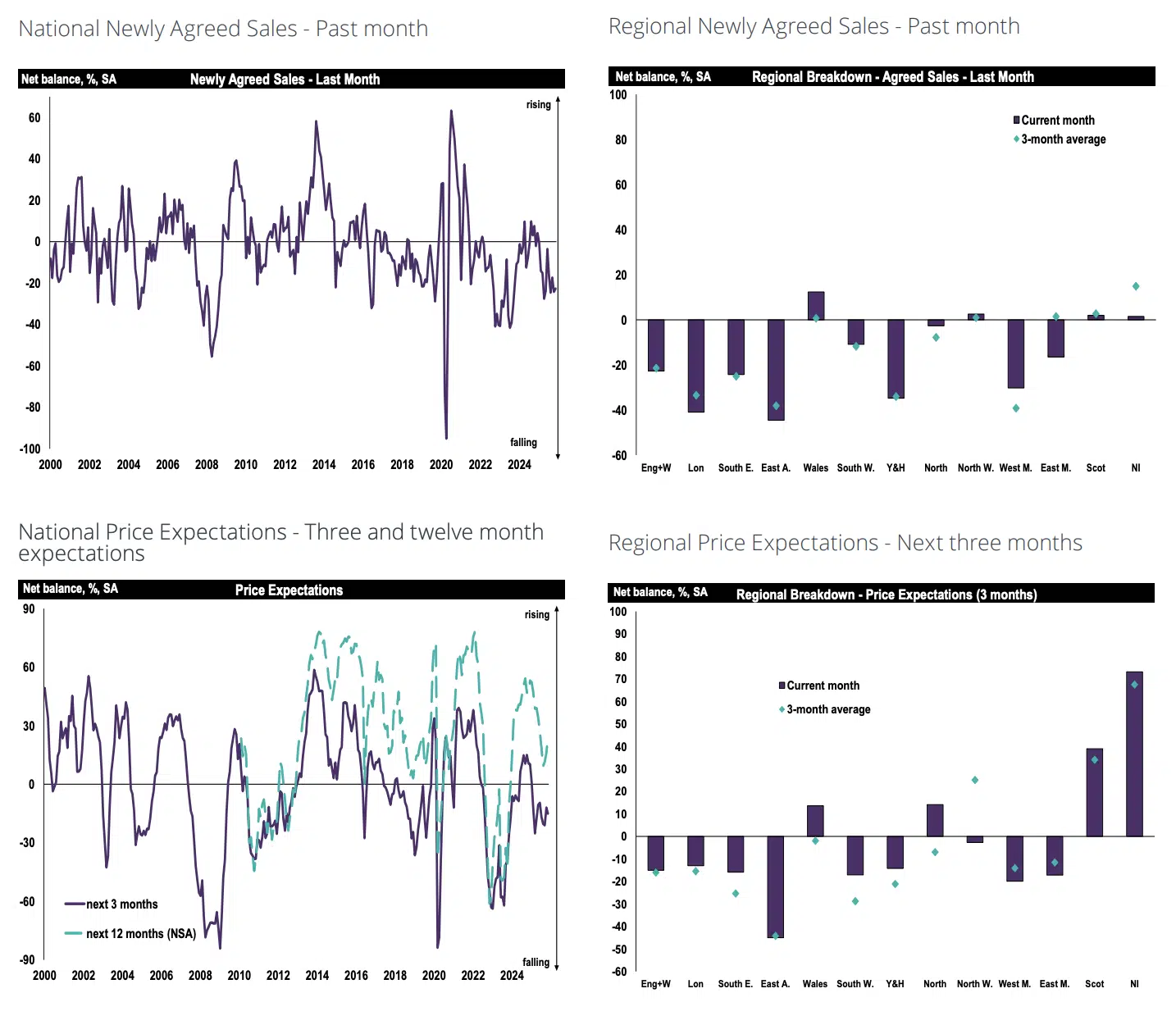

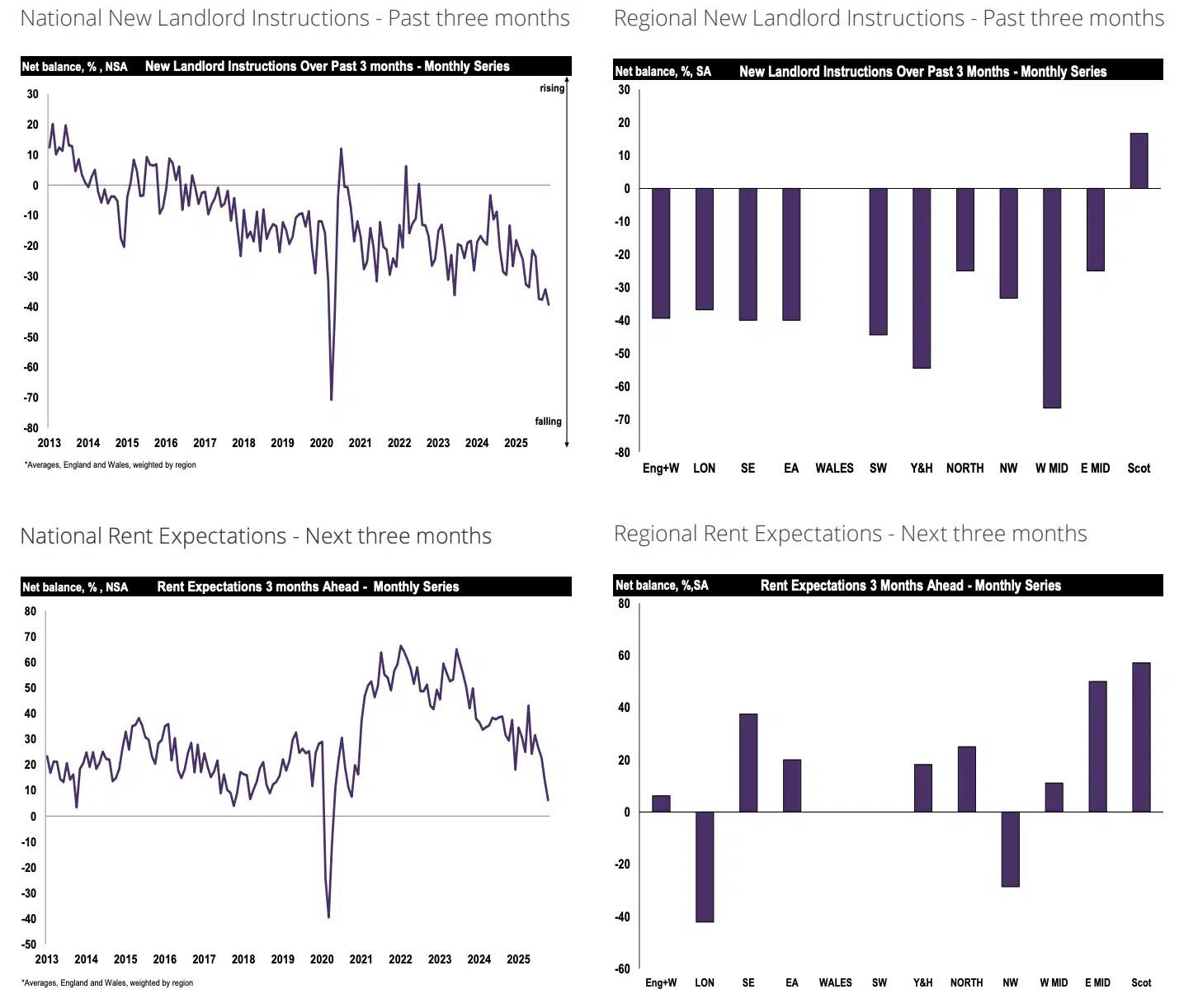

RICS’s despondent review of the residential market

Post budget blues has the UK property market waiting for Santa to bring a rate cut. In the near term RICS surveyors remain gloomy but see further promise in both activity and prices as we work through the New Year, with London being the exception. The top end of the market here is being taken down a rung or two with the mansion tax on the horizon. In the meantime, sellers batten down the hatches, till 2025 is in their rear view mirror and they can market with more confidence than they currently have.

