This week played out like a game of Top Trumps, be it who was going to pay their mortgage for longer, who would do more for tenants, which country put up their interest rates the most, or who had the best legal advice when avoiding property tax. Welcome to another UK Property News Recap 17.05.2024

Rise in ultra-long mortgages

Sir Steve Webb, the former Liberal Democrat pensions minister, obtained figures from the Bank of England that showed a total of 294,243 post-retirement age mortgages were taken out in the fourth quarters of 2021, 2022 and 2023 combined.

The end of cheap money has meant more first-time buyers are drawing out their mortgage term to get on the ladder, leaving many at risk of not having enough savings, post retirement, to fulfil payments, forcing many to work for longer.

As we live longer, our retirement age will age with us, however many will be banking on capital appreciation, rate reductions and job promotions to help pay down loans sooner.

Labour distance themselves from their own rental research

A report led by Stephen Cowan, the Labour leader of Hammersmith and Fulham council, proposed a “double lock” for those renewing their tenancies. “This would guarantee that any rise is capped at either consumer price inflation or local wage growth – whichever is lower – across England and Wales.”

Labour is keen to not endorse or oppose these proposals. Instead they are opting to sit on the political fence – careful not to promise anything that could rock the overall vote. Once in power, an in-house divide could erupt between those who think more should be done and others that fear an exodus of landlords and housing investment.

Earnings vs unemployment

The latest data from the ONS on earnings and unemployment in March painted a complex picture. Though wages stayed at the same level as they were in February, 5.7% without bonuses, 6% with, unemployment grew and a further 820,000 people joined the long-term sick list, now totalling 2,820,000.

Desperate to look on the bright side, Jeremy Hunt said: “this is the 10th month in a row that wages have risen faster than inflation, which will help with the cost of living pressures on families.”

Opinion was divided if this would spur the Bank of England into base rate action or not. Some said wages still remained too high to warrant a chip in the rate whereas others, including the markets, were more hopeful that with unemployment on the rise and wage increases stabilising, a cut could be forthcoming. The conjecture will continue, but all eyes will remain glued to June’s inflation and labour market figures.

China considers bailing out housing market

The property crisis in China is proving a drag on their economy. In an attempt to salvage the market, the state council is considering passing the parcel of housing debt. Local state-owned enterprises may be encouraged to borrow from state banks, whose margins have already diminished from existing bad property loans, to buy properties of struggling developers, at a discount, for affordable housing.

Listing time for rentals reduces.

The early bird catches the rental worm. Savills compared listings on Zoopla of properties to rent in the 2019 calendar year, and the 12 months to March this year. In each region, the listing time has reduced with Scotland topping the leaderboard.

Period houses cost more to maintain

According to a Zoopla survey, (always intrigued as to who fills these out) a fifth of buyers who bought a period property “didn’t realise how much they would need to spend to maintain, repair and upgrade their property – or didn’t envisage ANY costs at all – before buying.” The very reason you liked the property was because it was OTHERWORLDLY, from a time gone by, its character, warmth and craftsmanship that doesn’t belong to this era. You pay to keep it that way. If a low maintenance, energy efficient home was the preference; a period property WASN’T FOR YOU!

Affordable housing starts in London, backfire in 2023

Affordable housing took a 2023 sabbatical after shovels hit high interest rates. Only once these are reduced will work properly recommence.

Angela Rayner goes on the attack

Despite Angela Rayner reportedly set to be questioned under caution for tax avoidance, after claiming her ex-council house, which she sold in 2015, was her primary residence when she had another home that she lived in with her husband elsewhere, she took the high ground. Mrs Rayner accused Jeremy Hunt of not disclosing his tax advice, which she won’t divulge either, after he snuck back into ground rent discussions after previously excusing himself from them due to a conflict of interest. Him being a landlord and all…

