This week prime minister Keir Starmer broke ‘ground’, wielding his spade of power with the aim of aerating leasehold so commonhold would take seed. This will transform homeownership for many flat owners, who have seen costs spiral over the years while being powerless to call freeholders to account. This step forward is huge but has many investors and insurers getting their knickers in a twist over the loss of income, and the question of how blocks will be managed. After all, many a share of freehold can fall into mild disrepair from a lack of willingness to spend on upkeep till it comes time to sell. This is not an excuse to prevent commonhold; homeowners have a vested interest, especially in blocks of flats, for everything to work. The difference is they also know how to shop around. Welcome to another UK Property News Recap – 31.01.2026

£1 million households face mortgage spike

For around £1m households who fixed for 5 years back in 2021 when rates were sub-2%, their time has run out. Remortgaging will be painful but the financial pain won’t be as acute as it was for those immediately after Liz Truss’s not so mini budget

Kier Starmer lays down some ground rules

Tick tock on ground rent. Kier Starmer calls time, providing firm footing underneath for future voting generations, demonstrating he’s got their back. The prime minister announced plans to cap ground rents at £250pa, changing to a peppercorn after 40 years. This would make it obviously cheaper for most flats and remove concerns of escalating rents making it harder to sell in the future. However, in doing so he picks a fight with investors but wins public opinion.

