This week was all about revisal; be it property prices or rental growth, all were called into question and reined in. Affordability and caution dampened once-optimistic indices and agents’ predictions. Conservative leader Badenoch hoped to prove “clever” in her reshuffle and Ellen DeGeneres to make a swift “buck” on her home in the Cotswolds with a PR drive. The only outlier was buy-to-let lending which appeared to stretch its haunches in Q1. Welcome to this week’s UK Property News Recap – 25.07.2025

Rightmove reports the largest monthly drop in asking prices for July in 20 years

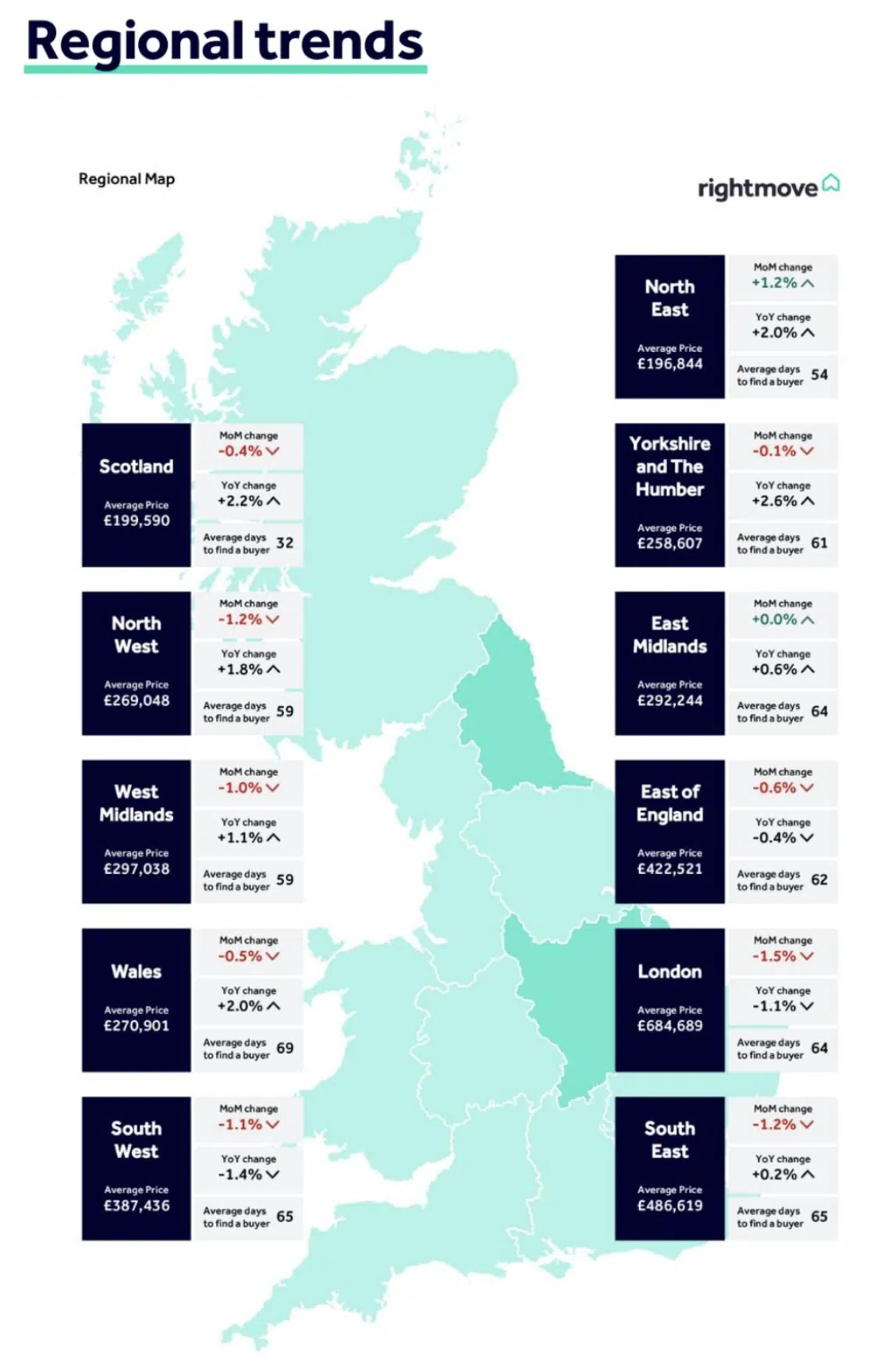

Average new seller asking prices shaved 1.2% (-£4,531) off their starting price in the hope of attracting a buyer during what is typically a sticky few months. As a result, average new seller asking prices are now just 0.1% higher than they were a year ago. Given the downward shift in rates since then, buying a property is a little more affordable than it once was, which explains the 6% uplift in buyers and the 5% increase in agreed sales on last year’s efforts.

