This week, the chancellor Rachel Reeves looked to galvanise developers into action by enabling more first time buyers onto the ladder through a permanent Mortgage Guarantee Scheme. Labour hope this scheme, alongside the affordable home programme and the new found flex in loan to value criteria, will bring their housing targets back into the economic sights of probability. With unemployment on the rise and wage growth slowing, there was more speculation that interest rates would fall in August but how much further give there will be is dependent on slippery inflation. Welcome to another UK Property News Recap – 18.07.2025

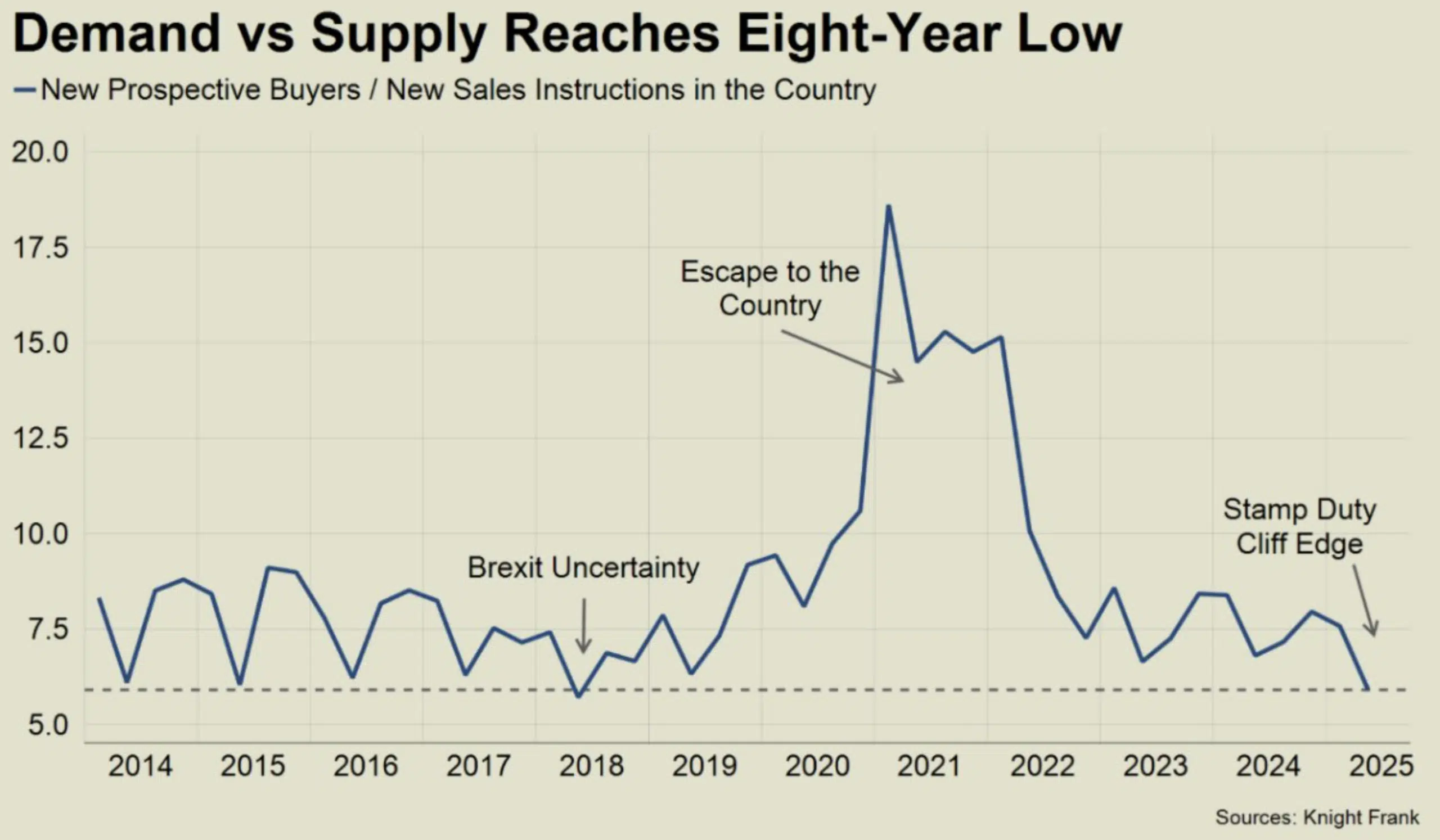

Buyers gain the upper hand in Knight Frank’s latest Prime Country House Index

The expedited move to the country post-covid, holidaying at home or getting away from it all is losing its financial appeal.

