This week the Conservatives jumped on the property bandwagon hoping to build on their voting numbers after they were demolished in the last election. To do this they are hoping to engage younger voters with NI rebates to help with first time deposits, and scrap stamp duty to get the rest of the market moving. Given their current chances of reelection are slim this sounds good but means next to nothing. Meanwhile, house prices continued to feel the heat of the budget glare while rates remain unmoved. Welcome to another UK Property News Recap – 10.10.2025.

Planning for small sites report shows SME builders feel the squeeze

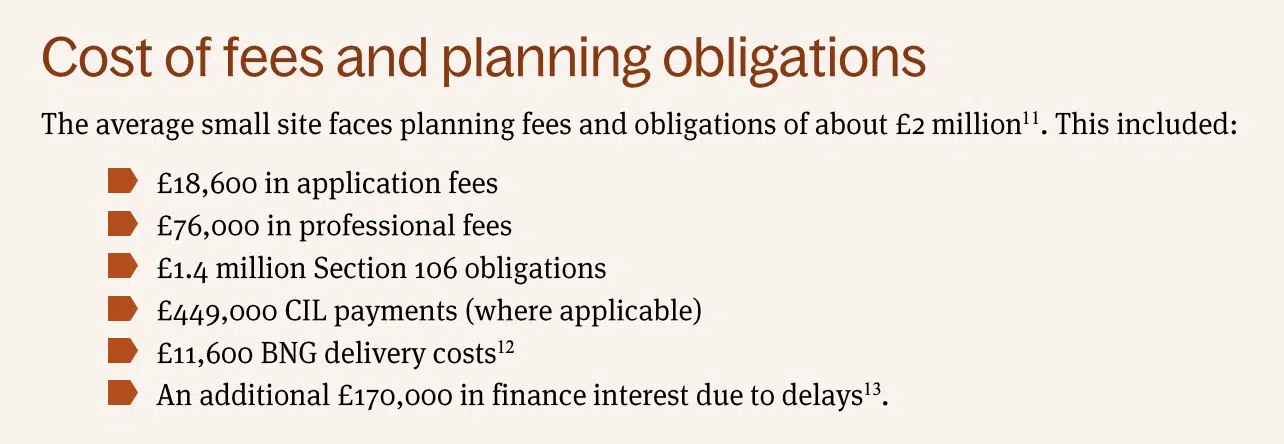

Build it and they will come, but not if they can’t even get started. Smaller developers faced with escalating costs and drawn out planning are haemorrhaging money for little gain. In the absence of market certainty, planning efficiency and confident buyers, many an SME builder will go to the wall further denting the government’s target of 1.5m homes. “In 2024, just 17,000 homes were approved on small sites of 3 to 9 units, down from an average of 35,000, with the proportion of total planning permissions granted on sites of 150 units or fewer, plummeting from nearly 20% in 2008 to 6-8% today.”

