This week, inflation falls short along with base rate cut expectations causing mortgage rates to increase. Legal challenges and promises are made while others are stalled. Annual and monthly data diverge while 2023 losses left the buy-to-let and construction sector reeling. Welcome to your UK property News Recap – 19.04.2024

The British Property Federation industry group sets their sights on Hunt

The British Property Federation industry group penned a note to Jeremey Hunt asking for him to reconsider scrapping stamp duty relief for multiple dwellings. They claimed that this crackdown on abusers of this tax loop, which would bring in around £290m to the Treasury, means they will lose around £900m from the UK Student Accommodation Fund from a lack of investment.

Rent growth stalls

Rental growth appears to be stalling as affordability issues dampen growth and demand wanes. Yet long term, new investment remains sluggish which will prove troublesome as demand is only due to increase.

According to Hamptons; the pace of rental growth has continued to slow, with the average price of a newly let property in Great Britain rising 6.7% over the 12 months to March 2024, reaching an average of £1,319 per month. This means that rental growth has nearly halved since it peaked at 12.0% in August 2023. “However, rents still stand 31% above their pre-pandemic average, while in the North West rents are 42% above their pre-pandemic peak, higher than anywhere else”

For Londoners though, rental growth has slowed faster than anywhere else in the country, rising by just 0.4% over the last 12 months as tenants hit their affordability limit.

Rightmove reveals which streets are asking the most

In case you were interested in knowing where you weren’t going to get bang for your buck. Rightmove revealed the most expensive streets…where sellers are ASKING the most, in the UK. This will no doubt impress those residents on the streets while diverting buyers and renters who don’t feel the necessity to show off elsewhere.

Based on where there are at least five properties for sale and rent this year – average asking prices were highest on Buckingham Gate at £9,633,333. Outside of London, Old Avenue in Weybridge, Surrey, came out top, averaging £2,633,333.

For rentals; Albion Street in Bayswater, West London, demands an eye watering £20,857 per month & outside London, London Road in Ascot, Berkshire cost £6,831 per month.

Buy-to-let boss takes a hit

2023 was a tricky year for many; for Andy Goldin, boss of OSB, which specialises in buy-to-let mortgages it meant a 40% dent to his earnings. Mortgage borrowers’ reversion rate response to high interest rates landed “a £210.7m blow to OSB’s annual pre-tax profits, which fell to £374.3m last year from £531.5m in 2022. When the bank first revealed the problem last July, shares in the group tumbled by 29% in one day.