Buyers gained the upper hand in Q2 as supply levels increased 9% while demand reduced, leading agreed sales to fall 9%.

Developers fall short on Building Safety Regulator standards

The Building Safety Regulator may need to speed up processing times but if the latest quarterly data is anything to go by, developers need to first up their game. 69% of applications were rejected after failing to show that the legal standards for aspects like structure, fire safety & quality would be met.

A wealth tax would be the straw that broke the non-doms’ back

Non-Doms are being taxed off the British Isles. Introducing a wealthy tax into the mix will lead to further migration east.

Purplebricks & Connells come under Panorama fire

Panorama exposed Connells and Purplebricks for conditional selling and incentivising staff for winning instructions via high valuations and then getting the price reduced in weeks. The aim, massage the company’s bottom line no matter the cost to others.

Barratt and Redrow fail to complete

International buyers and investors turned away from the London market hitting developer Barratt Redrow’s completions, which reduced by 7.8% to 16,565 from the aggregated comparable figure of 17,972 in FY24. Despite this, forward sales saw an uplift during FY25 increasing to £2,921.6m at 29 June 2025, buoyed by rates gradual descent southwards. Expectations remain dependent on further rate movement to boost buyer movement and further investment

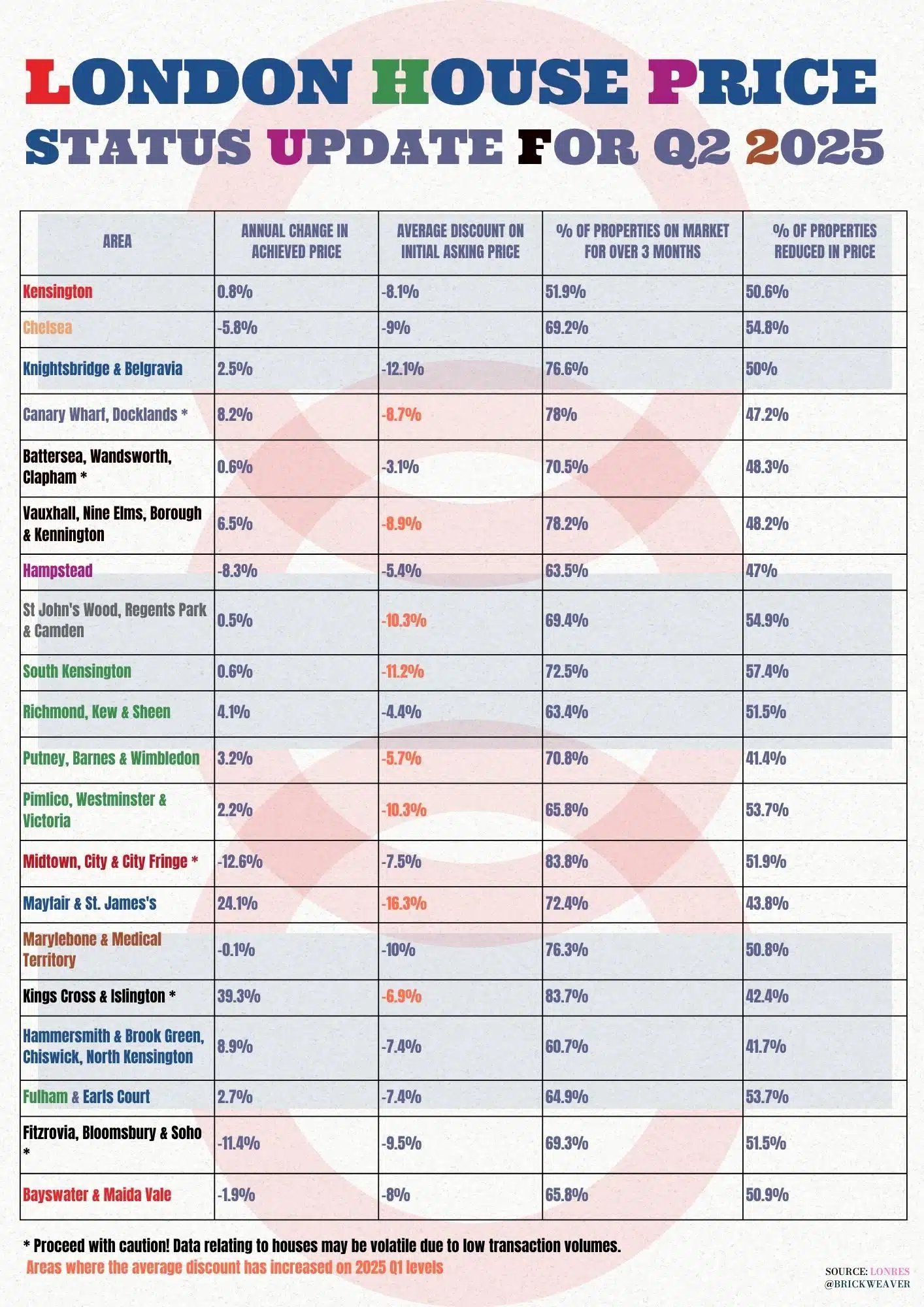

Lonres Q2 data shows central London discounts on the rise

Properties languished on the portals for longer in Q2 2025 causing discounts to grow in certain prime London boroughs as international buyers opted for more tax efficient shores and investors, regions where they can get more for their money by spending less in northern regions. Mayfair and St James’s continues to be hit the hardest, the average discount here now 16.3%, while 57.4% of properties in South Kensington were reduced in Q2, in the hope of luring a buyer.

Mansion House Speech Day

Chancellor Rachel Reeves set out her stall to get the UK property market moving in her speech at Mansion House. In this she stated that first-time buyers would be allowed to lend at over 4.5 times a buyer’s income – which could enable an additional 36,000 more people on the ladder over its first year. Nationwide’s “Helping Hand” mortgage, which supports buyers on lower incomes, could also lift an additional 10,000 onto the first rung. At the same time, mortgage lending rules are to be simplified making it easier for existing borrowers to remortgage, while a permanent government-backed Mortgage Guarantee Scheme will facilitate an increase in high loan-to-value mortgage products.