London saw the biggest new seller asking price falls this month (-1.5%), superseded only by Inner London where sellers were forced to trim -2.1% off their asking price. This is due to higher priced properties having to cut back further, with demand aloof and affordability stretched. Given this and buyers’ generally cautious approach in the current economic climate, Rightmove revised its growth forecast for the year downwards, from 4% to 2%.

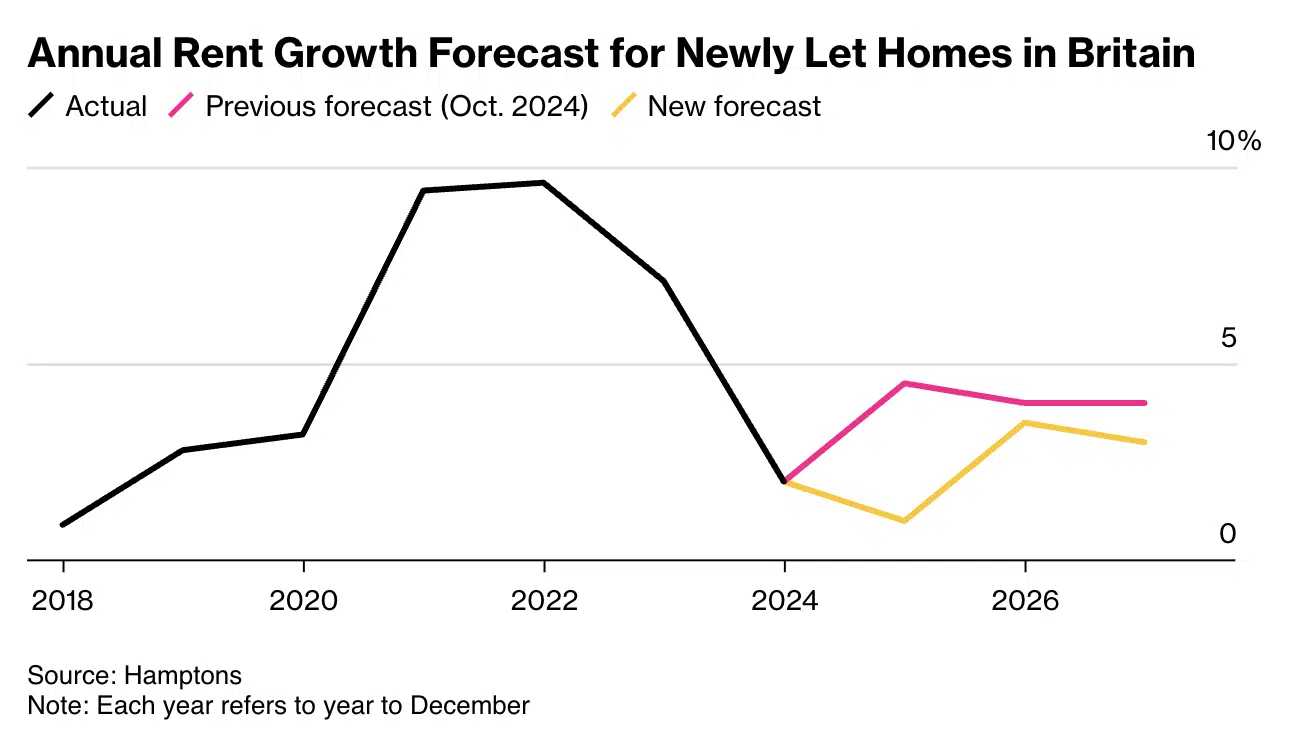

Hamptons Revises Rental Growth Forecast for the year

Rental growth is suppressed by falling rates, which is driving those that can, off the rental merry go round and onto the ladder. As a result, estate agent Hamptons revised its rental growth forecast down from 4.5% to 1% in 2025 and further tightened the next two successive years.

