This week was all about growth. Inflation grew, but by less than predicted, which got the markets betting again. This time on two more base rate cuts this year, instead of one. GDP grew by 0.6% and house prices and rents also continued to edge up in various parts of the country. The number of homes needed to become EPC-ready in time for Labour’s 2030 green deadline, grew and private pension fund the Universities Superannuation Scheme topped up its shared ownership stock levels. Landowners’ profits, from previously unusable land, also grew..only Marshall plc was stunted by the lack of building earlier on in the year but still they remain optimistic for the future. Welcome to another UK Property News Recap – 16.08.2024

Knockdown prices for greenbelt sites leave landowners out of pocket

An enforced financial land diet will “tighten” the green belt. In a bid to hit Labour’s ambitious but necessary target of 1.5m homes, councils are going to be given the power to compulsorily and cheaply buy up green belt land. Should landowners refuse to sell there will be a “benchmark” value that would be lower than the market value of similar sites outside of the green belt. This will go down like a cup of cold sick for landowners but some may seek to profit from land that previously was deemed to have no prior development value.

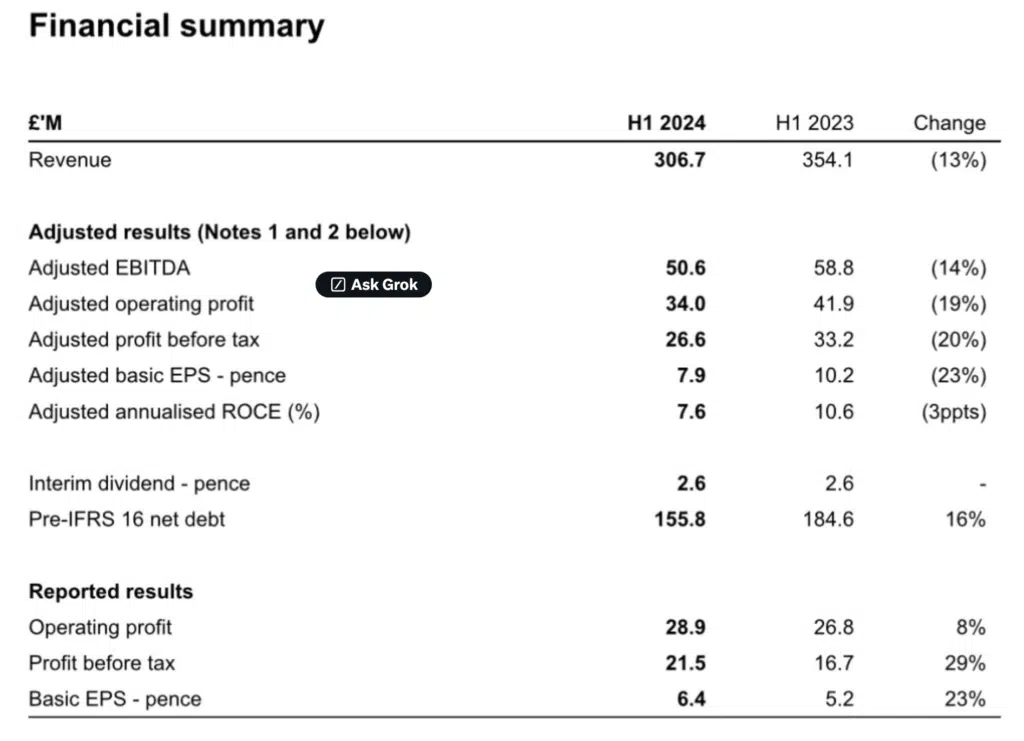

Marshall plc half year results

Marshall plc, the building materials manufacturer, saw a reduction in revenue in the first half of the year due to low levels of new build housing and private housing repair. However, various cost-cutting measures boosted operating profits and trimmed debt levels leaving the company…here it comes again.. “cautiously optimistic” for the year ahead.

EPC ready

Hamptons’ analysis suggested that 340,000 properties would need to be EPC-ready every year to make Labour’s 2030 green target. This is 225,000 shy of the expected uptake this year. The current, flawed, system will need to be dramatically incentivised, or the target pushed back to a more achievable timeline, to be deliverable. Hamptons are suggesting 2042.

Bellway retracted advances for Crest Nicholson

Bellway claimed they never wanted Crest Nicholson anyway after their financial advances were spurned.

