This week was all about moving on, be it prices, sales or estate agencies. Rightmove spurned the Rea Group’s moves, expectant of other more endowed suitors to now follow and Andrew Bailey teased that 25 basis point cuts in November could be on the cards if inflation plays ball. Welcome to another UK Property News Recap – 04.11.2024.

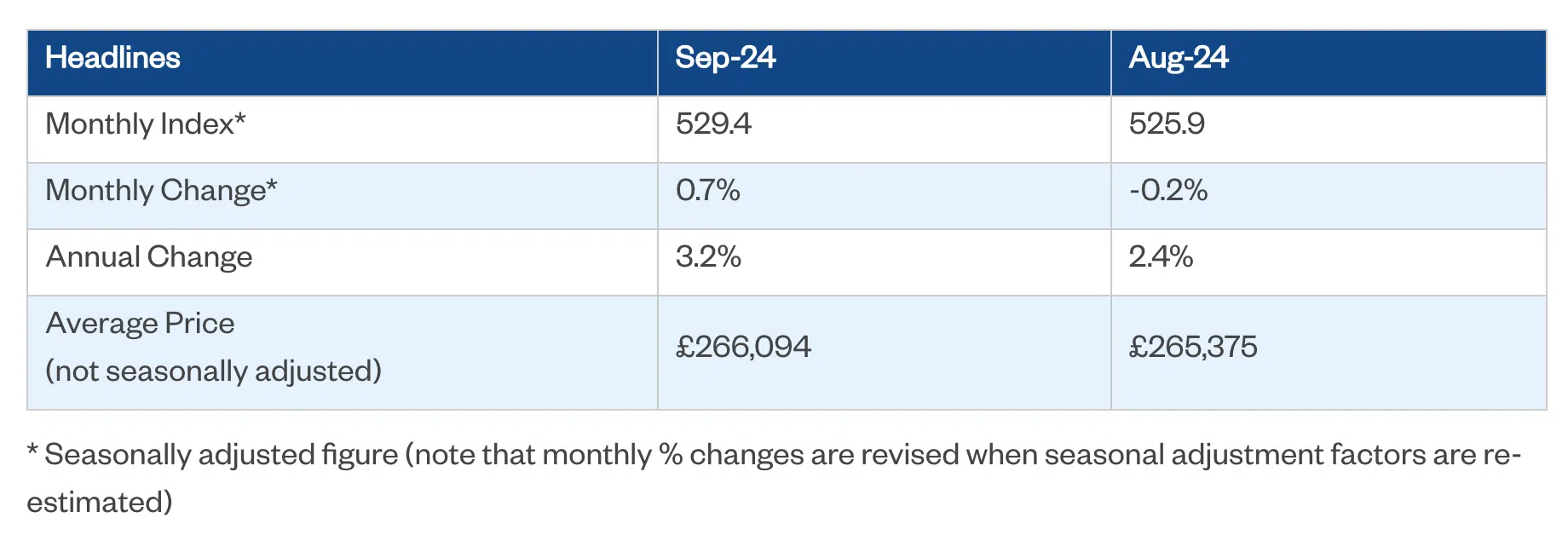

Nationwide HPI – September 2024

Back from their summer holidays, buyers kicked off the autumn term with purpose causing significant price growth on last year’s efforts. Results published via lender Nationwide showed UK house prices rose 3.2% annually, up from 2.4% in August, making the average home now worth £266,094, only 2% below the summer peak in 2022.

The increase in growth was led by Northern Ireland, up 8.6% followed by Scotland, up 4.3%, Wales, up 2.5% and England, up 1.9% in Q3 2024; only East Anglia continued to lag behind.

The Rea Group pass on Rightmove

The Rea Group’s fourth offer of £6.2bn for the property portal Rightmove apparently remained “unattractive and continued to materially undervalue Rightmove and its future prospects.” Defeated, from the lack of engagement, the Rea Group moved on, leaving Rightmove’s share price to fall back by 7% but still 12% above its pre-offer level at the end of August. Expectations are for other suitors to follow, off the back of the Rea Group’s interest.

