Topping and tailing this week, Zoopla and Nationwide released their house price indices. Rotten tomatoes voted Nottingham council as ‘rotten’ and Torridge ‘fresh’. Flats outshone houses, nimbys tried to stop the show, making it more costly for others to gain entry, and the lights failed due to the lack of tradesmen available to replace them. Welcome to another UK Property News Recap – 03.05.2024.

Build it and they will come

The only issue is, without a workforce, which according to recruiter Randstad the UK is short 500,000 of, any major infrastructure projects will remain pipe dreams. As pension funds look to raise investment to future-proof the UK power network, the technicality on “how” remains unanswered.

Zoopla House Price Index

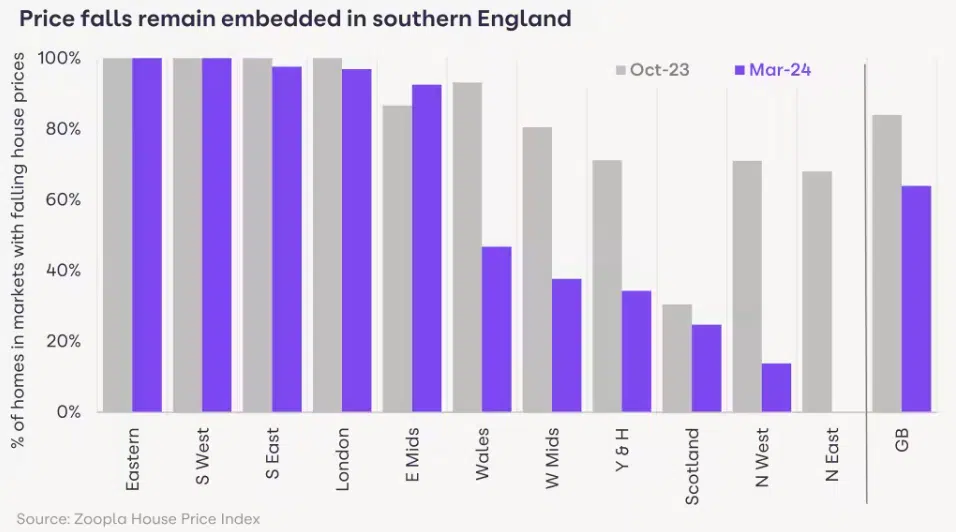

The Zoopla house price index for April 2024 showed market activity picking up the pace as prices stagnated. Annual house price inflation, as a whole, remained flat at -0.2% in March while sellers, bolstered by a brief new year spell of trimmed back rates, held back from reducing. Property price reductions, though still high, were down from 82% in October 2023 to 64% in March 2024. This motivated some financially able buyers to make the most of their move, bolstering agreed sales by 12% on last year.

Despite some northern areas displaying growth, eastern and southern prices remained out of reach for those looking to borrow with 2024 rates so further deductions were being implemented.

Nimbyism wastes time and taxpayers’ money

The share of rejected planning applications that were subsequently overturned increased by 30% last year. According to the last published financial reports for the Planning Inspectorate, local opposition to developments has led to the number of appeals increasing, putting pressure on resources, driving up handling costs to more than £30m. Of those costs, roughly £10m was spent reversing local government decisions, the most on record.

Flats overtake house price growth

Demand from first-time buyers, those keen to get out of the rental market and those who’ve revised their size requirements down to meet their budget, has caused prices to rise on the average flat faster than houses.

According to Halifax, in the year to February the average price of a flat increased by 2.7%, while the average terraced property value rose by 2.6%.

Prices for semi-detached and detached homes increased 1.7% and 2.0% respectively.

Rental growth versus affordability

Landlords are testing tenants’ affordability limits causing the rate of rental growth to slow, but the amount paid to still grow. For larger homes affordability has stunted growth, causing 30% of larger homes to reduce their listing price.

Local authorities are named and shamed the best and worst

The Times newspaper diligently trawled through the Government’s latest data resource, the Office for Local Government council data, (oflog) to reveal the best and worst local authorities. The worst local authority in England went to Nottingham and the best to Torridge.

The current financial predicament England’s councils now find themselves in is dire. Six local authorities are bankrupt, 50 now owe at least 10 times their core budget and 34 are spending more than £1 in every £3 they receive in tax and government grants on interest payments.

Cheap money turned costly.

Buyers move on up – Money and Credit

The Bank of England’s Money and Credit report showed as the effective interest rate decreased by 17 basis points, to 4.73%, 61,300 borrowers were in need of finance to move onto the ladder. This was an 800 increase on February showing where there is a will to get out of rental accommodation, there is a way.