UK house prices remain at the mercy of Reeves and interest rate movement

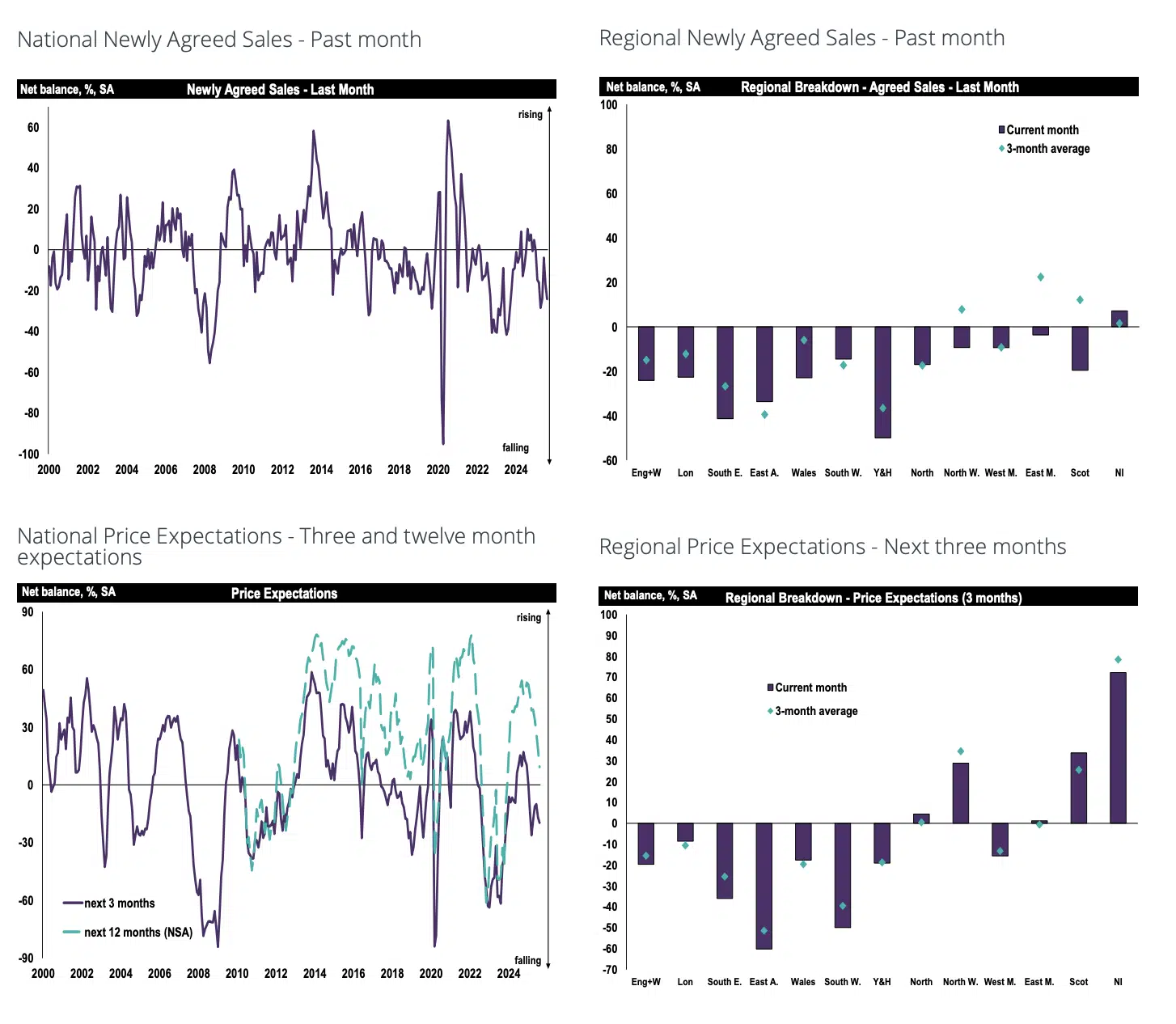

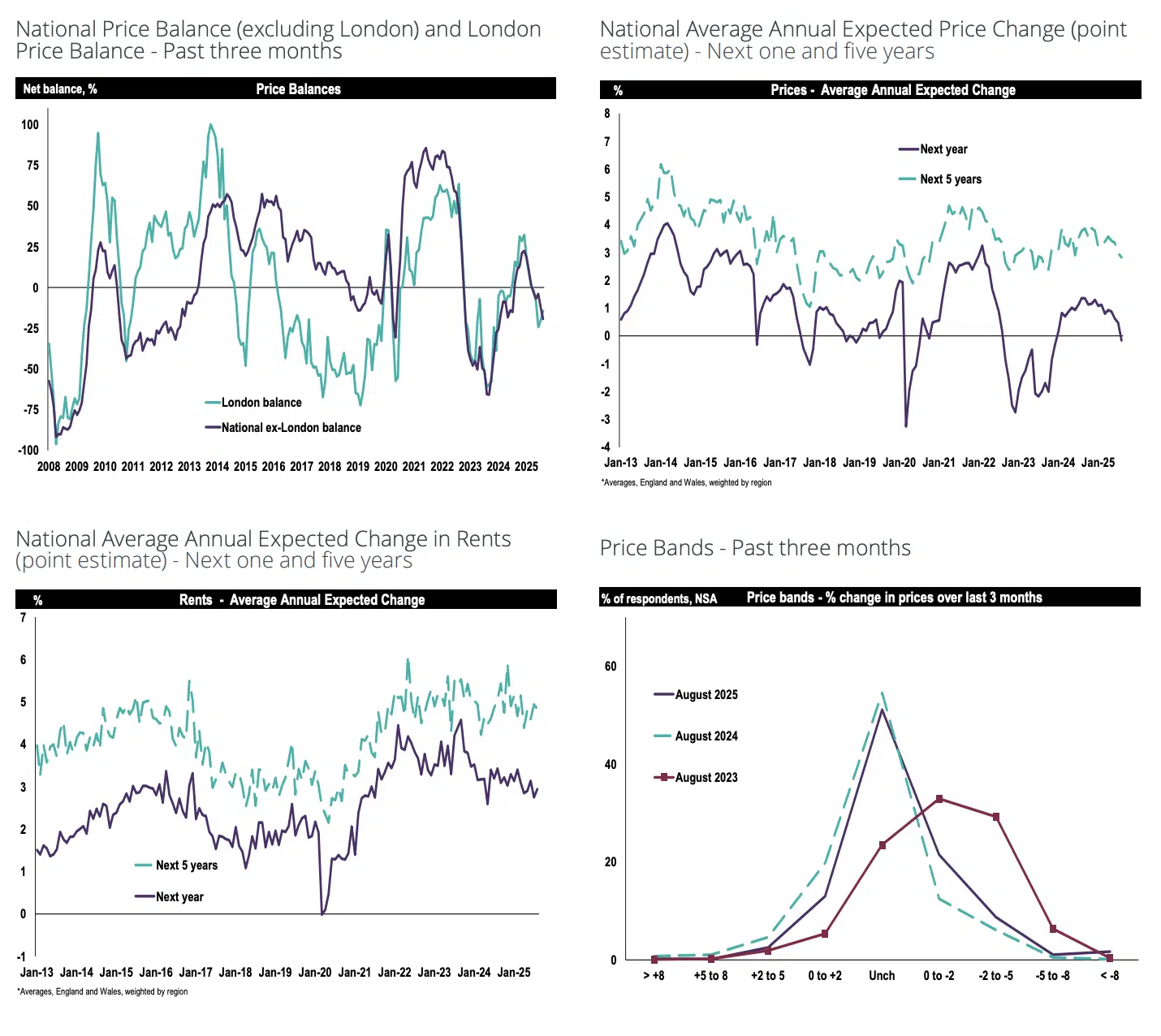

In RICS’s Residential Market Survey for September 2025, the outlook turned autumnal as buyers and sellers bed down till budget day. As a result, with the exception of Northern Ireland, UK house prices nationally marginally dipped with East Anglia and the South West seeing the most significant falls. This has resulted in a flat market, stagnated by indecision and fear of what is coming. Sellers who can afford to wait are drawing up the drawbridge in hope of a better market in 2026. Rics surveyors however only now foresee a slight increase over a 12 month period, meaning a decent offer today will likely be the same come new year. Hopes remained pinned on interest rates reducing further to galvanise the market, which will certainly help but may not save those heading to the top of the ladder should additional property taxes be levied.

In the rental market, new instructions were noted to be at their lowest level since April 2020 while demand continued at a similar level to the previous month. This has led those surveyed to believe that rental prices have the ability to rise, nationally, by another 3% over the next 12 months which will certainly motivate some first time buyers to make a move.