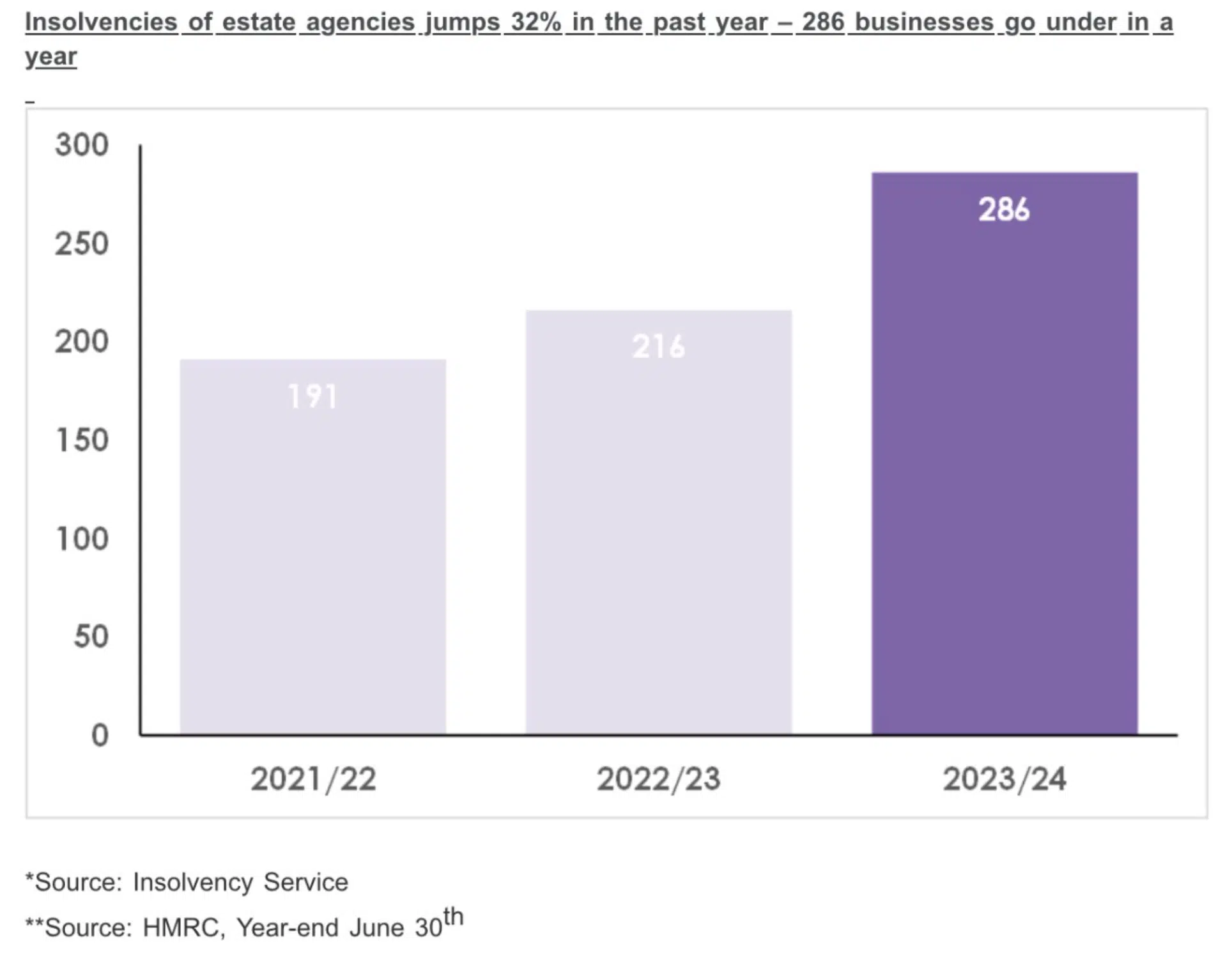

Balancing the agency books

Buyers faced with high interest rates retreated from the sales market in 2023, leaving some estate agents without a strong lettings book vulnerable to insolvency.

The number of UK estate agency businesses going insolvent increased 23% in the year to July 31, from 216 in 2022/23 to 286 in 2023/24, according to Forvis Mazars, a tax advisory consultancy.

Money and Credit Report – August 2024

Despite the ‘effective’ interest rate on newly drawn mortgages increasing to 4.84% in August, up from 4.81% in July, net mortgage approvals for house purchases increased by 2,400 to 64,900 in August, the highest level since August 2022 (72,000.)

Likewise remortgaging approvals rose from 25,200 in July to 27,200 in August.

