Finally, the wait was over. Budget day arrived and the OBR – brimming with excitement – spilt the beans before Reeves could utter a word. The speculation turned out to be worse than the delivery but the budget still leaves many facing increased taxes by stealth. It is estimated a further 780,000 workers will pay tax at the lower end who previously were spared, while another 920,000 will pay a higher rate of income tax by 2029-30. Wages have increased, softening the blow but at the cost of some jobs and increased taxes. Welcome to Brickweaver’s BUDGET SPECIAL alongside your weekly UK Property News Recap – 28.11.2025.

The Mansion tax isn’t crippling but it will hurt prices in the capital and the south causing chaos around properties valued at the threshold levels. An extra £2,500 a year doesn’t sound that much but on top of higher mortgage rates, higher taxes, council tax and school fees alongside living costs, the cumulative effect of this is huge on middle earners. An extra £150 off your heating bill or a freeze on already extortionate rail fares sounds good but means too little to many.

At the same time, developers are expected to continue to underperform until 2029-30 when rates and financial confidence are hoped to stabilise and the public cast their vote. During this time house prices are predicted to grow from £260,000 in 2024, to just under £305,000 in 2030. This will be driven by activity at the bottom as more affordable regions gain popularity with both first time buyers and investors looking to make mid to long-term gains while avoiding penalising higher taxes.

For part time/ accidental landlords, a 2 percentage point increase to the basic, higher and additional rates of property income tax, will result in further listings for sale come the New Year, which could further maintain and increase rents as supply reduces. Yes, these properties will be bought by others but they may not be suitable for investors if the yields are below 5 to 6%, as often found in London. This means new owner occupiers will benefit from discounted properties but renters in need of homes where the jobs are will suffer.

So what will be the outcome? The top of the market should accept the offers they got this year and stop hoping for salvation from rate cuts. This market doesn’t typically rely on a lot of borrowing so given the annual £7,500 fee which could otherwise be invested elsewhere, buyers will continue to purchase with their heart but expect to be compensated on price. The middle market, which is more reliant on borrowing, will really feel the squeeze. Yes they can swallow an extra thousand pounds or two but it’s what they cut back on to survive that will impact the market. Second homes will be offloaded at discount prices but only if buyers can still afford them in those areas. There will be a rise in Airbnbs to bring in an income without the fear of evicting a tenant on an AST should they find a buyer. Some will downsize, increasing prices in the £800,000 to £1.4m bracket, squeezing out second steppers. First time buyers will drive up prices in more affordable areas, making average price indices look like growth is booming. This will free up some of the competition for rentals but not squash it enough for tenants to be able to pick and choose.

This budget could have been a lot worse but it will have an impact on the market, even if not as dramatic as we first feared.

BUDGET KEY POINTS

SURCHARGE ON PROPERTIES WORTH £2m+

The Government has announced the introduction of a new high value council tax surcharge. From April 2028, owners of properties identified as being valued at over £2 million by the Valuation Office (in 2026 prices) will pay an annual charge on top of their council tax. There will be four price bands with the surcharge rising from £2,500 for a property valued in the lowest £2 million to £2.5 million band, to £7,500 for a property valued in the highest band of £5 million or more, all uprated by CPI inflation each year. This measure is estimated to raise £0.4 billion in 2029-30 with revenues going directly to central government.

BUILD BABY BUILD:

