This week UK house prices stabilised leaving sales to tick over. Lenders continued in their attempts to get buyers to pick them, reducing rates further while displaying their newfound flexibility. Meanwhile, developers offered a token sum to the Competition and Markets Authority to turn a blind eye and leaseholders remained in limbo, awaiting reform. Welcome to another UK Property News Recap – 11.07.2025

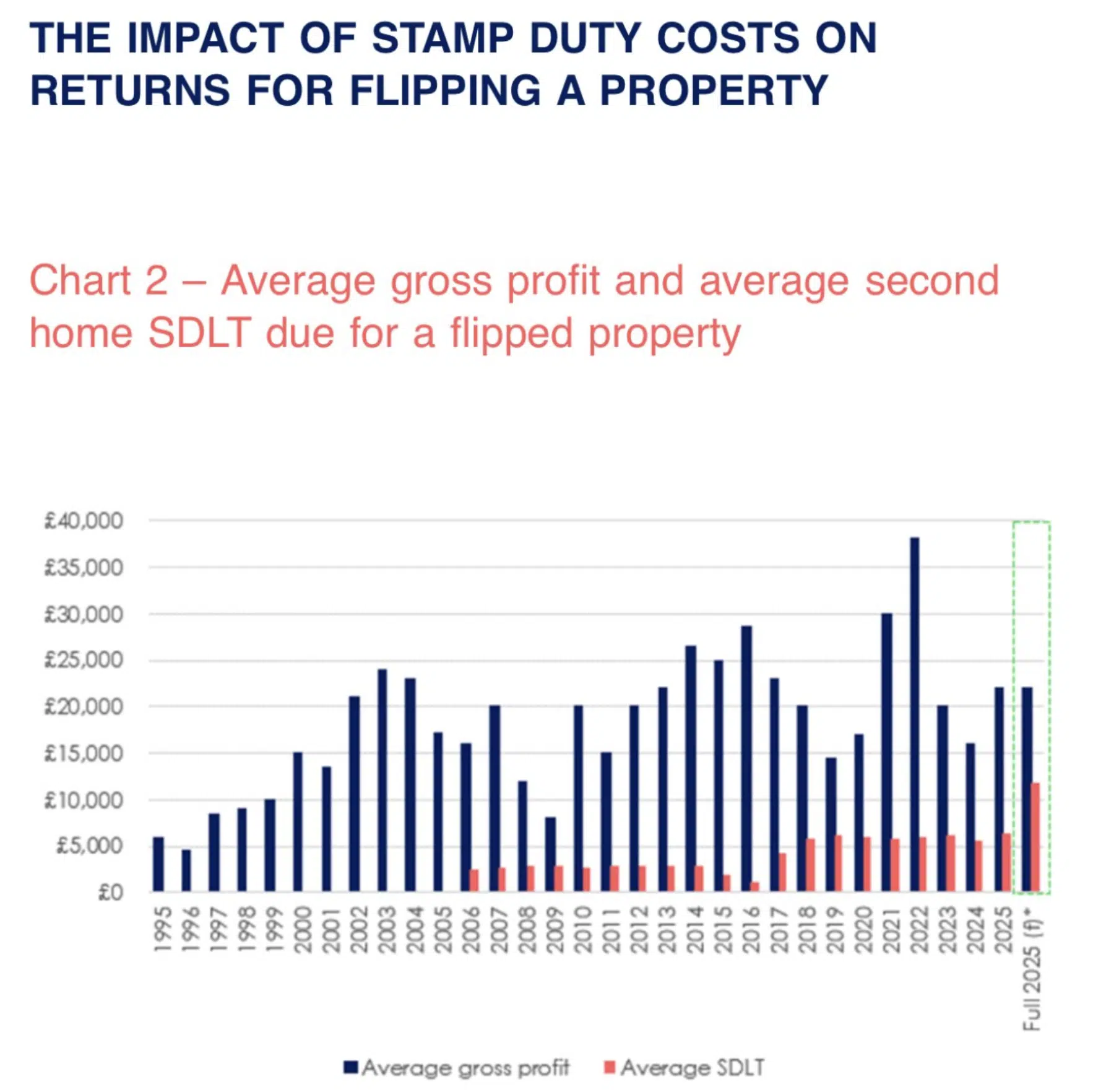

It’s “flipping” hard to make a good turn

Increased stamp duty and renovation costs in a shaky market is nothing to be flippant about. The number of properties flipped in Q1 2025, were 27% below the 10-year Q1 average. The most active and profitable region currently is in the North East where homes remain relatively affordable. However despite 80% of flipped homes being sold for a higher price in Q1, increased stamp duty both due to the additional surcharge and the nil-rate SDLT threshold falling to £125,000, meant only 66% of investors made a profit. With an average profit of £22k, for many the effort outweighs any gain especially in more expensive southern regions where profits are further reduced.