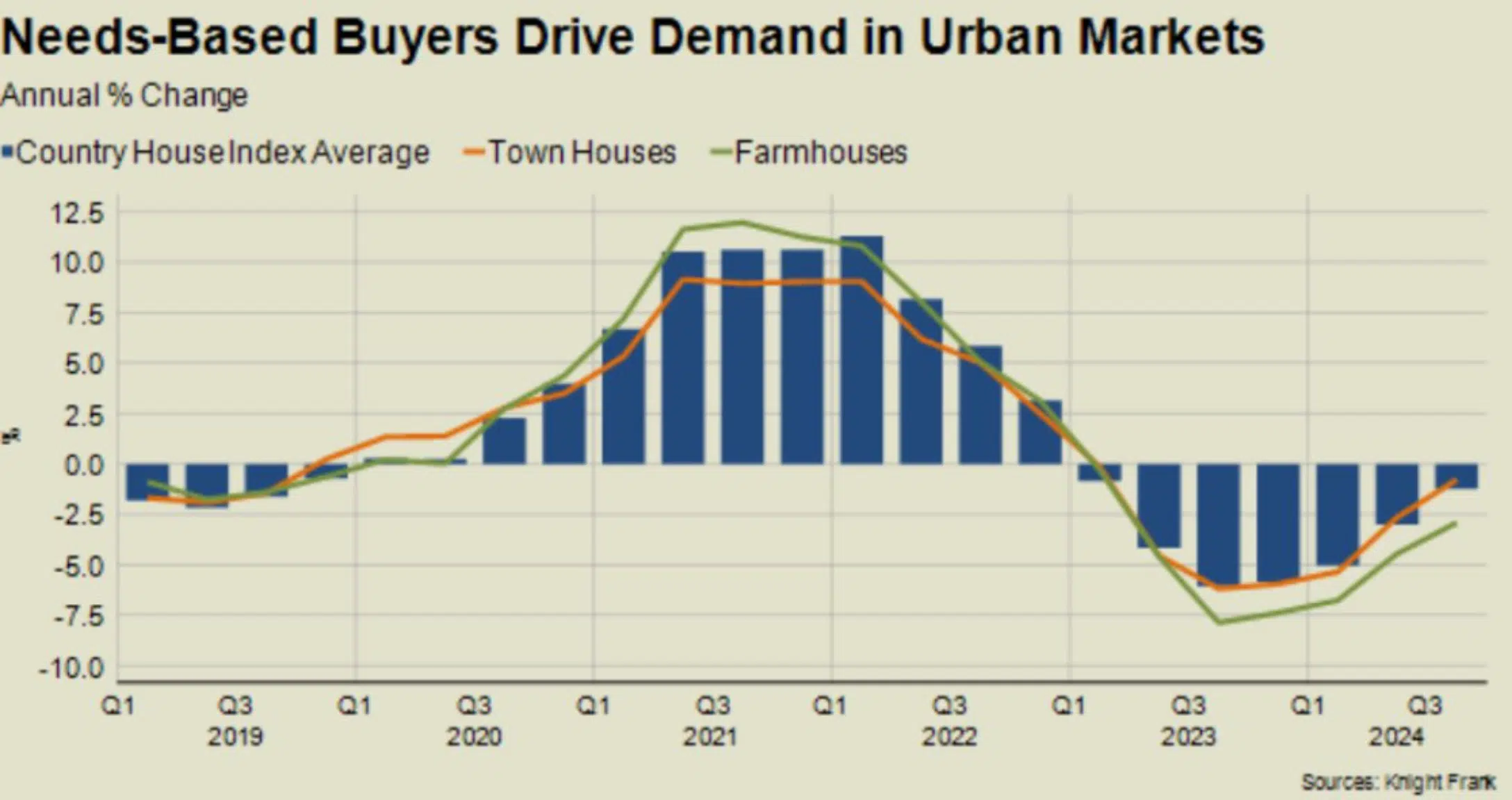

Needs-based movement

Knight Frank found that “the number of exchanges in the country above £2 million in the three months to August was 20% down on the same period last year. Meanwhile, the drop was only 9% below the £2 million threshold.”

Taut finances have meant that until the budget, some affluent buyers aren’t confident about the scale or the price of their next move.

