A fitful Boxing Day scrolling saw first-time buyers rewarded with replenished portal shelves and others left wanting as some sellers opted to hold off marketing until the general mood and weather improved. This came off the back of a dismal December in which the indices reported house price growth slowed, along with transactions and construction activity. Welcome to another UK Property News Recap – 09.01.2026.

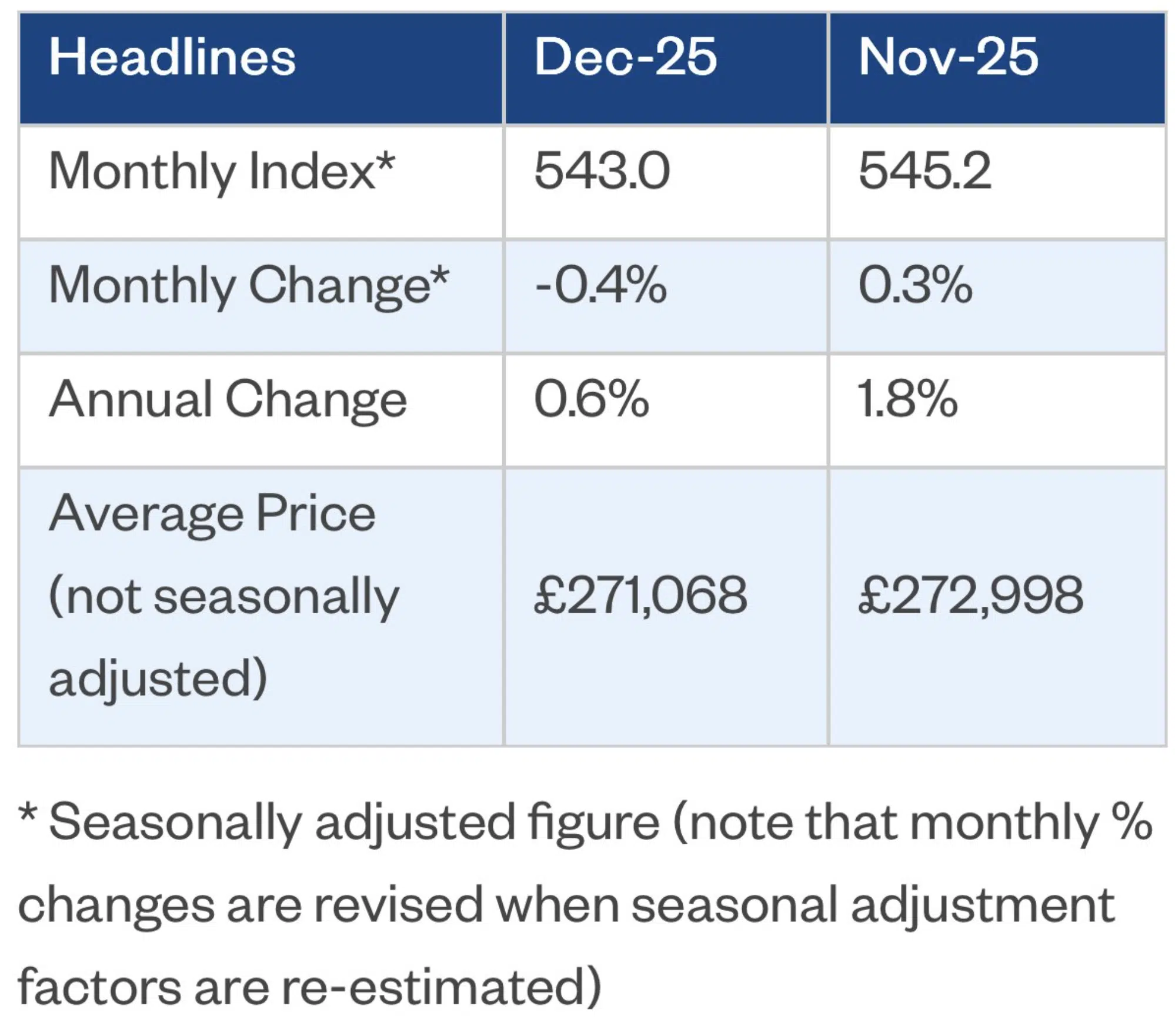

House price growth slows in December

According to Nationwide house prices softened in December as those still buying looked for a seasonal discount. Despite this, annually AVERAGE house prices shuffled forward aided by increased wages and falling rates. Northern Ireland continued to see prices soar in 2025, prices rising 9.7% however they still have some ground to cover to reach the heady heights recorded in 2007. Scotland and Wales saw prices rise 1.9% and 3.2% respectively while England only grew 1.2%. East Anglia was the worst performing region followed by the south east. Moving forward the lender estimates overall house price growth of 2 to 4% over the course of 2026. Interest rate reductions will help more affordable areas of the market and enable others to move on but growth will not be uniform.