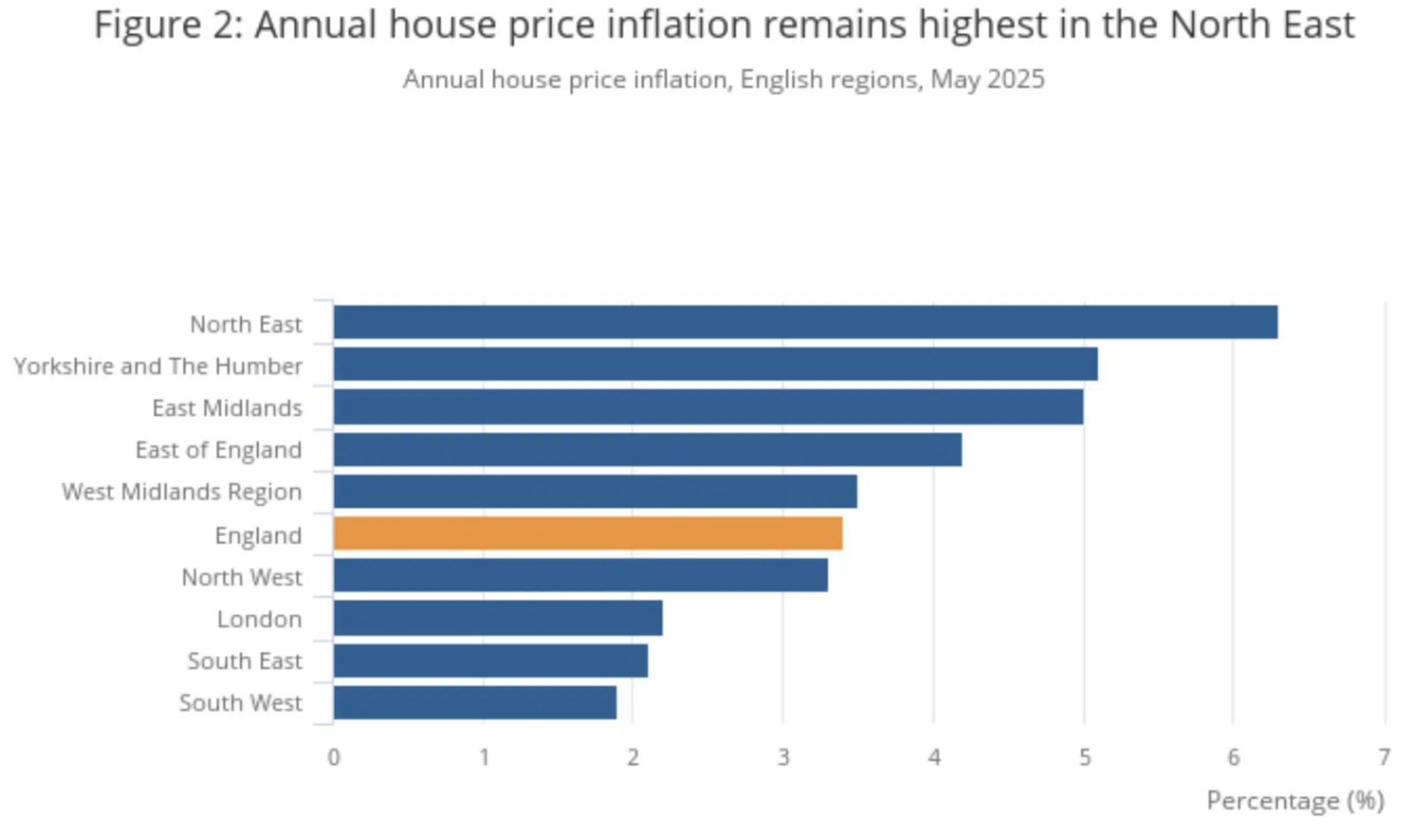

ONS estimate house price rises

After a post stamp duty lull the ONS estimated that average UK house prices regained some momentum, increasing from 3.6% in April to 3.9% in the 12 months to May 2025, making the average property worth £269,000.

The North East was the region with the highest house price inflation in the 12 months to May 2025, at 6.3%, while the South West resided at the bottom at 1.9%.

Moving forward the ONS are expecting an improvement in their reporting come August after reviewing their UK HPI methodology.