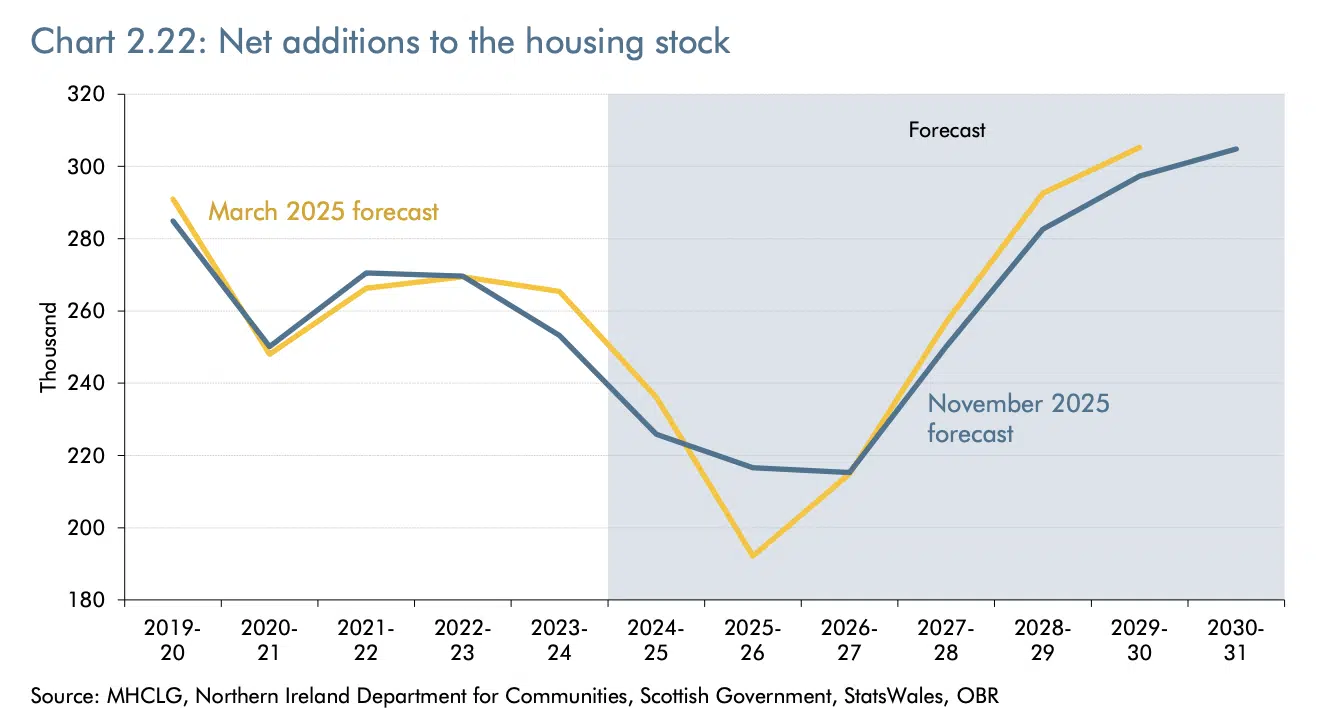

Net additions to the UK housing stock are to fall to 215,000 a year, for the next two years before finding its footing in 2029-30 (around election time) to 305,000.

After backlash from developers and concerns over achieving the government’s housing target without them onside; Reeves spared builders from a single rate on landfill tax. At the same time she retained the tax exemption for backfilling quarries and is offering free apprenticeships to under-25s for small and medium sized businesses. In addition Reeves committed to devolving £13bn in flexible funding for regional leaders to invest in skills, infrastructure and business support.