A potential wealth tax on properties over £2m could affect 150,000 households

If implemented, a wealth tax will prove a sinker weight on both house prices and a colossal administrative task to reel in with properties in the Capital and south bringing in the biggest haul.

FCA simplifies mortgage rules

The FCA continues to push lending boundaries. Today this comes in the form of an announcement about a number of VOLUNTARY actions to enable borrowers already on the ladder. Firstly they want to make it easier for borrowers to reduce their mortgage term, saving them from a costly retirement. Secondly, facilitate switching lenders when remortgaging so borrowers can get a more competitive product, which could create more competition in the market and thus enable more borrowers out of a prolonged financial squeeze. Thirdly, and why this is even an announcement is telling in itself. Borrowers will be able to discuss options with their mortgage provider and get advice when they need it. In turn, lenders are EXPECTED to identify and offer advice to those in need…you’d hope they’d already be doing that but still, nothing is written in stone.

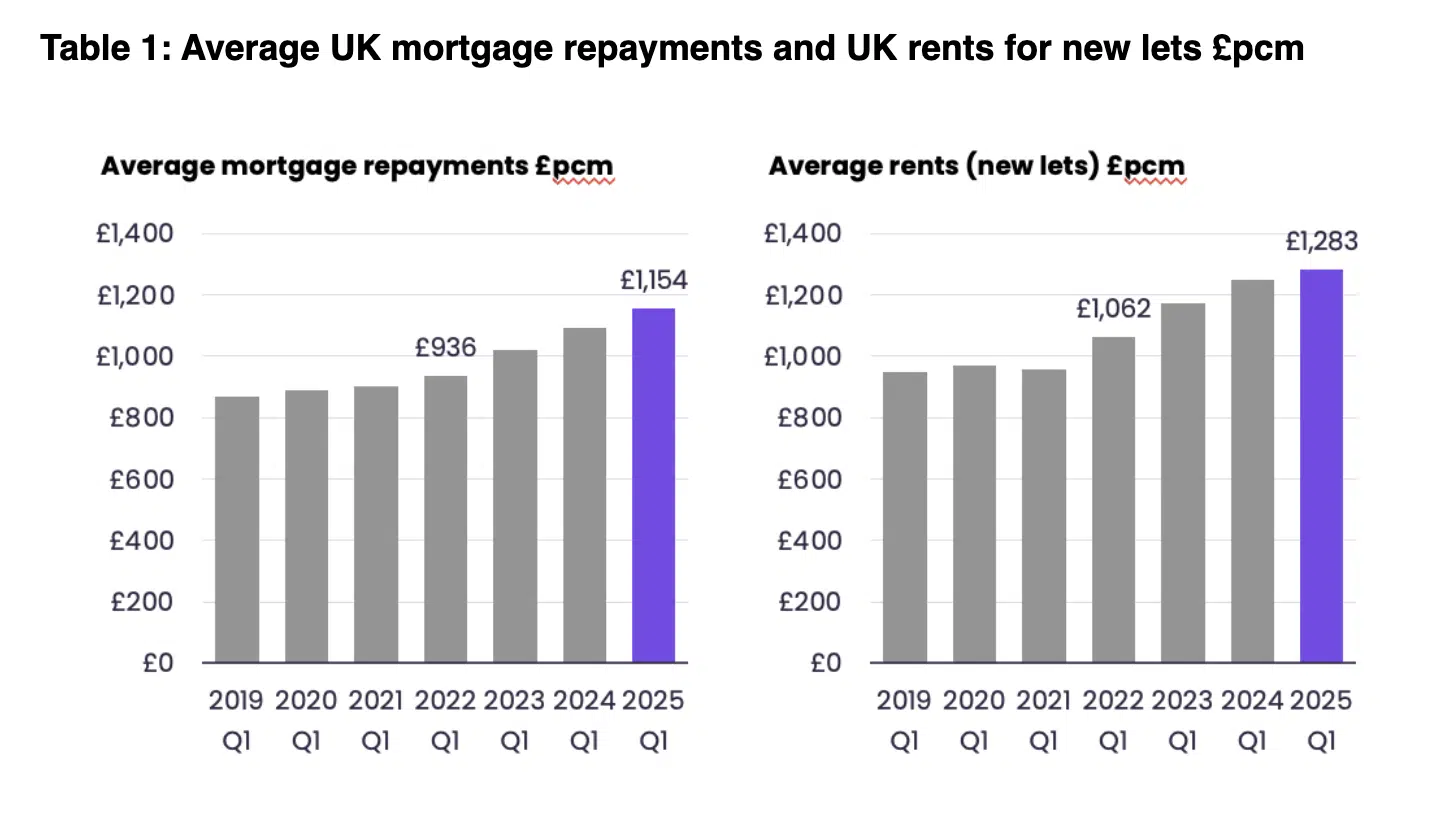

The balance between profit and rental loss

According to Zoopla, over the last three years, the average mortgage repayment on outstanding mortgages rose by £218 per month. At the same time, rents for new lets increased by £221pcm leaving little wiggle room for error. Northern regions have driven rental price inflation but in more expensive areas, like London, affordability now strained, rental inflation has been contained.

As a result chasing a profit has become less likely for those indebted, leaving only cash rich investors in the rental game. The once reliable individual pension pot is tipped upside down, with new regulation, maintenance, increased insurance and rental repayments resulting in Landlords attempting to cash out.