Elders get the better of youth

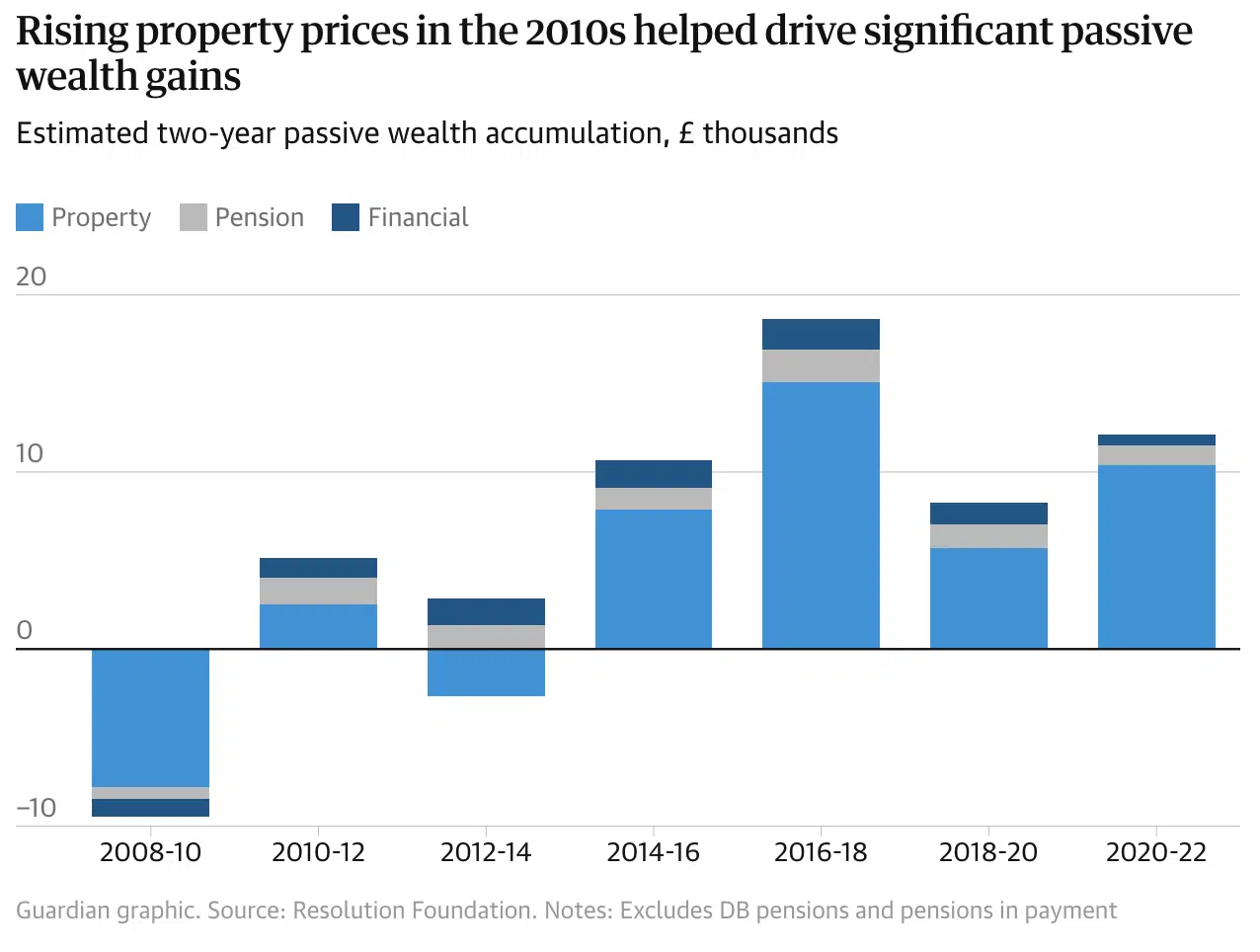

The Resolution Foundation analysed the Office for National Statistics’ latest wealth and assets survey and found “it would have taken 38 years’ worth of median full-time earnings to lift a worker into the top 10th of the wealth distribution. By 2020-22 that gap had widened, so that it would take 52 years of earnings.” The elder generation benefited from cheap rates, and the occasional stamp duty holiday to boost their wealth via property. Now the tide has changed; relinquishing any gains comes at a price that is hard for some to swallow despite their initial advantage.

