This week, speculation about what Rachel Reeves may or may not do in the budget continued. Despite the chancellor claiming an exit tax is now off the cards, rates falling and lenders flexing lending criteria to win business; the endless pontificating has prices, construction and many wealthy homeowners’ hair receding. Welcome to another UK Property News Recap – 14.11.2025.

New Yorkers move on

Zohran Mamdani joins Reeves in flying kites around a wealth tax which reportedly has New Yorkers on the phone to London estate agents. No one is going to make a move though until Reeves’s budget is delivered; until then, let’s hope the hold music is good.

Crisis charity turns Landlord

Crisis charity aims to turn landlord in response to homelessness crises, by fundraising to buy homes that social housing providers can’t afford to buy right now, to help plug the current 300,000 gap needed.

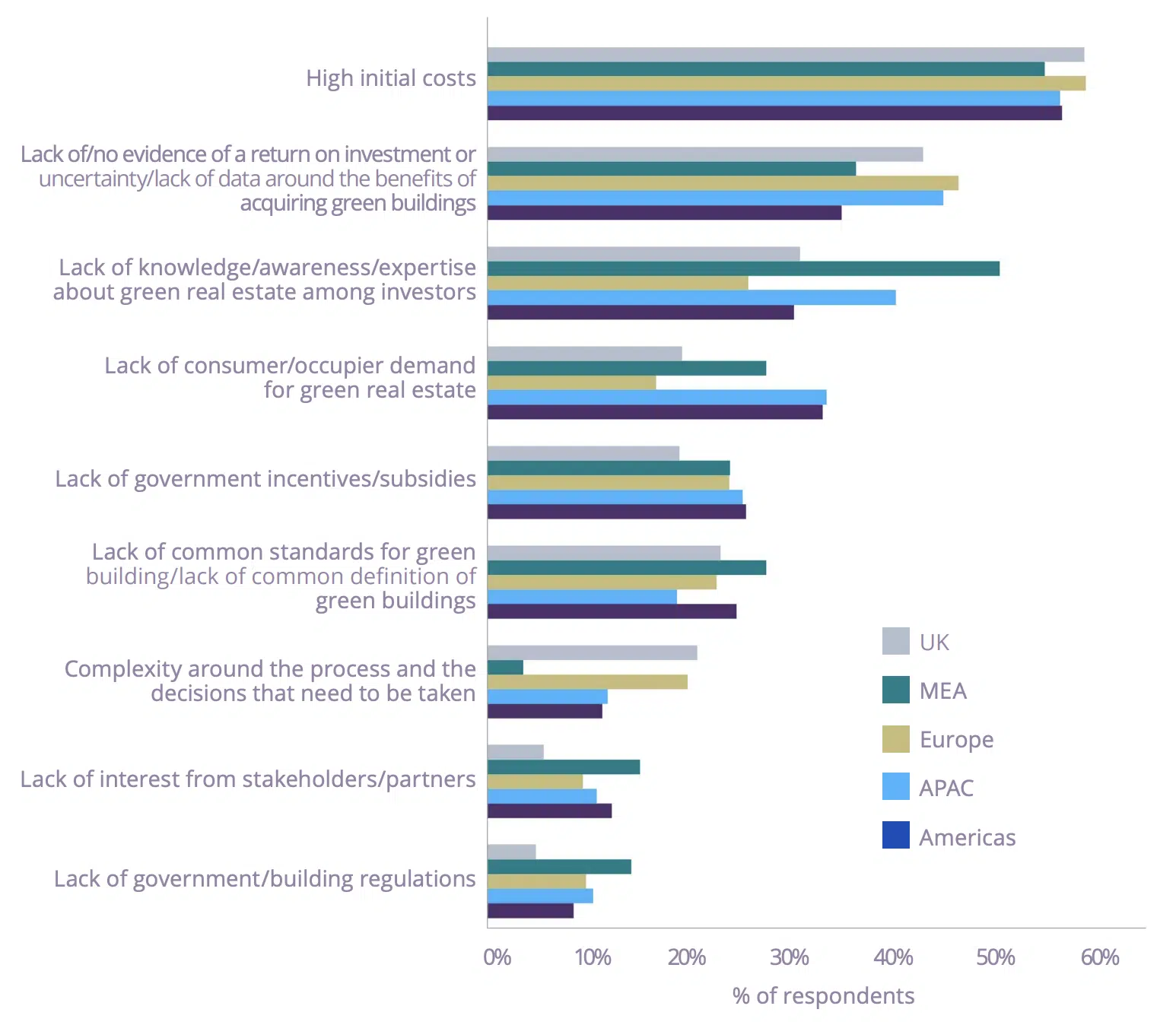

Interest in development sustainability wanes

The Royal Institution of Chartered Surveyors has released its 2025 Sustainability Report – this showed that despite an appetite for green real estate, demand growth weakened, notably in America. High costs and an absence of evidence on returns are key obstacles to investment. As a result RICS is proposing mandatory whole-life carbon assessment and reporting, if the sector is to achieve national and global decarbonisation targets.