TRANSACTIONS

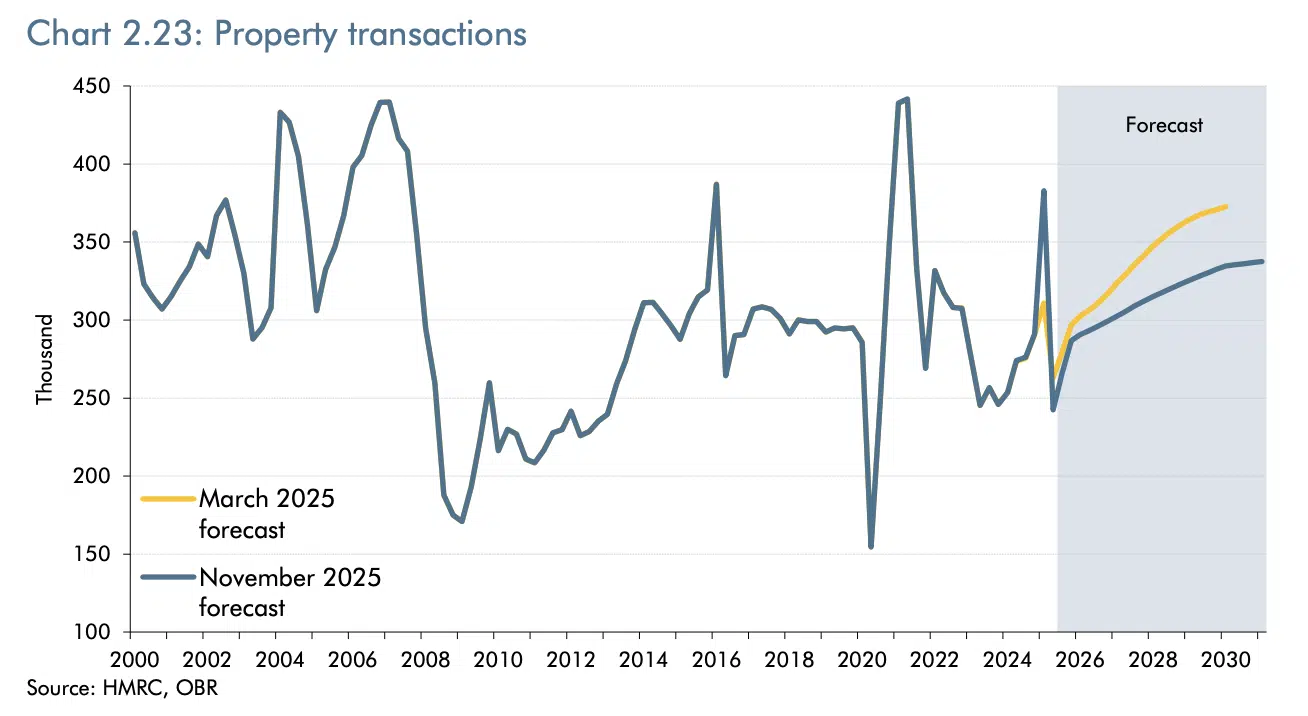

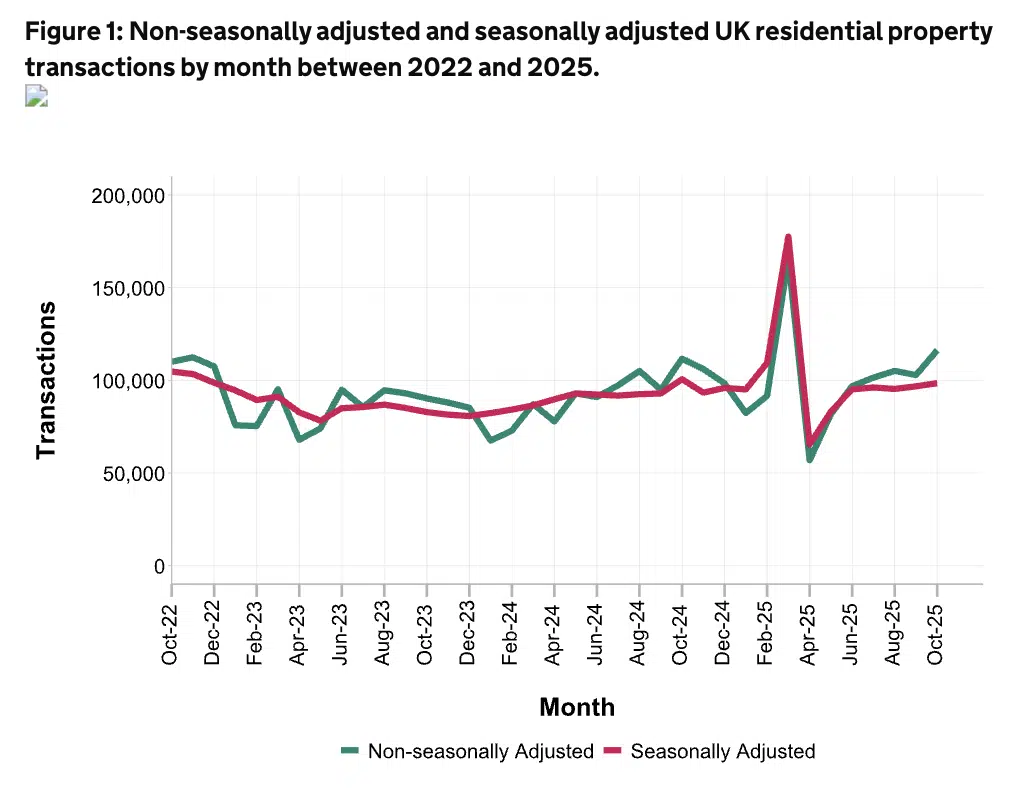

The OBR predict property transactions are to rise to 1.3m in 2029 from 1.1m in 2024 however, overall the volume of transactions has reduced by 155,000 from their last forecast after they lowered their assumed turnover rate (the ratio of the total housing stock to housing transactions) to better reflect the impact of past increases in average stamp duty expect property transactions to increase over the forecast.

HOUSE PRICES

Prices meanwhile are expected to rise from £260,000 in 2024, to just under £305,000 in 2030 with growth just shy of 3% in 2026. Come 2027/28 though growth will slow as new property taxes are implemented.

NATIONAL INSURANCE RISES FOR LANDLORDS

Squeezed landlords will squash tenants’ take home pay to compensate for a 2 percentage point increase to the basic, higher and additional rates of property income tax, increasing to 22, 42 and 47 per cent respectively come April 2027. This is estimated to yield £0.5 billion a year on average from 2028-29 but will cost tenants dearly as more landlords abandon ship.

For all those keen on data the OBR forecast can be found in full here.

IN OTHER NEWS

JPMorgan to build a new Tower in Canary Wharf

The Treasury asked the banks to show support for the budget. JPMorgan’s boss responded heaping praise on Reeves before releasing a press release saying they are building a new tower in Canary Wharf on land they bought in…2008 with a completion date set for 203.

