Another week of budget speculation continues to have the UK property market on hold. Developers plead for relief, sellers pray to escape additional taxes and buyers watch, hopeful, for rates to fall and the market to freefall in the chaos making buying more affordable. Next week the speculation will be put to bed, meaning all parties can decide whether to move forward or stay put. Welcome to another UK Property News Recap – 21.11.2025.

Asking prices feel the weight of budget speculation

UK property prices are freezing under budget speculation, with the top of the ladder feeling the chill more severely than those listings on the bottom rungs. Average new seller asking prices typically fall in November but this year it was noticeably more marked, down by 1.8% (-£6,589) to £364,833. Price reductions also gathered momentum with little effect. Agreed sales for homes priced above £2m were down 13% and 8% between £500,000 and £2 million. Below this, agreed sales only dropped 4%; many a portfolio investor and first time buyer cracking on at this level without the same concern of significant additional taxes as those at the top fear.

Councils silenced by the government from blocking planning permission

“Councils will be prevented from refusing planning permission for housing projects of more than 150 homes and will have to refer the application to the government for a decision.” The government will silence the nimbies to get their housing numbers up, whatever the cost, as they bank on younger voters and economic growth; rates and taxes permitting.

Super prime residential sales are hit by global uncertainty

Dubai is profiting from global political shocks that have super prime activity on the rocks. Across 12 key markets, Knight Frank found the average sale price settled at US$18 million, down from US$20 million in Q2. Dubai, New York and Los Angeles dominated transactionally and in value while London saw volumes fall back noticeably to 36 deals, -31% QoQ under the spotlight of Rachel Reeves’s forthcoming budget.

Retirement home specialist calls for stamp duty relief for downsizers

John Tonkiss, the outgoing chief executive of RETIREMENT homes specialist McCarthy Stone, called on the government for a ‘targeted stamp duty relief’ for those downsizing to stop ‘older people rattling around in homes that are too large for them’ and free up stock for families. At the same time boosting their bottom line…

Planning for retirement could cost future housing

About a fifth of planners intend to leave or retire within the next 5 years. Given the government’s own plans to “build baby build” they may have to rethink how they incentivise a new generation of planners. When faced with a wage packet of £40-50,000 over £80,000 in the private sector, I know which one most would choose.

Labour minister resigns for neglecting to get a property licence

Labour minister Michael Situ resigned for not having a licence to rent out his properties in Southwark while Reeves kept her seat. Again, blame was attributed to the agent but responsibility lies with the owner…

Crest Nicholson profits slide

Another developer feels the economic strain from budget uncertainty. Crest Nicholson’s latest trading update revealed their adjusted profit before tax performance for FY25 is expected to be at the low end of, or marginally below, the guidance range of £28-38m. Despite their sales rate initially lifting at the start of the year the past 13 weeks haven’t been kind, falling below 2024 year levels to 0.45. In addition the volume of units was just below their guidance range at 1,691 units.

Council tax looks set to double for higher bands

Speculation is mounting that council tax bands F,G and H will double. A rise to the higher council tax bands will be a tax on the capital and the south depleting house prices but if not introduced till 2028, expect a lot of movement before then both from homeowners and politically.

Opposition to new housing developments near railway stations to be railroaded

Your next stop will be in development shortly. Please mind the objection gap. New homes earmarked near train stations to get ‘default yes’ from planners