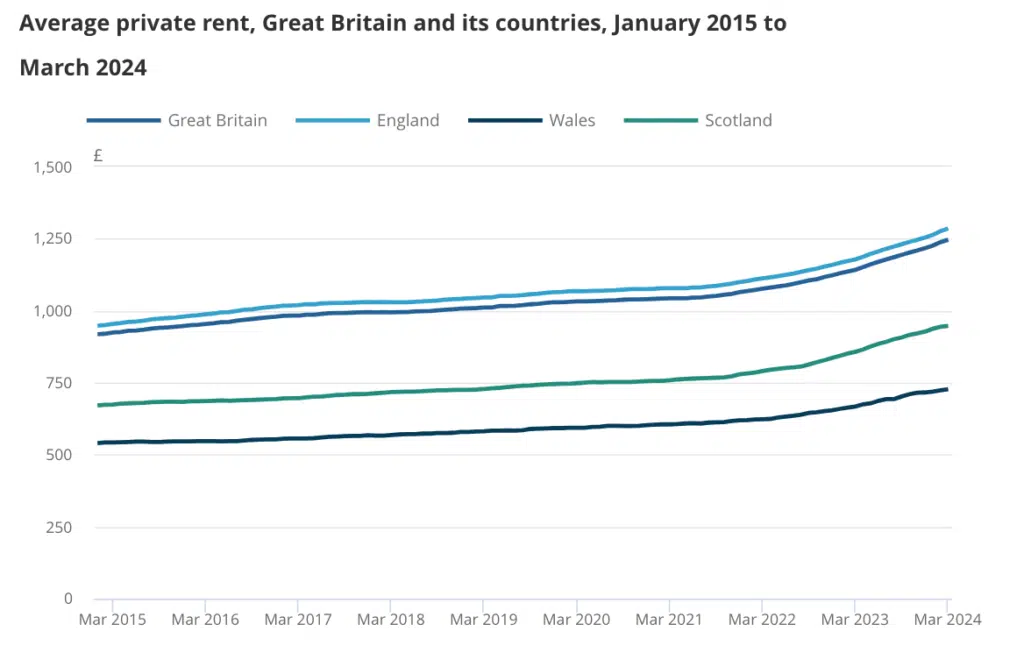

ONS private rents for March 2024

Driven by rental increases in England & Northern Ireland, according to the ONS, average rents crept up from 9.0% in Feb to 9.2% in the 12 months to March 2024. This is the highest annual percentage change since the ONS UK data series began in January 2015.

The ONS reports:

£1,285 (9.1%) in England – up from 8.8% in February 2024

£727 (9.0%) in Wales – unchanged from the 12 months to February

£947 (10.5%) in Scotland- up from an annual inc of 10.9% in February

For Northern Ireland in the 12 months to January 2024, there was a 10.1% increase, up from 9.3% in December 2023.

For struggling Londoners, the capital had not only the highest private rent inflation at 11.2%, driven largely by high rent growth in Brent, but also the highest average private rent in Kensington and Chelsea.

ONS House Price Index – February 2024

According to the ONS, average UK house prices decreased by 0.2% in the 12 months to February 2024 but increased 0.4% compared with January 2024 prices. Once again on an annual basis, Scotland and Northern Ireland continued to see prices increase while England and Wales remained in negative territory. However the monthly picture showed England clawing back some lost ground, especially in the East Midlands.

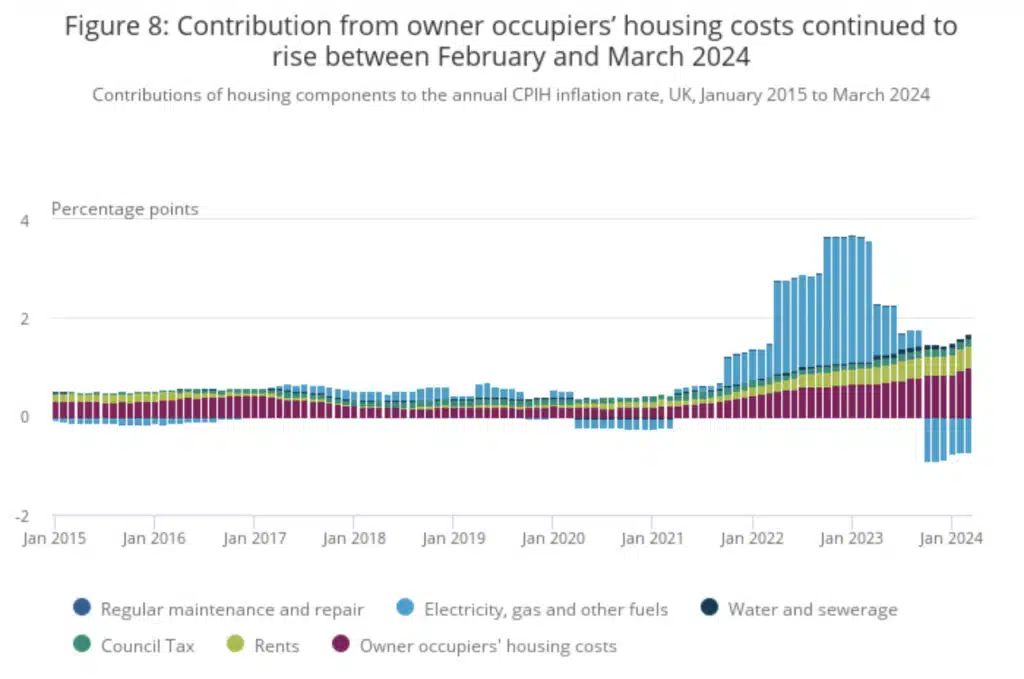

Inflation expectations fall short along with rate cuts

The rate of inflation may be slowing but after expectations were left short after inflation slowed to 3.2%, the markets placed new bets that the first base rate cut will be pushed back to September/November. However, this setback could be short lived as April’s reduction in Ofgem’s energy price cap is likely to further dampen the rate of inflation towards the Government’s 2% target. So bets today could be off, yet again, in a few weeks.