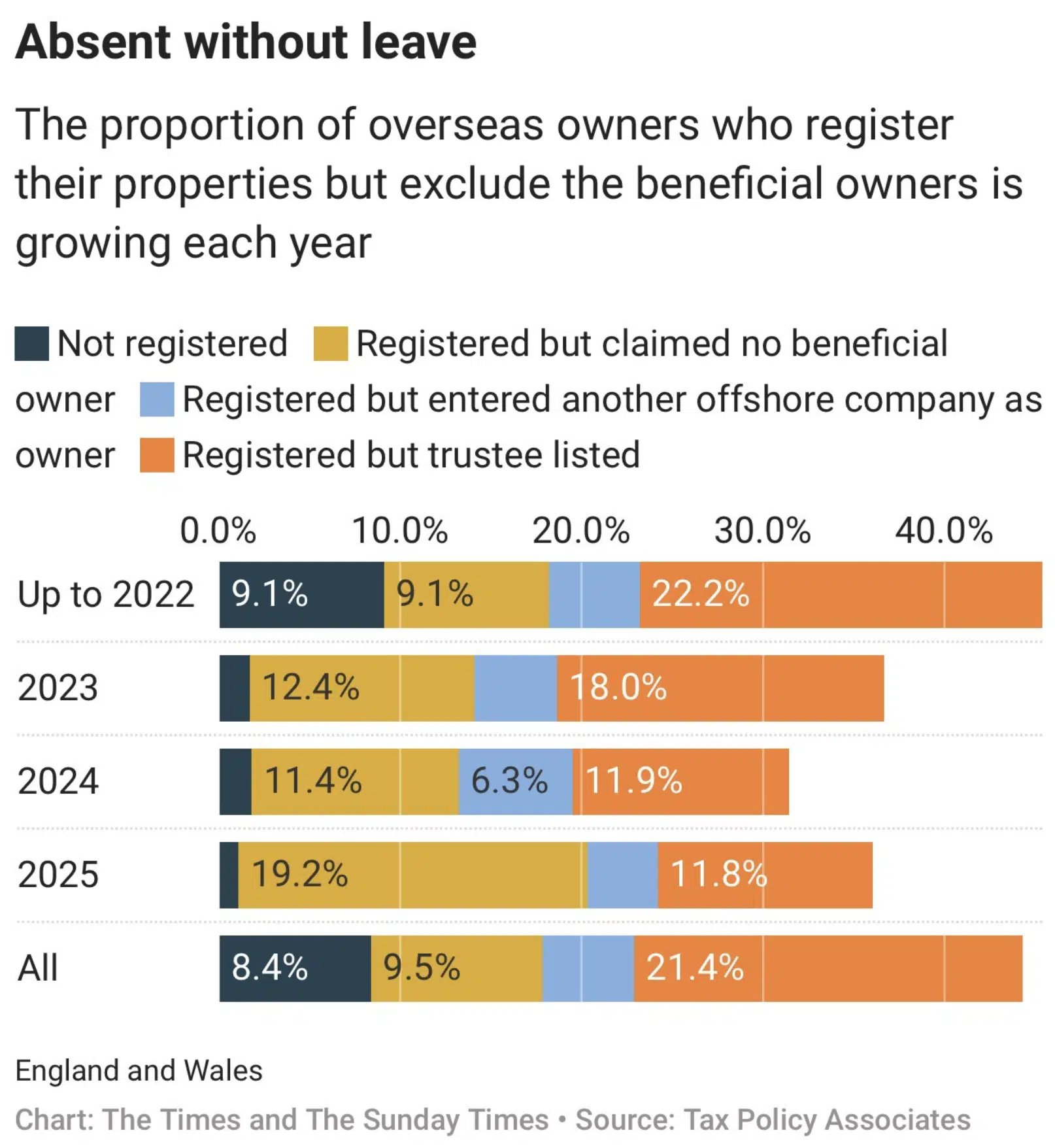

UK Laundromat remains open for business

The analyst DanNeidle has found the UK laundromat is still open for business for 44% of the 97,978 properties registered to offshore companies in England and Wales. These have either claimed ignorance, it isn’t them, ignored or placed their “trust” in others and that Companies House hasn’t got the resources or time to unpick each case. The majority of these homes are based in London and are registered in Jersey based companies or Saudi Arabia. It’ll take time to air their dirty washing fully but everything comes out in the wash eventually.

Cyber attack stalls prime London transactions

Sellers in Westminster, Kensington & Chelsea have had a hard 2025. For those who finally agreed to an offer, the recent cyber attack on the councils impeded sales from progressing, giving buyers time to shop around & potentially discount further.