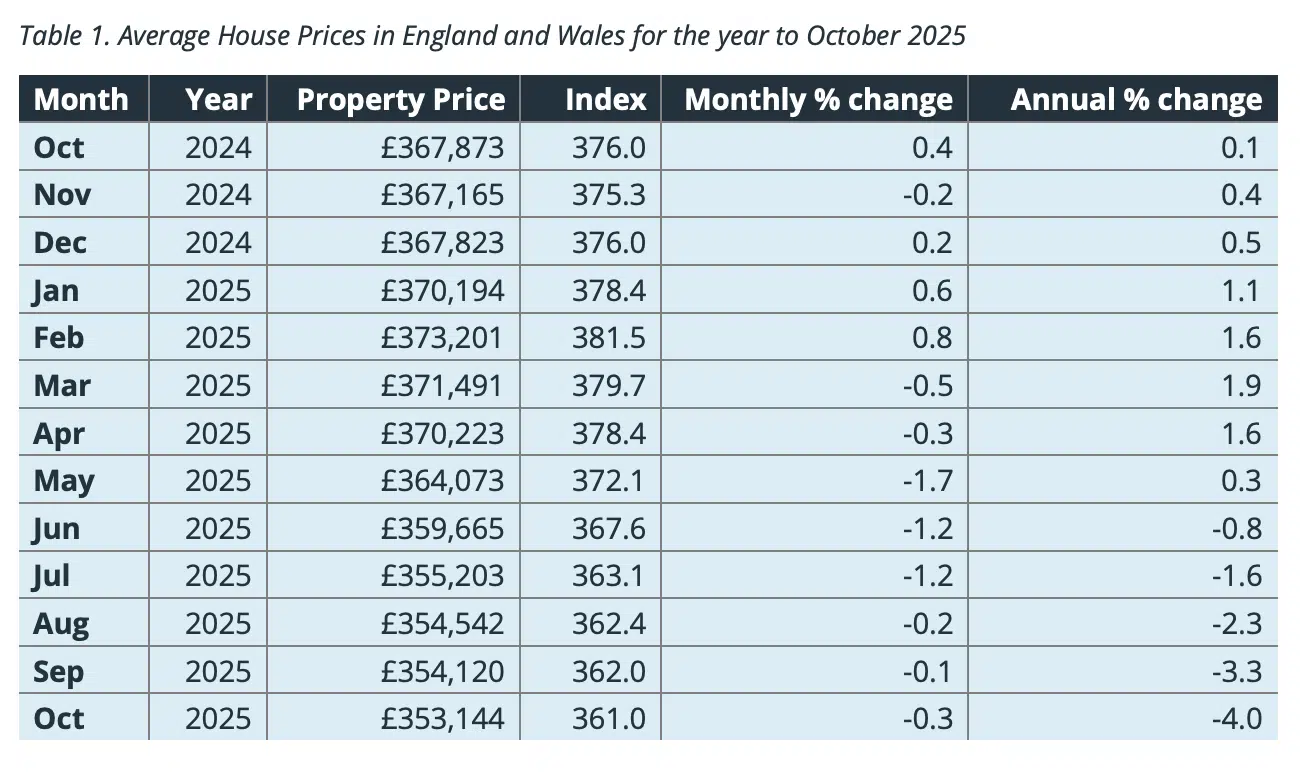

House Price growth stalls

According to Acadata’s HPI for October 2025, economic uncertainty stunted house price growth. Average house prices in England and Wales fell by 0.3% in October and -4% annually, bringing the typical sale price to £353,144, the lowest since early 2024. The south east and south west continue to see the most significant falls while the north west showed the most resilience.

”Reform”ing the amount of tax second home owners pay in North Northamptonshire

Leader of the Reform Party, Nigel Farage, claimed raising council tax on second homes was “extortion” yet when his party’s elected councillors found themselves in power they discovered they haven’t got the funds to be “socially” inclusive with everyone, so did precisely that.

