Half term over, the UK property market appeared to go back to school. Short lets sought permission, bailed out councils took away privileges. Sellers hoped for higher results while landlord growth was held back. Older borrowers took an extended sabbatical, while China got needy, overcompensating for past failings. In the debate team, Andy Haldane pitted himself against Andrew Bailey on interest rates, and the head suggested 99% mortgages to get down with the kids. Welcome to another UK Property News Recap.

Michael Gove seeks permission to restrict Airbnb’s in saturated areas

Michael Gove annonuced plans to curb 90 day + short lets by firstly making owners apply for planning permission, which costs around £450, before signing up to the government registration scheme. In addition, he plans to get legislation passed for new laws which would empower local authorities to evoke “permitted development rights”, restricting further growth of Airbnbs in areas already overun.

Rightmove HPI for February

Rightmove, who loves to report on the months property activity before it even ends, found agreed sales got a 3% boost on 2019 levels for the first six weeks of 2024. Renewed seller optimism increased listings by 7% along with average ASKING PRICES, which were up 0.9% in February to £362,839.

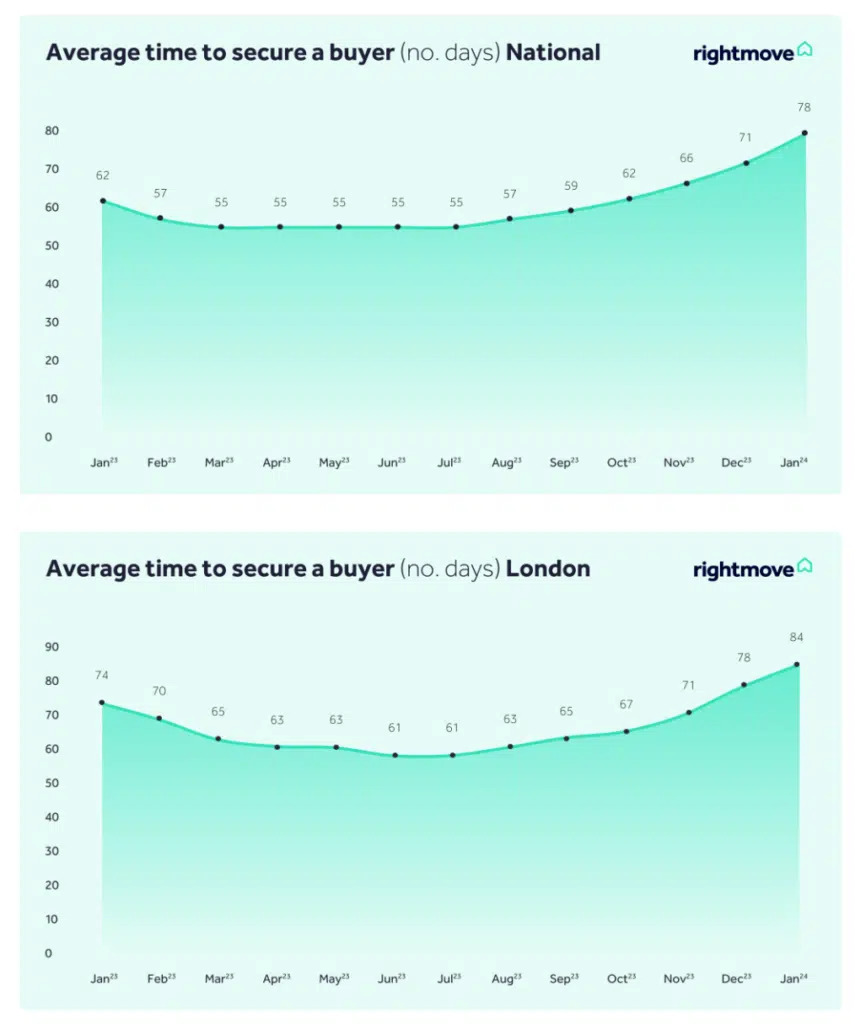

Caution is advised though as misguided pricing can be detrimental if hoping to agree a sale without first having to reduce. Given the average time to agree a sale is between 78 to 84 days, greed has clearly got the better of some. However, those who price right in the first instance are drawing buyers out from hibernation.

Hamptons Lettings Index January 2024

Hamptons lettings index for January 2024 showed the pace of rental growth slowed between August 2023 and January 2024 in 8 of the 11 regions in the UK.

Due to affordability pressures, London’s rental growth was notably stunted, with growth retracting from 17.1% to 8.1%. As a result of this shift, 59% fewer landlords secured higher rents in January 2024. Though significant, I suspect many renewals were hit with a significant increase the year before, hence the reticence to squeeze tenant affordability further. Landlords are choosing sustainability, over the risk of an indebted tenant.

Older borrowers take time out from mortgage lending

In 2023 older borrowers, faced with the prospect of high rates, took some time out from mortgage lending in the hope the “base” will kick in 2024.

The Financial Times reported that:

“The number of new mortgages taken out by older borrowers — aged 55+ — fell by 37% year-on-year in October, November & December last year. The value of this lending was £4.1bn, down 42% and new lifetime, or equity release mortgages were down 40%.”