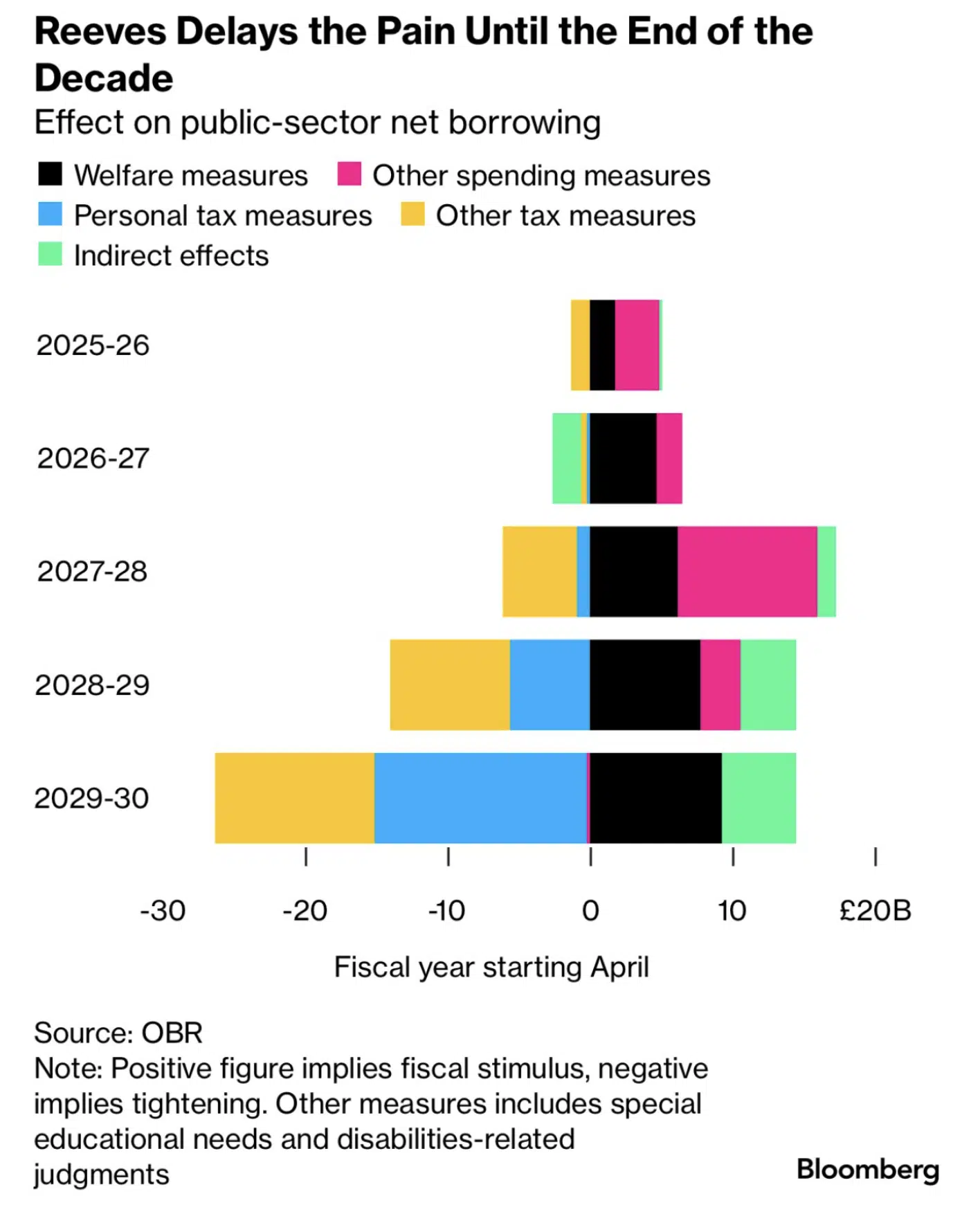

RATE CUT EXPECTED FOR CHRISTMAS

Bets remain high for a rate cut in December but with taxes due to increase come 2027/8 the Bank of England’s path down Table Mountain may not be smooth. Labour has diverted the real sting till after the next election, however since Reeves has gifted herself with an increase in fiscal headroom, up from £9bn to £22bn, there could be some giveaways before votes are cast.