Despite the overall easing in inflation, it doesn’t touch the sides for those with mortgages, rents and council tax to pay who continue to feel squeezed. “Owner occupiers’ housing costs rose by 6.3% in the year to March 2024, compared with a rise of 6.0% to February. The OOH annual rate was last higher in July 1992.

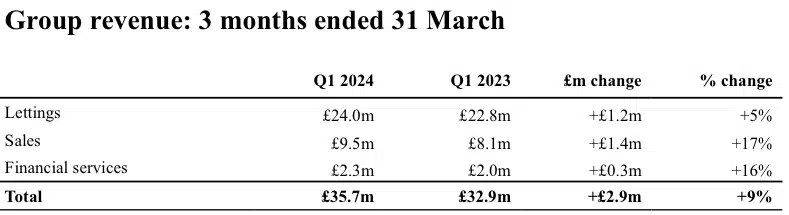

Foxtons first quarter comeback results

Foxtons made a dramatic 2024 comeback – their first quarter revenue results showed a 9% growth spurt across all business segments to £35.7m. As a consequence the company’s expectations are high for Q2 2024.

– Lettings revenue up 5% in the quarter to £24.0m

– Sales revenue up 17% in the quarter to £9.5m

– Sales agreed in the quarter were 31% higher by volume compared to Q1 2023, the value of which was 34% higher than 2023, the highest value since the 2016 Brexit vote.

Sadik Khan throws in the kitchen sink

Khan set out his aspirations, hopes and dreams for re-election, omitting feasibility. As part of his canvassing spiel he claimed to want to double income from Places for London by “quadrupling the number of rental homes on TfL’s books, from 4,000 to 20,000, by 2031” while also capping around 6,000 rents & investing profits back into TFL.

Sometimes, if something sounds too good…it is.

Tory rebels hope to further stall Leasehold reform bill

Tory rebels were at it again, hoping that amendments and court lack of capacity would give Section 21 a stay of execution. The bill that has spent years kicking around the chambers is yet to be signed off and could potentially be kicked into the long grass, for Labour to pick up post-election.

Home Reit comes under fire

Acquisition overspending and lack of rent means Home Reit faces a legal challenge from its shareholders. Home Reit, keen to defend its position, has in turn laid the blame at Alvarium Fund Managers, its former investment adviser, and AlTi RE, Alvarium’s parent company. May the legal battle commence.

Mortgage rates increase..again

What a difference a day makes…according to Moneyfacts on Friday, two and five-year average rates increased for both residential and buy-to-let mortgages by around 0.02% while product choice reduced. Costing existing and new borrowers, along with brokers…grey hair.

The average 2-year fixed residential mortgage rate today is 5.83% ⬆️ from an average rate of 5.81% on the previous working day.

The average 5-year fixed residential mortgage rate today is 5.40% ⬆️ from an average rate of 5.39% on the previous working day.

Today there are 6,301 residential mortgage products available ⬇️ from 6,342 products on the previous working day.

The average 2-year buy-to-let residential mortgage rate today is 5.56% ⬆️ from an average rate of 5.54% on the previous working day.

The average 5-year buy-to-let residential mortgage rate today is 5.52% ⬆️ from an average rate of 5.51% on the previous working day.

Today there are 2,764 buy-to-let mortgage products available ⬇️ from 2,768 products on the previous working day.

Osborne files for Administration

Property developer Geoffrey Osborne has filed for administration after 58 years of trading. This is despite the company’s best efforts, which included selling its property management division, infrastructure business and offsite manufacturing arm, securing 850 jobs. “Residual losses on legacy projects that have undermined performance, have impacted on their ability to win new work.” Another 2023 construction casualty.

And that concludes another UK property News Recap – 19.04.2024. Should you have any comments or suggestions, as ever, please get in touch here.