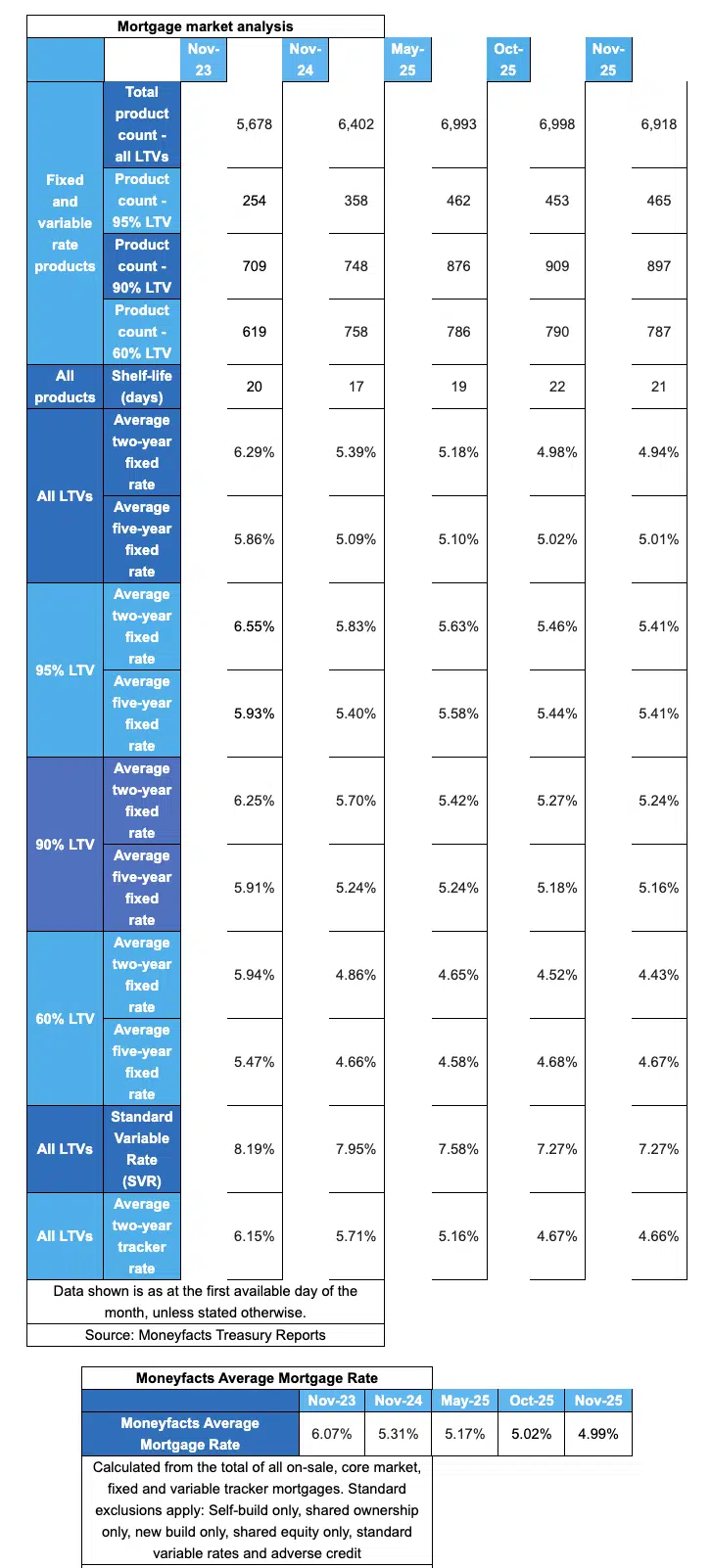

Rate falls gather momentum

According to Moneyfacts; lenders are pushing low deposit mortgages rates down – a fixed deal at 95% loan-to-value has fallen to 5.41% and the average two-year fixed deal at 90% loan-to-value, 5.24%. We aren’t close to 2022 rates yet, which were 4.51% and 4.27% respectively but it is a step closer. Overall the Moneyfacts Average Mortgage Rate fell below 5% with shorter-term fixed mortgages falling furthest over the past 12 months. The average two-year fixed rate has fallen by 0.45%, from 5.39% to 4.94%.

Many are hoping for more movement come December and into the New Year, which will definitely help with affordability unless Reeves’s budget takes more elsewhere.

Taylor Wimpey’s sales stall with budget uncertainty

Budget uncertainty stalls sales for developer Taylor Wimpey. In their latest trading statement for the period from 30 June to 9 November 2025 – the net private sales rate per outlet per week was 0.63, down from 0.71 in 2024. Everything else remained largely on a par with last year but the group’s order book, excluding joint ventures, stood at 7,253 homes, with a value of c.£2,116 million, down from 7,771 homes in 2024 with a value of c.£2,214 million. Much rides on Reeves’s actions come budget day and rates falling further, for developers to realise greater gains that will encourage them to build more, faster.