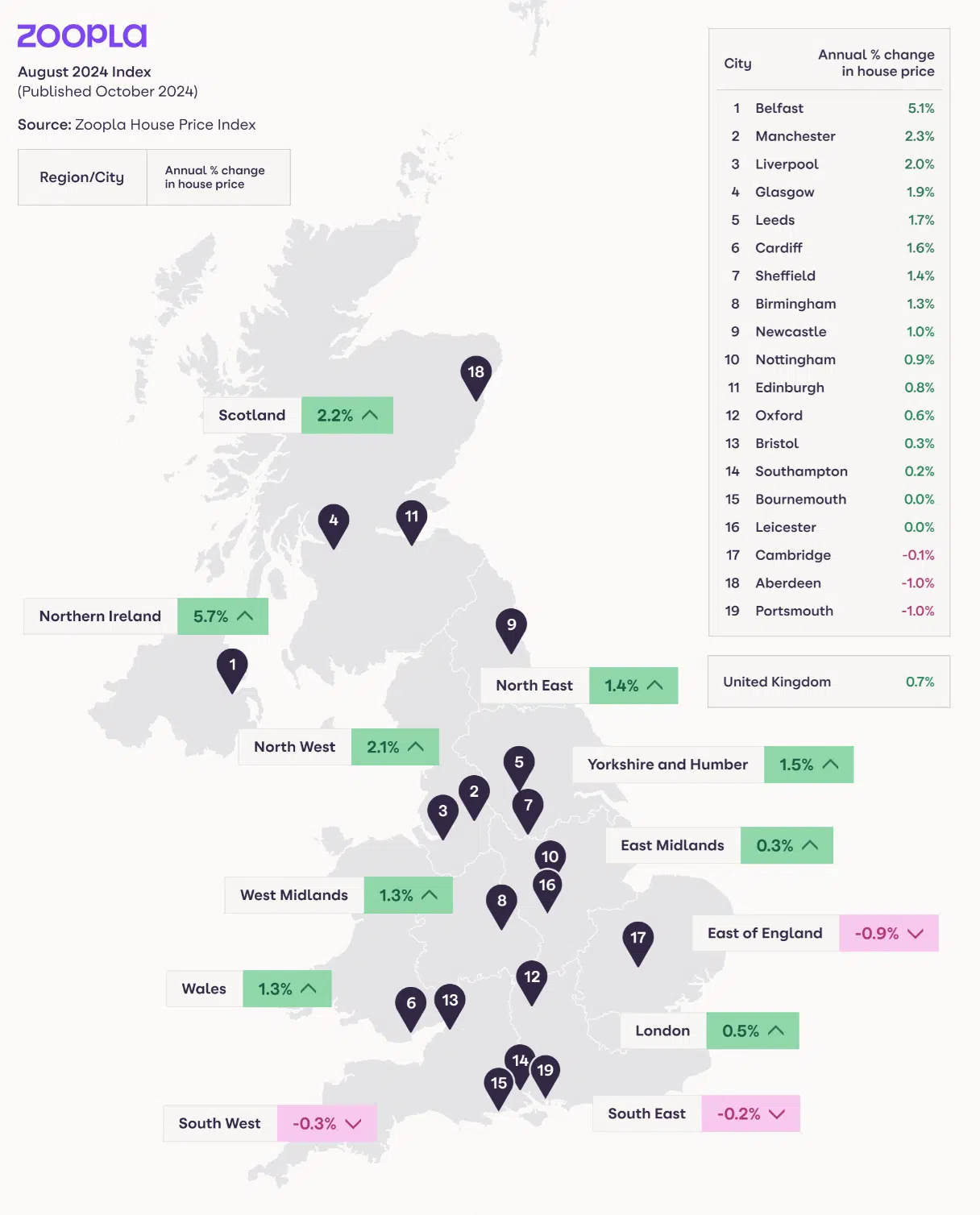

Zoopla HPI – September 2024

Rate trims spurred market activity, pushing prices back up in the North and West of England but the South of England remained bogged down by affordability issues and mushrooming stock (32%) from second homeowners and investors looking to hang up their bucket and spade now the profits don’t stack.

According to Zoopla, sales increased 25% on last year in September but the journey to completion could be long for those sellers taking news of a 0.7% increase on prices last year as a reason to aim high. Around a fifth of homes remained on the portals after 6 months while another fifth had to reduce their price by 5% to entice buyers to market. As a result around a third of sales are being agreed 5% below asking price.

Andrew Bailey suggests cuts are on the way

The governor of the Bank of England, Andrew Bailey, suggested to the Guardian that cuts could become more aggressive if inflation news remained positive. This sent markets back to the bookies, causing the pound to fall.

