This week, the lack of new housing dominated the headlines. As a result, developers have reimagined help-to-buy in an attempt to build on their numbers while the London mayor, Sadiq Khan, pleaded on their behalf for affordable targets to reduce to 20% in the Capital. At the same time the government made moves to block planning opposition in the hope of placating developers. Welcome to another UK Property News Recap – 17.10.2025.

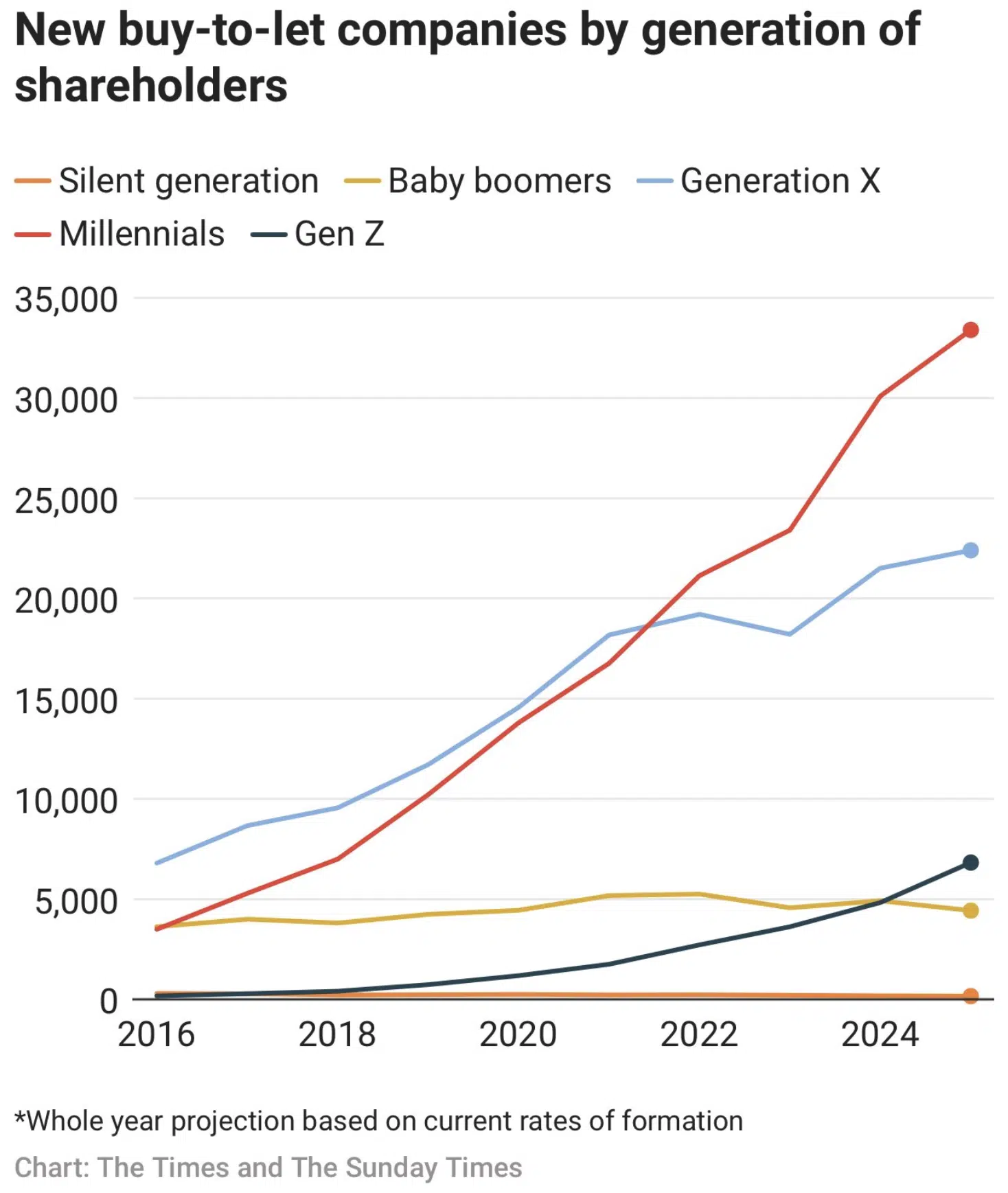

Younger generations move into the buy-to-let arena

Younger generations have taken up the buy-to-let baton from older generations in more affordable, northern, areas with the aim of making a buck to help propel them forward.