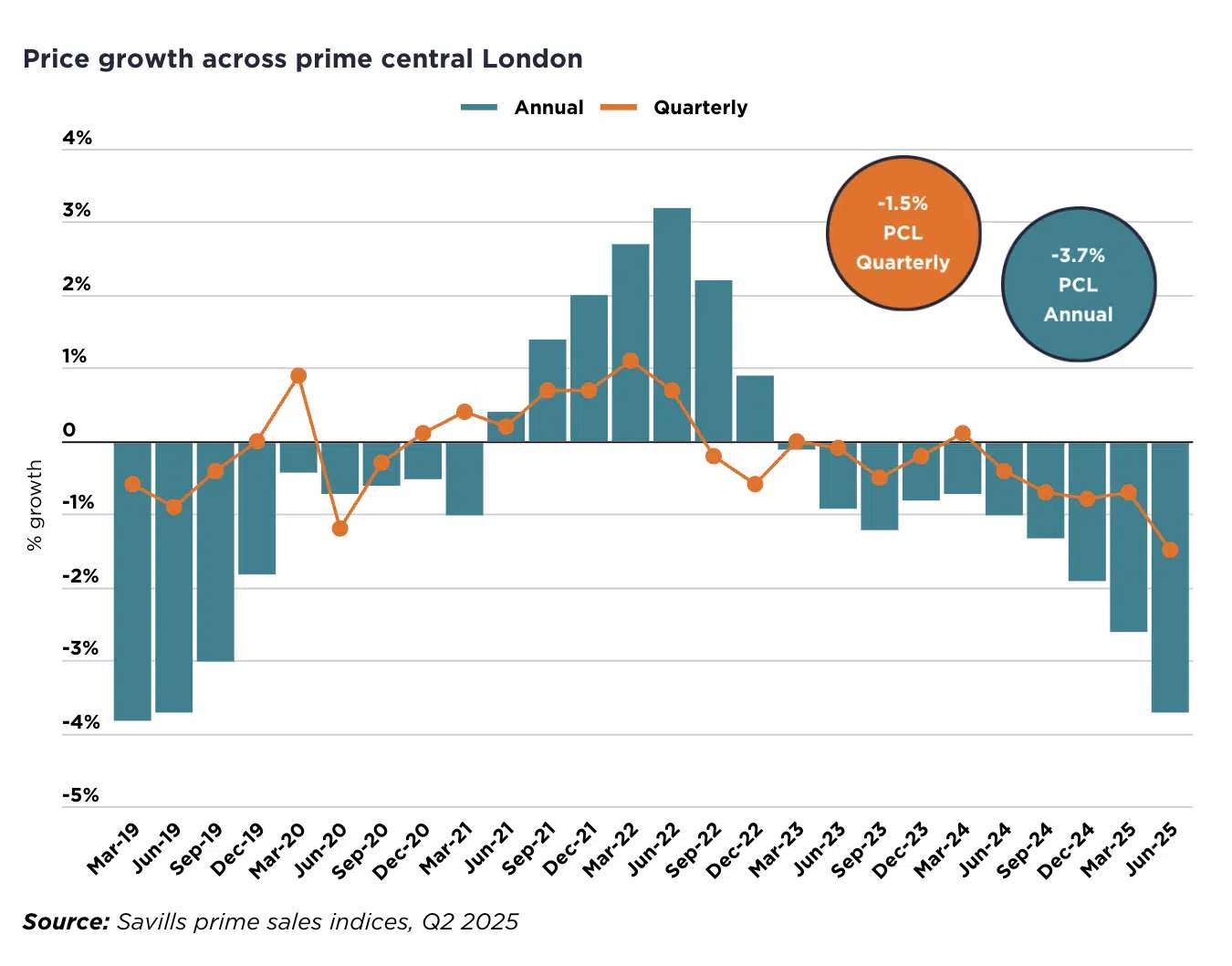

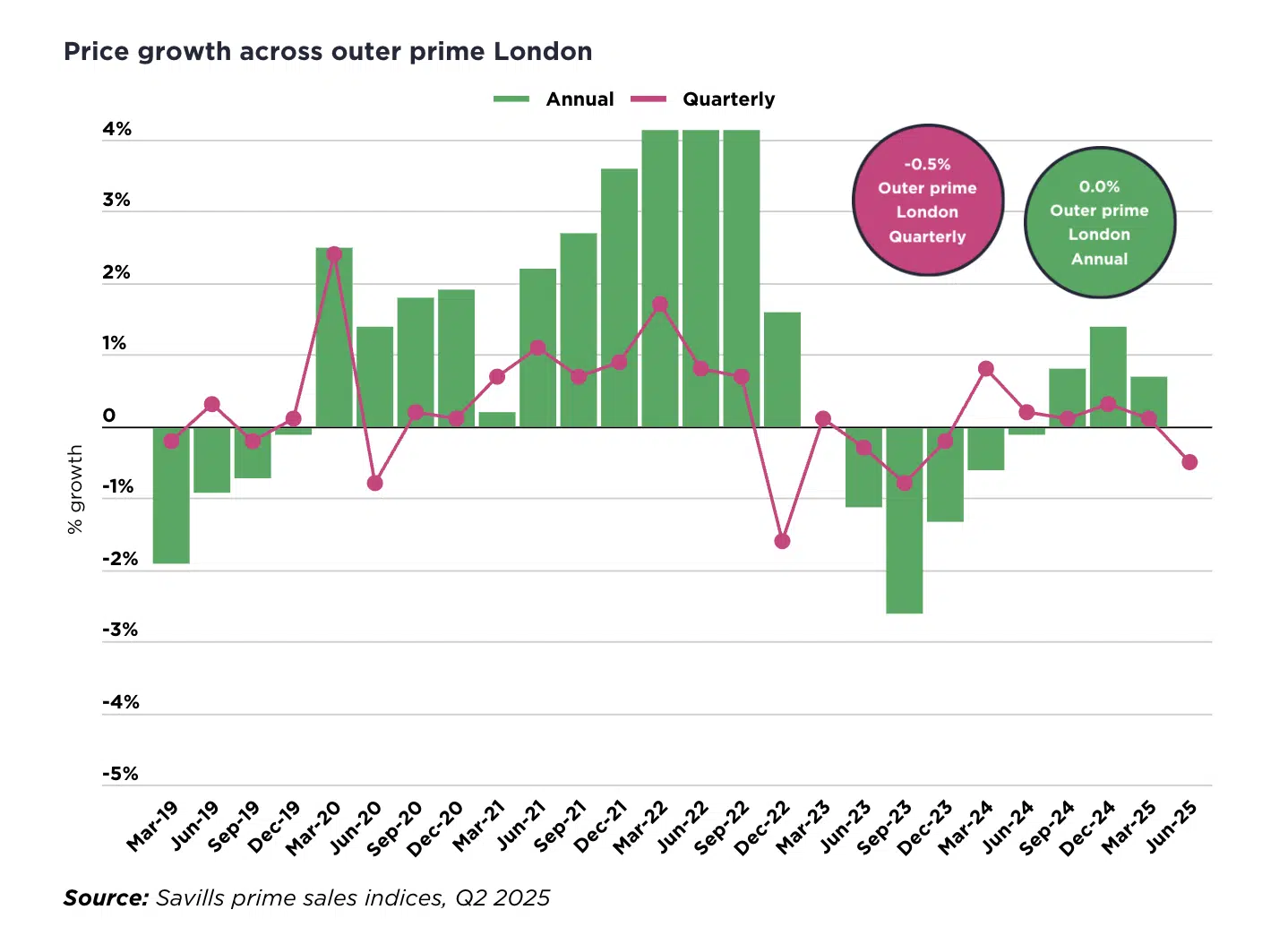

A story of two house price Capital paths

International sellers keen to move abroad have seen London prime central prices tumble over the past year. Increased competition from likeminded individuals with a lot of tax to lose has enabled this downward trajectory, when investors and second home owners aren’t buying for similiar reasons. This has resulted in quarterly price falls of -1.5% in prime central London contrasting marginal falls in prime outer London of -0.5%. This Savills claim is due to domestic and needs-based buyers keeping the market moving in areas with easy commutes into central London and the city. The West of London proved the most resilient with annual growth of 0.6%, followed by the South West of London where prices grew by 0.5% over the same period. Areas, like Wimbledon rising 3.4%.

As a result Savills has revised its house price forecast for 2025 down. They now “predict” growth of just 1.0% from 4% previously, which they accredit to stamp duty upheaval, tariffs and global unrest. Moving forward though they expect the market to pick up in autumn which will then lead to house price growth, totalling “24.5% by the end of the five years to 2029, adding an extra £86,300 onto the average house price.” Much remains uncertain though, as potential tax hikes in the upcoming budget and any further global conflicts could further stifle economic growth.

Cleverly faces off Angela Rayner in reshuffle

Sir James Cleverly returned to the front bench as shadow housing secretary in Kemi Badenoch’s Conservative reshuffle this week. Their first line of attack was focused on Labour cancelling the London Plan review of housing and “using precious stock to house asylum seekers”.