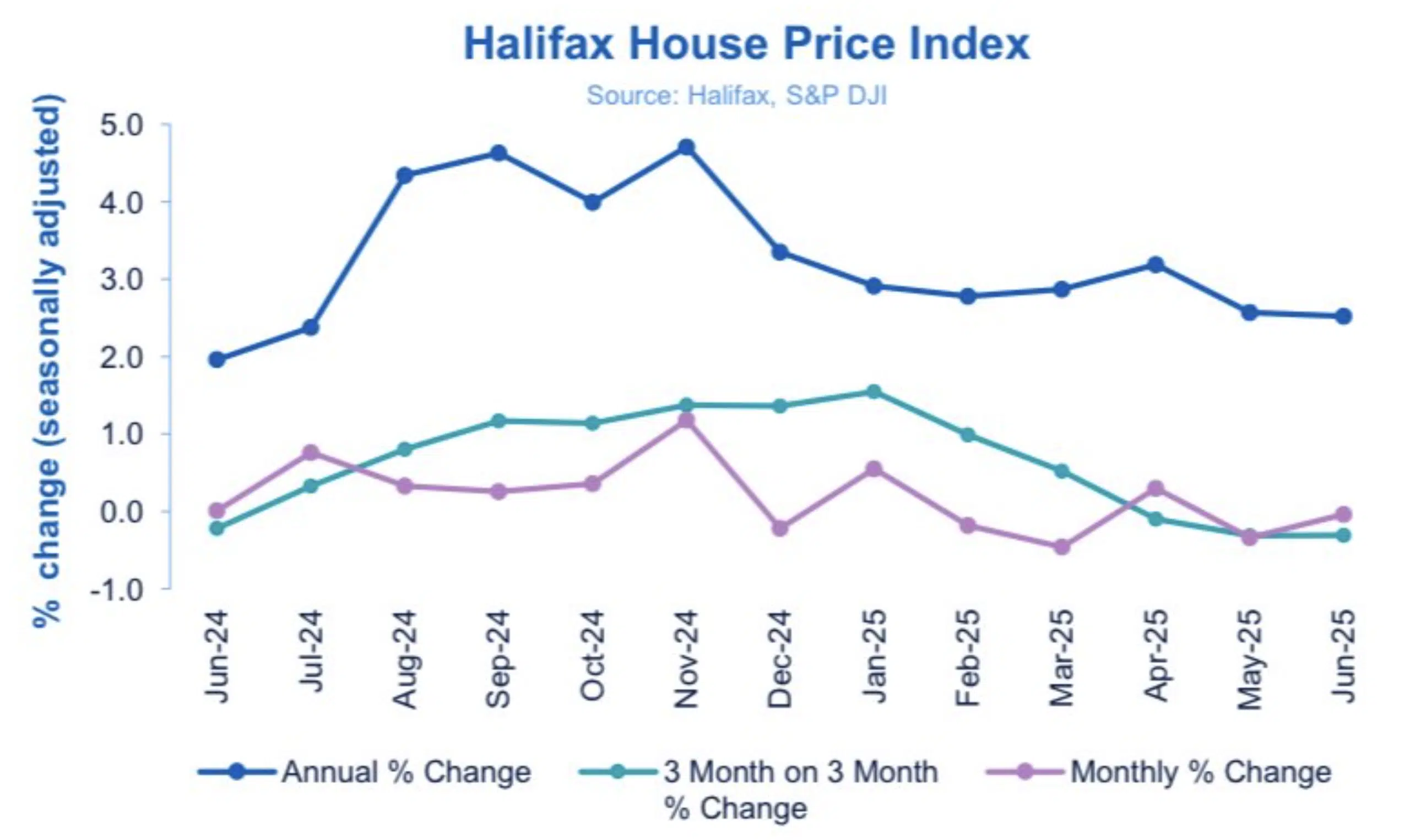

House price growth is stifled in June

According to Halifax average house price growth was flat in June making the average property price now £296,665, down £117 on May’s performance. Moving forward increased flex around mortgage lending and two rate cuts has the lender expectant of a more buoyant market towards the end of the year. As is, annual house price inflation remains highest in Northern Ireland up 9.6% and lowest in the south and London up 0.5% & 0.6% respectively.