Hamptons found millennial investors made up 50% of new buy-to-let limited companies in 2025, a 142% rise since 2020.

Developers launch their own Help to Buy scheme

UK homebuilders Barratt and Persimmon teamed up with lenders Barclays and TSB Bank to launch their own Help to Buy offering, enabling buyers onto their property ladder with a 5% deposit, ensuring their profitability.

Construction start fail to get off the ground

Labour’s plans to “build baby build” remains merely aspirational. In the Glenigan UK construction review: project starts declined by 15% during the review period, down 40% compared to 2024 levels. At the same time planning approvals fell -21% compared with the previous three months, and were down 18% on the previous year. As a result, many development projects reside on paper awaiting sign off and economic stability.

Planning bill gets tweaked

MHCLG tweaked its planning bill proposals to safeguard development projects from local opposition by empowering ministers with the ability to issue ‘holding directions’ to stop councils refusing planning permission.

This comes alongside a reduction in the number of challenges being permitted being reduced from three to one, Nature England being streamlined and non-water sector companies being granted permission to build reservoirs.

Lofty ambitions add value

Lender Nationwide surveyed 2000 people and arrived at the following data:

Loft extensions add more value than refurbishing a bathroom or kitchen, yet this is the most popular renovation…no doubt because it costs…well, less. Younger generations were revealed to spend more than older generations on refurbishments. I suspect due to them buying homes with more room for improvement while older generations don’t want the hassle.

House builders hang up their tools now ‘help’ is no longer on hand ‘to buy.’

According to Hamptons the number of homebuilders trading in Britain fell by more than 1,500 — or 1.7% — in the year to September, 71% of these set up in the Help to Buy era. This alongside protracted planning approval, increased rates and economic uncertainty have driven many to the wall, decreasing the average life expectancy of a developer to 9.8 years in 2025 from a peak of almost 13 years in 2016.