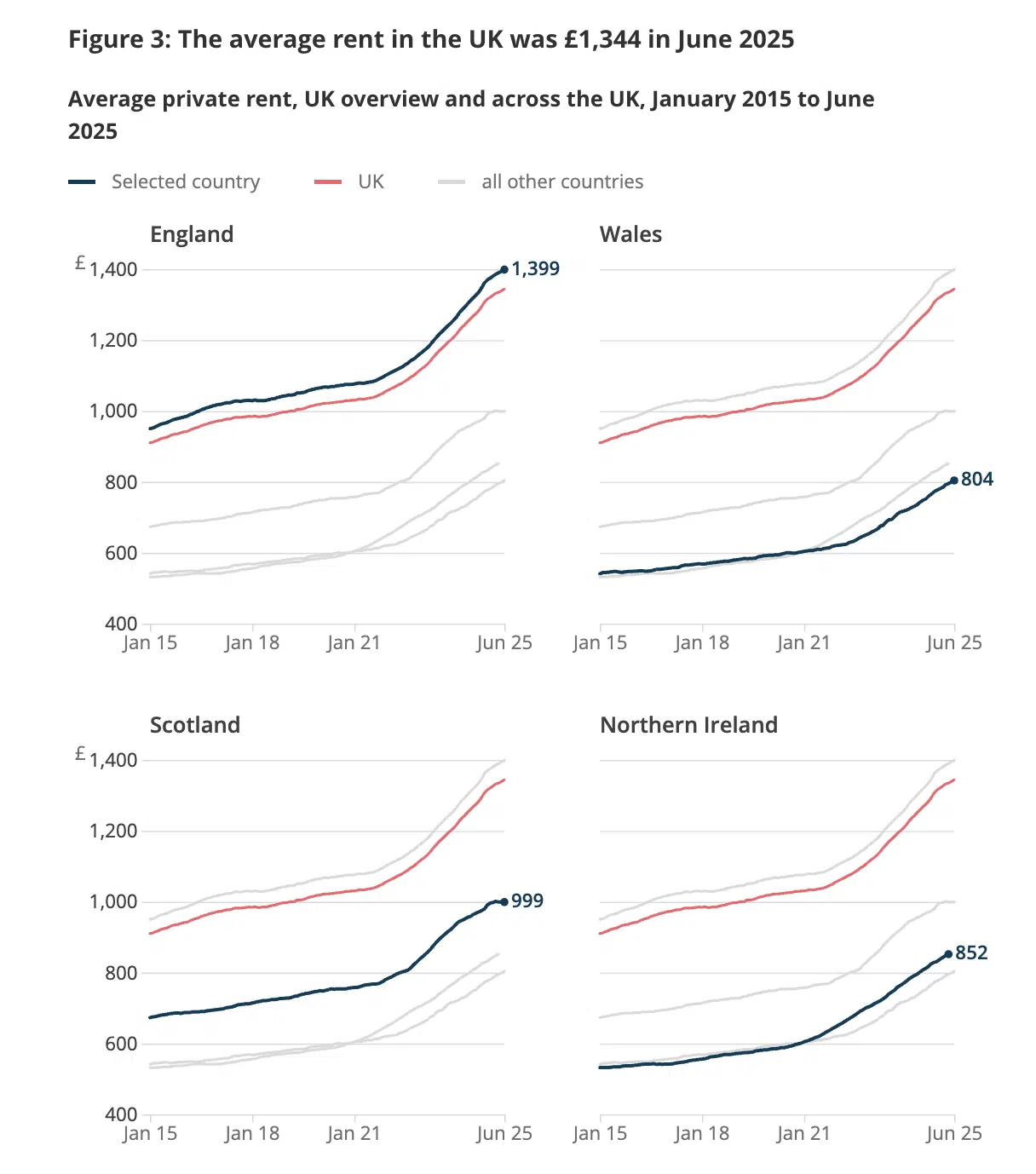

ONS rental price inflation slows…again

Rental inflation continued to slow but maintained its hold on tenants; leaving them little financial headroom. The average annual private rent in the UK rose 6.7% to £1,344 per month in June 2025.

Average annual rents were highest in Wales up 8.2% to £804 but the North East of England saw prices soar 9.7% while Yorkshire and The Humber saw the lowest at 3.5%.

Vistry plasters over the cracks down south

Southern mistakes which led to a 40% downward revision in profits for developer Vistry is apparently plastered over, according to the group; laying the foundations for future growth born from affordable housing.