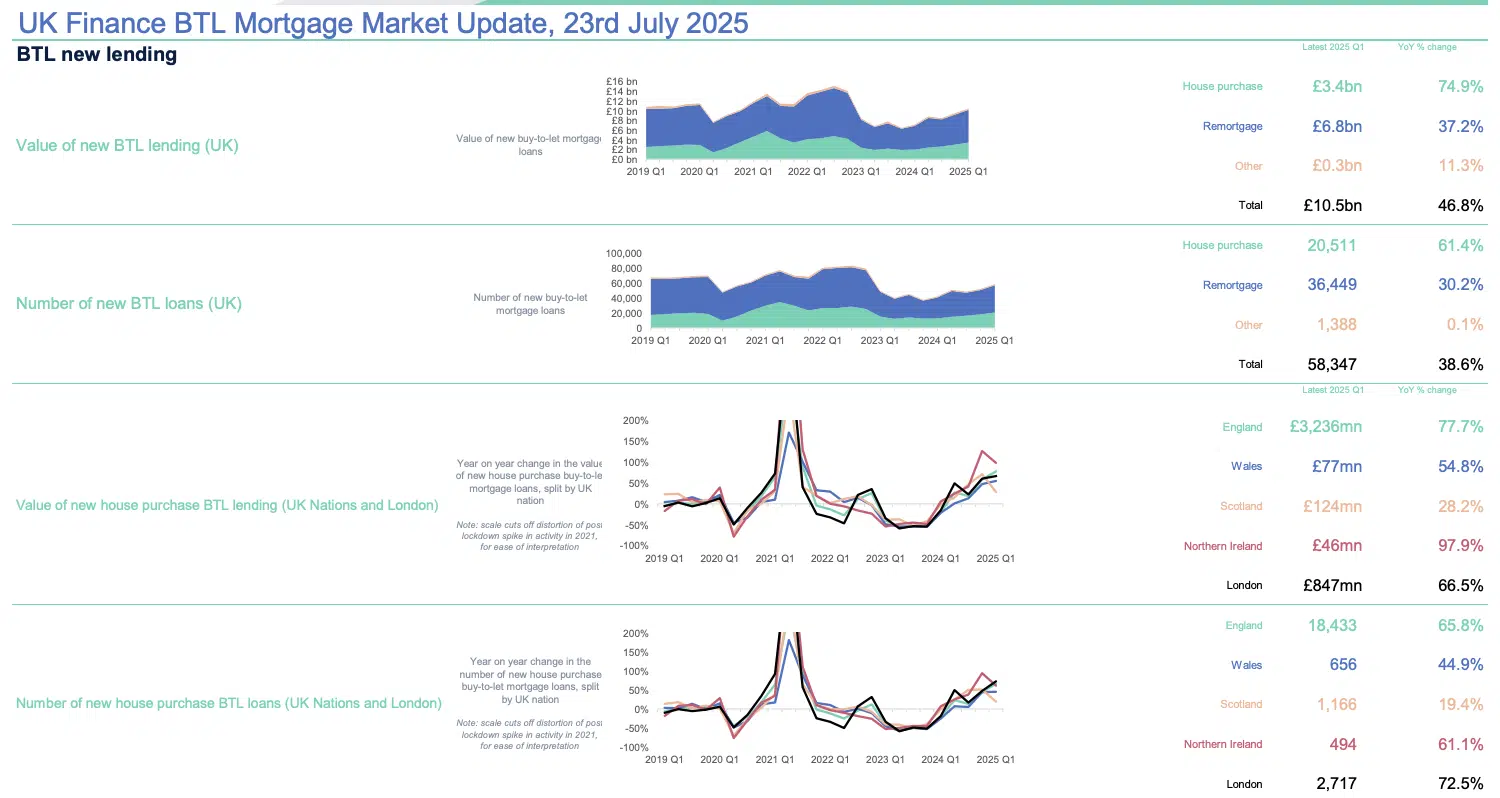

The Buy-to-let sector gets a boost in Q1

The buy-to-let market got a boost in Q1 2025 as unperturbed investors looked to more profitable investments in cheaper areas, before tax thresholds shifted in April.

According to UK Finance, as yields crept up and rates went down, the number of buy-to-let loans rose by 58,347 in Q1 2025. This was worth £10.5 billion; up 38.6% by number (46.8% by value) compared with the same quarter in the previous year. Many will be banking on future rates falling, further increasing profits but for now they are erring on the side of caution, opting to fix rather than risk a variable rate. (The number of variable loans falling 15.8% compared to the same quarter last year.)

Meanwhile buy-to-let mortgages in arrears, greater than 2.5% of the outstanding balance, fell by 780 in Q1 to 11,830 on the previous quarter.

However it was too late for 810 ex-landlords whose investments were repossessed, up 28.6% on the same quarter a year previously.