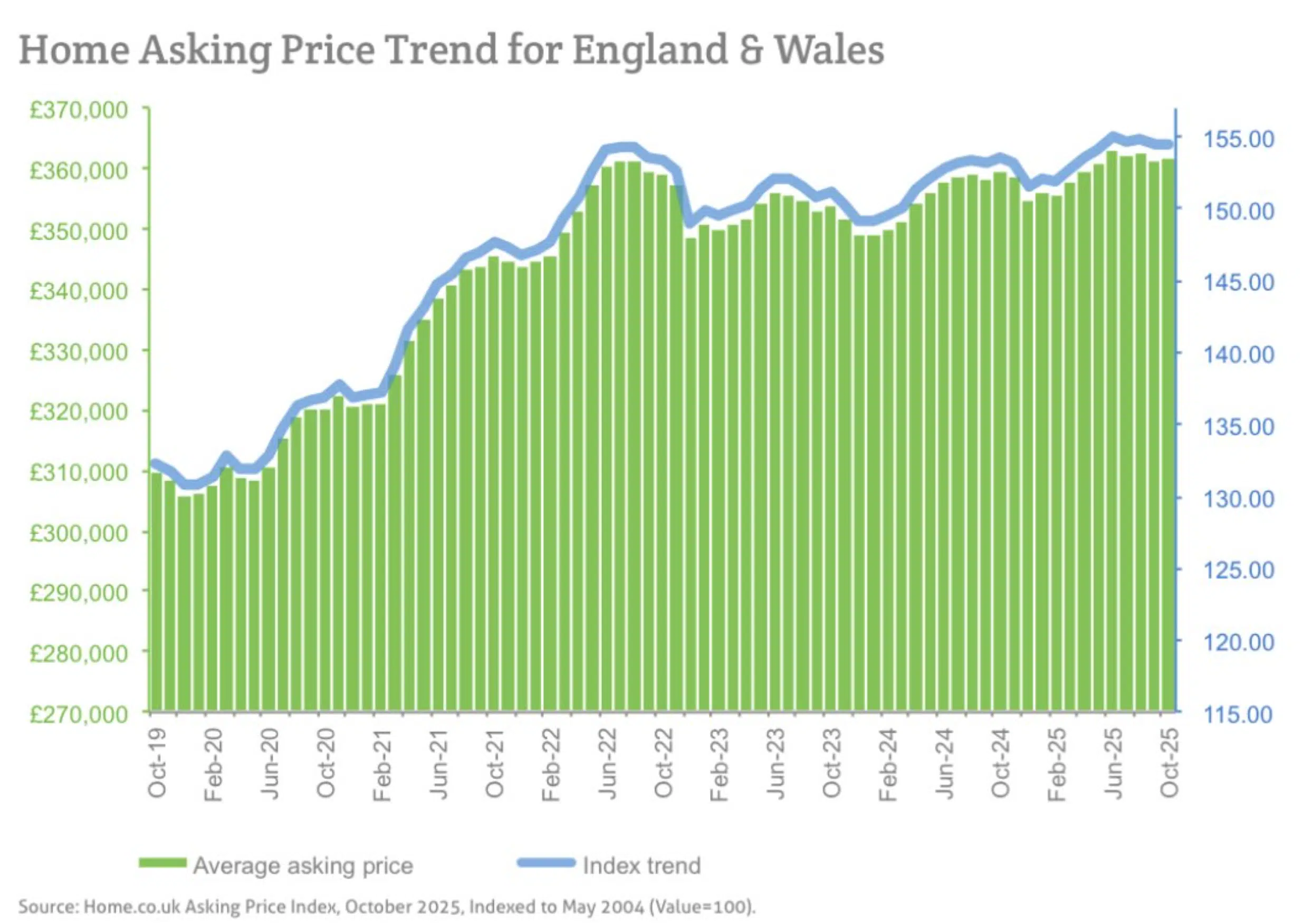

Asking prices remain contained

Unsold stock keeps the portal shelves bulging, grounding prices and deterring others from joining till there is more certainty post budget day. As a result the mix-adjusted average asking price for England and Wales according to Home_co_uk edged up by only 0.1% in September. Yorkshire is the top annual performer with 3.6% growth while the south west was the worst at -1%.

The housing promise Labour could never ‘afford’ is to be broken

Affordable homes target in London is to be culled to 20% to keep developers on side according to a leak memo seen by the iPaper.