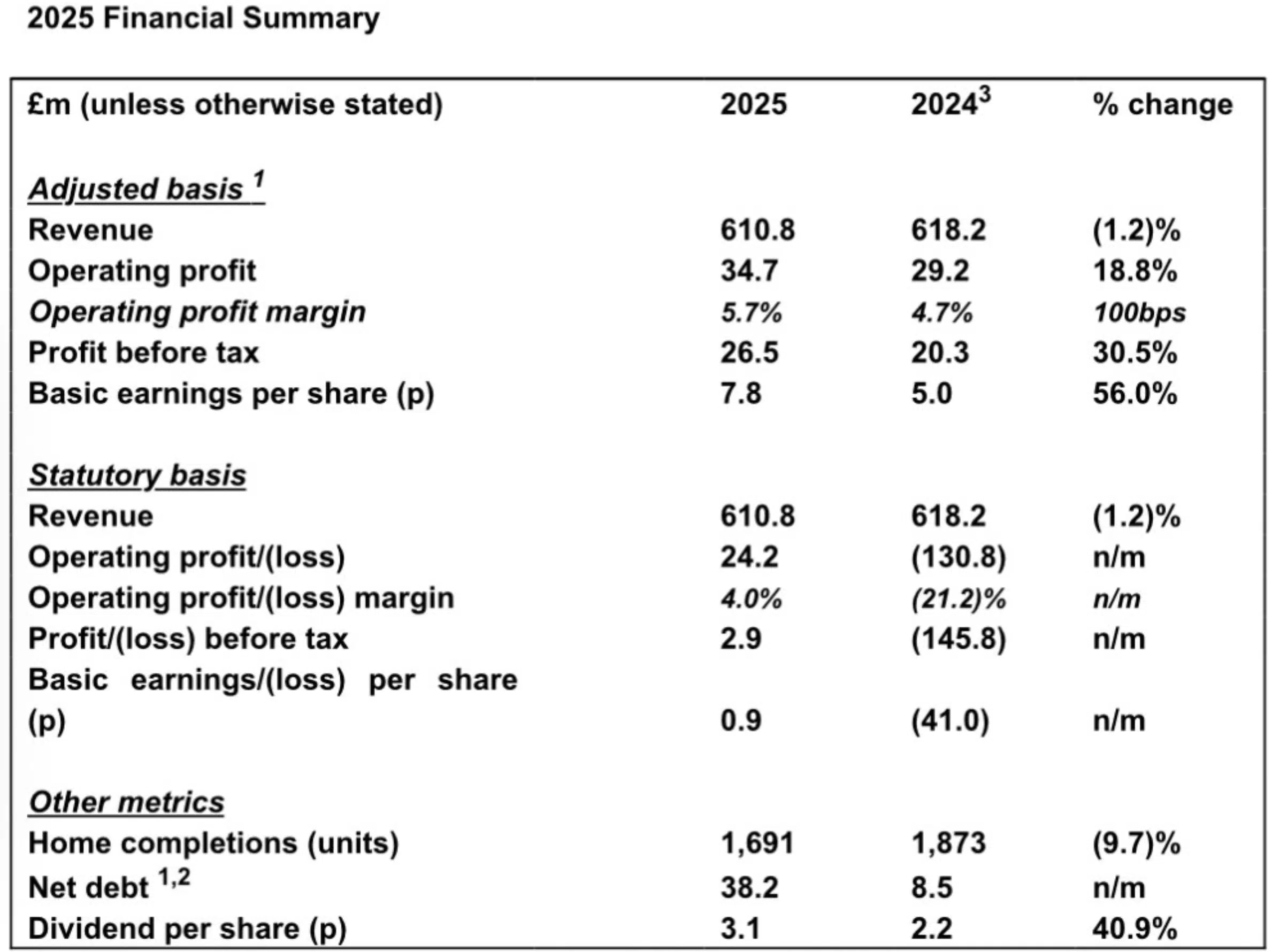

Crest Nicholson profits miss their target

Crest Nicholson’s share price bounced in reaction to the developer’s latest trading update which reported an adjusted pre-tax profit of £26.5 million for the year ending October 31. The general consensus was this is below expectations as a result of a sluggish end to 2025, as a result of budget speculation. Moving forward they are seeing activity pickup and therefore, cautiously, expect an improvement on last year‘s efforts.