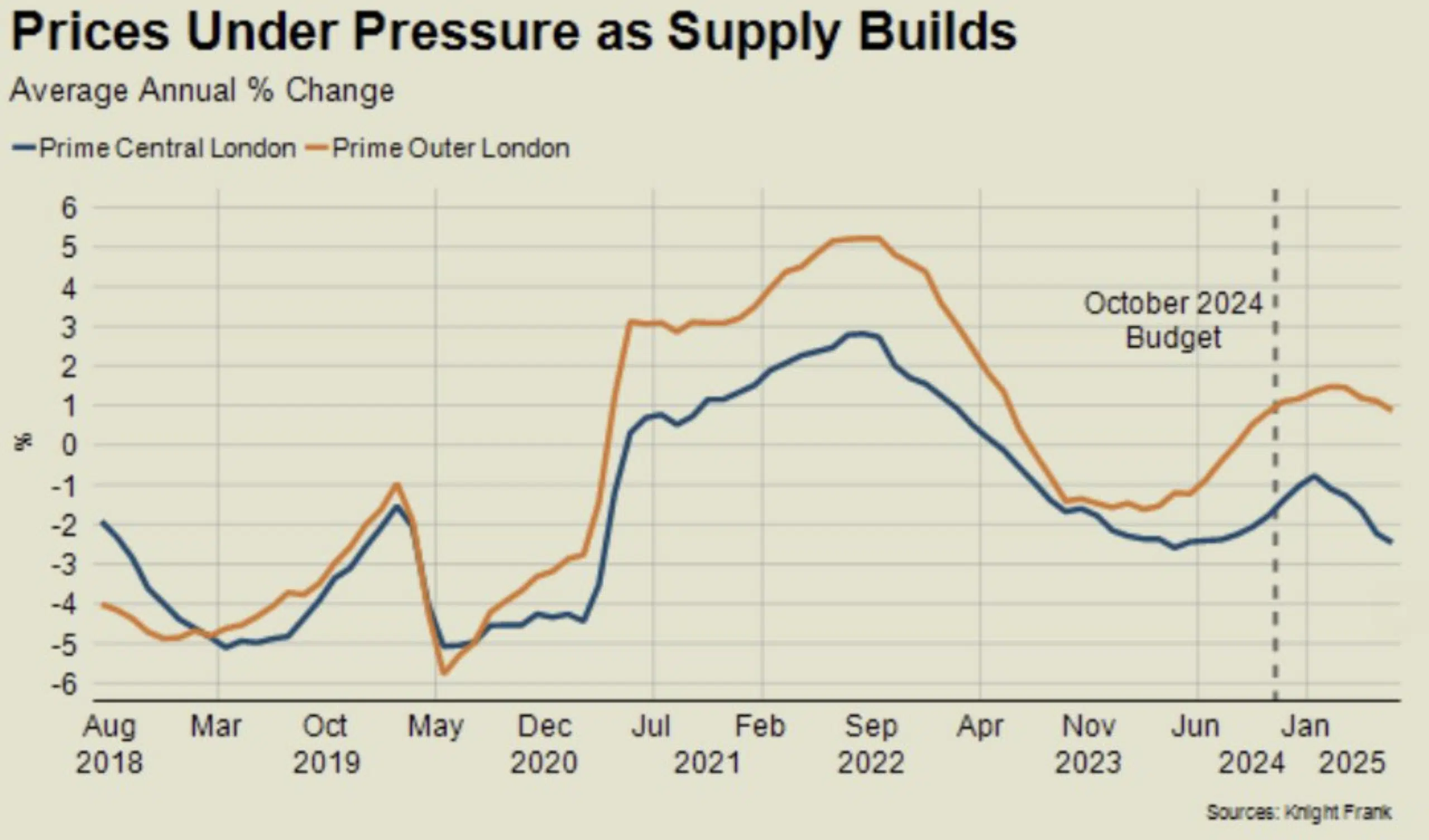

Prime central London stick or twist

According to Knight Frank, non-doms in Prime Central London who won’t bend the knee on price, rent instead. However, many have; resulting in a 21% upsurge in agreed sales when compared to June last year. Meanwhile Prime Outer London Price growth slowed due to stock levels rising. This is enabling domestic buyers to pick and choose; slowing growth to 0.9% in June, down from 1.5% in March.

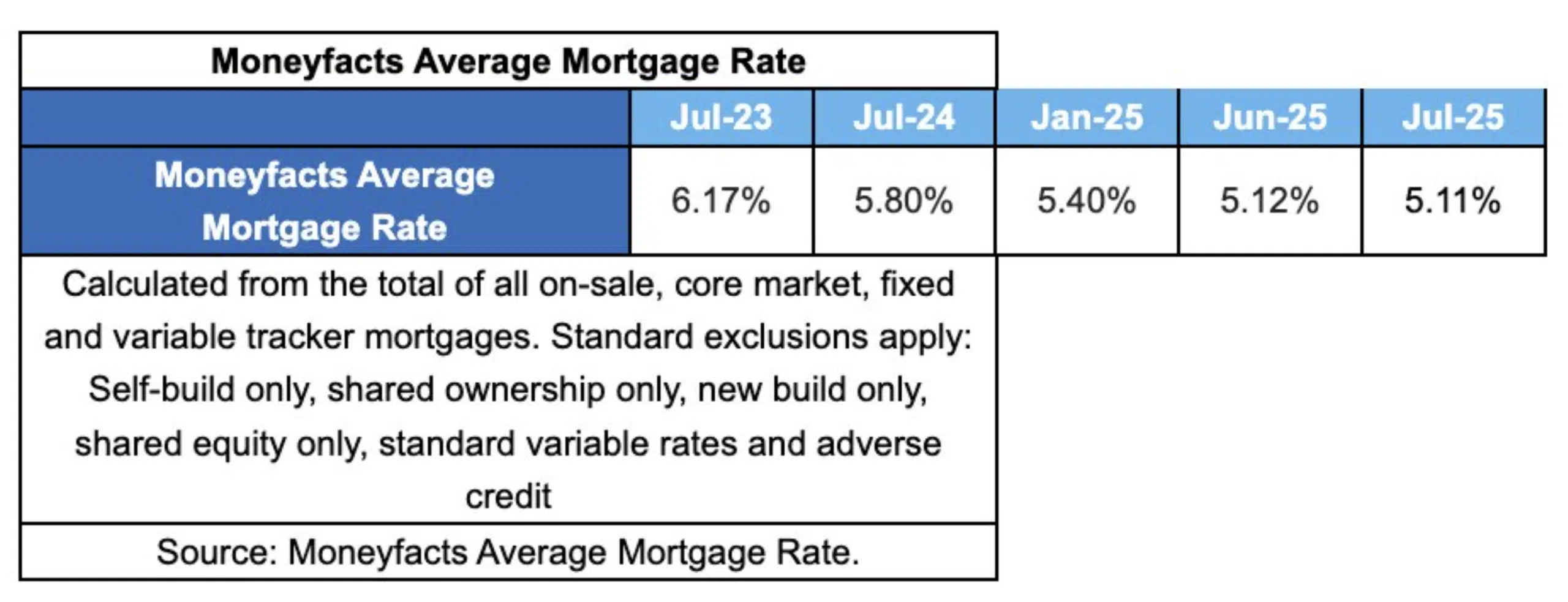

Average rates continue their gradual descent downwards

Since July 2024, average two-year fixed rates were more progressive than five-year fixed rates; falling by 0.86% compared with 0.45% for five-year rates. At the same time product choice rose but their shelf life fell; down to 16 days. For those on a tracker variable mortgage rate, there was no reprieve – the average two-year rate remaining unchanged at 4.91%.

In this week’s lender news individual lenders were keen to show some initiative: HSBC and NatWest trimmed their rates further, slim lining their margins in a bid to attract business over the summer, before others jump in.