In the rental market tenant demand has decreased alongside supply levels as landlords continue to offload. As a result RICS surveyors foresee prices to remain fairly consistent in the short term before sprouting new growth come spring.

Building safety regulator delays prolong residents ability to move on

More harm than good and about as much common sense as Homer Simpson. The building safety regulator appears to be unable to respond within the statutory “target” of 12 weeks, instead drawing out the process to 9 or more months, thus prolonging many homeowners’ purgatory in their flammable wrapped homes

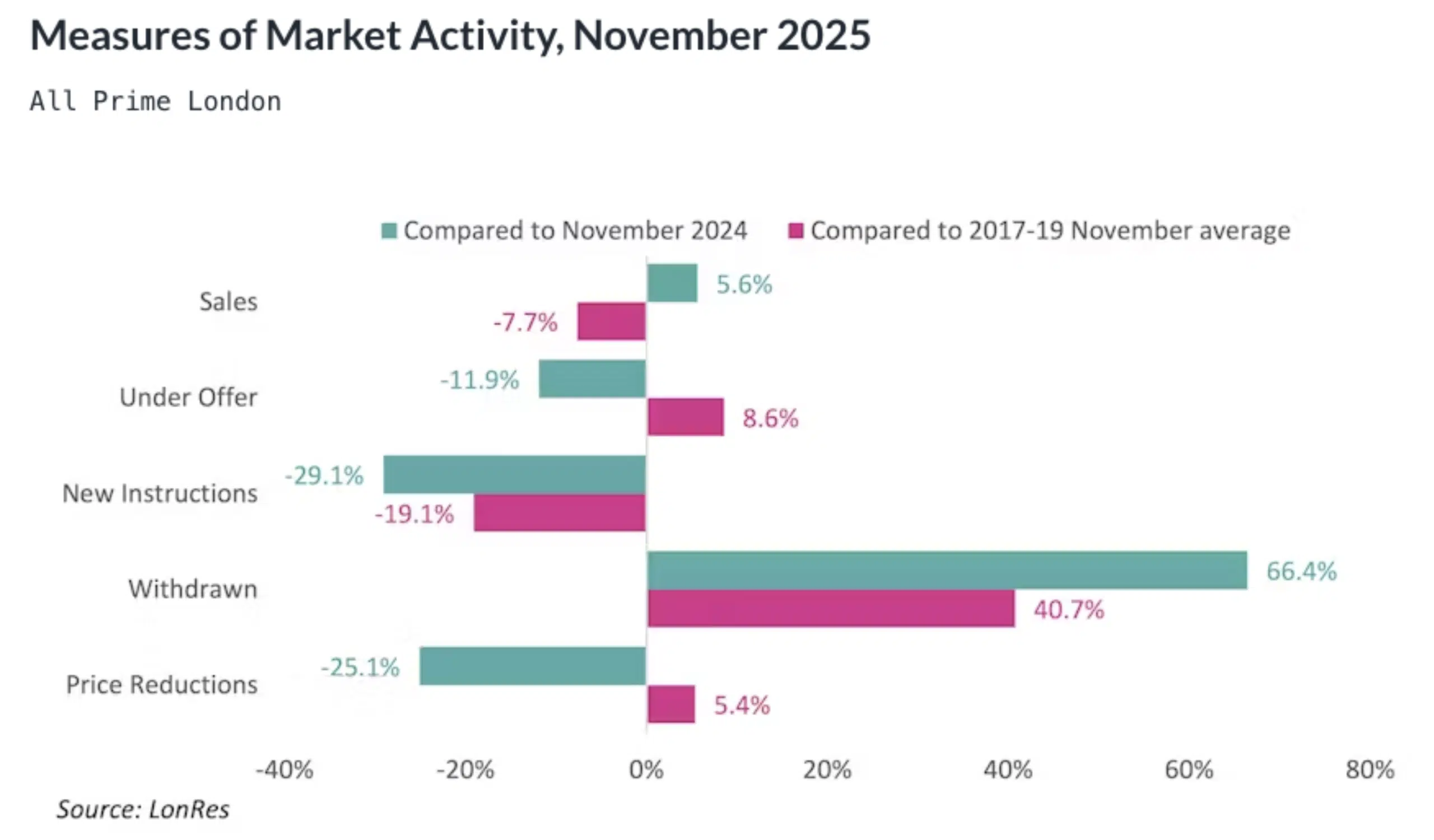

Prime central London sales pick up at a price

Prime central London saw a rise in sales in November but only when the price was right. The average discount rose to 9.3%, leaving the average achieved price 4.0% lower annually in November. Meanwhile some sellers refuse to be moved and have pulled up their drawbridge till they feel a renewed “spring” in their step.