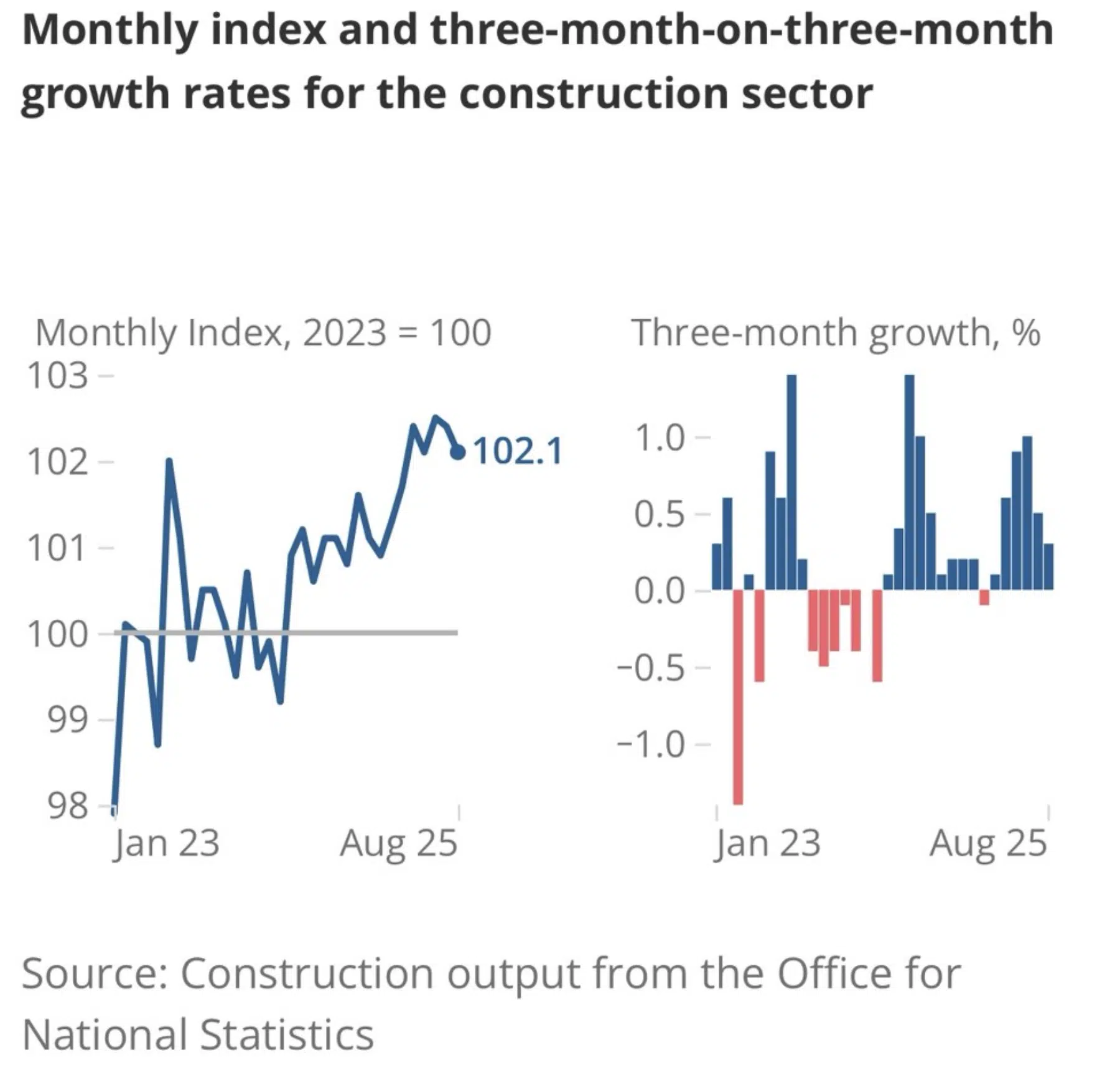

Existing housing stock gets maintained in favour of development

Housing repair and maintenance boosted overall growth in the construction sector over the past three months by 0.3%, the latest GDP report showed. Private housing repair and maintenance rose 5.6% while new work fell 1.8% leaving new housing targets off their mark.

Reeves hints at further taxes on the wealthy

Reeves looks poised to extract from homeowners and landlords via capital gains and NI payments causing further market chaos for the sector, which will only further squeeze renters as prices increase and potentially lockdown the top end of the market.