Back to work signalled the start of the rate war

HSBC was first out the New Year gates hoping to win some new business with reduced rates but others weren’t to be held back rushing to slash their product offerings making buying a little more affordable than it was a month ago.

Dexters looks set for the market

Oakley Capital, which acquired a majority stake in Dexters in 2021, is considering flipping the Estate Agency for around £500m. Barclays is rumoured to be lining up the sale and if successful in achieving asking or above, Dexters would be worth more than rival Foxtons.

Landlords feel the strain

The biggest mistake homeowners and landlords make is to not budget for upkeep. Every property needs it and if you buy without the funds to service it, you will get caught out. Pegasus research shows that maintenance and repairs remain the largest cost for landlords, accounting for 31% to 39% of expenditure depending on property type. This they worked out meant the average total annual expenditure is £19,604 for landlords with non-HMO properties, or £35,720 for those operating HMOs.

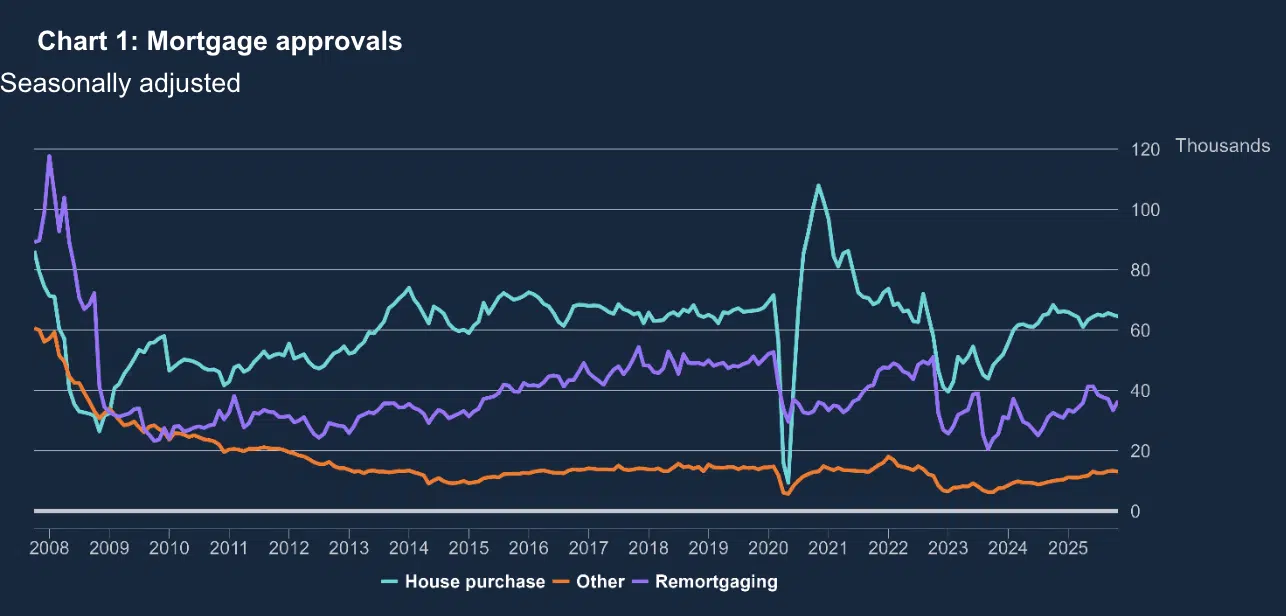

November sees mortgage approvals fall

The ‘effective’ interest rate on newly drawn mortgages increased for the first time since February 2025 to 4.20% in November 2025, up from 4.17% in October. As a result of this and budget caution, net mortgage approvals for house purchases fell by 500 to 64,500 in November. By contrast, approvals for remortgaging with a different lender rose by 3,200 to 36,600 in November when seasonally adjusted. However when not adjusted both mortgage approvals and remortgaging figures fell by 10,299 and 1,700 respectively.

Connells Group signs up to Zoopla

The Connells Group’s 1,263 branches which span across 86 estate agency brands including Barnard Marcus, Hamptons, John D. Wood & Co, Bairstow Eves, Bridgfords and William H Brown signed a 5 year contract with Zoopla to support growth. In return they will gain access to further data insights and premium listings that they hope will garner more business and release them from the clutches of Rightmove.

