This week, the news revealed agreed mortgages ticked up as transactions fell in December 2023. Zoopla and Nationwide painted an impressionistic picture of property promise while the Bank of England remains on table top mountain. Welcome to another UK Property News Recap.

Court calls time on Chinese Developer Evergrande

The debt-riddled Chinese developer Evergrande’s stay of execution came to an abrupt end with Justice Linda Chan ruling on Monday to liquidate the company. This will allow a liquidator to take control of Evergrande assets outside China, opening the door to numerous lawsuits by those hoping to claw back losses. How successful they will be, depends on whether the Chinese courts will recognise Hong Kong’s ruling.

Zoopla HPI January 2024

Zoopla’s HPI report for January 2023 demonstrated how a raft of rewrites to property forecasts had led to many sellers and buyers reconsidering their position in 2024.

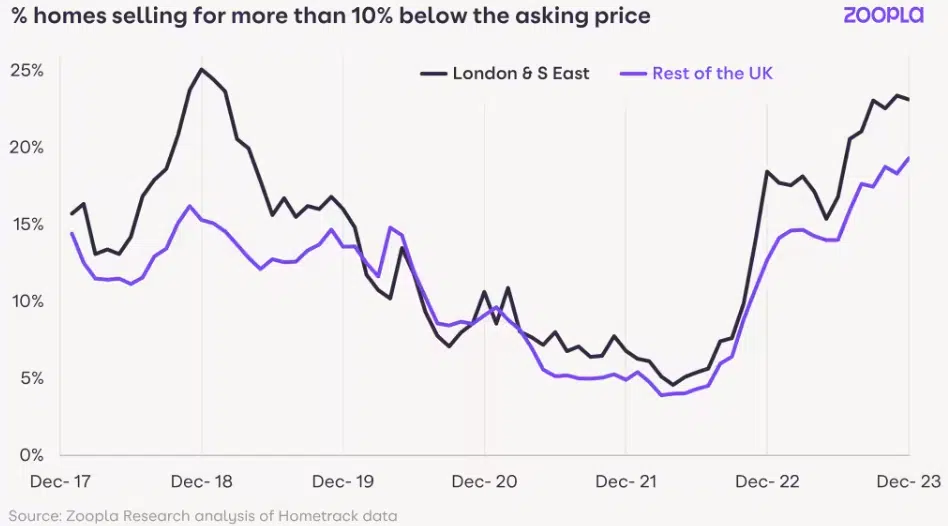

With a fifth of sellers accepting more than 10% below the asking price, seller’s realism gave new year sales levels a 13% year-on-year boost – contributing to higher sales volumes but not higher prices.

In turn, bolstered by the promise of base cuts, demand and supply increased with many buyers turning back to city living.

Nationwide HPI January 2024

Nationwide’s HPI for January 2024 focused on UK house prices which rose 0.7% month-on-month in January to £257,656, when not seasonally adjusted, but still down -0.2% annually.

The marginal overall increase is attributed to mortgage rates adjusting down, enabling those with bigger deposits to make a move.

The need for a larger deposit, or even any deposit, resulted in nearly half of first-time buyers getting some help to raise a deposit, either in the form of a gift or loan from family or friends, or through inheritance in 2022/23– up from 27% in the mid-1990s.

Money and Credit December 2023

Over at the Bank of England, their December 2023 analysis showed the ‘effective’ interest rate on newly drawn mortgages fell in December for the first time since November 2021 by 6 basis points, to 5.28%. This helped buyer confidence increase, lifting net mortgage approvals for house purchases marginally from 49,300 in November to 50,500 in December 2023.

UK Monthly Residential Transactions

Despite an uplift in agreed mortgages, UK monthly residential transactions for December 2023 fell for the fourth consecutive month.

The provisional non-seasonally adjusted estimate of the number of UK residential transactions in December 2023 was 85,820, 20% down on December 2022 figures and 2% down on November 2023.

Seasonally adjusted they were at 80,420, 18% down on December 2022 & 1% down on November 2023

JLL Q4 PCL Report 2023

According to JLL’s PCL 2023 Q4 report , the top of the market showed more resilience against reducing prices in Q4 2023. The £5m-£10m & £10m+ sectors experienced the smallest quarterly price falls, of 0.9% & 0.4% respectively, with the combo of cash, dogged determination & lack of choice conserving prices.

The same wasn’t however true for the rest of PCL – the average discount in Q4 being 9.9% with the £1m-£2m price band offering the largest discounts. With affordability levels stretched – this section of the market couldn’t afford to hold out. The crash pad is no longer the cash pad.

In the 2m-5m bracket there were the highest increase in annual stock levels in PCL, increasing +18.3%, but the smallest of transaction volumes at -25.2%, suggesting a need to move but an ability to cling on a while longer to achieve a better price.

Keeping Prime Central London afloat

To complement JLL’s report, Bloomberg and Hamptons unveiled the type of buyers in PCL 2023. 45% of which were international buyers.

Middle Eastern & American buyers, who’d revelled in the pound’s downfall in 2022, took a step back from the PCL market in 2023, leaving buyers from Asia & the European Union to step up.

Bank of England vote to hold the base rate at 5.25%

There were no surprises from the Bank of England on Thursday, with the Monetary Policy Committee (MPC) voting 6-3, to hold rates at 5.25%.

The Bank of England, attempted to be optimistic saying: “they expect inflation to fall further by the end of this year to around 2¾%” however not wishing to get carried away they said, “there could be some BUMPS along the way.

Lower oil & gas prices could mean that inflation temporarily drops to 2% , only to rise later in the year”

And that concludes another UK property News Recap. Should you have any comments or suggestions, as ever, please get in touch here.