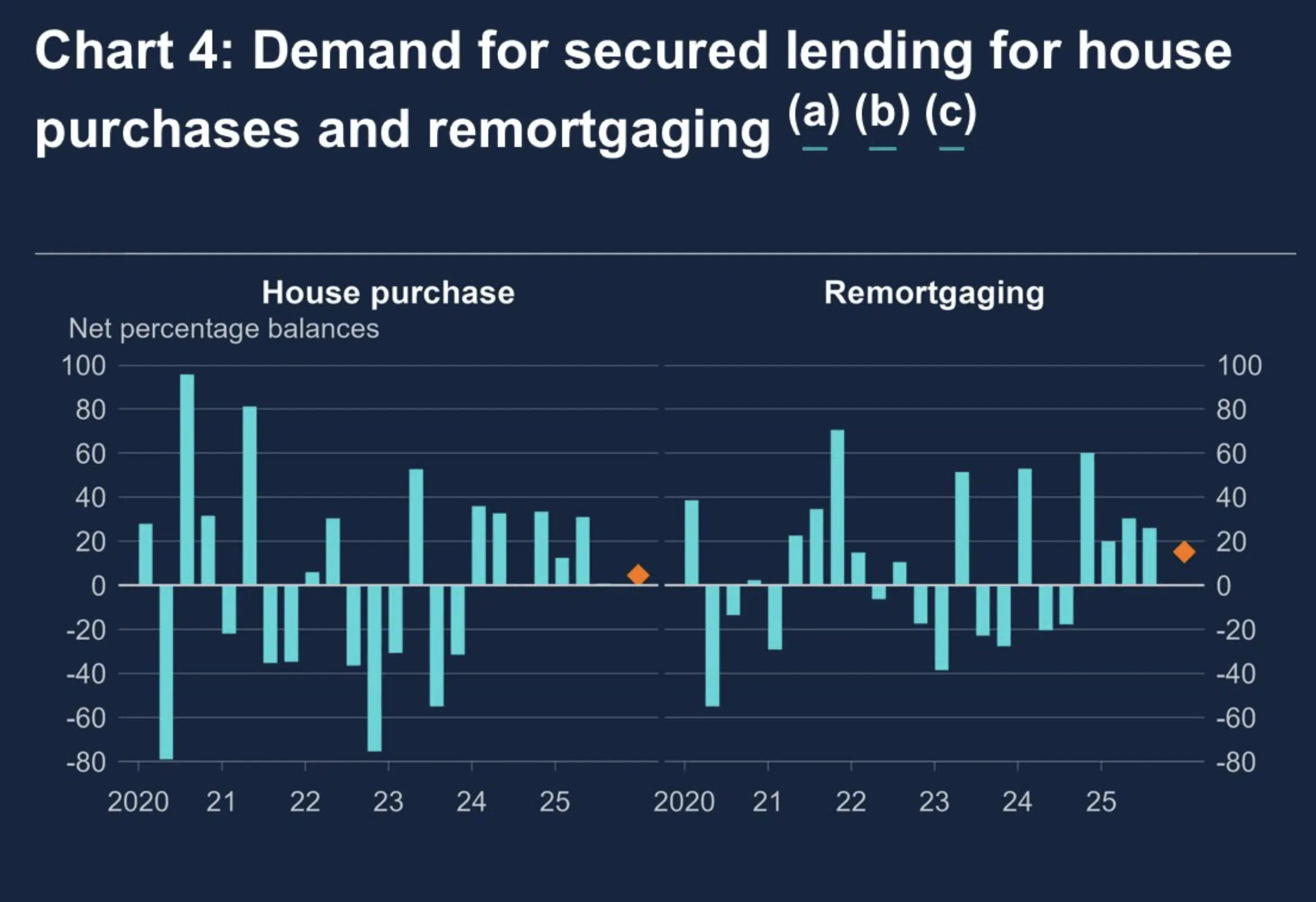

Mortgage lending remains constant

No change: secured lending for house purchase remained consistent in Q3, while demand for remortgaging increased and is expected to rise again in Q4 as more borrowers run out of the once cheap borrowing line, the Bank of England reported.