The Boxing Day Bounce

This year Rightmove reported Boxing Day scrolling on its site increased 93% post Christmas Day with first time buyers getting an eye full with a 143% increase in new listings in the five days after Christmas. The stock though plentiful wasn’t what all buyers had hoped for as many a family home was held back; some sellers waiting till their kids are back and others for another rate cut and spring. In the meantime, the south east saw the most activity, many looking to scoop up a bargain with reduced rates.

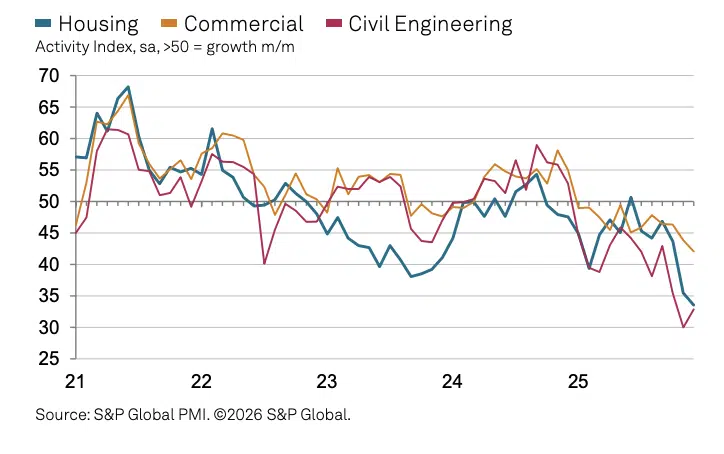

Construction activity downturn slows

According to S&P Global’s UK Construction Index, due to pre-budget stalling; UK construction companies experienced another sharp downturn in business activity and incoming new work at the end of 2025. That said the downturn slowed in November and there were signs or renewed business optimism, especially in the infrastructure sector, that construction activity would pick up in 2026, aided by rate falls and budget clarity.

Lower rates to support moderate house price growth

Analysis from Moneyfacts showed how reduced rates could support moderate house price growth but anything more would be unobtainable given rates are now considerably higher than they have been for a decade. As a result, expect Northern, more affordable regions to build on 2025 growth further and southern regions to stabilise.

‘Allo ‘allo…. Building Safety Regulator refers an impersonator to the police

Someone decided to speed up development by pretending to be a Building Safety Regulator generating a report using AI. As if confidence in development wasn’t low enough as is…