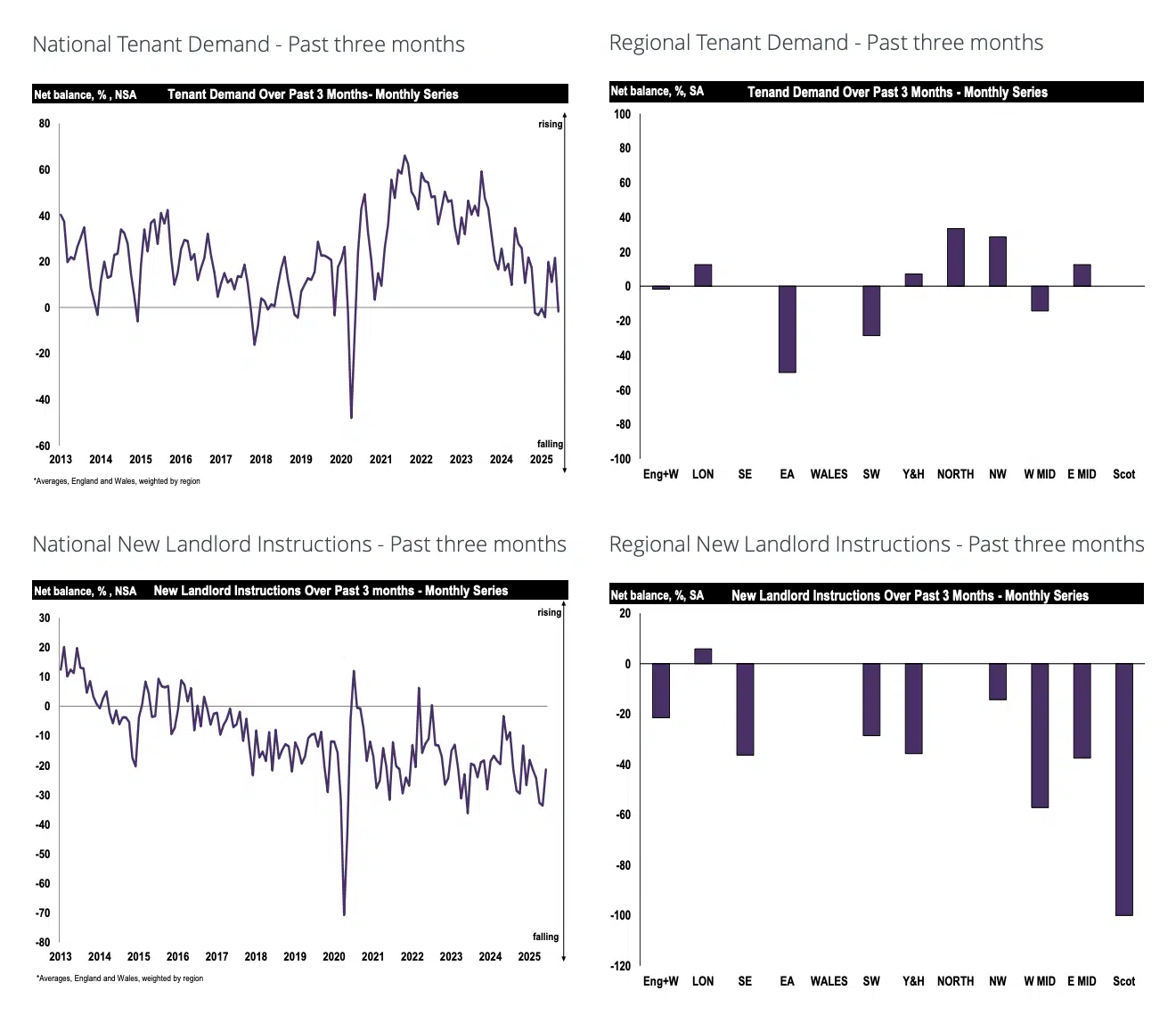

Renters’ Rights Bill causes a landlord loss

The Renters’ Rights Bill was introduced in May 2023, resulting in a loss of more than 45,000 properties. Then, between May 2024 and May 2025, a further 57,000 were removed.

Good intentions have led to a brutal reality. The Renters’ Rights Bill is a vote away from becoming law, once passed it will provide more legal rights to tenants, providing them with greater security that comes from consistency and better living conditions. This tenant gain, however, comes at a cost to landlords, which ultimately backfires on tenants who will see rents increase as landlords opt out.

The removal of section 21 has been blamed for this but on the whole landlords who are committed don’t fear this because they can’t ditch a tenant at will but they do fear the loss of income that could occur from tenant arrears.

Waiting three months before an eviction plus another few months for a hearing means there is a window of opportunity for tenants to take advantage. How successful they will be with their onward remains to be seen but once a landlord is burnt and/or in the red due to this they don’t return. Limiting supply further. If there was any confidence that the courts could perform at speed this concern would be mitigated but there isn’t.

Developers offer an “affordable” deal to make investigation disappear

Barratt Redrow, Bellway, Berkeley Group, Bloor Homes, Persimmon, Taylor Wimpey and Vistry offer £100m towards affordable homes to make the Competition and Markets Authority investigation into them about exchanged details go away while promising to never, ever, do it again. If accepted, this would be a financial slap on the wrist that would barely smart.

Mortgage flexibility sees demand for higher loan to interest ratio lending rise

As a result of the FPC recommending the Prudential Regulation Authority and the Financial Conduct Authority to amend its implementation of its LTI flow limit “to allow individual lenders to increase their share of lending at high LTIs while aiming to ensure the aggregate flow remained consistent with the limit of 15%. The share of lending at an LTI ratio of greater than or equal to 4.5 rose to 9.7% in 2025 Q1.” This flexibility, along with reducing rates, is expected to see this percentage share rise over the course of the year as first time buyers look to make a move.