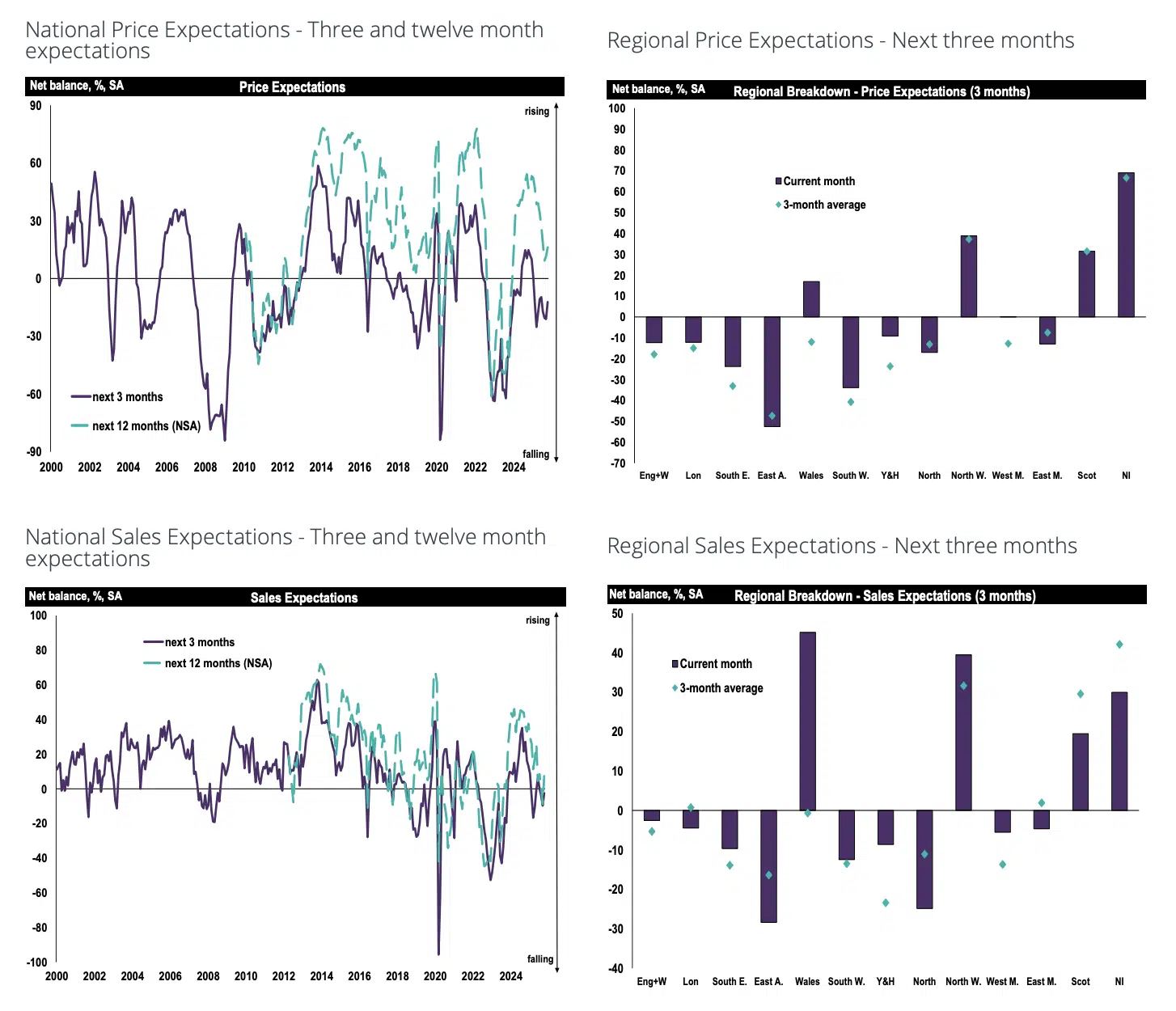

In RICS’s latest residential Market Survey

Our survey said…RICS Surveyors painted a subdued property market in their latest Residential Market Survey. Both buyers and sellers are warily keeping an eye on Reeves’s next move and what rates are doing. Hopes remain that the latter will compensate for tax increases but others suspect rates would have to fall a lot further for anyone to feel the benefit. As a result, they are reporting prices are starting to feel the cold but expect them to thaw in time for spring. For the time being though prices remain resilient in Northern Ireland, Scotland, the North West and Wales while southern regions and East Anglia are stubbornly refusing to grow.

Lloyds taps into both the sales and the rental market revenue streams

Lloyds set up Lloyds living in July 2021, which has since purchased around 7,500 rental properties giving it a portfolio with assets in excess of £2bn. The group is focused on investing in new housing estates as opposed to blocks of flats, potentially because upkeep isn’t an issue from the outset and resale should be easier if needed.

Rate cut forthcoming

UK wage growth slowed to 4.8% while the unemployment rate rose to 5%, the highest since February 2021. The government’s past budget decisions are taking their toll on “working people.” Is it any wonder everyone is bracing for the next? Meanwhile GDP limped 0.1% in Q3, lower than economists expected which further suggests a rate cut will be forthcoming in December.