Inflation falls giving room for a rate cut

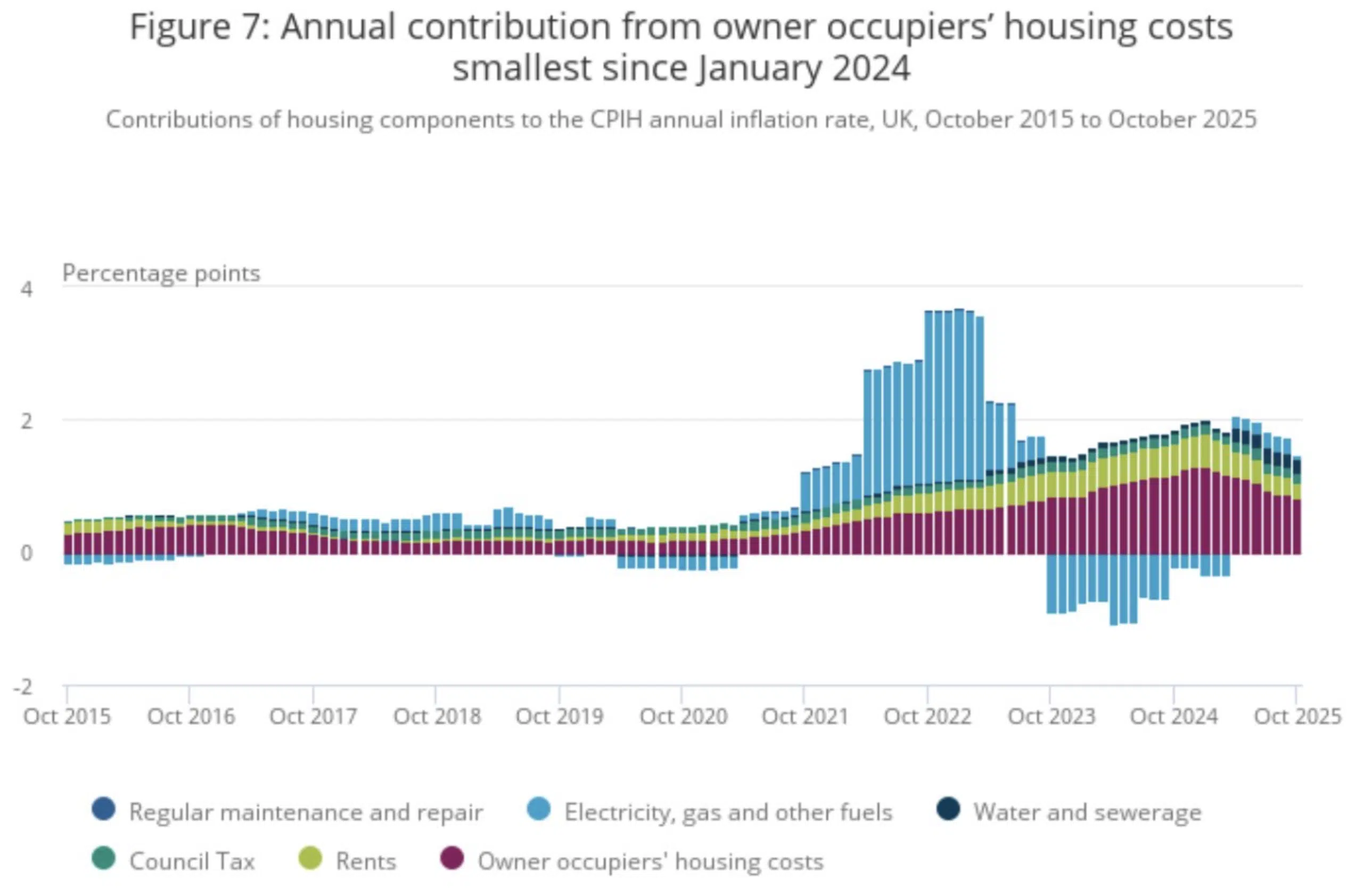

Inflation shuffled down from 3.8% to 3.6%. The OOH costs component, which accounts for approximately 17% of the CPIH, felt the biggest shift via housing and household services which dropped from 5.9% to 5% as the cost to fuel your home slowed.

This won’t provide much warmth to homeowners but it will help avoid frostbite especially if off the back of this, and service inflation falling to 4.5% the Bank of England gifts homeowners with a rate cut for Christmas

Rates fall ahead of budget

Lenders are vying for buyers’ attention before Christmas, dropping rates for those with 40% deposits. Currently Santander is the most eager, closely followed by Nationwide.

Budget jitters sow seeds of doubt across the UK Property market

Rightmove commissioned a study of over 10,000 potential movers to find out how Budget speculation is affecting decisions. As a result: 79% of those aware of tax changes said they were concerned and 17% were on pause. Those based in the south or over the age of 50 displaying the most concern.