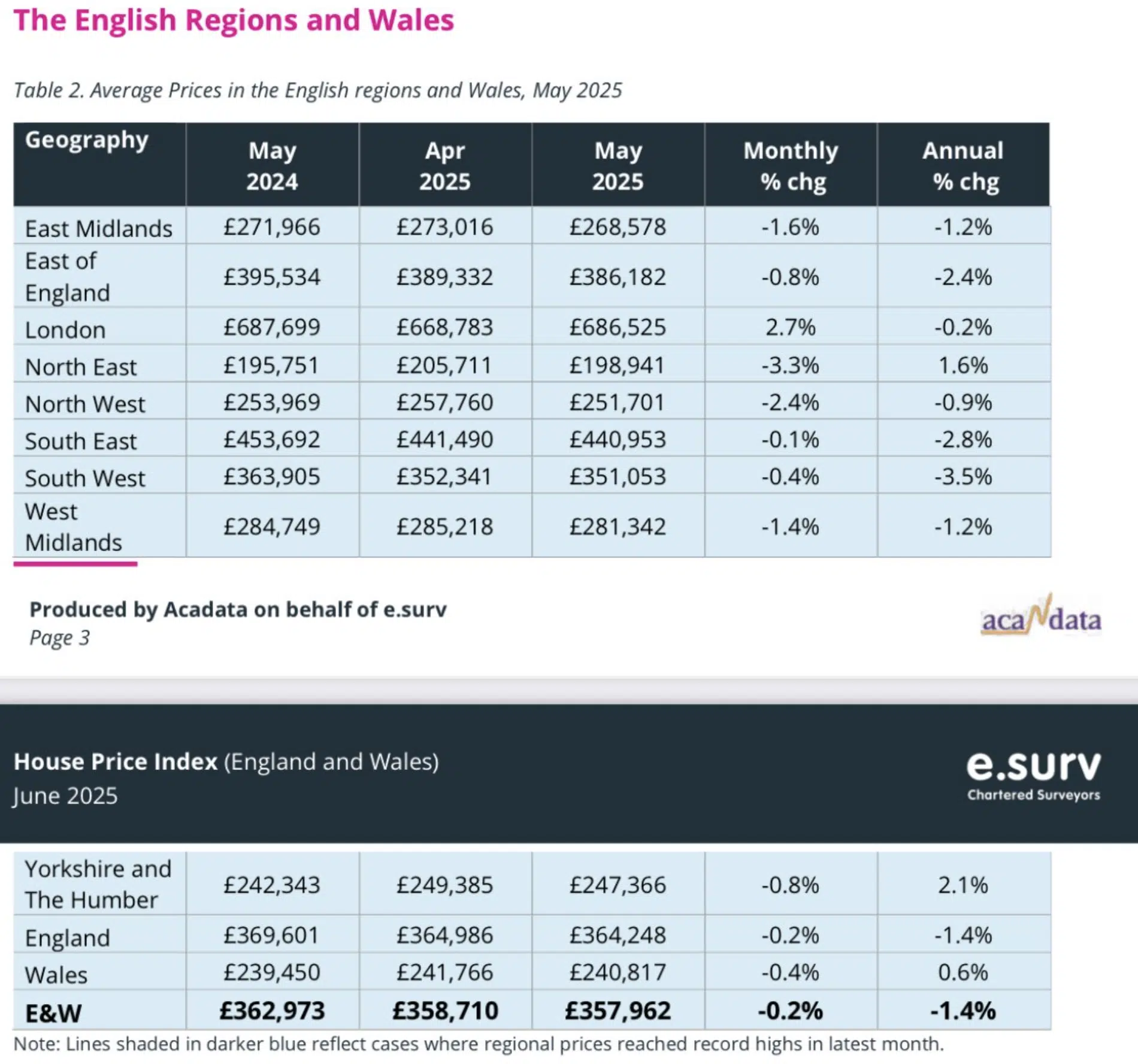

UK house prices stabilise

According to Acadata HPI for England and Wales house prices stabilised at £358,000 in June 2025. Noticeably prices in the North West softened while London prices showed the first shoots of growth.

Delays to the Renters’ Right Bill leave leaseholders stranded

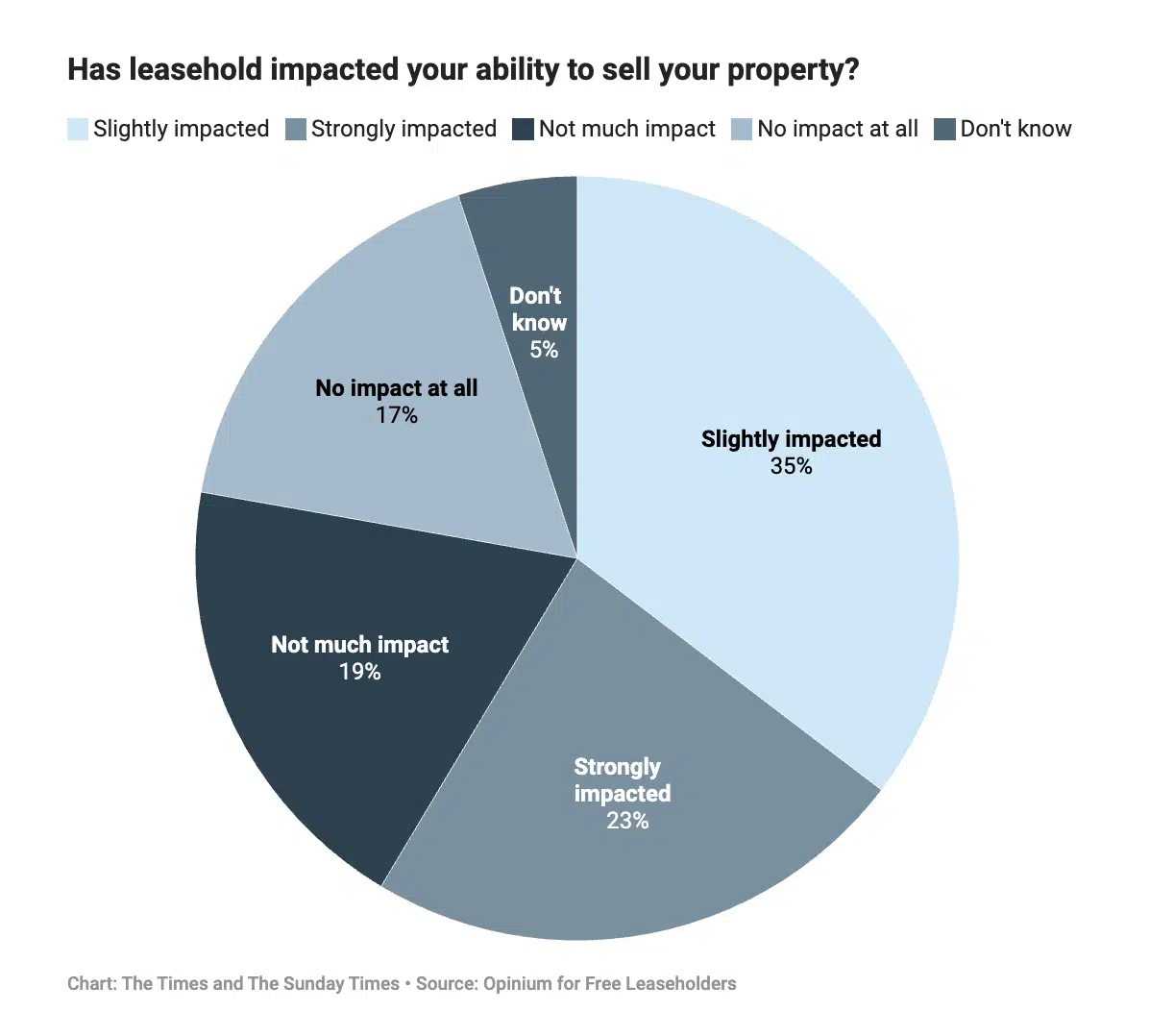

A survey conducted by Opinium reported 77% of participants had a rise in service charges in the past year — “of whom 24 per cent experienced an increase of more than £1,000 a year.” Is it any wonder then that 58% of respondents also struggled to sell their home.