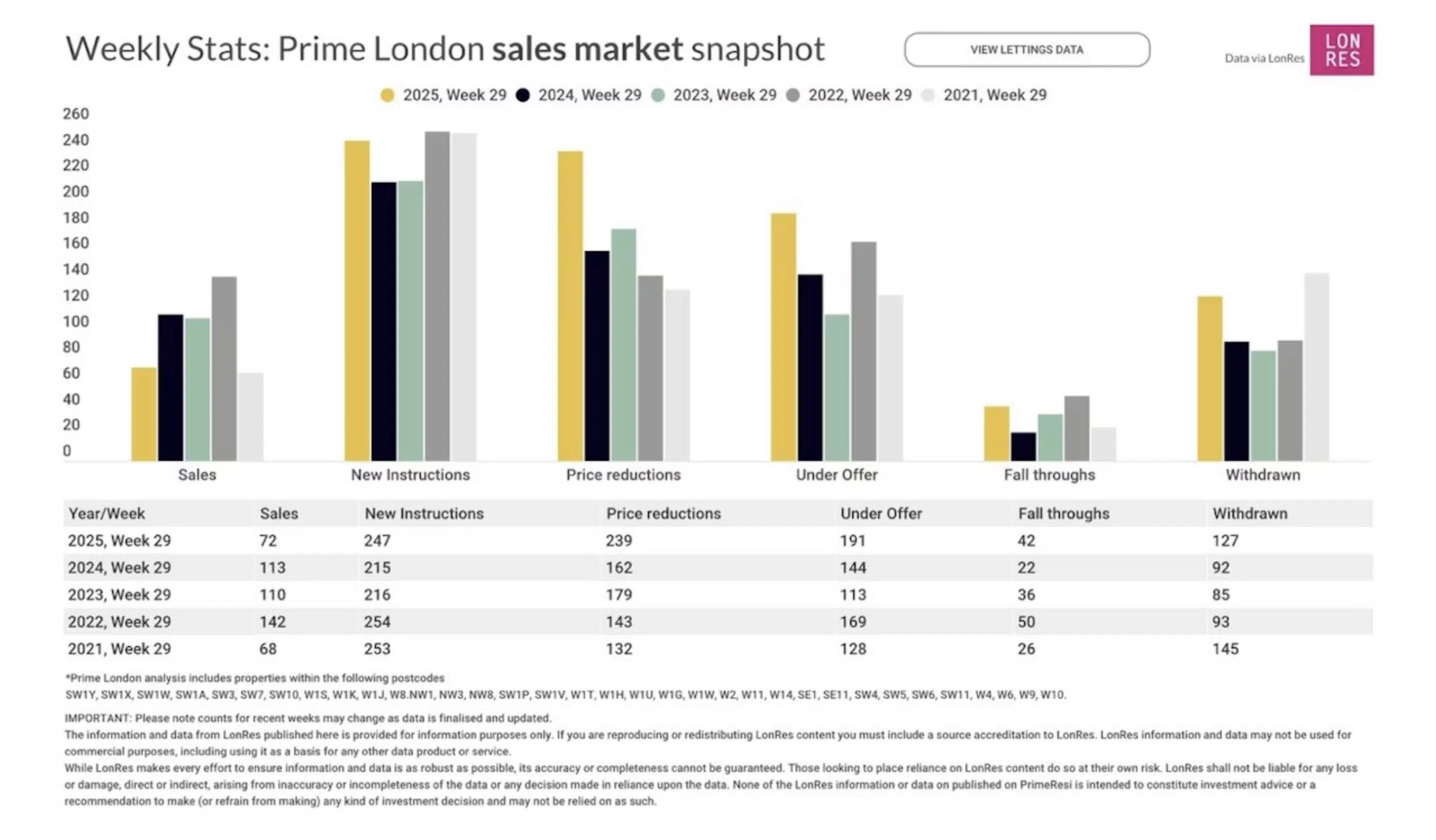

Prime Central London price falls stir life into the stagnant market

Stock levels and price reductions continue to snowball this week in prime Central London leaving sales down but with the increase in the number of properties under offer this week, there are signs of movement… if the price is right.

Longer mortgage terms rise knocking back retirement plans

The number of borrowers looking to longer terms to get on the ladder, increased by 251% from 2019 to 30,338 in 2024. Many, hoping they will be earning more in the future to pay down sooner. For those, less fortunate, retirement will be set back (which will inevitably happen anyway as we live longer) tarnishing their golden years

Commercial rent review increases curtailed

Commercial Landlords face a ban of upwards rent reviews. Giving tenants a break from further analysis and landlords, to reconsider contract lengths.

And that concludes this week’s UK Property News Recap – 25.07.2025. Any comments or suggestions please get in touch.