The property market remains divided by speculation. Investors fear CGT increases in the budget so are getting shot while those looking to remortgage are holding off, betting on a 25 basis point cut in November. Buyers though are divided, some needing another cut or two as others look to buy before prices rise.

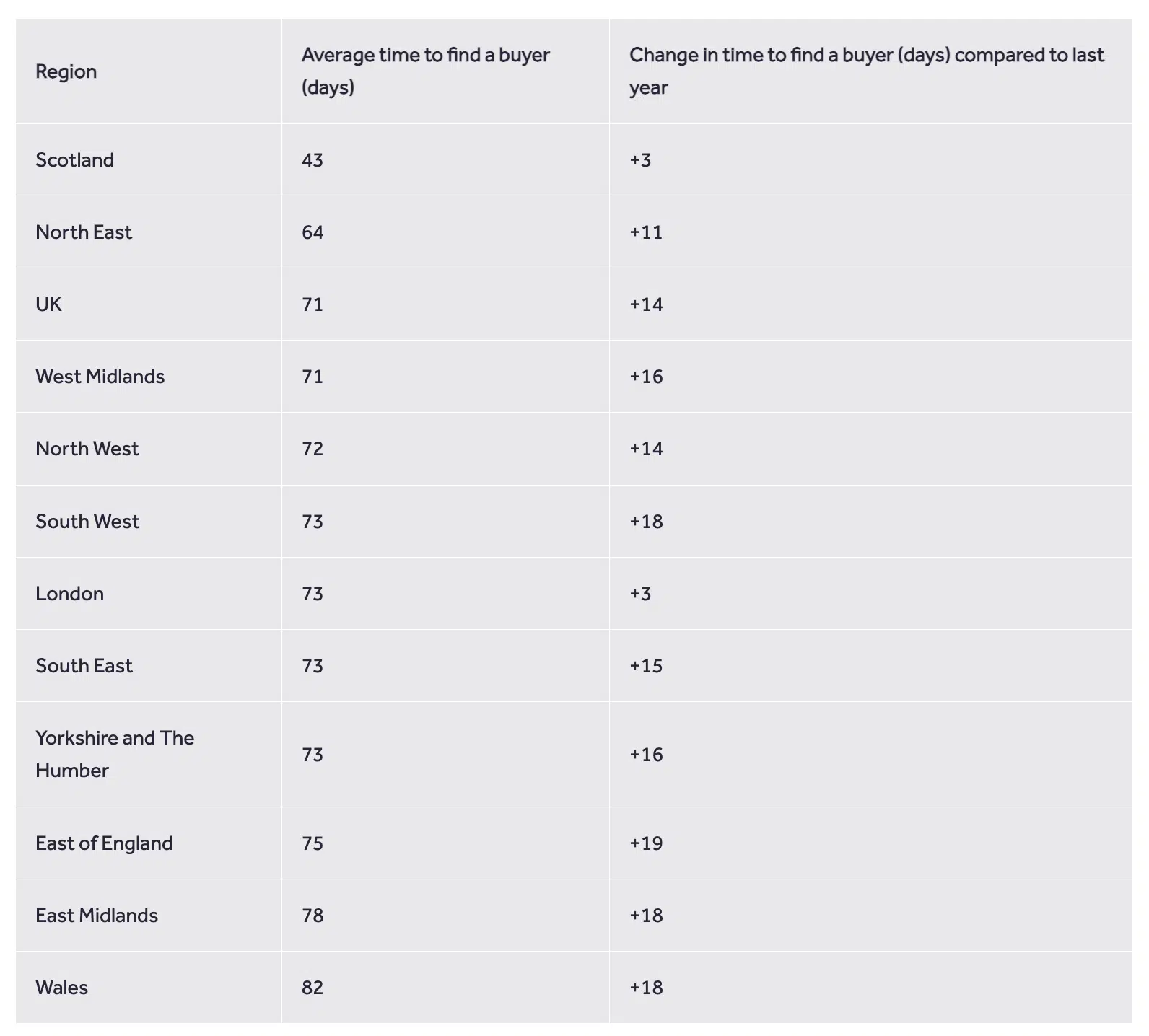

Rightmove: Britain’s fastest and slowest markets revealed

According to Rightmove data, Carluke in Lanarkshire is Britain’s quickest-selling market, with the average home finding a buyer in just 15 days.

Overall, Scotland remained the fastest market taking only 33 days versus 60 days across Great Britain. Commuter belt towns generally sold faster than city centres. In London this was demonstrated by Walthamstow taking on average 32 days to secure a buyer versus 135 in Knightsbridge.