Until Leasehold reform is passed, stability will elude many homeowners, costing them not only financially but mentally as well.

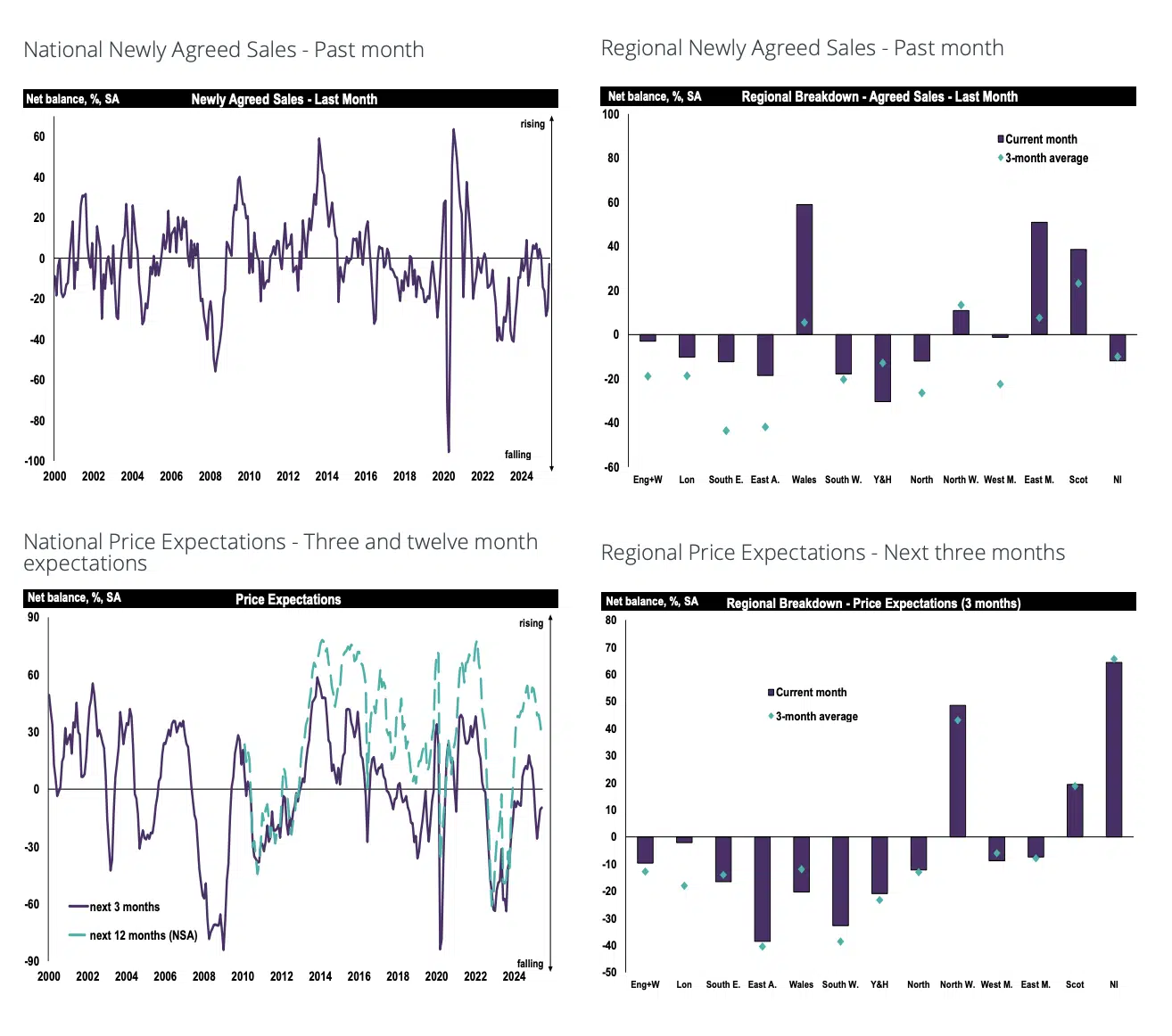

UK property market looks set for a sticky summer

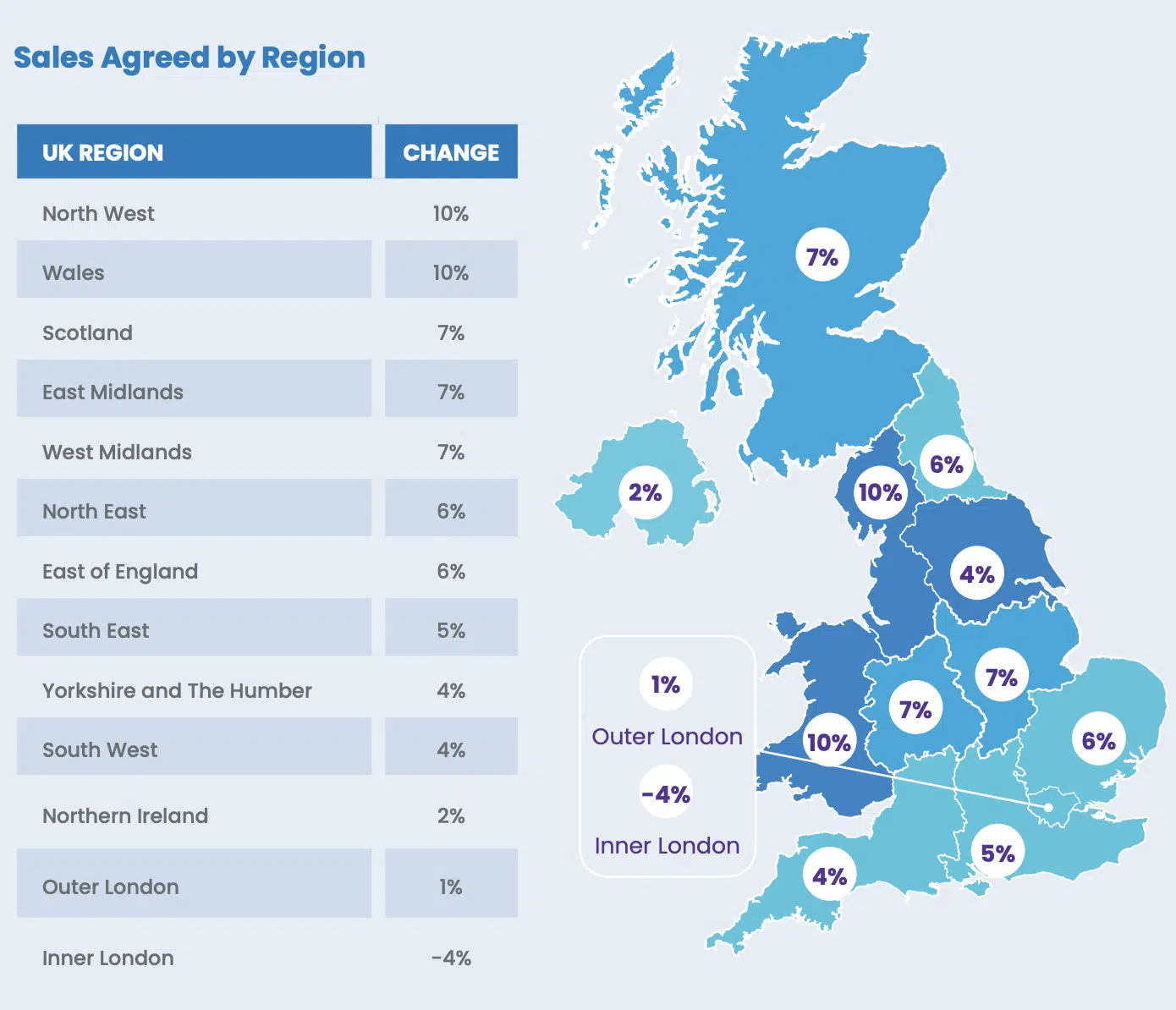

According to RICS Residential Market Survey – Buyers snapped out of their post stamp duty lull, registering their intentions to move, if not now than in the near future. For some though moving on remains a priority resulting in agreed sales improving on May’s efforts especially in Wales, the North West, East Midlands and Scotland. Meanwhile, vendors in certain regions began to hold back from listing but not from exploring what they could get come autumn. Sellers