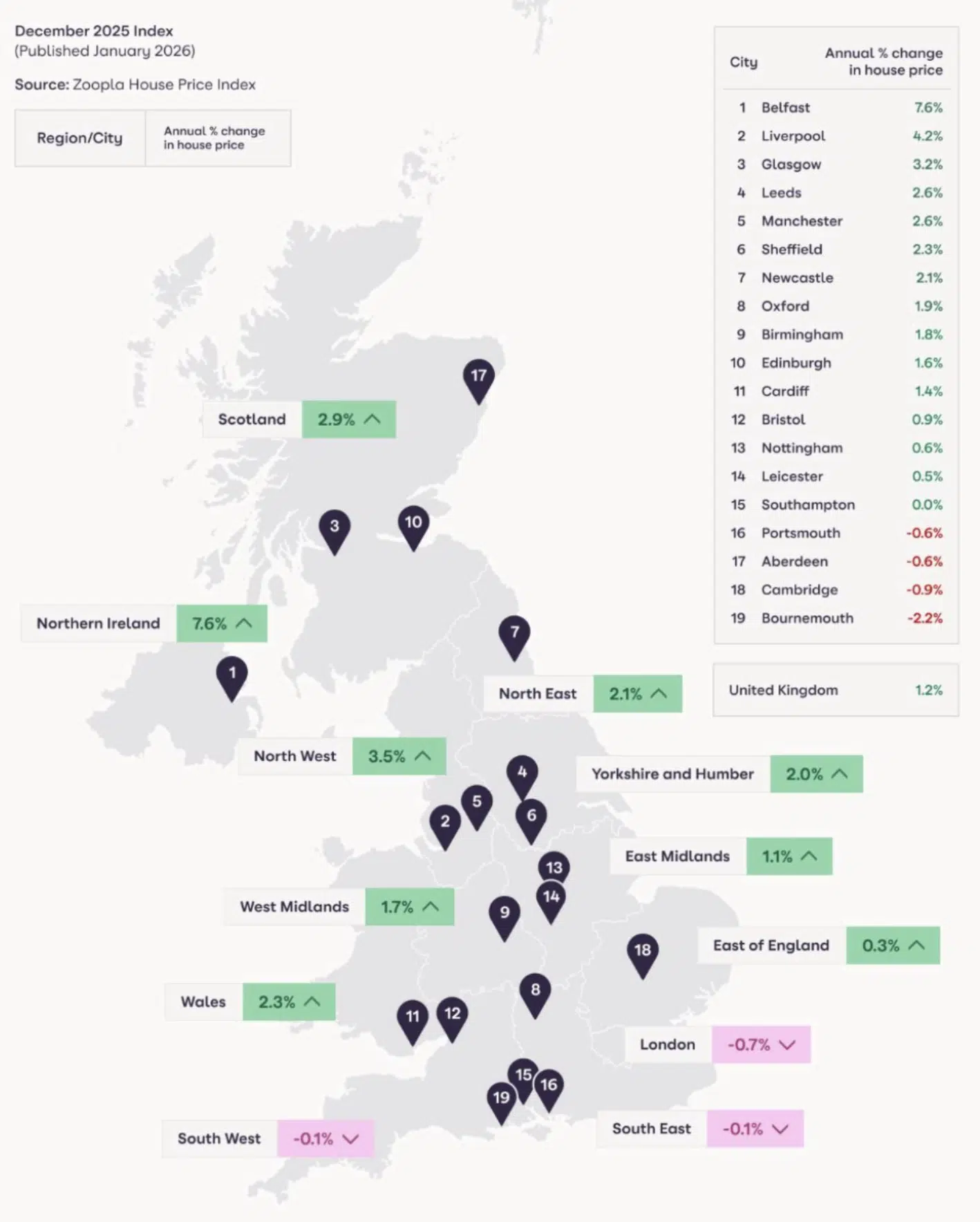

Supply levels dampen growth in southern regions

Supply levels are rising, suppressing prices in the south against rising house prices in more affordable, northern areas where supply remains tight. According to Zoopla, overall house prices slunk forward by 1.2% last year. The North West saw rises of 3.6% vs a 0.7% decline in London. Here prices continue to struggle as competition on the portal shelves increase while affordability remains tight. Demand at the start of 2026 has picked up but is 9% down on this time last year as the rush to meet the first time buyer stamp duty threshold is removed. With rates falling activity is expected to pick up but the market remains sensitive to price.

Passing the cladding buck

Jeff Fairburn and hedge fund Elliott are taking Lloyds Banking Group to the High Court. Claiming Gladedale, the company that was previously owned by Lloyds constructed the majority of the developments which now face a £107 million remediation bill.