Instead, the developer claimed to remain confident that their robust “balance sheet and operational strength, combined with the depth and quality of its land bank, will enable them to deliver volume growth in the years ahead and support ongoing value creation for shareholders.”

Blackstone sells off 3,000 homes

The second biggest residential deal this year was struck between Blackstone, who sold 3,000 shared ownership homes for £405m to Universities Superannuation Scheme, the private pension fund. The deal will no doubt turn lucrative for the pension fund as “affordable” homes rarely turn out to be that for buyers.

Inflation rises but is less than expected

As a result of the latest inflation data coming in under the soothsayers’ predictions, the money markets increased the odds of a September base cut from 36% to 45% (in short, it basically still seems highly unlikely till November.) However, they also reverted to forecasting two cuts instead of one this year, which should boost seller and buyer morale.

Average house prices and rents hold their ground

Overall, the summer season looked warm but sluggish, with average house and rental prices increasing but at a much slower rate.

Average UK private rents increased by 8.6% in the 12 months to July 2024, unchanged from June, while average UK house prices increased by 2.7%, to £288,000, unchanged on May 2024.

Northern Ireland and Scotland saw the biggest annual increase in average house prices, up 10% (Q2) and 6.4% respectively.

Meanwhile, Northern Ireland and England saw the biggest annual increase in average rents, up 10% and 8.6% respectively.

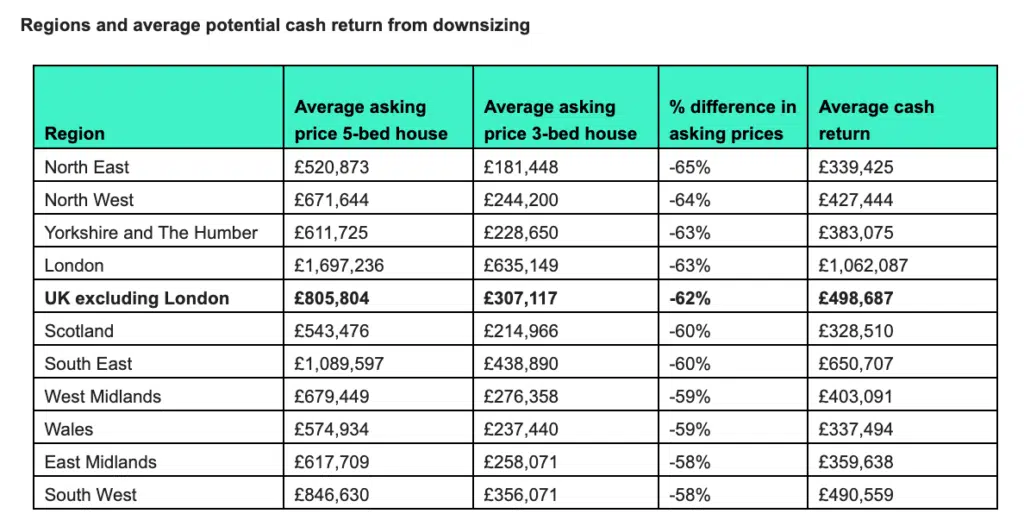

Rightmove outlines the benefits of downsizing

Property portal Rightmove tries to engage the older market by showing them the financial savings and EPC benefits of downsizing. Keen to keep the top of the market mobile by moving the occupants on, Rightmove omits that it is the TYPES of properties these buyers want that are in short supply. A typical three-bed won’t often do. Downsizing doesn’t mean making do.

Construction output grows

Warmer weather brought a change to construction levels. Seven out of the nine sectors grew in June 2024, with the main contributors to the monthly increase from non-housing repair and maintenance, and private commercial new work, which grew by 3.2% and 2.1%, respectively. New housing continued to struggle to get underway.

The Bank of Mum and Dad supports over half of first-time purchases

Based on Bank of England data, Savills concluded that 57% of all first-time buyer transactions in 2023 were aided by the Bank of Mum and Dad. Approximately £9.4bn was loaned or gifted to first-time buyers from relatives last year — twice the total in 2019. “Forecasts for 2024-2026 predict a similar annual total (£9.3bn) will be handed over in each of the three years. Nearly £30bn is expected to go to family members over the period — in spite of expectations that mortgage rates will continue to decline.”

The divide between those who can and those who can’t is widening, along with where first-time buyers can afford to buy.

And that concludes another UK Property News Recap – 16.08.2024. Should you have any comments or suggestions, please get in contact here.