The property portal Zoopla and lender Nationwide top and tailed the week with their house price indices whilst the Bank of England released transactional data revealing a retreating housing market. The Monetary Policy Committee then announcing its decision to hold the base rate at 5.25%, leaving many hopeful that any potential cuts would be brought forward next year.

Welcome to another UK property news recap.

Leasehold reforms

So it would be remiss not to add in this week’s recap, Michal Gove’s proposed leasehold reform teaser ahead of the king’s speech. The promise of reform is well overdue but on the 7th of November we may finally have movement on the following:

- All new houses to be sold as freeholds

- Existing ground rents reduced to peppercorns

- Legislation to change contract lease extensions from 90 years to 990 years

- Two year requirement before negotiating an extension removed

The devils in the detail but this will come as good news to many.

Zoopla

Affordability and market caution reduced property transactions by 23% on last year, whilst prices tumbled at varying degrees, depending on their location and price point. Expensive areas such as London and the South and East of England, are the worst affected due to the absence of cheap money to over extend.

Controversially for some, Zoopla reported price drops, on the whole, remaining just under 5%, with further falls of around 2% expected in 2024. Given the affordability issue it’s interesting that first time buyers are stepping up, joining cash buyers, keen to scoop a discount and get out of rental dodge.

Bank Of England

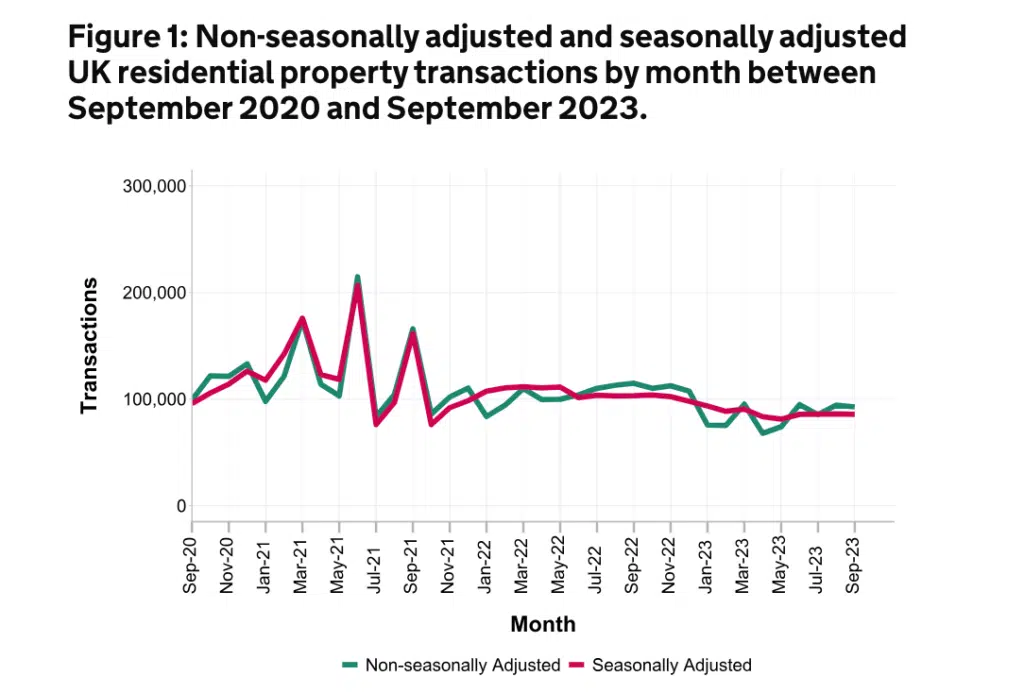

Mid-week the Bank of England provided data on transaction volumes and lending statistics.

From this it’s clear, recent rate trims have proved futile at enticing more buyers out of hibernation. Net approvals for house purchases falling from 45,400 in August to 43,300 in September 2023.

HMRC transaction data which includes transactions not reliant on lending, backed up this narrative, with UK residential transactions falling to 85,610 in September 2023, 17% lower than September 2022 and 1% lower than August 2023. As we continue through winter I’d expect this downward trend to continue as buyers retreat till rates or prices drop or stabilise further. In turn sellers, who don’t need to sell, are withdrawing, till conditions improve.

The Base Rate remains unchanged at 5.25%

The Monetary Policy Committee voted 6-3 to take a breather, leaving rates at 5.25%. This break is likely to be drawn out as they assess the impact 14 hikes has on inflation whilst keeping a watchful eye on rising wages and potential oil increases.

Nationwide HPI

After a sticky summer, buyers autumn resolve to move, resulted in a mild uptake in house prices, edging up 0.9% in October 2023 but leaving prices still down -3.3% on last year. As winter sets in, this reprieve may prove short lived, as many wait for the right climate before “spring”ing back into action.

And that concluded another UK Property news recap.

As ever, any suggestions, comments, please get in touch here.