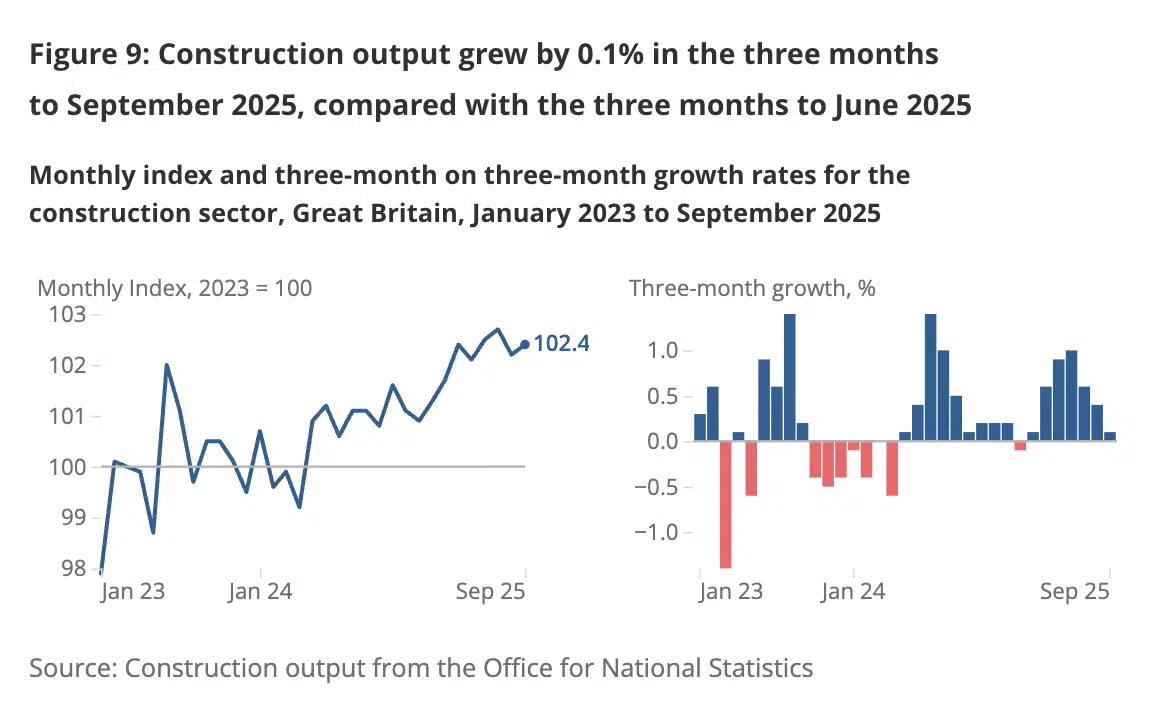

Construction output struggles to put out

Homeowners are hunkering down, repairing and maintaining their properties before the winter months, hopeful for a better New Year while new homes remain unfinished. The only developments taking shape were private commercial and industrial new work, which grew in the quarter up 9.8%. At the same time, private housing repair and maintenance grew by 2.9% but private new housing fell by 1.9%. As a result, construction output increased by only 0.1% over Q3.

Rightmove comes under fire

Former Competition and Markets Authority panel member Jeremy Newman is taking legal action against Rightmove, claiming damages for all the estate agents who use the portal, which he claims charges excessive prices to list properties on its online portal due to their dominance in the market place. His claim is fully funded by specialist litigation funder Innsworth Capital Limited and if successful he hopes to extract £1billion from the portal. Popcorn at the ready

Mike Scott steps down as CFO at Barratt Redrow

Mike Scott has stepped down as Chief Financial Officer and as an Executive Director with immediate effect after four years at Barratt Redrow. A search for a replacement is underway but in the interim Micheal Passmore will step in.