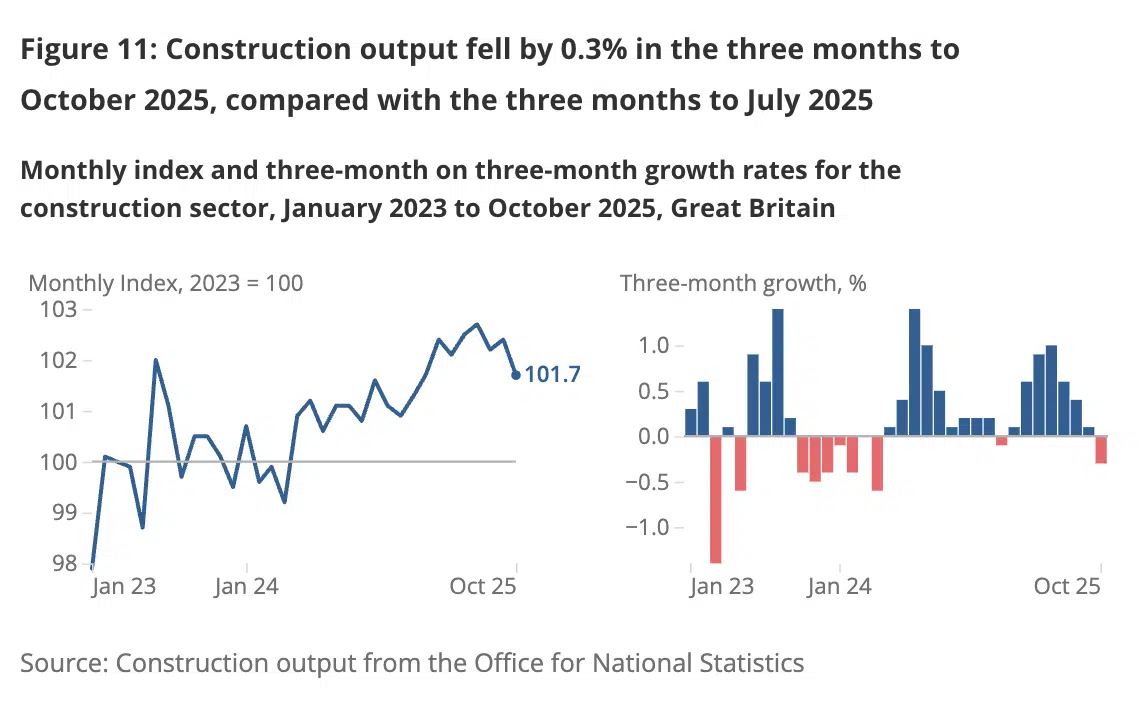

The building boom remains devoid of any spark.

Construction output was estimated by the ONS to have decreased by 0.3% in the three months to October 2025 and by 0.6% on September’s efforts. The biggest losers over the month remained private new housing, which fell by 2.4% but both new work and repair and maintenance, which to date had been doing their best to bolster construction figures, also nosedived 0.7% and 0.6%, respectively. This all came as a result of the continued speculation on what the budget would hold and how people’s finances would be affected as a result.