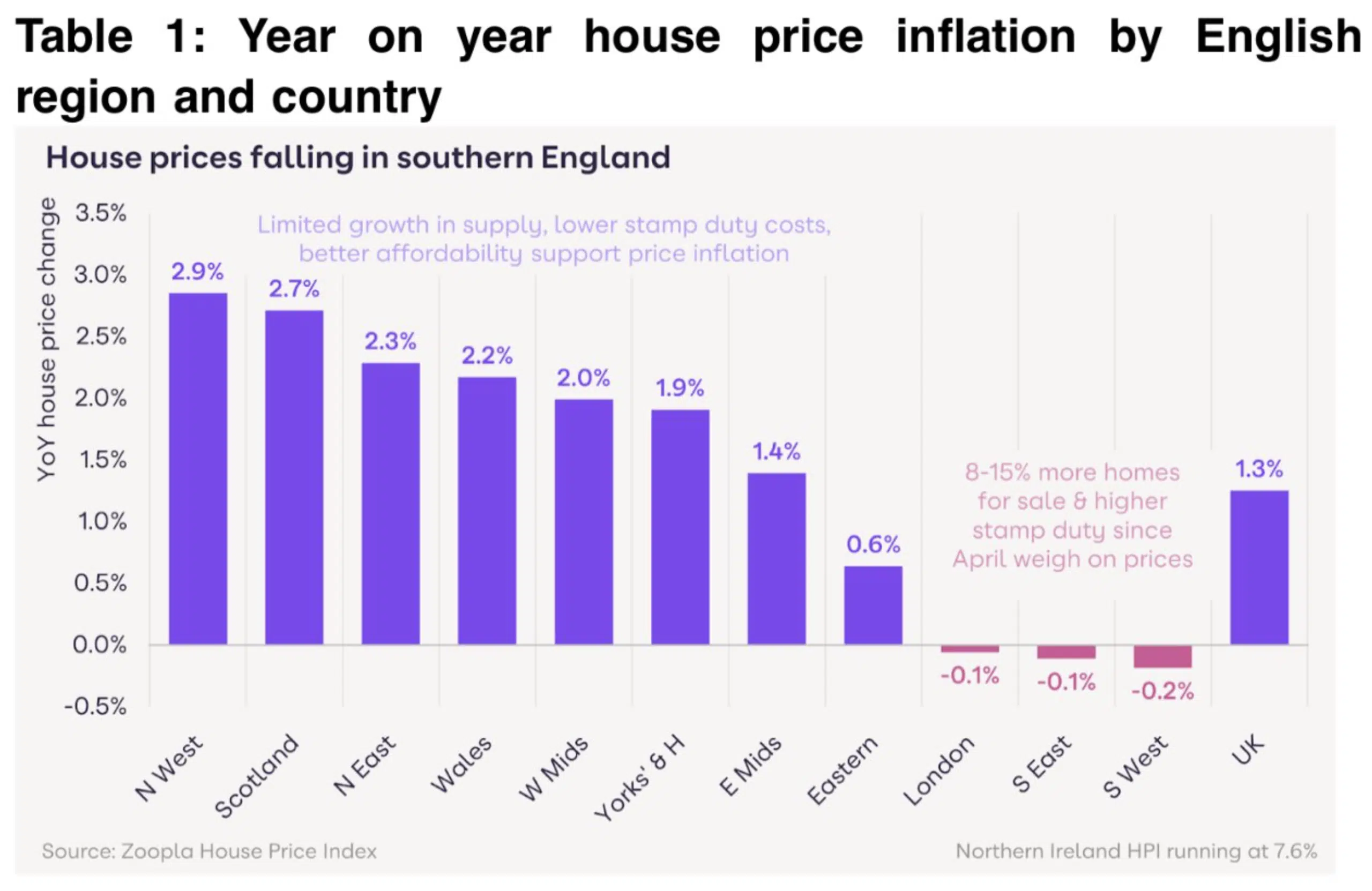

House Prices turn chilly in the Capital and the South

Budget speculation had the market on hold, demand falling 12 per cent year on year, whilst sales agreed dropped 4 per cent. This was felt acutely in the capital and the south causing house prices here to fall -0.1% and -0.2% in the South West of England. The Budget introduction of a mansion tax on properties worth £2m and above won’t help their recovery but rate reductions may ease the pain. Meanwhile, pent up demand from those looking from £500,000 and above will feel more confident about moving on in the New Year now they know they have been spared increased taxes and no stamp duty holiday is forthcoming. This alongside a widely expected rate cut in December means the New Year will be busy.