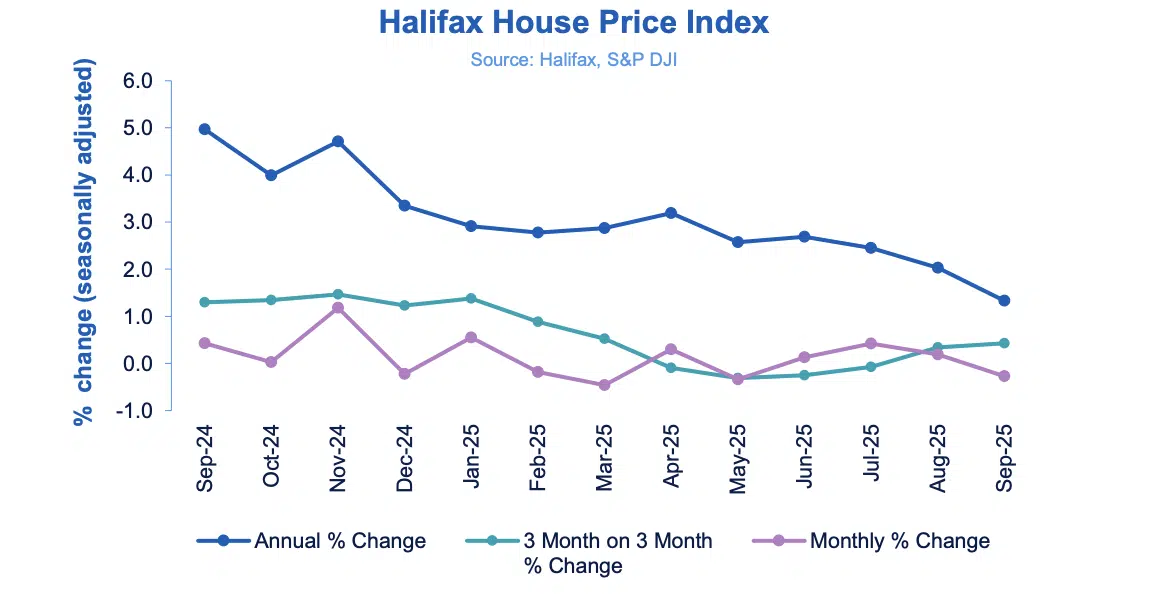

UK house prices slipped back

In Halifax’s HPI: house prices continued to yo-yo, dipping in September by 0.3% after a rise in August to £298,184. According to the lender the market remains largely stable with growth expected when rates further reduce should Reeves not scupper activity in November. As usual growth remains restricted to more affordable, connected northern regions while more established southern areas struggle to achieve what they aspire to.

First time buyer incentives to drum up conservative votes

In an attempt to garner younger votes, the Conservatives entered the first-time buyer arena suggesting a £5,000 NI rebate towards buyers’ first home once in full time employment. This would automatically be paid into a savings account of their choosing and can be used at any time to purchase a property, or withdrawn after a minimum of five years. This would be funded by trimming back welfare funding for conditions considered of lesser importance to those uneffected.

Shifting Conveyancing speeds

A consultation has been launched into how to speed up the buying process by having all the information pertaining to a property upfront, rather than being unearthed during the conveyancing process. This obviously makes sense but with some buyers struggling to sell, searches could become redundant within months. That said, if buyers had surveys, management packs and leasehold information upfront this would make a massive difference to purchasing choices and times. It would also provide clarity to not only buyers but sellers over what might need to be done to a property or compensated for.