Northern affordability drives house price growth

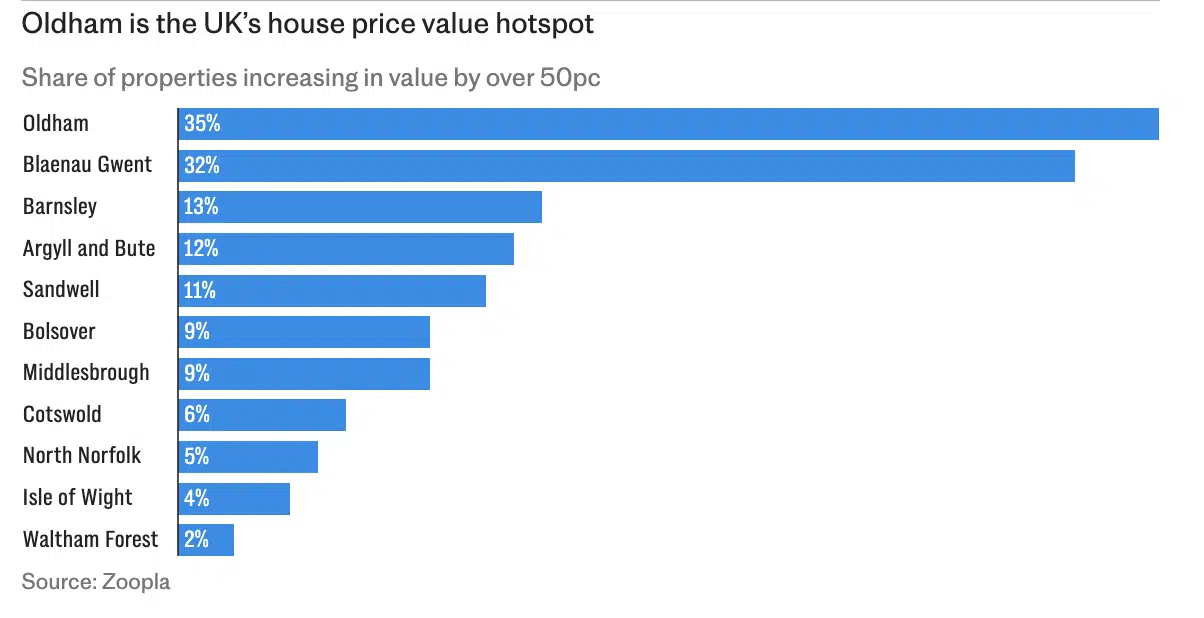

According to Zoopla, house prices are more likely to have increased over 50% in Rochdale, Oldham and Bolton since 2020, as first time buyers look to get more for their money in the commuter belt.

Making waves, property with a sea view

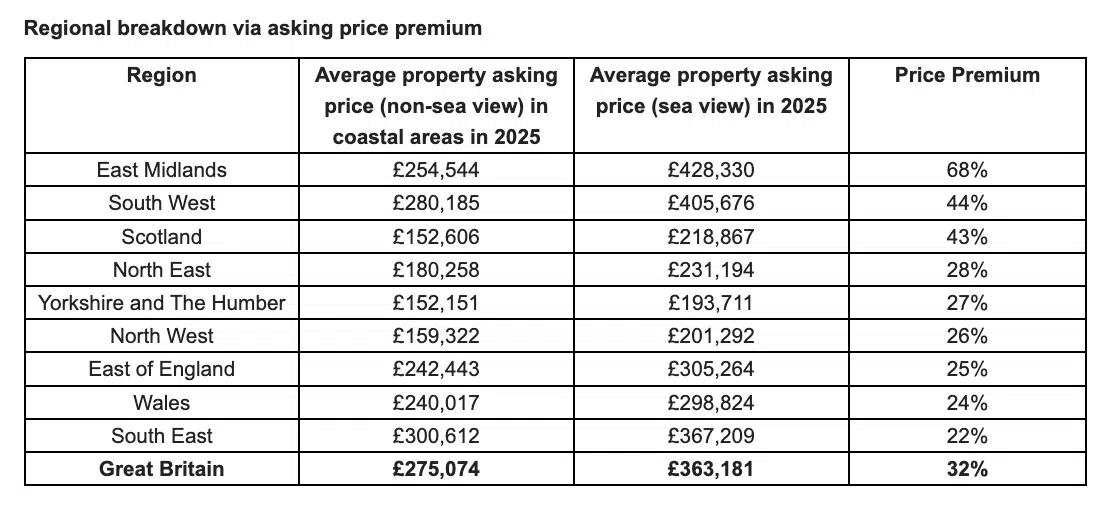

New research from Rightmove claims that UK homes with a sea view garner a 32% premium over those that don’t. Currently the area achieving the largest premium at 68%, is in the East Midlands. In its tailwind is the South West with 44% while the South East drifts at 22%.

Renters Right Bill won’t be Law till the Autumn

The Leader of the House of Commons, Lucy Powell MP, has not scheduled any time for MPs to debate the Renters Right Bill next week. As a result, the issue will be put on hold over the Summer recess till they reconvene in the Autumn.

Is the bigger house worth the cost of the commute?

Post Covid, moving out to gain more space for less made sense when the call of the office was on hold. With covid in our rear view mirror employers are increasingly demanding workers show their face in the office leaving many facing a costly commute. For those still set on space over commute, Savills broke down the best-value locations.

And that concludes another UK Property News Recap 18.07.2025. Any questions or comments please get in touch.