Lloyds claim first time buyers are better off than renters

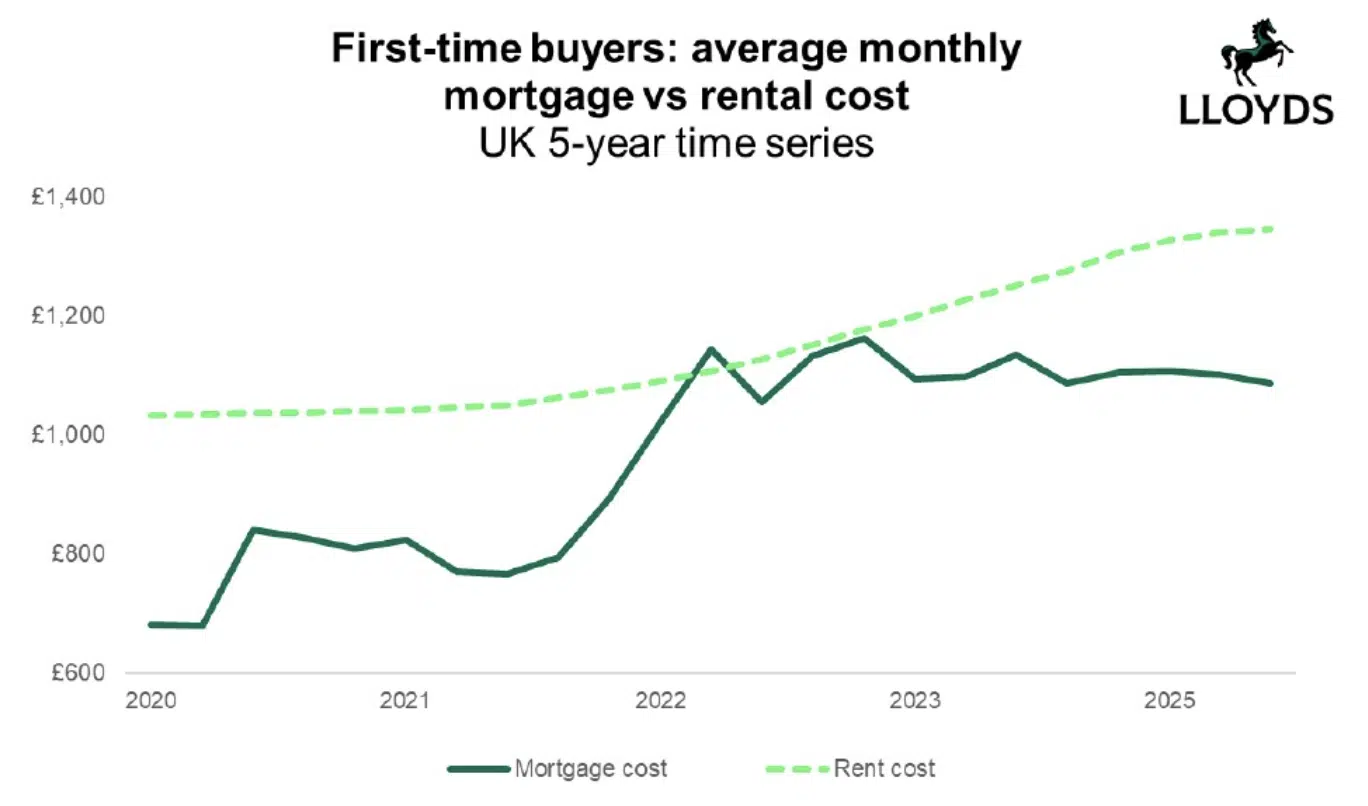

LENDER first, Landlord second; Lloyds claims that a typical first-time buyer home now costs 5.9 times average earnings, down from 6.2x last year, making it the lowest ratio since 2015. As a proportion of income, average monthly mortgage costs have fallen from 34.6% to 32.6%. This coupled with rising rents, which are on average taking 40% of income, has made, according to Lloyds, buying £259 cheaper than renting if you have a 10% deposit on a 30 year term.

Earls Court development gets the green light

After 4 years of “consultations” it looks as if the Earls Court scheme is a step closer to getting the green light. All now rests on Kensington & Chelsea’s verdict after Hammersmith & Fulham’s planning committee unanimously backed the “Hybrid Planning Application for its stretch of the former Earls Court Exhibition Centre site – the first major consent for the £10bn, 44-acre scheme.”

Transaction numbers tick up

Unperturbed by speculation or motivated by high rents and fears of capital gains on primary residencies, which didn’t transpire in this years budget. The market showed signs of continual movement. Transaction numbers rose in October up by 2% from 96,730 in September 2025 to 98,450 in October 2025 when seasonally adjusted and 13% when not.

That concludes this week’s UK Property News Recap – 28.11.2025. Any comments or suggestions please get in touch.