in London, the South East, East Anglia and the Midlands however bucked this trend; in the hope of a mid-year sale.

For residential property prices, the next three months are expected to remain largely unchanged, residing in negative territory, only gaining strength over time, The exceptions: Northern Ireland, Scotland and the North West. Here prices will continue to prosper, for as long as they remain affordable.

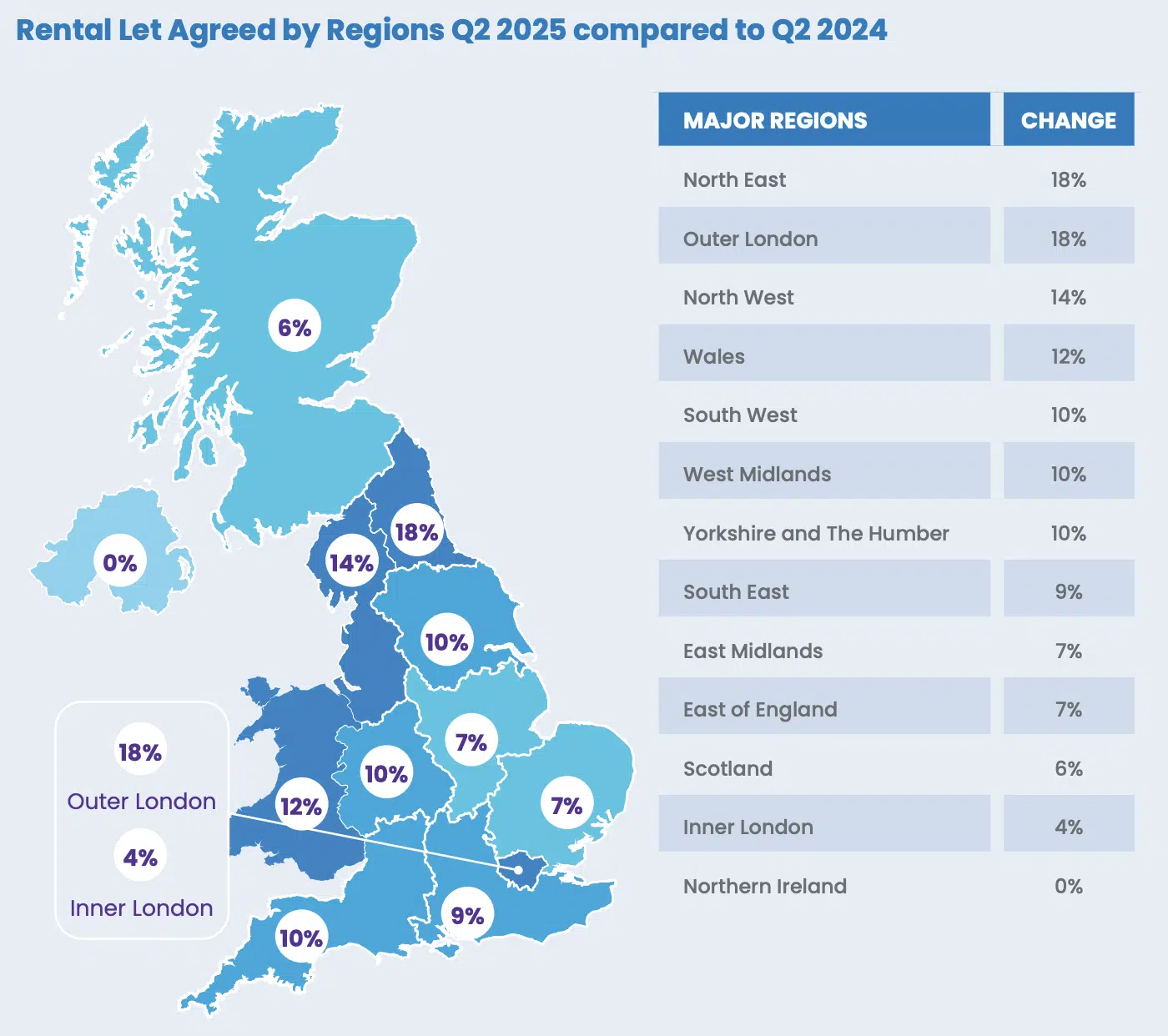

In the rental market, demand remained largely flat overall while new instructions, in the past three months, remained down across the country with the exception of London. Moving forward, prices though are expected to continue to edge up as demand outweighs supply.