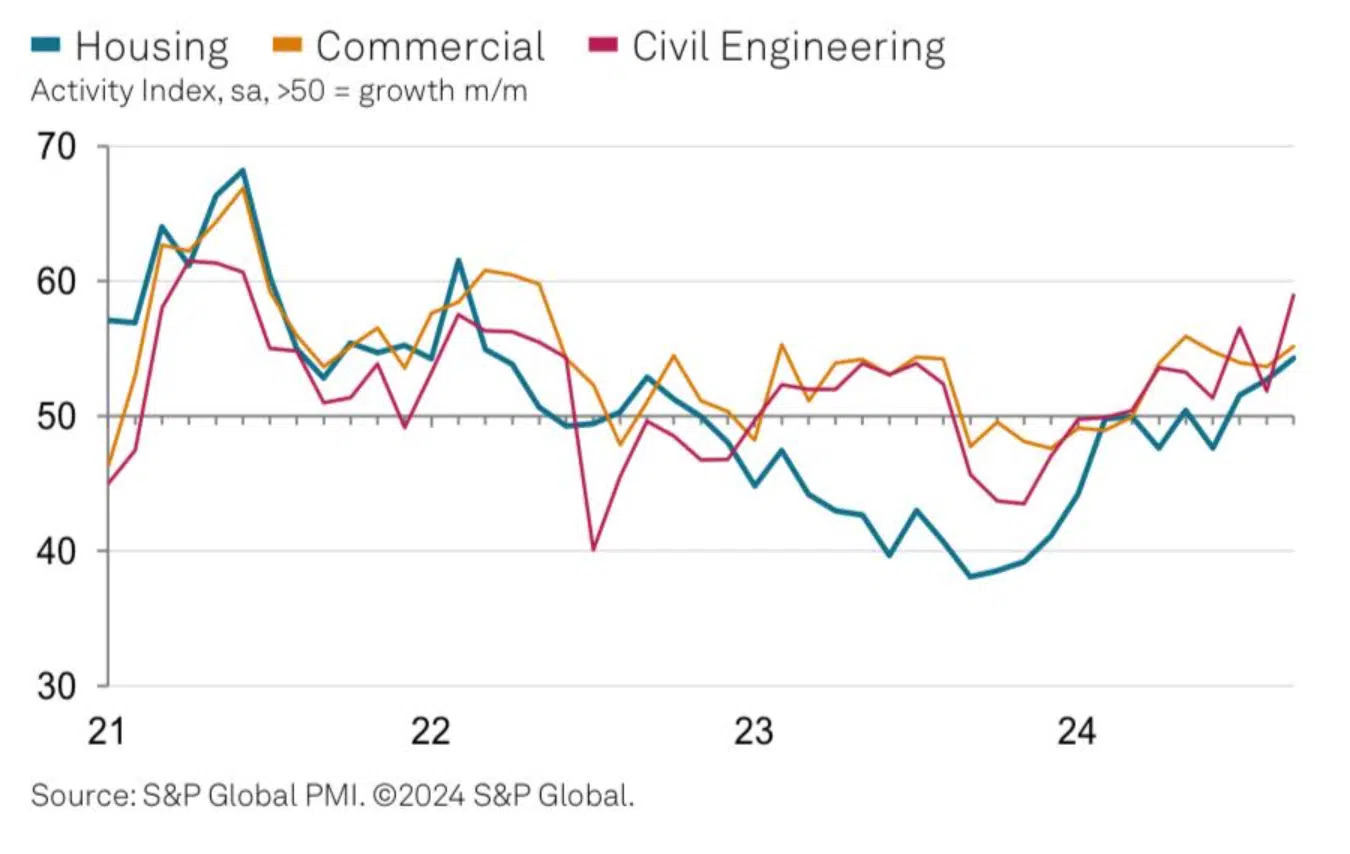

S&P Global Construction Index

Political certainty + reducing interest rates accelerated construction growth at the start of the autumn term. Civil engineering excelled with increased demand for renewable energy infrastructure and an uplift in work on major projects. Meanwhile commercial and house building also picked up as new orders came in

Barratt and Redrow Cleared by CMA

Barratt’s £2.5 billion Redrow acquisition is cleared by UK Watchdog CMA making them the largest UK house builder.

And that concludes another UK Property News Recap – 04.10.2024. If you have any comments or suggestions, please get in touch here