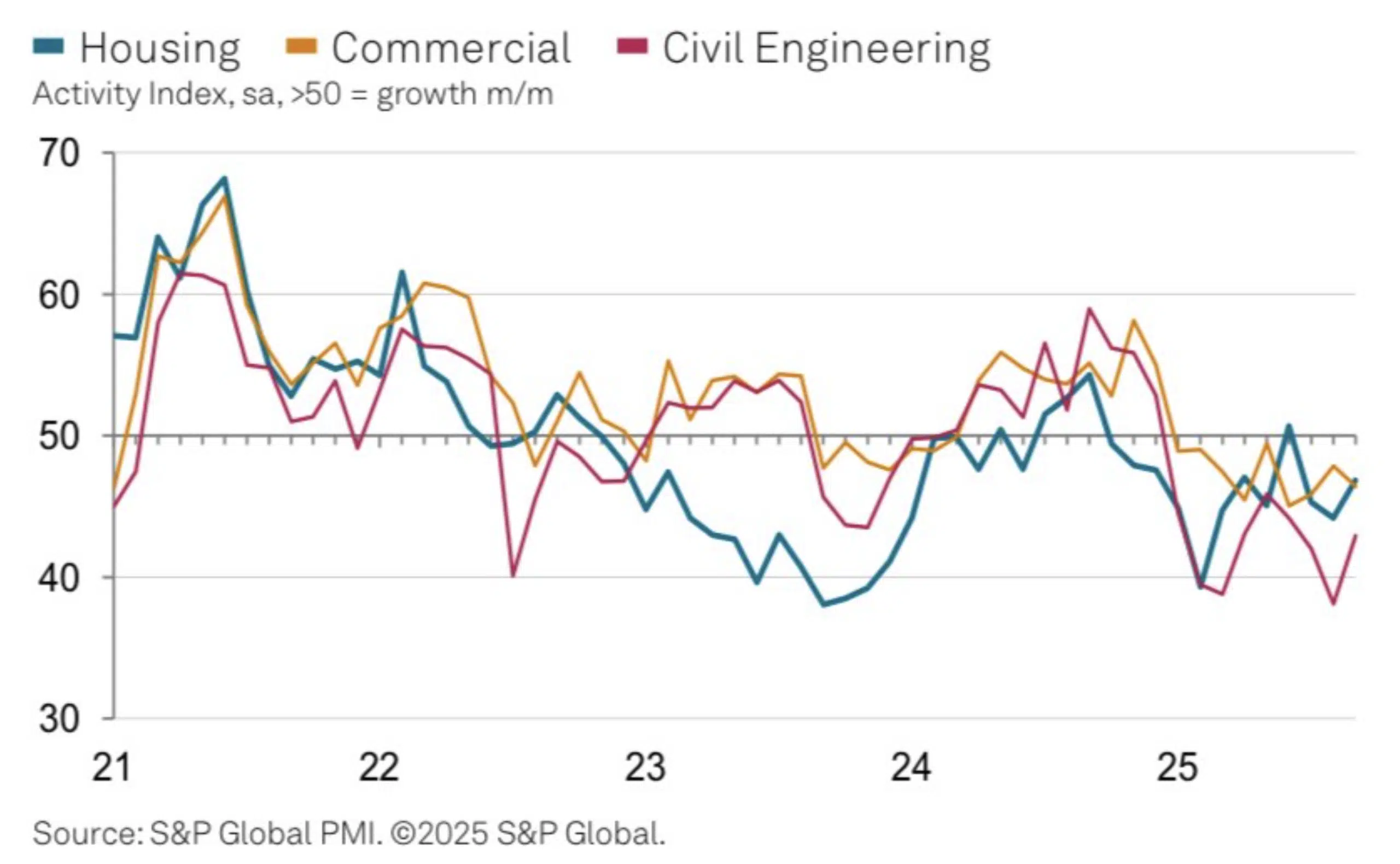

UK construction remains limited by economic uncertainty

S&P Global Ratings’ construction index showed overall activity was considered to have marginally improved in September. However the industry continues to struggle to get “started” while uncertainty remains around the budget and interest rates stubbornly hold firm. As a result, falls in residential and civil engineering were less pronounced but commercial development nose dived. This has led to employment figures continuing to fall for the ninth consecutive month, as developers wait for fairer market conditions.

Badenock promises to scrap stamp duty on primary residences

To conclude a rather lacklustre Conservative party conference, the leader of the opposition decided to save the best for last, by claiming the party would scrap stamp duty on primary residences should they be elected back into power. This move was estimated to cost the government around £9-11bn which would be recuperated by cutting back on welfare, foreign aid and the civil service. For many this is a long time coming and would be a brilliant way to kick start the market back into life. So long as hidden in the small print additional property taxes would be introduced. This though, as it currently stands, remains a pipedream as the Conservatives are a way off reclaiming their worn seats. This is just the beginning of a lot of election lip service.