Prime Central London showed signs of movement in June 2025

Supply rose 19%, which caused 51% of properties to be discounted by an average of 8% as sellers jostled for buyers’ attention. This, in turn, boosted agreed sales which rose by 9% when compared against the same month last year.

The non-dom tax haul could cost more than the government hoped to take

According to a study from the Centre for Economics and Business Research, if a quarter of the country’s non-doms choose to leave the UK, the tax take would be £4.6bn lower over five years and result in 3,000 fewer jobs. “If half the country’s non-doms leave – a worst-case scenario – this would increase to £7.8bn and cost 6,325 jobs. And if just 10 per cent depart – the Office for Budget Responsibility’s current most likely scenario – the Exchequer would miss out on £2.8bn.”

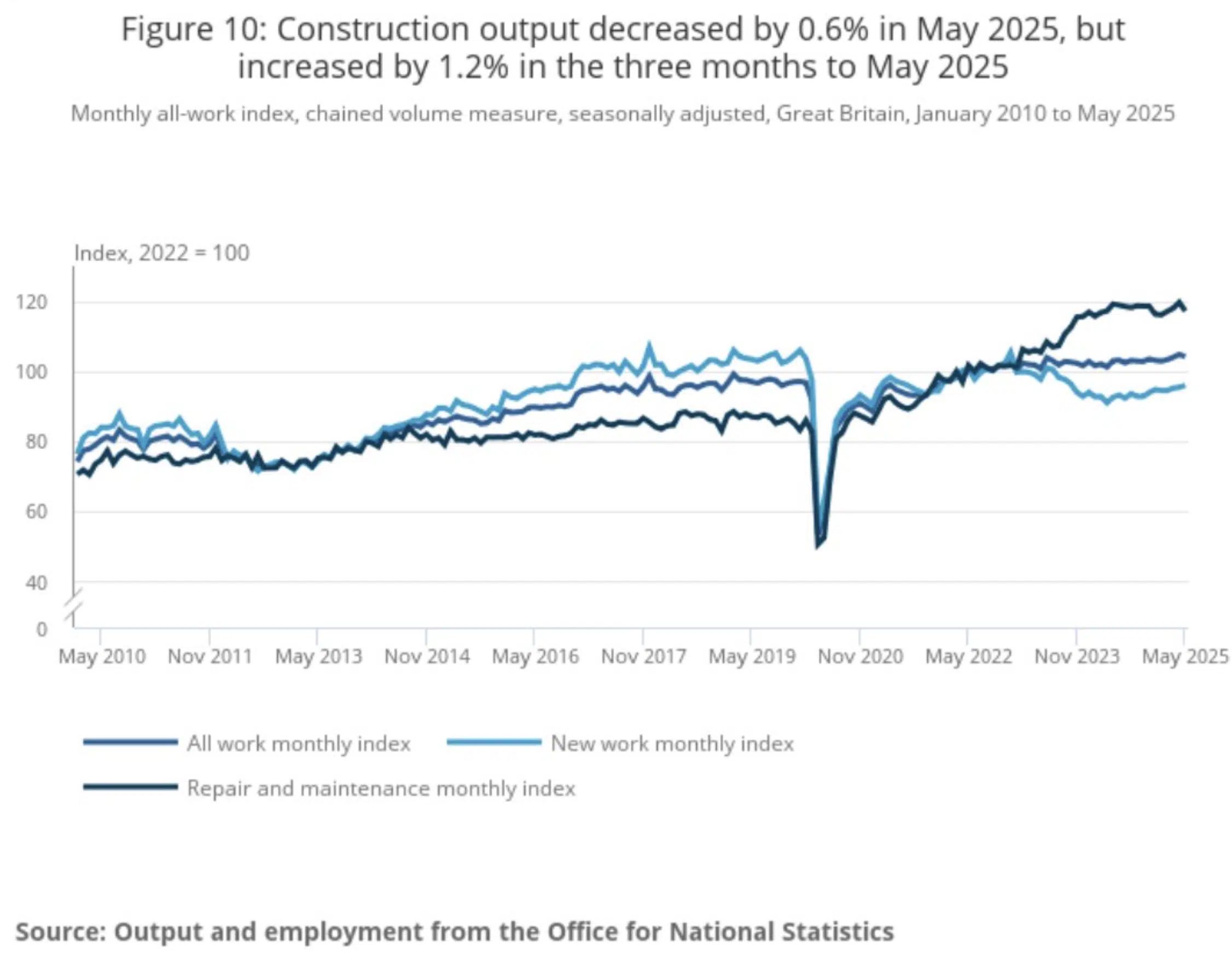

UK Construction stumbled in May 2025

Repair and maintenance embraced the bank holidays in May 2025, pulling monthly construction output down by 0.6%. At the same time new work found its feet increasing by 0.6% on April’s efforts.

According to Twentyci – The need for a sale has seen supply levels rise to the highest level in 7 years. This bolstered agreed sales which were up 5.3% in the second quarter of this year compared with the same period last year. Manchester saw the largest increase up 15% while inner London saw a 3.6% decrease. Affordability continues to dictate price, leaving cheaper regions to prosper while others struggle to accept the new norm.

Twentyci agreed sales Q2 2025

In the rental market they found the average asking price is now £1,814 per month, up by £47 from Q1 2025. Manchester again outperformed other regions agreeing 19.8% more lets in Q2 than last year. Meanwhile, outer London attracted far more renters than Inner London as renters looked for cheaper accommodation within commuting distance.

Rental lets agreed Twentyci Q2 2025

And that concludes this week’s UK Property News Recap – 11.07.2025. Any comments or suggestions please get in touch.