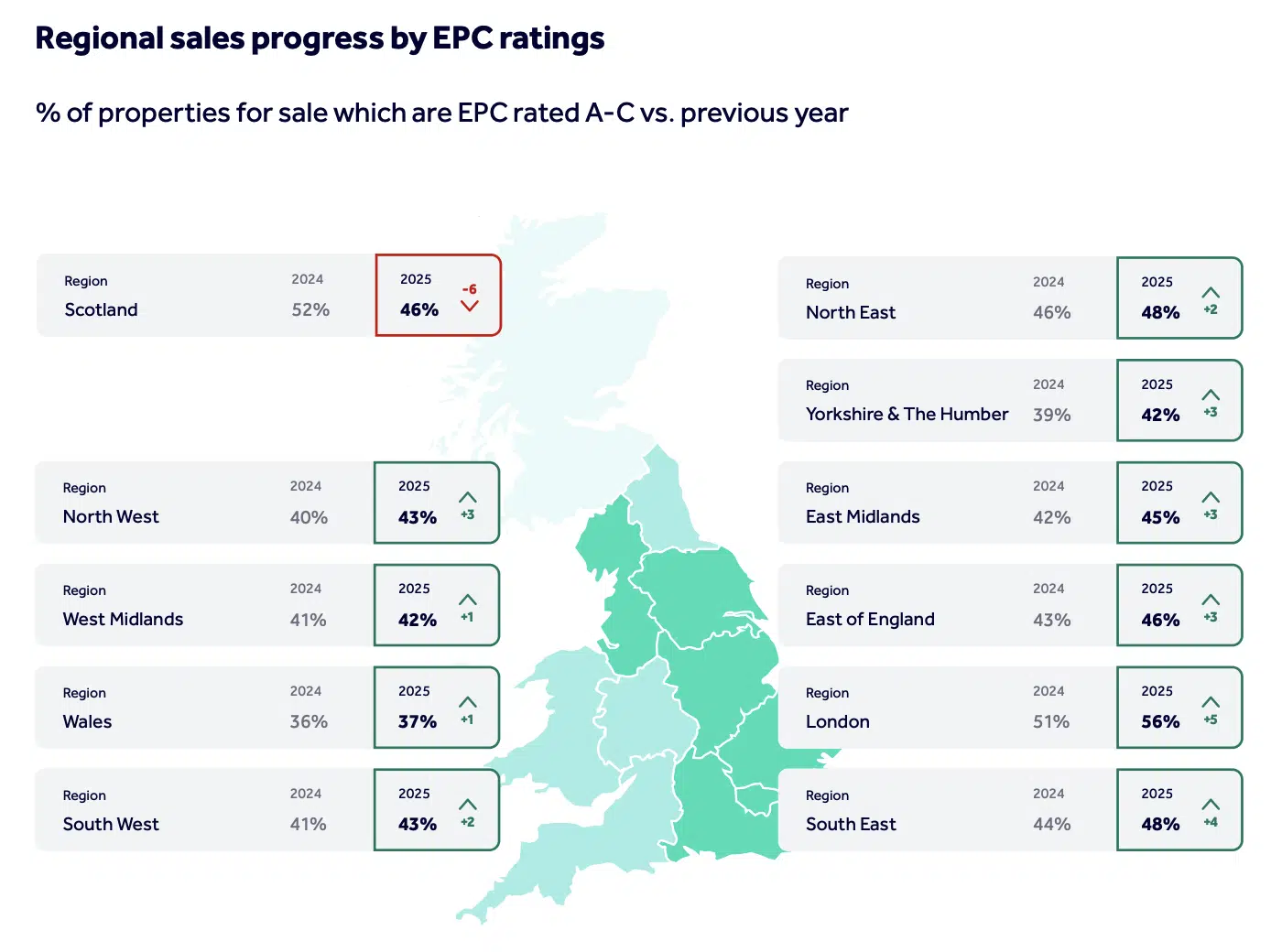

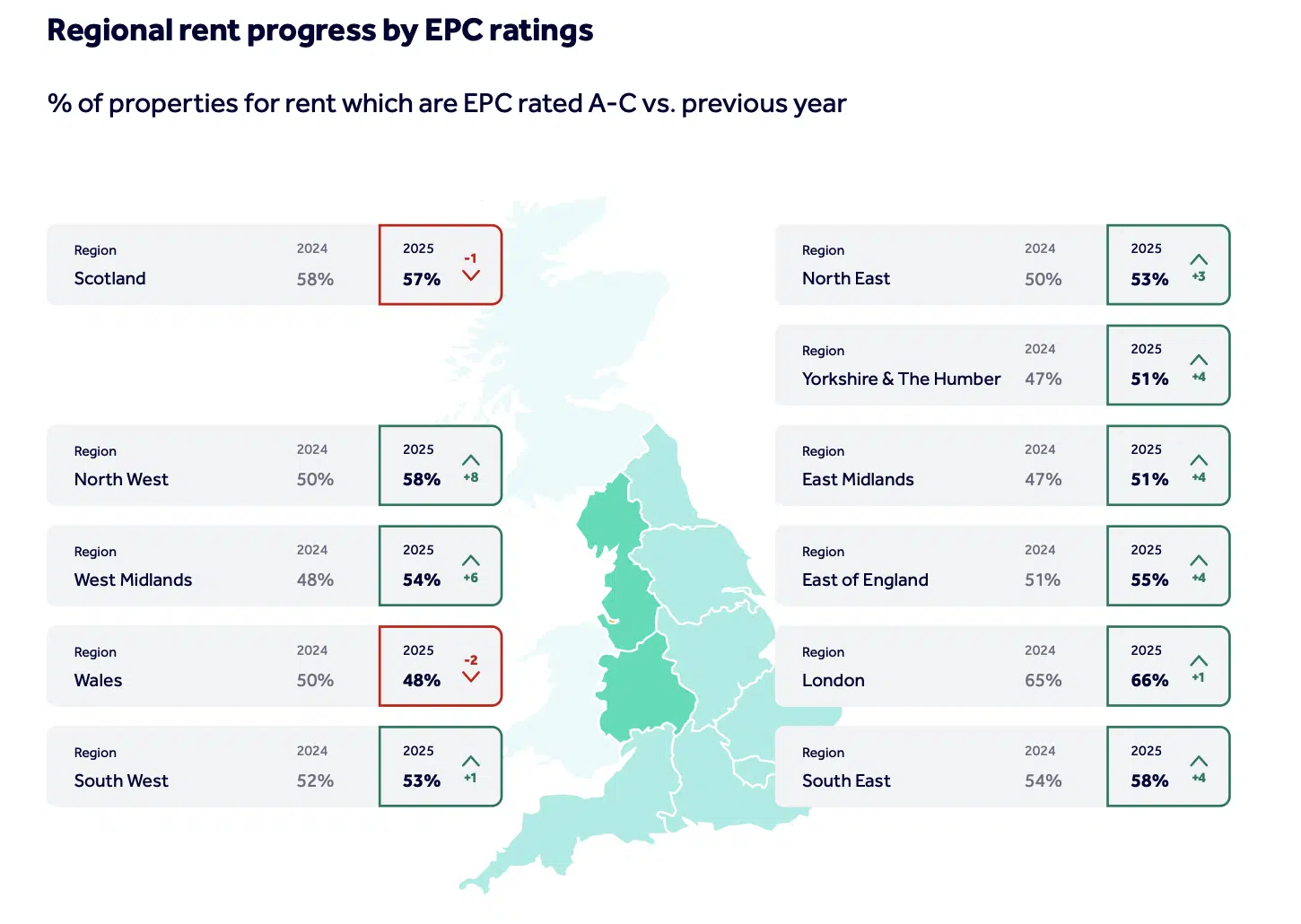

EPC rating upgrades have room for improvement

Getting the ratings proves hard while funds are hard to come by. Rightmove’s Greener Homes Report shows progress has been slow and steady over the past 5 years with only a recent push in both the private and rental sector in the last year of 3%. Currently, 46% of homes currently for sale and 58% of homes for rent are rated EPC C or above compared to 29% of resale properties and 41% of rental properties in Great Britain back in 2015

Unsurprisingly, the rental sector has outperformed the sales market with London and the North West outperforming other regions. However the report suggests movement in the rental sector should be higher given proposals for all rental properties to be a C rating by 2030. Progress is slow due to affordability and timing. If a landlord is intending to offload in the not so distant future, the motivation to upgrade isn’t there and for others, rate reductions will dictate when they can afford to upgrade.

That concludes another UK Property News Recap – 12.12.2025. Any comments or suggestions, please get in touch.