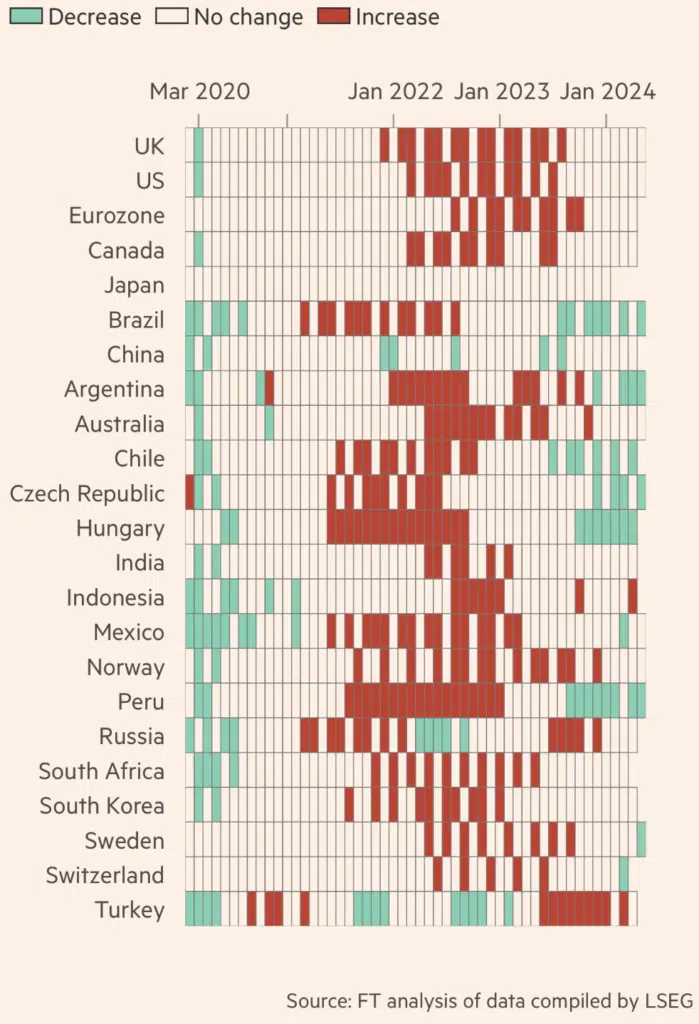

Global interest rates

In the UK it’s easy to think we are the only county with a broken government and high interest rates. However, this isn’t the case. Other countries also have halfwit politicians and growth issues. To help make us realise we aren’t alone and enable a game of Top Trumps as to who has it worst on a global scale, the Financial Times put together a crib sheet showing how central banks responded to rising prices with a synchronised increase in interest rates across the globe over the past three years.

Landlords selling up

Are they, aren’t they? The National Residential Landlords Association claims they are, others say they aren’t. The Guardian, picking through Government. data said: “more than four in 10 families who have asked councils for temporary housing after a private landlord ended their tenancy are in the predicament because the owner told them they were putting the property on the market.”

Uncertainty for both renters and landlords has been detrimental to both. The symbiotic relationship between tenants and landlords is out of kilter and is set to continue till more homes are built and legislation is clear. Until then, the rental situation will only get worse, not better, leaving many growing up with no fixed address.

Base rate uncertainty causes PCL sale jitters

The longer a base rate cut date isn’t clear, those under offer in prime Central London risk a fall-through. Demand is there but caution remains over pricing. What once was sought after can easily lose its appeal when the heat of getting a sale agreed is off and more property comes to market.

According to Lonres; “the number of homes that went under offer across prime London this year was 15% higher than the 2017-2019 average, while the number of sales (exchanges) was 0.3% below. This is partly due to rising numbers of fall-throughs – which have risen by 26.6% over the same period.”

Lenders reduce rates

After torturing those who had to remortgage in the past month, the lending herd drove reduced rates to market – 2 year swap rates fell from 4.57% to 4.46% and 5 year rates dropped from 4.02% to 3.9%. This will help those already under offer and others about to remortgage.

And that concludes another UK property News Recap – 17.05.2024. Should you have any comments or suggestions, as ever, please get in touch here.