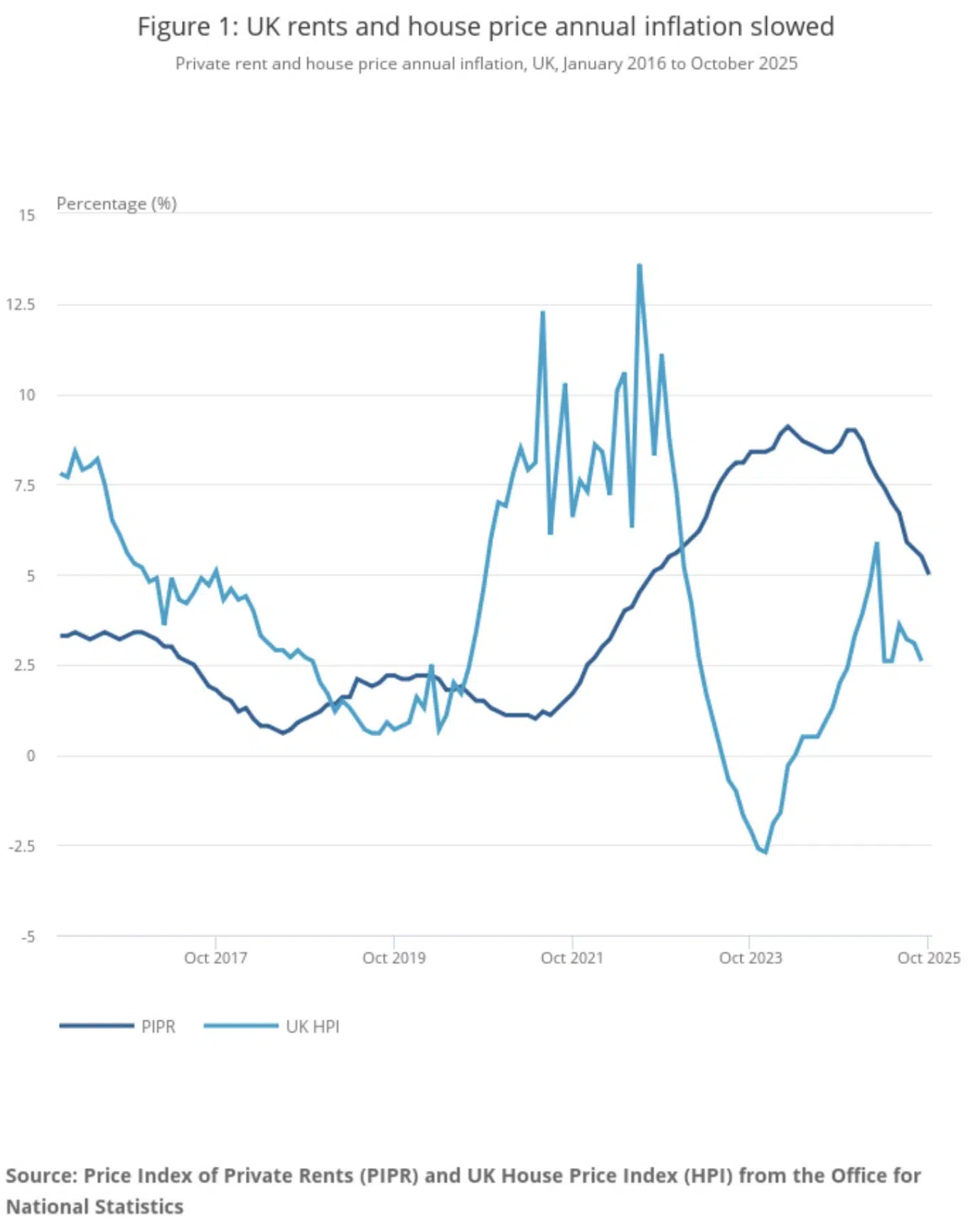

Average rents and house price growth slows

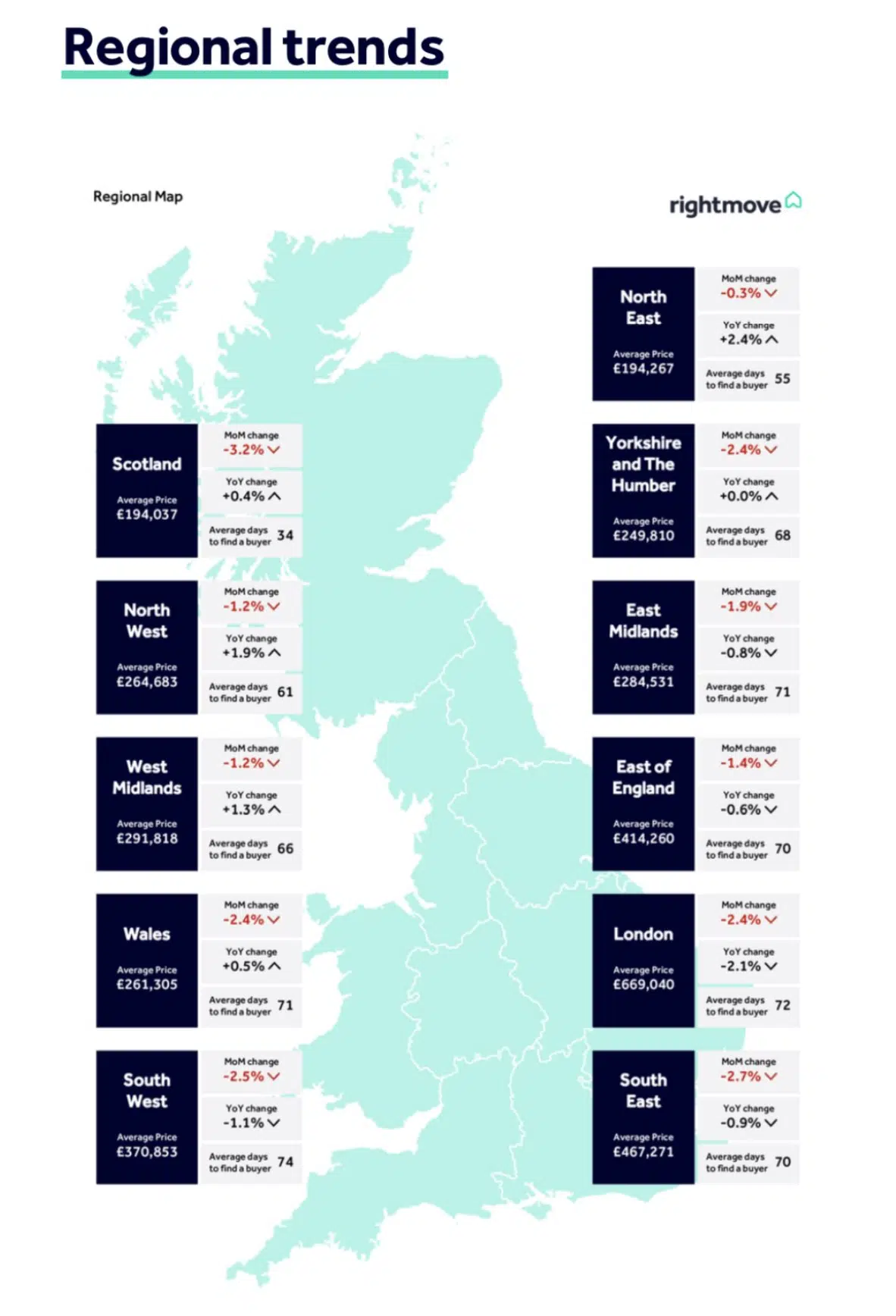

Average rents and house price growth have slowed, the former due to affordability constraints and the latter because of economic uncertainty and concerns over tax rises which may dent any benefit felt from rate cuts.

The average UK house price increased by 2.6%, to £272,000 in September. Scotland saw prices rise the most, up 5.3% and England the least up 2.7%. Meanwhile average rents increased 5.0%, to £1,360 in October with inflation highest in the North East (8.9%) and lowest in Yorkshire and The Humber (3.8%).

Kensington and Chelsea consider doubling council tax on second homeowners

Kensington and Chelsea consider finding £130m down the back of second homeowners’ sofas to plug funding gap left from central government’s decision to divert funding from affluent councils towards poorer ones.

Annual housing supply falls

So…how’s that building going, babe?

Annual housing supply in England actually decreased annually by 6% to 208,600 net additional dwellings in 2024-25.

New build homes consisted of just 190,600, of which 58,960 were new build affordable homes. 17,710 came from change of use between non-domestic and residential, 3,850 from conversions between houses and flats and 1,080 other gains (caravans, house boats, etc), offset by 4,630 demolitions.

That concludes another UK Property News Recap – 21.11. 2025. Any comments or suggestions please get in touch.