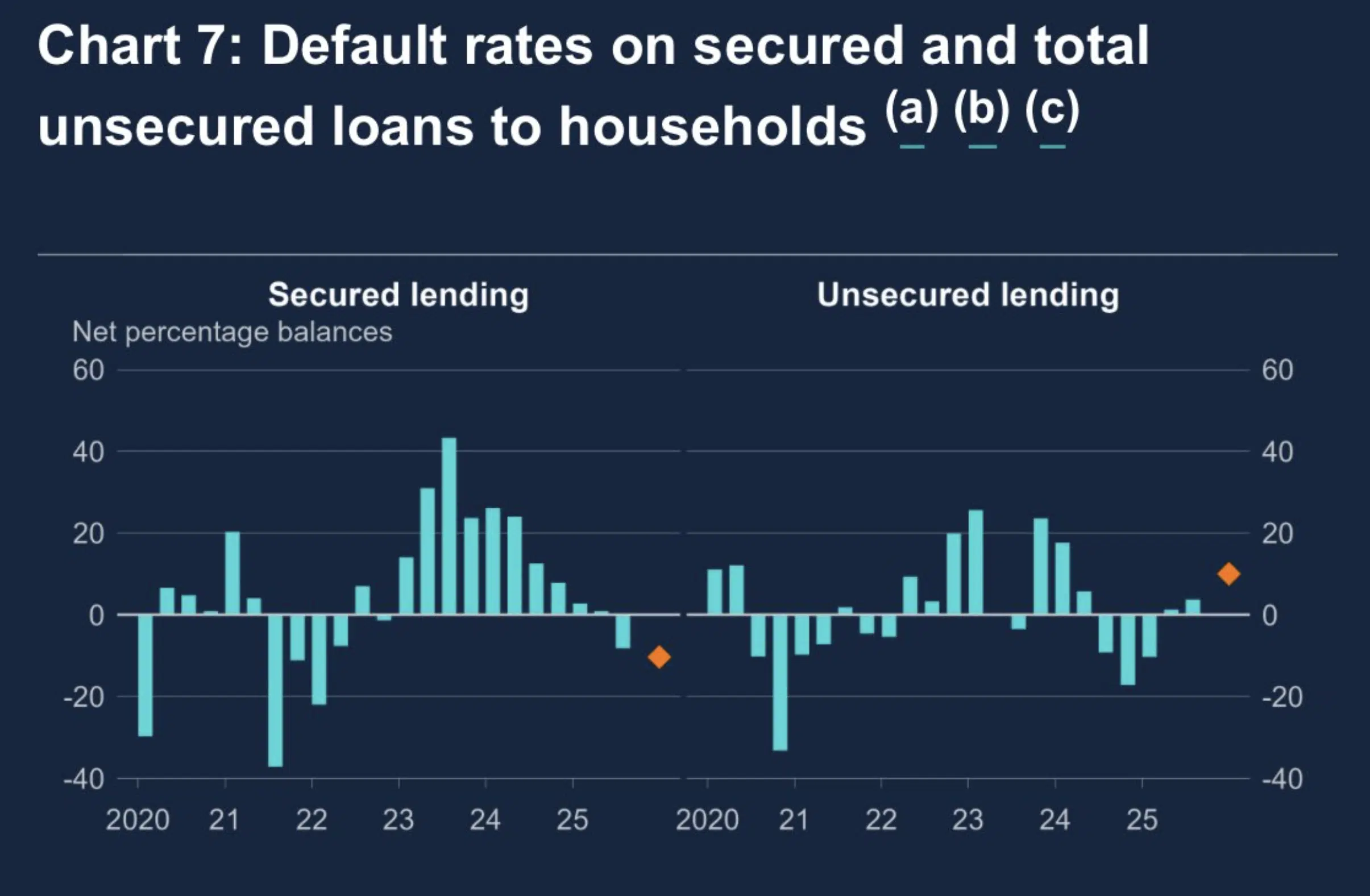

Signs of defaults salvation

The number of homeowners in the red decreased in Q3. Default rates on secured loans edged down in Q3 and are expected to decrease further in Q4. However losses rose in Q3 but are expected to also decrease in Q4.