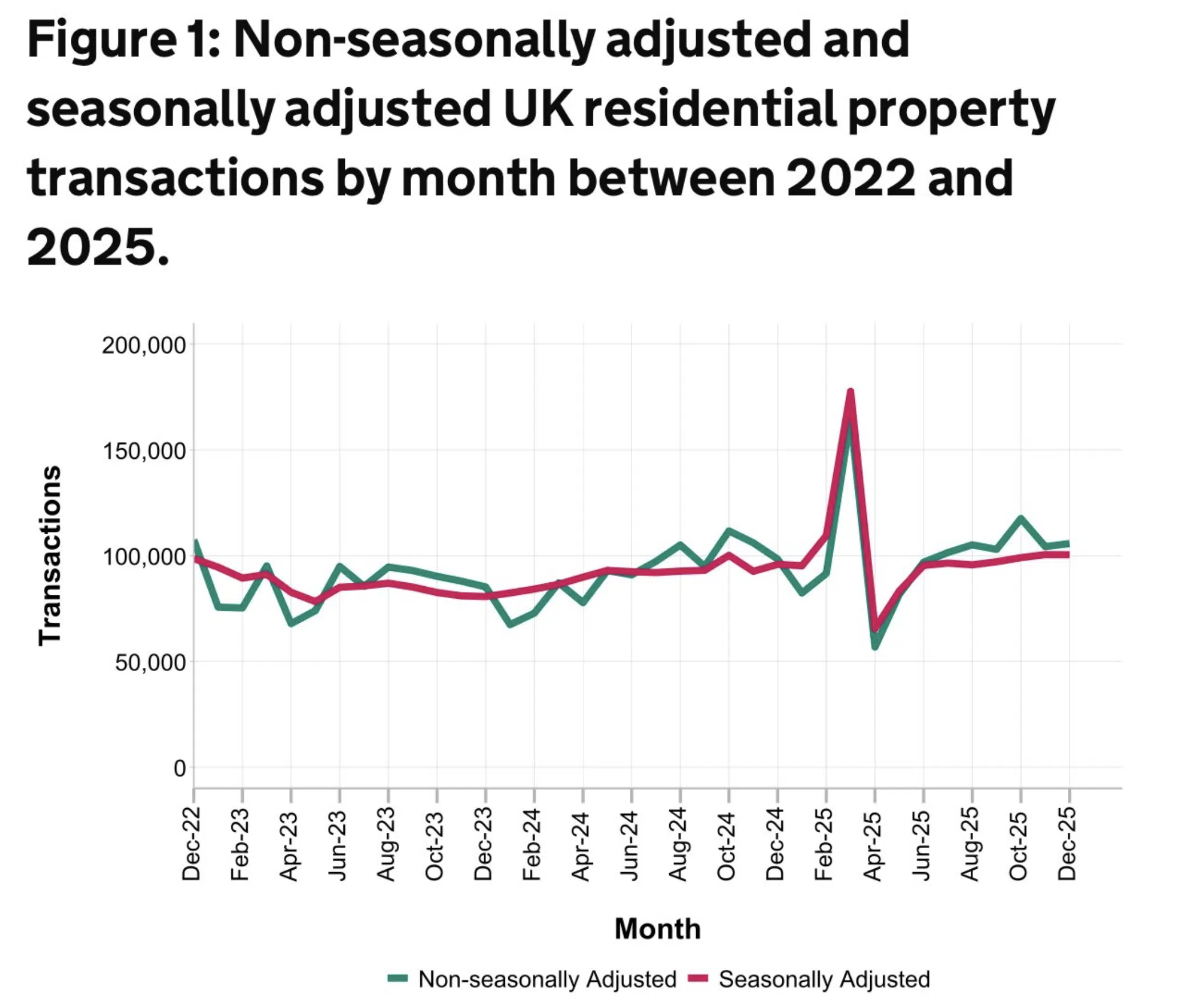

HMRC UK Property transactions rise in December

Moving on. UK residential transactions in December 2025 increased by 5% on 2024 levels to 100,44, down 1% on November 2025 levels. However, when not seasonally adjusted transactions were 7% higher and 1% up on November levels.

Mortgage Approvals slow in December

Many homes remained unwrapped in December as mortgage approvals for house purchases fell by 3,100 to 61,000. In contrast, approvals for remortgaging rose as interest rates fell by 1,600 to 38,400 in December when seasonally adjusted. That said when not seasoned they fell alongside approval.

That concludes this week’s UK Property News Recap – 31.01.2026 . Any questions or comments please get in touch.