The London School of Economics and Political Science – Capital Gains Data

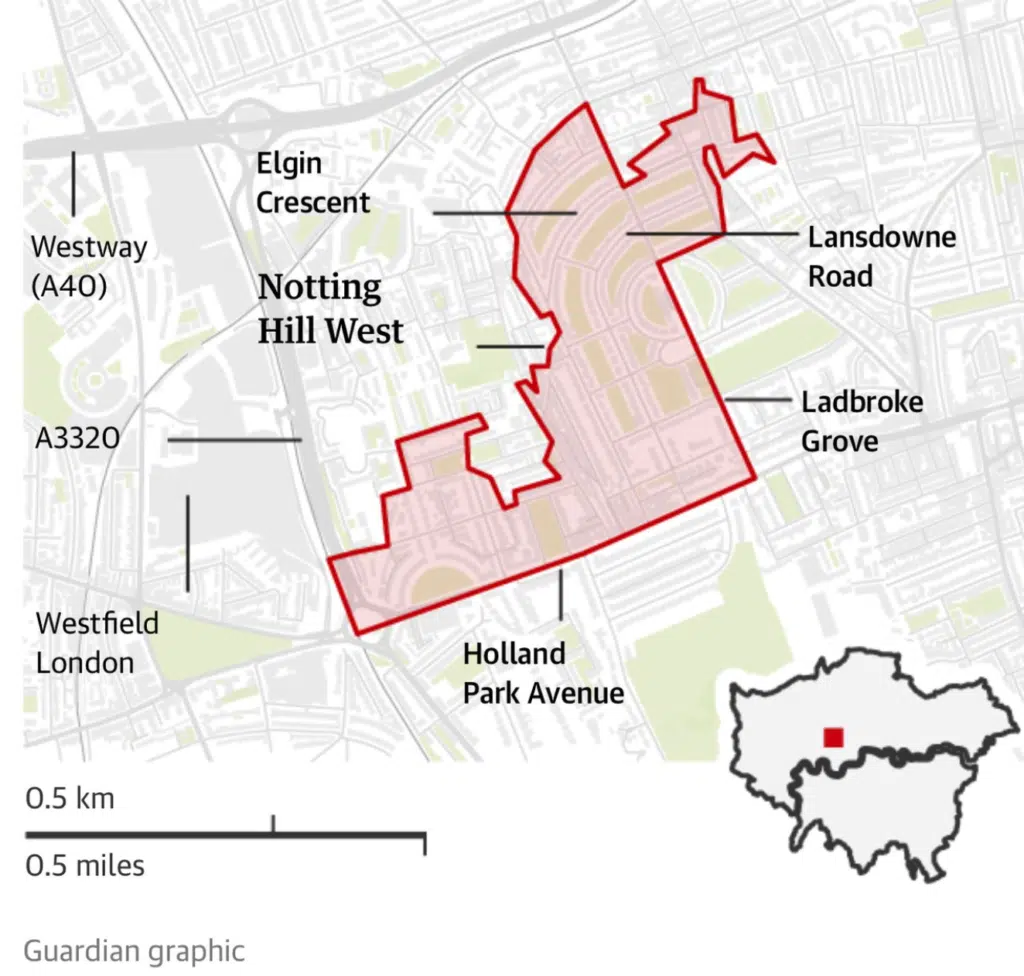

Over at the Guardian; researchers at the London School of Economics and Political Science found “that 97% of the population never receive any capital gain. In fact, half of capital gains for the entire country go to as many people as could fit in the Albert Hall.”

Unsurprisingly, gains are concentrated in the capital, closely followed by the South East. Within London, gains were restricted to the richest postcodes, however for people

people living in a select number of streets in Notting Hill, research revealed they “had as much capital gains in 2015-2019 as Liverpool, Manchester & Newcastle combined”.

Desperation in China

Financial scaffolding is brought in to hold up the new homes market but offers no relief to existing borrowers while squeezing bank profits.

“On Tuesday the benchmark 5 year loan prime rate, which affects borrowing costs for households, was lowered from 4.2% to 3.95%.”

The need to bolster the flailing property sector, after developer Evergrande was put into liquidation, is clearly a pressing financial issue for the country.

Andy Haldane vs Andrew Bailey

Ex-Bank of England economist Andy Haldane decided enough was enough and laid into governor Andrew Bailey for not acting fast enough when tackling inflation:

“It’s one thing to have missed inflation on the way up, which happened, it’s quite another to then have crushed the economy on the way down. That double blow to credibility is one if I were a central banker, in my old job, I would be looking to avoid.”

This critique was picked up on by the Treasury Select Committee chair, causing Governor Andrew Bailey to downplay the UK recession and emphasise the labour market risks…

Birmingham City Council Cuts

Despite Birmingham City Council being handed a £1.25bn bail out after mismanagement of public funds, the council is planning to spend £367m less on services and increase council tax by 21% over the next 2 years. Other potential cuts include but aren’t limited to:

- 600 jobs cuts

- Cuts to services supporting children & families

- Cuts to adult social care

- Street lights to be dimmed

- Reduced highway maintenance

- Fortnightly rubbish collections

- The closure of potentially 25 libraries

99% mortgages LIKELY

More Government election desperation to appear down with the kids came from speculation that a “ new Treasury-backed 99% mortgage scheme was LIKELY to be in the chancellor’s March 6 Budget.”

The offer of more debt on a property you may still not be able to afford, to enable buyers to step up on the property ladder in return for some votes, caused some “negativity” around equity.

Mortgage rates take one step back

Here today, gone tomorrow. HSBC, NatWest, and Virgin Money decided to increase the cost of new deals while Halifax made cuts on others. The rate see-saw to first attract customers and then repel them doesn’t make for a steady relationship.

And that concludes another UK Property News Recap. Should you have any comments or suggestions, as ever, please get in touch here.