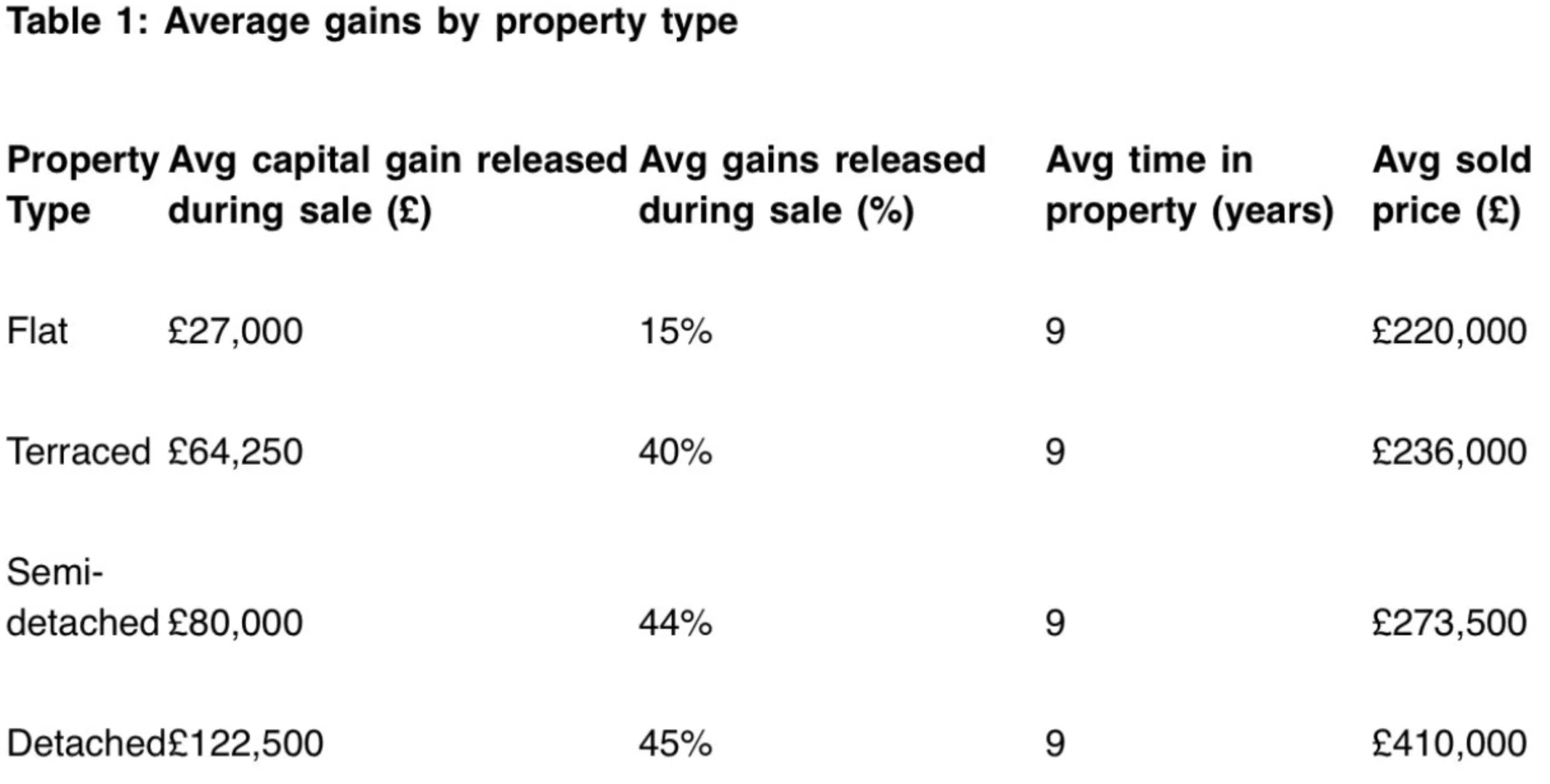

Freehold properties make gains

New research from Zoopla found freehold properties made greater gains over the average lifespan of a home, nine years, than flats. Recent cladding, ground rents, service charge and building insurance hikes denting price growth.

Overall, sellers in England and Wales were found to have made an average gain of £72,000, a 38% increase in value from when they bought the property.

Pricing right remains key to moving on

According to TwentyCi latest property home mover report, sales activity ticked up alongside new instructions. Pricing however remains key to any move which many sellers continue to get wrong: in the year-to-date, 919,000 properties were reduced, up 16% on last year. The hardest hit remains those properties priced above a million and located in the south.

The city seeing the most action was Cardiff, with agreed sales up 6.4% on last year while the East Midlands was the most popular region, sales up 6.5%. In stark contrast, inner London saw sales decline 3.8% – budget uncertainty gnawing at sales pricing and activity.

HMRC ensures it gets seconds

The taxman collected £256 million of unpaid capital gains tax last year, up 41% on the year before. Keen to ensure no capital is missed, HMRC are ploughing more resources into collection to plug the deficit

RICS flooding advice

RICS released a new practice information paper on evaluating flooding risks for homeowners. This, for many UK homes could make or break properties in the future. Homes that were once perceived desirable could find themselves unmortgageable if not insurable in the future. As a result, some homeowners may be stuck for life.

That concludes this week’s UK Property News Recap 17.10.2025. Any comments or suggestions, please don’t hesitate to get in touch.