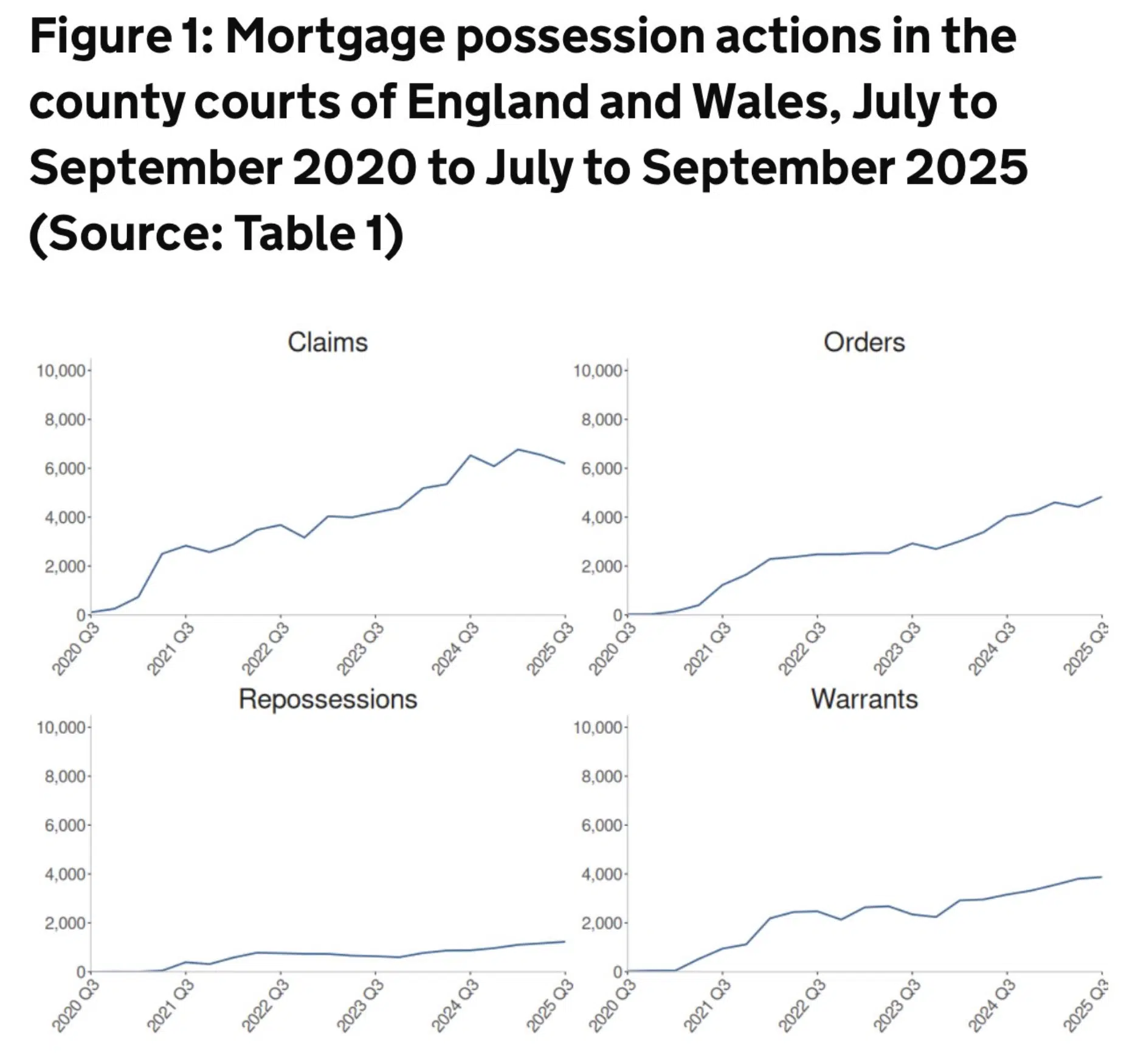

Repossession rise but new claims fall

Homeowners that were already in trouble struggle to stay put while others manage to keep the bailiffs from the door. Mortgage and landlord repossession volumes rise but new claims fall in Q3 while repossession median timeliness are drawn out by another 2.1 weeks compared to the same quarter last year, taking it up to 46.1 weeks. Compared to the same quarter in 2024, mortgage possession claims (6,193) are down 5%, mortgage orders for possession (4,840) are up 20%, warrants issued (3,876) are up 23% and repossessions (1,228) are up 40%.

Reeves dismisses exit tax

Reeves winds down a capital gains raid on wealthy people fleeing Britain, but holds her other kites taut. In response the prime London market continues to see prices fall, in an attempt to win over hesitant buyers.