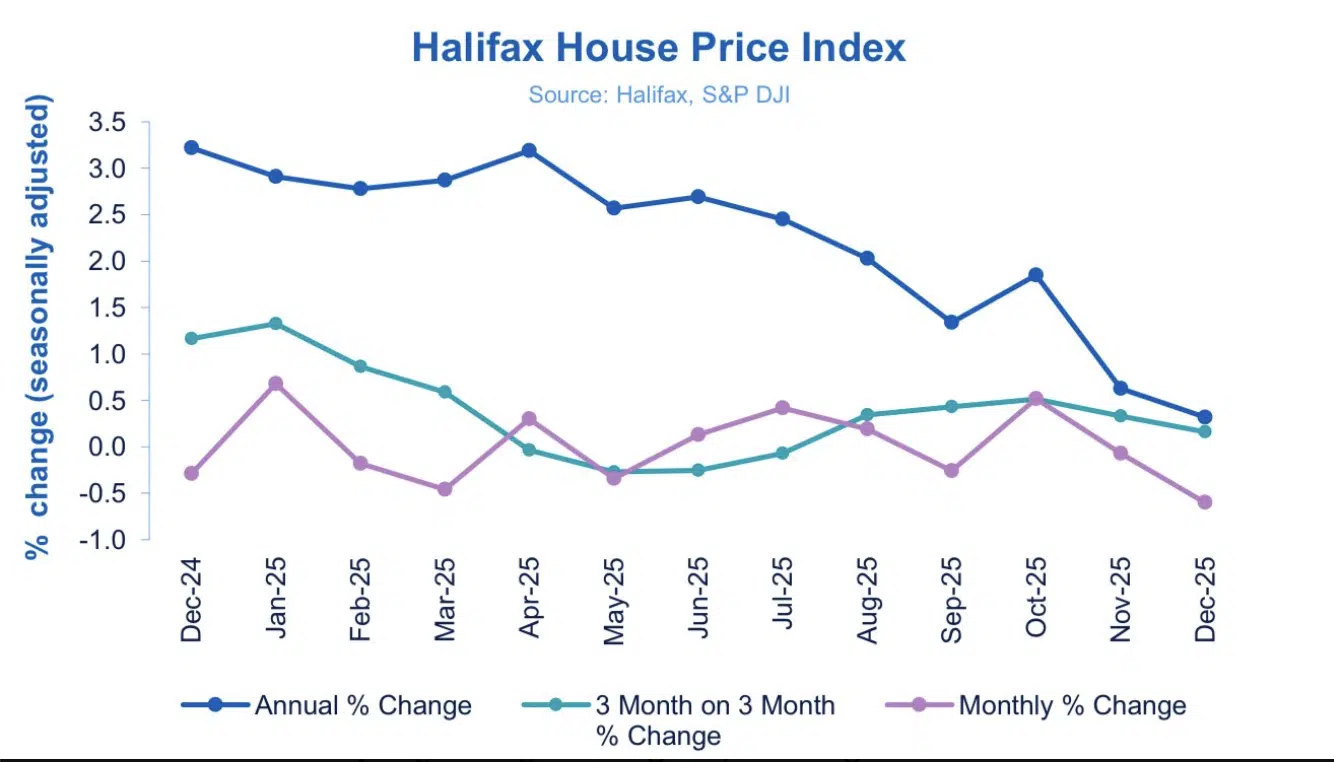

House prices chill in December with Halifax

According to Halifax HPI: UK house prices fell again in December down 0.6% leaving the average property price, on this index, at £297,755. Those selling over Christmas got to move on, accepting realistic offers from motivated buyers.

Overall, annual growth fell 0.3% in December but Northern Ireland continued to outperform other regions with 7.5% growth. London however saw prices fall 1.3% over the year as budget concerns and affordability issues remained constrained.

Calls for Lead to be tested in Water flood in

Soldering is being used by some plumbers in new builds and period properties corrupting our water supply. Lead has been linked to behavioural problems, delayed growth and hearing loss, especially acute in children, so the revelation that when one water company tested 817 schools for lead and found 794 tested positive, is alarming. It should be tested but I imagine this has been swept under the rug as it would reveal a nationwide problem.

Student Bed sales fall, causing Unite to mark down fund Valuations

If you can’t get the international students, you can’t get the beds filled at premium prices. Unite, which provides student accommodation, disclosed a 0.7% dip in the value of its USAF fund while its LSAV venture with Singapore’s GIC Pte was marked down 1.4% in the fourth quarter… The writedowns come as the company reported it had sold 64% of beds for the next academic year, down from 67% a year earlier.

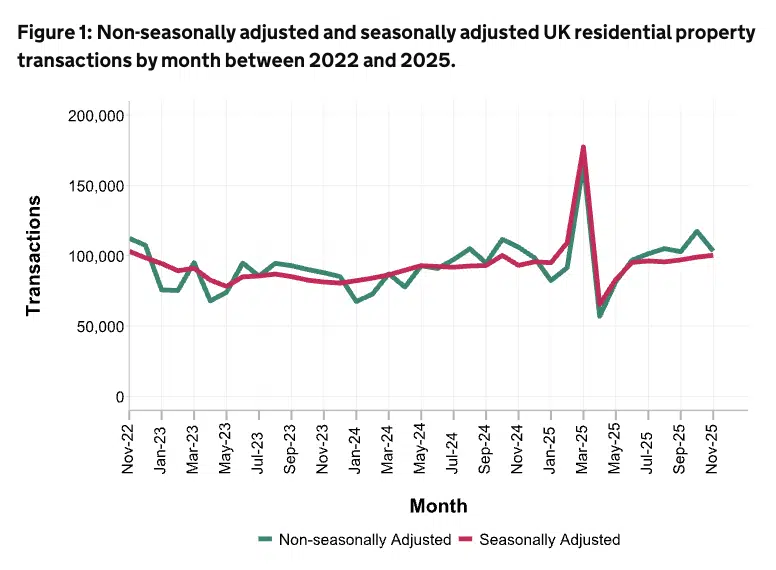

UK Property Transactions in November

UK residential transactions estimates diverge depending on your preference to season or not. In November 2025 there were 100,350, 8% higher than November 2024 and 1% higher than October 2025 when seasonally adjusted, That said when non-seasonally adjusted the number of UK residential transactions in November 2025 was estimated to be 103,330, 3% lower than November 2024 and 12% lower than October 2025.

That concludes this week’s UK Property News Recap – 09.01.2026. Any questions or comments please don’t hesitate to get in touch.