As some embraced homeownership others, as a result of increased interest rates and the cost of living, stepped off the ladder; net approvals for remortgaging decreased from 37,700 to 34,200 over the same period.

Nationwide to stop granting mortgages to high risk flooding homes

On Wednesday, Nationwide announced that it was to stop granting mortgages to those homes at high risk of flooding. As the effects of global warming continue to wreak havoc on our homes, the chances of other lenders following suit is likely especially if the government’s flood insurance scheme isn’t extended before it runs out in 15 years’ time. If not extended, you may not be able to borrow on the property but it certainly will be a lot cheaper.

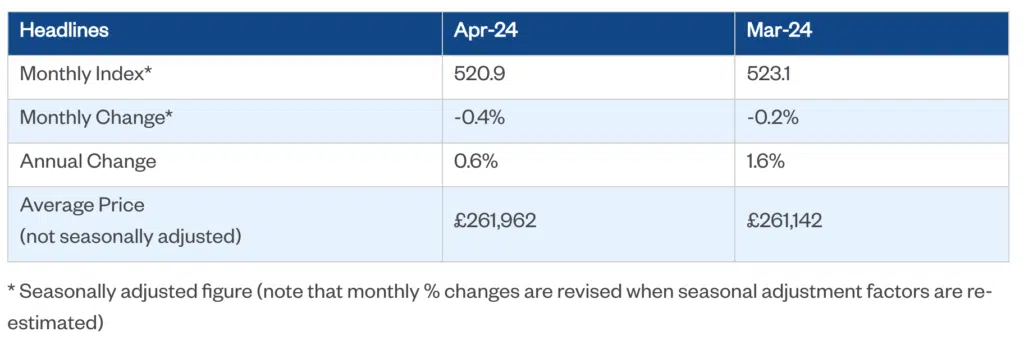

Average house prices and rates step back

Nationwide HPI showed recent rate reversals had started to unsettle newfound buyer confidence, causing UK house prices to fall 0.4% in the month to April 2024. On an annual basis the rate of change showed prices slowed to 0.6%, from 1.6% in March, making the average price of a home (according to Nationwide’s data) £261,962, 4% below 2022 peak levels. This pattern may continue, till the base cut narrative is more encouraging after inflation slows further.

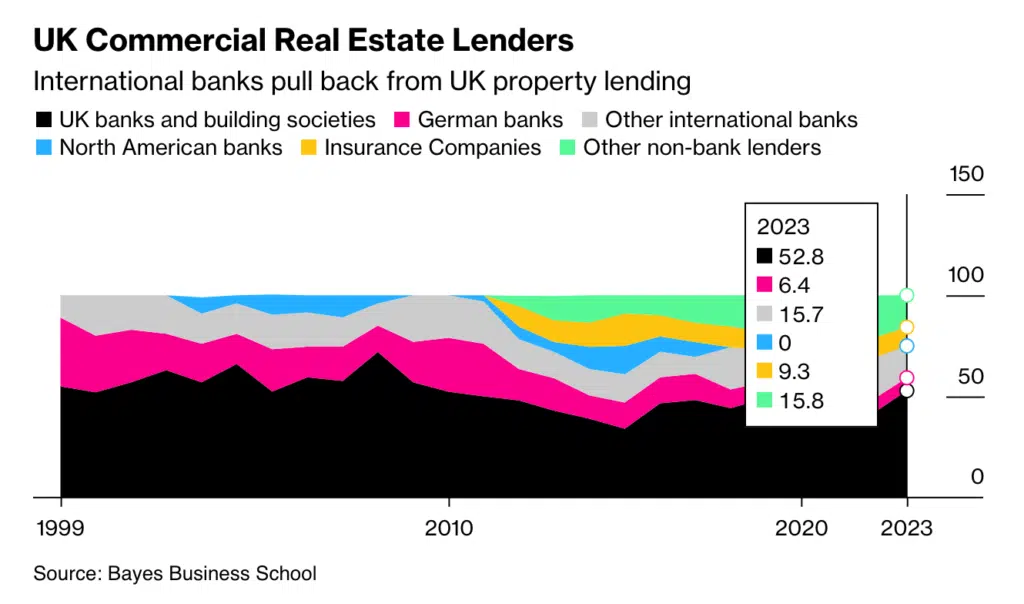

Commercial lending became less commercially viable

Research conducted by Bayes Business School showed that, in 2023, commercial lending rates soared while property prices and rents plummeted, causing international banks to reduce their market share and smaller lenders to hold their breath. As commercial lending fell to 32m, Germany reduced its UK market share to 6%, the lowest it’s been since the survey began in 1999.

@bloomberg

And that concludes another UK Property News Recap – 03.05.2024. Should you have any comments or suggestions, as ever, please get in touch here.