The Renters Rights Act get an Implementation date

‘Phase one’ of the Renters’ Rights Act is to be implemented by May 1 2026. This will include:

– Abolishing section 21 ‘no fault’ evictions ( section 21 and tenancy reforms during Phase 1 will not apply initially to the social rented sector)

– Introduce Assured Periodic Tenancies in the private rented sector

– Reform possession grounds in the

PRS so they are fair for both parties

– Limit rent increases to once a year in the PRS

– Ban rental bidding and rent in advance

– Make it illegal to discriminate against renters who have children or receive benefits

– Require landlords in the PRS to consider tenant requests to rent with a pet

– Strengthen both local council enforcement and rent repayment orders

Cash Isa Limits could hit mortgage market

Building Societies fear Reeves trimming back the cash tax-free allowance from £20,000 to £12,000 as at least “50 per cent of a building society’s mortgage book must be funded from members’ savings, under the Building Societies Act 1986.” This would result in fewer mortgages being offered to those borrowers with smaller deposits.

Meanwhile investment managers rub their hands in glee but this could prove premature if the thought of stocks and shares is baffling to some

House prices spiral

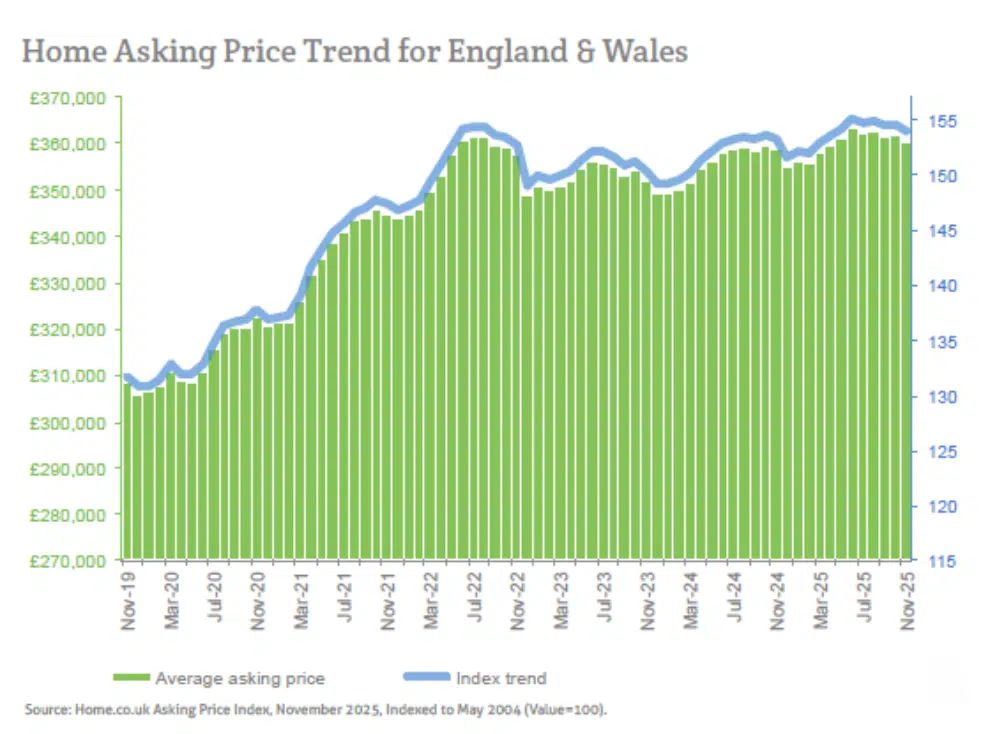

Economic uncertainty and budget fears have the UK property market in a spin of negative conjecture. According to Home.co.uk the mix-adjusted average asking price for England and Wales dropped by 0.4% during October but estimate that overall real growth currently stands at around -4.2%. Unsold stock collects dust on the portal shelves as they fall to the back pages with new stock adopting the first. Yorkshire was the best performing region with year-on-year growth of 3.2% while the South West saw declines of 1.3%

That concludes this week’s UK Property News Recap – 14.11.2025. Any comments and suggestions please get in touch.