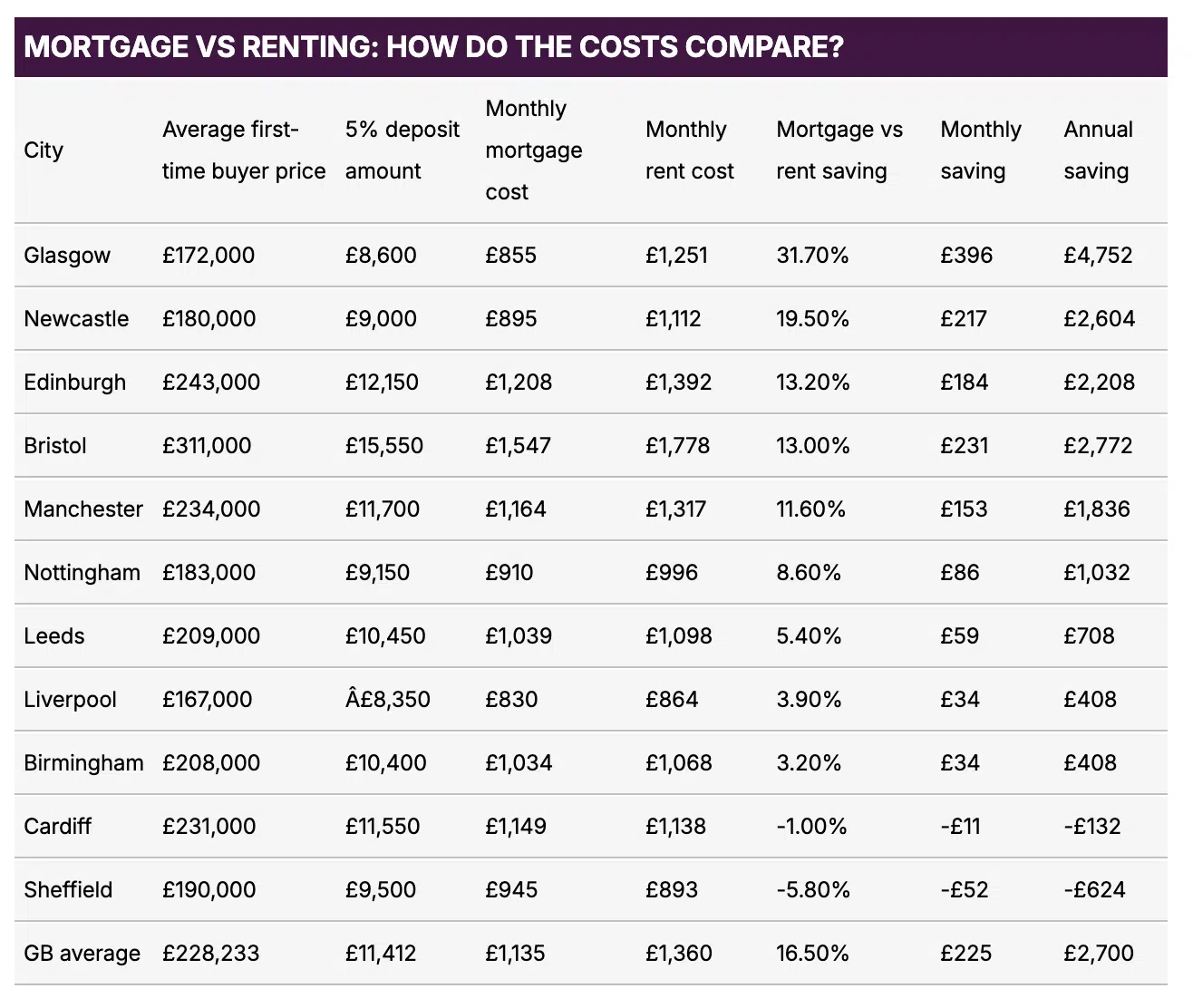

The cities where it is cheaper to buy than rent

As rents soar, many an able first time buyer has turned to the property ladder for a step up. Swapping rent for cheaper mortgage payments. This largely depends on where you are in the county but Lloyds analysis found that with an average UK rent of £1,577 per month, someone could save 17% on their monthly housing bill as a homeowner in a typical starter property in certain cities. The top three cities were all located up North; Glasgow, Newcastle and Edinburgh, which explains why house price growth has largely been restricted to these more affordable areas where buyer demand is higher.

That concludes, this week’s UK Property News Recap – 10.10.2025. Any comments or suggestions do please get in touch.